pixelfit/E+ via Getty Images

Investment Thesis

ReneSola’s (NYSE:SOL) share price trades at close to a 52-week low. Why? Because of several factors, including the fact that Q1 2022 is going to be reporting very weak top-line growth, but also because of the businesses’ overall volatility.

On a positive note, management believes that it can dramatically improve its revenue growth rates starting Q2 2022 so that by the end of this year, its revenues will be up more than 35% y/y.

Furthermore, this is a business with minimal debt, which is obviously a substantial part of the bull thesis.

However, when all is considered, I am inclined to believe that this investment is too unpalatable.

Revenue Growth Rates Are Unpredictable

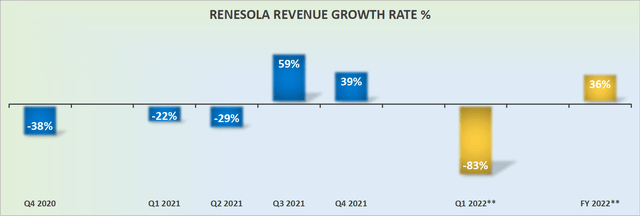

ReneSola revenue growth rates

The biggest single largest detraction from ReneSola’s bullish thesis is that its revenues are too volatile. It’s so difficult to get a sense of the underlying growth in intrinsic value when its top line grows and decreases depending on the lining up of projects.

For example, as you can see above, for Q1 2022 the guidance points towards its topline being down more than 80% y/y to approximately $4 million in revenues for the quarter.

Even if revenues ramp up in the later parts of the year, investors are asked for a substantial amount of patience to see that the company is back on steady footing, sooner rather than later.

Why ReneSola? Why Now?

ReneSola is a solar project developer and operator. ReneSola develops and sells solar power projects, or sells project SPVs (project development business), with a smaller proportion of its business associated with the sale of electricity generated by its operated solar power plants (IPP business).

For context, the vast majority of its revenues, approximately 85% as of Q4 2021, are derived from its project development business, with more than 70% of its geographical exposure being tied to Europe.

For its recent Q4 2021 results, ReneSola signals to investors the progress it made in 2021, including more than doubling its mid-to-late stage project pipeline from 1 GW to 2.2 GW.

What’s more, coming on the heels of countless countries clamoring for energy independence, with not only oil and gas being an immediate necessity, but the green-agenda still very much in demand too, it feels somewhat disappointing that ReneSola’s proclamation to become a leading global solar project developer, is marrying up with Q1 2022 guiding for its revenues to be down so materially.

However, it’s not all bad news.

Cash Flows Improve, But Is It Enough?

In the first instance, it’s worth noting that ReneSola holds $254 million of cash and equivalents and is for all intents and purposes close to debt-free. More specifically, its debt to asset ratio at end of Q4 was a record low of 10.3%.

Furthermore, on a positive note, ReneSola did manage for Q4 2021 to be cash-flow positive at approximately $8.5 million compared with negative $3.6 million in cash flow generation in the same quarter a year ago.

That being said, this strong end to the year, wasn’t enough to turn the year as a whole cash-flow positive.

In fact, 2021 ended using $6.4 million of cash flows from operations. Nevertheless, this was an improvement from the $10.0 million use of cash flows from operating in 2020.

On yet the other hand, ReneSola’s management team decided that after diluting shareholders earlier in 2021 by selling $290 million worth of stock, management then proceeded to make an about-turn later on in 2021.

Accordingly, during Q4 2021, as ReneSola saw its share price continue to slide lower, management believed that repurchasing approximately $18 million worth of stock was a worthy endeavor, in an attempt to add some support to the share price.

SOL Stock Valuation – Difficult to Value

On the one hand, the business is cheap. For example, as of Q4 2021, cash per ADS was $3.65 compared with the current share price of $5.90 per ADS. This implies that approximately $60 of its market cap is made up of cash.

The problem though, as we’ve discussed, is we are looking at a business that isn’t able to sustainabily generate cash flows. And this is then further compounded by the fact that its revenues are just volatile.

How does one even value this sort of investment?

The Bottom Line

ReneSola asserts that the second half of the year will be very strong for the company. ReneSola states that the bulk of its sales will ramp up in Q2 and throughout the remainder of 2022.

What’s more, even though ReneSola contends that 2022 will see its revenues increase by more than 35% y/y, investors are not willing to give this stock the benefit of the doubt right now.

And I’m inclined to agree. I believe that right now, there are meaningfully easier investments available.

Be the first to comment