tolgart/E+ via Getty Images

Investment thesis

In October 2021, I wrote a bearish article on SA about a small privacy-oriented messaging app developer named DatChat (NASDAQ:DATS) in which I said that there appeared to be a short squeeze that was ending. Sure enough, the share price declined sharply but then DatChat’s market valuation soared by over 60% on March 28 alone after the company announced the launch of a metaverse project. In my view, the business of DatChat isn’t worth much in its current state and this increase in the market valuation creates a good short selling opportunity. Let’s review.

Overview of the latest developments

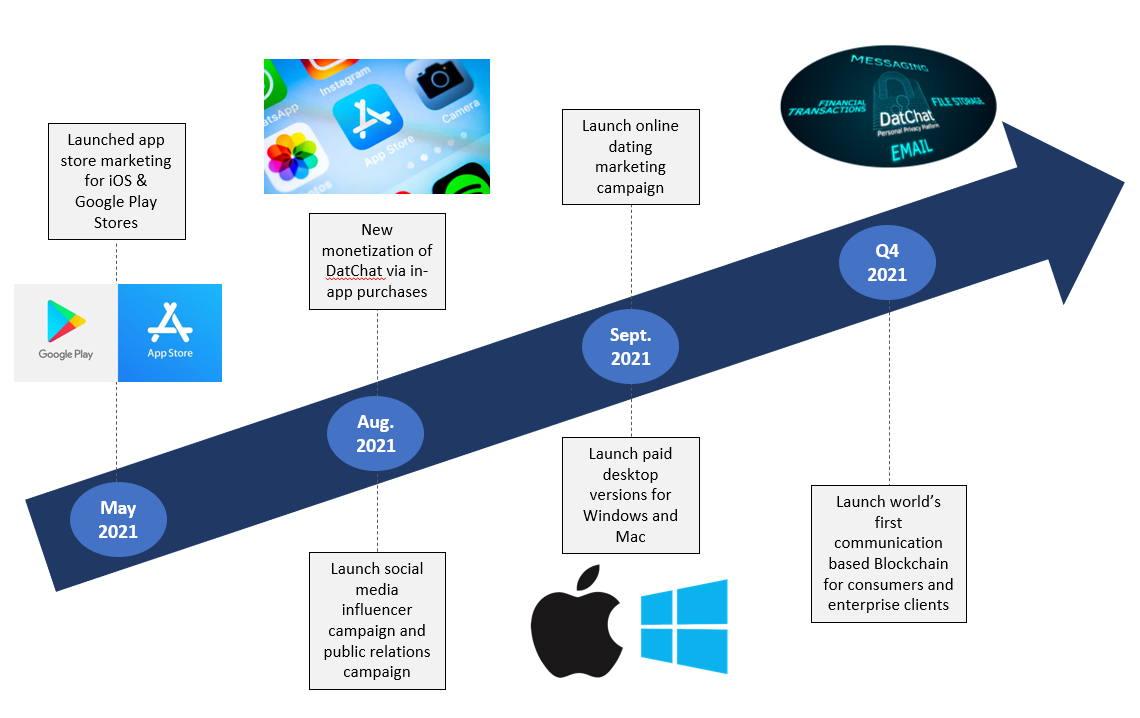

In case you haven’t read my previous article on DatChat, here is a short description of the company. DatChat has been around since 2014 and it owns a social networking app and private messenger that allows its users to modify or delete sent messages, hide encrypted messages as well as set messages to be automatically deleted after a fixed time frame or a set number of views. I think that there is nothing groundbreaking about this app and investors may have been more interested in DatChat’s $12 million initial public offering in August 2021 because management mentioned the word blockchain on several occasions. However, several competitors already use blockchain technology as well, including Dust, eChat, and Sense Chat.

DatChat

Just when I wrote my first article on DatChat, Culper Research released a short report about the company in which it questioned the track record of the CEO and claimed that the app was overrun with bots, scammers, and solicitation of prostitution. I’ll have to act as devil’s advocate here and say that I prefer to judge a business based on its fundamentals rather than the track record of its management. Also, as someone who met his wife through a dating app, I have to point out that pretty much all social media apps and sites are rife with chatbots. As an example, Ashley Madison used fembots that even messaged each other by mistake.

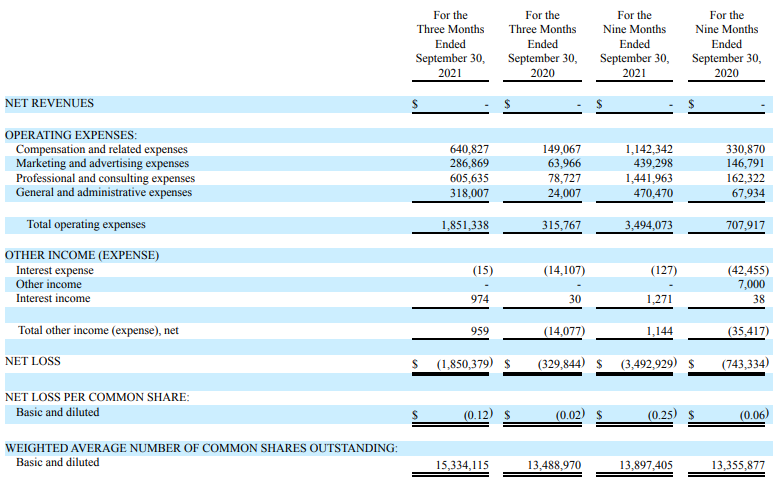

Now then, how are the financials of DatChat looking? Well, the 2021 financial report isn’t out yet and the Q3 2021 financial report showed that the company still had no revenues. Operating expenses for the quarter came in at $1.85 million, which is more than five times higher compared to the same period of 2020.

DatChat

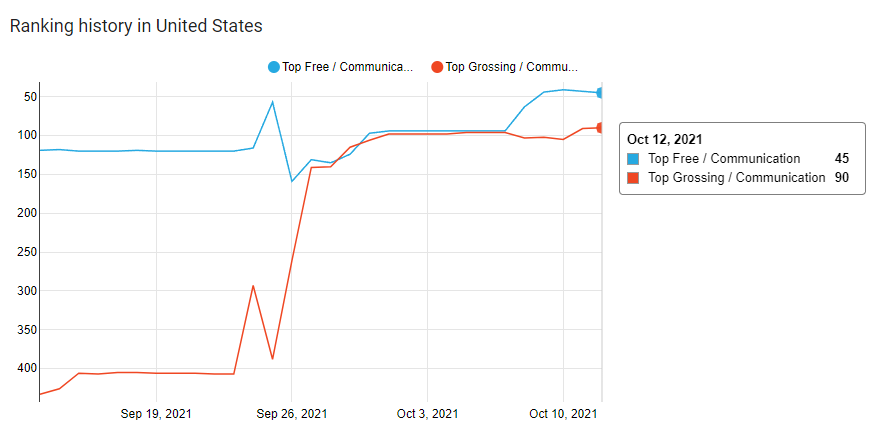

I find the lack of revenue puzzling considering that DatChat launched paid features at the end of Q3 2021. Here’s a chart I showed in my first article about the app’s ranking on Google Play.

AppBrain

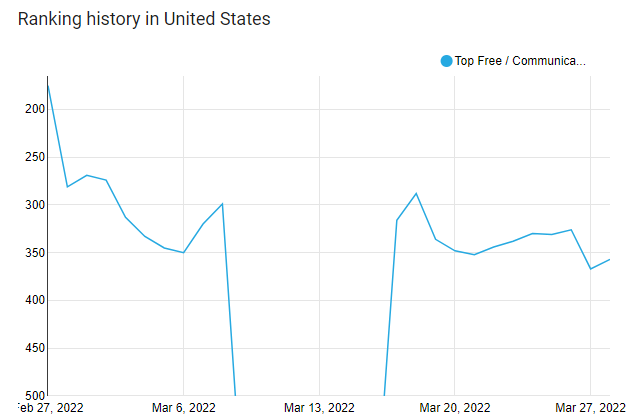

The Google Play page of the app still mentions three paid tiers but the ranking history shows that the popularity of the app has dropped too low for it to appear on the list of top-grossing apps in the communications category.

AppBrain

Considering the app doesn’t appear to be doing well at all, why did DatChat’s market valuation soar by over 60% on March 28? Well, the catalyst seems to be the announcement of a metaverse advertising and NFT monetization platform called VenVūū. This platform will allow metaverse landowners and brands to connect using DatChat’s proprietary patented and patent-pending technology. There is little information about VenVūū and there isn’t any mention of it even on DatChat’s corporate website or its LinkedIn page. However, the announcement about the platform seems to have attracted retail investor interest as there is a considerable amount of posts about the company on social media platforms like StockTwits, and Twitter. On YouTube, several videos about DatChat were released on March 28 by channels focused on stock trading, including ClayTrader, MAKING EASY MONEY, Evan Evans, SpicyTrade, UltraAlgo, Triad Trading, Ronnie Fox Trader, Jocaris Finance, and Dip Snipers. Two of the videos have over 1,000 views each as of the time of writing. Note that the company wasn’t promoting its business or shares itself, but this was done by several stock traders.

Overall, I think that VenVūū sounds like a small and rushed metaverse and NFT project and reminds me of the one of Mega Matrix (NYSE:ACY), which I’ve covered here. There is very little information about VenVūū, there are no influencers or brand ambassadors promoting it, and the chatter on social media about DatChat currently revolves mainly around the company’s share price performance. Even if DatChat commits most of its cash reserves to the development of VenVūū, I think this would be too little to make the company a significant player in the metaverse and NFT space.

I expect the retail investor interest to decline in the near future, with the share price of DatChat returning below $2.00 in the next month or two. Considering that DatChat had $25.8 million in cash as of September and its expenses stood at $1.85 million in Q3 2021, I expect the company to have around $23 million in the bank at the moment. In my view, DatChat’s messaging app and its upcoming metaverse platform are not worth much at this point, so I think its market valuation shouldn’t be much higher than its cash position until the company proves it can attract a large user base.

Looking at the risks for the bear case, I think the major one is higher retail investor interest as meme stocks can sometimes be very unpredictable. I guess that there’s also a small chance that DatChat’s metaverse platform becomes a major player in the industry.

Investor takeaway

The performance of DatChat’s messaging app looks underwhelming but the company’s market valuation has increased significantly after the announcement of a metaverse project. In my view, there is very little information about this endeavor and this seems to be a small project that is unlikely to attract a lot of attention.

I think the market valuation of DatChat has increased due to renewed retail investor interest and I think this creates a good short selling opportunity as I don’t see this interest lasting for long. However, data from Fintel shows there are no shares available for borrowing as of the time of writing and the latest short borrow fee rate was 79.39%. There are still no put options available. In view of this, I think the best course of action for investors could be to wait for shares to become available for borrowing at a lower rate with the idea of opening a small short position.

If you’re a risk-averse investor, my view is that it might be best for you to avoid DatChat as I think this is a high-risk, high-reward opportunity.

Be the first to comment