Olemedia

Livent Corporation (NYSE:LTHM) is a good way to be exposed to the secular growth trend of electric vehicles, which should support higher demand for lithium over the long term, as the company has good growth prospects due to its investment initiatives and its current valuation is quite undemanding.

Livent Corp. Background

As I’ve analyzed in previous articles, I’m bullish on the electric vehicles (EV) sector, and my largest investment within this theme is Albemarle (ALB), due to its leadership position in the lithium industry. While I think Albemarle is a great play over the long term, due to its size and geographic exposure to less risky areas than its closest competitors, it is not a pure-play on lithium considering that in most recent quarters only some 60% of its revenue were generated by its lithium segment.

As I’ve a long-term bullish stance on lithium as the demand is expected to grow considerably over the coming years, leading to a tight supply-demand situation for many years, pure lithium plays can have even more upside than Albemarle, even though they are also more risky. This happens because they are more exposed to lithium prices, which have been quite volatile in recent years.

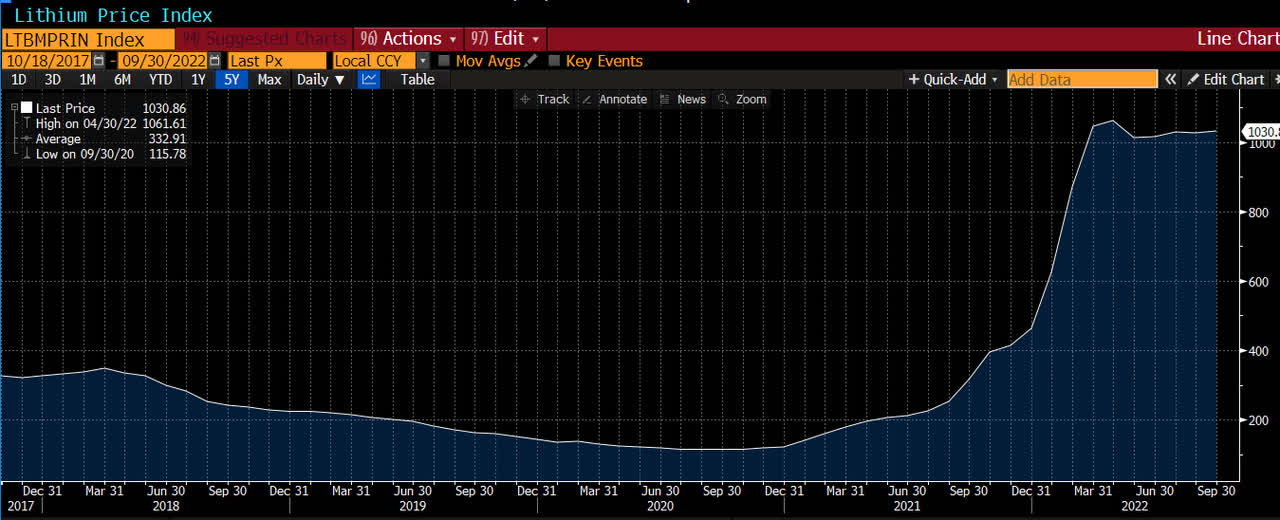

As shown in the next graph, after some years of weakness, lithium prices have skyrocketed during the last months of 2021 and beginning of 2022, setting new all-time highs and remained at very record levels since then. This is a clear sign that the supply-demand situation of the lithium market remains tight, particularly due to strong EV sales in Europe and China, and the supply deficit situation in the market should continue for some time.

Lithium price (Bloomberg)

Given that the growth prospects of the lithium industry remain quite good and prices have been resilient in recent months, in this article I analyze Livent to see if it’s a good alternative to Albemarle in this investing theme or if its shares may also be interesting to add to my portfolio, beyond my current exposure to lithium through its larger competitor.

Company Overview

Livent Corporation was formed and incorporated by FMC Corporation (FMC), a chemical company, as FMC Lithium in 2018, and later was renamed to Livent. FMC transferred most of its lithium assets to Livent during a restructuring process, in exchange of Livent’s common stock. Livent was then listed on the stock exchange in October 2018, and FMC completed the spin-off of the remaining shares of Livent back in March 2019. Since then, Livent has been operating as an independent company, and its shares are nowadays distributed by a large number of shareholders, including institutional and retail investors. It currently has a market value of about $5 billion, being a relatively small company by this measure.

Livent is a pure-play lithium company with an integrated business model, and its focus is to provide lithium compounds to electric vehicles and broader battery markets. Beyond supplying battery-grade lithium hydroxide, Livent also supplies butyllithium, used for the production of polymers and pharmaceutical products, and a range of specialty lithium compounds, used for example to manufacture lightweight materials for the aerospace industry.

Livent is one of the largest lithium companies in the world, with its most important competitors including Albemarle, Sociedad Quimica y Minera de Chile (SQM), and Ganfeng Lithium (OTCPK:GNENY). The industry is relatively concentrated, considering that the five largest players account for about 50% of annual global production of lithium carbonate equivalent (LCE), and there are significant barriers to entry, which means established companies enjoy a competitive position that is not easy to challenge.

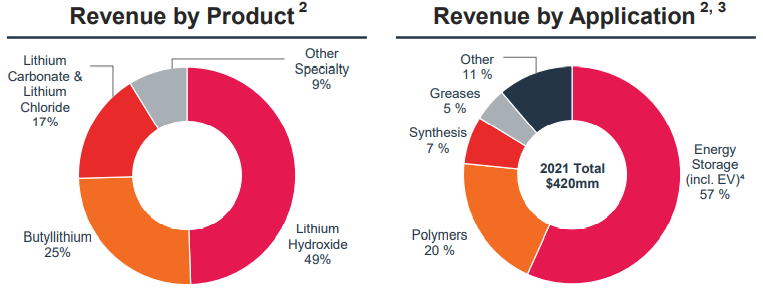

During 2021, the vast majority of its revenue was generated by battery-grade lithium hydroxide and carbonate used for energy storage, a profile that is expected to increase even further in the future, as growing sales of EVs across the globe leads to strong demand for these types of lithium.

Revenue diversification (Livent)

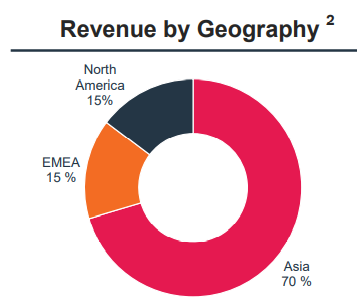

By geography, the vast majority of Livent’s revenue comes from Asia (about 70% in 2021), as the largest battery manufacturers are located in the region. Livent wants to have a balanced global exposure over the long term, but due to lower labor costs in Asia compared to other geographies Livent’s revenue profile is not likely to change much in the near future.

Revenue by region (Livent)

Growth Strategy

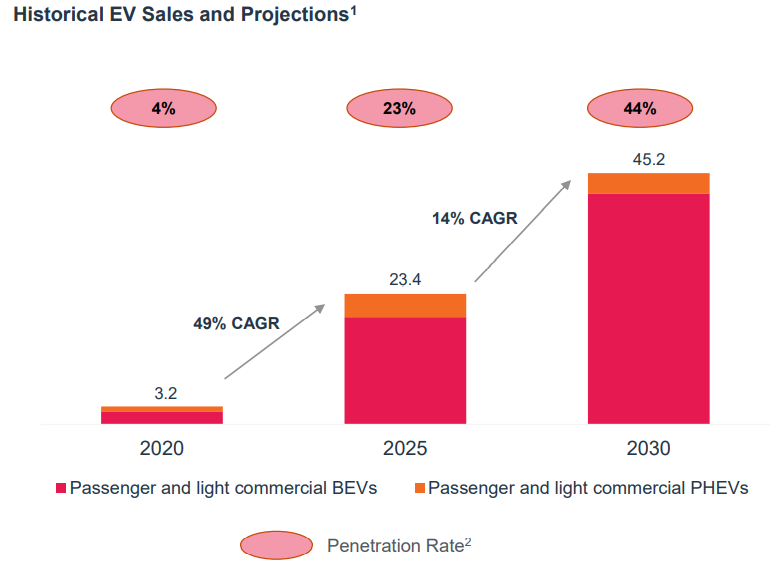

As a pure-play in the lithium industry, Livent has very good growth prospects over the long-term due to the expected increase in EVs expected in the coming years, which should be a strong support for sustainable demand growth for lithium compounds. Global sales of EVs reached 3.2 million vehicles in 2020 (including plug-in hybrid electric vehicles), and are expected to grow to about 45 million by 2030. To benefit from this expected growth, Livent’s strategy is to expand its production capabilities and establish long-term partnerships with auto and battery manufacturers.

EV sales (Livent )

At the end of 2021, Livent’s annual production capacity, across its lithium product range, was about 55,000 metric tons. Lithium hydroxide was the largest product, with an annual production capacity of some 25,000 metric tons, with the company having production facilities in the U.S and China. In Lithium carbonate, the company obtains the majority of its lithium from its operations in Argentina.

Livent is currently working on the expansion of a lithium hydroxide facility in North Carolina, and an expansion of lithium carbonate facility in Argentina. The new hydroxide unit is expected to be operational in the next few months, while the Argentinian unit during 2023.

These two units will increase its annual production capacity by some 25,000 metric tons (5,000 lithium hydroxide and 20,000 lithium carbonate), and Livent is also working on a second expansion project in Argentina that should increase its production by 20,000 metric tons by 2025, with the company expecting to have total production capacity of 60,000 metric tons of lithium carbonate in Argentina by 2025. In lithium hydroxide, the company also has a 50% stake in the Nemaska project in Canada, which is expected to start commercial production in late 2025.

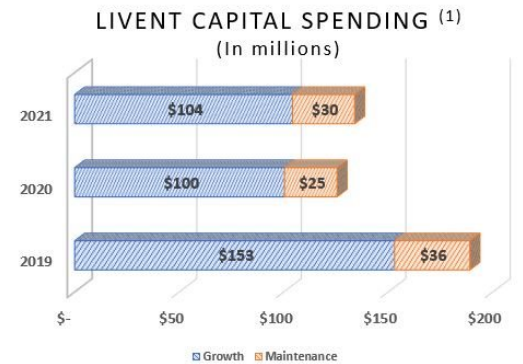

Over the long term, Livent wants to increase its production capabilities of lithium hydroxide in multiple geographies, and is targeting annual production capacity of about 150,000 metric tons of both lithium hydroxide and carbonate, or about 3x higher than its current production capacity. As can be seen in the next graph, the vast majority of Livent’s annual capital expenditures over the past three years have been dedicated for growth initiatives, a profile that is not expected to change much over the next few years and should be financed organically from cash flows from operations.

Capex (Livent)

Regarding its long-term partnerships with established OEMs and battery manufacturers, Livent has made over the past few years supply agreements with some of the leading companies in the auto and battery industries, such as Tesla (TSLA), BMW Group (OTCPK:BMWYY), General Motors (GM), or LG Chem (OTCPK:LGCLF). Therefore, Livent should not have any issue from a customer demand perspective, which means that its main issue is to meet rising customer demand through its expansion projects over the coming years.

LTHM Stock: Financial Overview & Valuation

Regarding its financial performance, Livent has reported improved financial numbers in recent quarters, as the company benefited both from higher lithium prices and positive operating leverage. In 2021, its revenues amounted to $420 million, an increase of 46% YoY, and reached breakeven as the company reported a small bottom-line profit of $1 million based on GAAP. Its adjusted cash from operations were $39 million, while capex was $119 million, which means that Livent did not generate enough cash to finance investments during the last year.

During the first six months of 2022, Livent achieved record financial performance, and raised its full-year guidance due to a better pricing environment than expected. Additionally, during the quarter, the company also entered into a long-term supply agreement with General Motors, including an advance payment of $198 million to Livent, which is quite positive for Livent to organically finance its capex plans.

Its revenues in Q2 2022 amounted to $219 million, an increase of 114% YoY, and its net income was $60 million, up by 823% YoY. For the full year, Livent expects revenue to be between $800-860 million, up by 97% at the midpoint of its guidance, and adjusted EBITDA should be between $325-375 million, up by 404% YoY. Its cash flow from operations are expected to be between $280-340 million, which are very close to its capex spending of $300-340 million.

Going forward, as Livent increases its production capacity, its revenues are expected to continue to grow consistently, even though at a much moderate pace than in the past couple of quarters. Indeed, according to analysts’ estimates, Livent’s revenue should increase to $1.58 billion by 2025, representing annual revenue growth of 23% during 2023-25. Its bottom-line is also expected to improve markedly due to better operating leverage, to about $663 million by 2025.

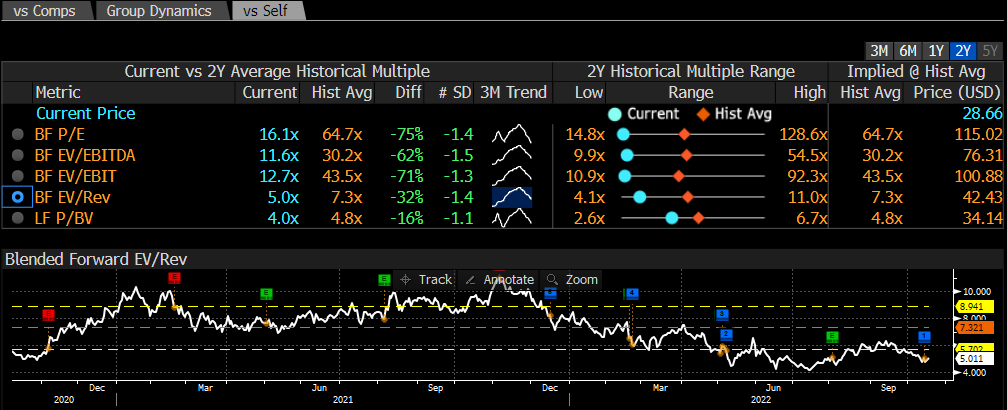

Regarding its valuation, as Livent’s profitability was quite low in the recent past, I think the best metric to analyze its valuation is still based on sales, even though Livent is already profitable. Livent is currently trading at about 5x its forward revenues, a smaller multiple than its historical average over the past couple of years, being a sign of undervaluation. This is also confirmed by its forward P/E ratio of about 16x currently, which seems to be relatively undemanding for a company that is reporting impressive growth, and has good growth prospects over the coming years.

Valuation (Bloomberg)

Conclusion

Livent is a pure-play on the lithium growth trend, while Albemarle has a more diversified business model, which means that Livent is more exposed to lithium prices. The current supply deficit in the market has led to very high prices, a situation that is not much likely to reverse soon, as EVs continue to gain market share in Europe and China, and to a less extent in the U.S., and this trend is not expected to change in the foreseeable future.

Despite this background, Livent has a very undemanding valuation for a company that is reporting impressive growth, being therefore a compelling buy for long-term investors that want to be exposed to the secular growth theme of EVs.

Be the first to comment