WendellandCarolyn/iStock via Getty Images

Co-produced with Treading Softly.

One major aspect of dividend investing that I have grown to love and embrace fully is not needing to have a cash pile to use for taking advantage of dips and drops as the market moves along.

The stock market is not a uniform and single entity – like the abominable snow monster – where one part of it goes, it all goes. It is instead best understood to be a market of stocks, many various pieces that live under the same umbrella but can move and be influenced independently.

With the rise of passive exchange-traded fund (“ETF”) investing, it can more frequently feel that where the market goes, so do all stocks, but this is not entirely true. The stock market is more like a herd of cows being driven from one place to another. Yes, the herd moves as a group, but individual cattle are faster or slower. They don’t stay in uniform movement. Some stray off and need to be brought back into the group. There will always be stragglers, but it won’t always be the same cattle holding up the rear.

If the market is a herd, the cowboys and cowgirls are sentiments, economic factors, and other external forces that directly influence the herd.

That being said, I don’t buy the whole herd. As an income investor, I constantly have cash from my holdings pouring into my account – so I don’t need to horde cash!

With every dividend payment, I have the capital to add to my holdings when opportunities arrive. And opportunities spring up consistently in a market as vast as ours.

Let’s look at two I’ve been buying up as they’ve been overlooked, straying from the rest of the herd.

Pick #1: GHI – Yield 8.0%

America First Multifamily Investors LP (ATAX) disappeared from your portfolio on Monday, December 5th. But don’t panic! It has been relisted under a new name: Greystone Housing Impact Investors LP, trading with the ticker GHI (GHI). Greystone is the General Partner, having bought the GP in 2019, so this name change is a branding move to make ATAX more identifiable as part of the Greystone network.

For investors, nothing will change. The company is still operating with the same management, with the same assets, and in the same lines of business. The only thing that will change is the ticker.

Most importantly, your income will remain unchanged. Except for the fact, in mid-December, we anticipate that GHI will announce yet another supplemental/special distribution to continue distributing the excess returns it has experienced from its “Vantage” Joint Venture. This is a JV where GHI provides capital for developing new multifamily buildings, and then the property is sold for a gain after it is leased up.

While the Board has not yet declared any distributions for subsequent quarters, the Partnership currently expects to continue to be in a position to make a supplemental distribution, in addition to the regular quarterly distribution, for the fourth quarter of 2022.

– Sept. 14, 2022 announcement of Q3 supplemental distribution

We’ve discussed it a lot this year because GHI has recognized excessively large gains. These are the gains that GHI has been paying out in the form of special and supplemental distributions. They are large, but they are not necessarily predictable.

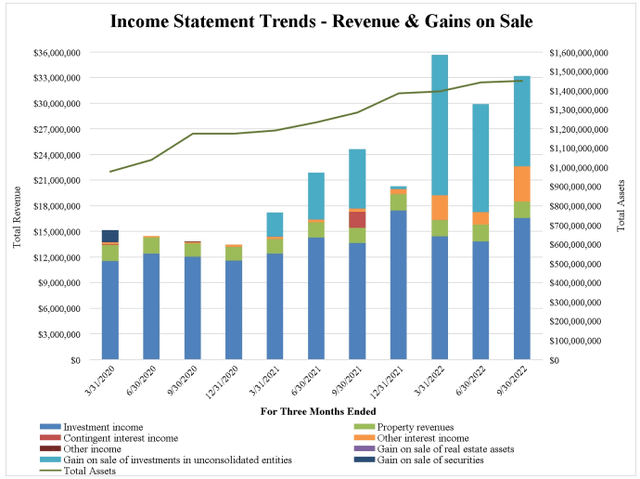

However, it is worth noting that GHI’s core business of investing in MRBs (mortgage revenue bonds) is still humming along. Here is a chart of GHI’s revenues by source. The light blue at the top is Vantage sales, and the darker blue at the bottom is GHI’s investment income. Source.

It might not be as splashy, but GHI’s core engine is still churning away and is producing its “regular” $0.37/quarter distribution.

We don’t expect any Vantage sales this quarter, but you will note that it is normal for GHI not to have Vantage sales in Q4. Also, Q4 is a slow time for the real estate market.

As we go into next year, GHI has several properties that will be ready to sell, which will provide the potential for excess distributions. Meanwhile, GHI’s regular distribution continues to be supported by its core business.

We are buying today before GHI announces its supplement for the end of 2022, and the chasers rush in!

Note: GHI issues a Schedule K-1 at tax time.

Pick #2: BCX – Yield 6.3%

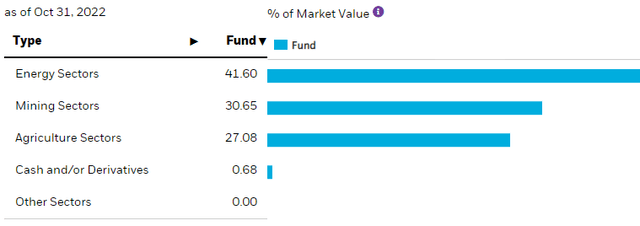

BlackRock Resources & Commodities Strategy Trust (BCX) is a closed-end fund (“CEF”) option to take advantage of the Commodity Supercycle. We’ve been in an inflationary environment for some time, and BCX is invested in the areas that have seen the most inflation: Energy, Mining, and Agriculture. Right now, the emphasis is on energy, which is a good call. Source

BCX hiked its dividend twice this year, most recently in October.

Despite this, BCX has had a weak rebound from September lows. Perhaps this is because recent inflation reports show that inflation is slowing.

Inflation is coming down; we’ve identified that at HDO before the rest of the market. Yet it is important to keep the perspective that inflation measures the rate of change in prices, not how high prices are. True, commodity prices are not climbing as quickly as they were in early 2022. However, they are still much higher than they have been in recent years.

For companies in energy and mining, the prices they are realizing are much higher than they’ve been receiving for most of the past decade. As inflation normalizes, prices are being reset at higher levels, and this is a big positive for commodity producers. Crude oil is around $80/barrel today, “down” from over $100, but much higher than the $30-$60 prices seen from 2015-2020.

Throughout commodities, we are seeing prices coming down. Yet they are settling at levels that are well above historical averages. This is great news for commodity companies.

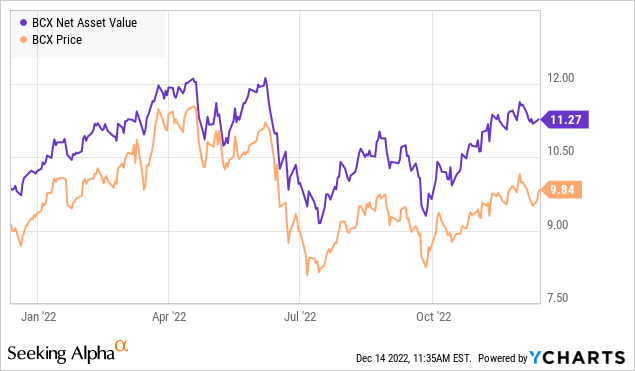

With BCX, we see an interesting dynamic that we can take advantage of. NAV has been climbing and is just a stone’s throw from Spring highs. However, the price has climbed much more slowly. As a result, BCX is trading at a ~13% discount to NAV.

We believe this dynamic is caused by traders bailing out of BCX because of slowing inflation fears. Meanwhile, the earnings of the companies that BCX invests in continue to outperform despite slowing inflation.

These are companies that learned to operate lean in the very tough commodity environment of the 2010s. Prices were low and declining, forcing commodity producers to tighten up their businesses and learn how to profit on low margins.

When a business is used to profiting from low prices, profiting when prices are high is easy! The prolonged bear market in commodities has culled the weak, and the solid that have survived will thrive as prices are reset at much higher levels for the long term.

The current negative sentiment toward BCX is short-sighted, and we can benefit by investing in commodity producers at a double-digit discount. With BCX seeing its NAV up 11% year-to-date, there is room for additional dividend growth or supplemental/special dividends in the future.

Conclusion

Both BCX and GHI have more gas in the tank to fuel higher distributions and provide more income today and down the road.

When I’m looking at the herd of the market, I don’t look at those who are leading the herd and burning all their energy to do so. Often those have the farthest to fall and least to provide in the near term. I look to those well-run companies which have been overlooked and offer tremendous value for investors and myself. These two hit that nail on the head.

So when others catch on, you’ll have locked in your income and enjoy those paychecks coming into your account. Those paychecks are cash you can reinvest into new opportunities as they appear! You can also use them for daily life, buying groceries, paying your power bill, or topping off your gas tank.

Income investing is less about playing games and trying to time the market, and more about having time in the market as it pays you to be there. I don’t want your retirement filled with gambling bets on which cow will lead the herd. I want it to be filled with your family, loved ones, and hobbies that you enjoy. If you enjoy a good gamble, don’t ever bet that which you cannot afford to lose! Dividend investing will provide you with plenty of extra cash to use if you choose to indulge – so even you can benefit from it!

That’s the beauty of income investing – everyone can benefit from it in the end.

Be the first to comment