RHJ

Investment Thesis

GoGold (OTCQX:GLGDF) has been very quiet lately, with few updates on the drill results, but the stock price has recently recovered reasonably well from the lows and is up almost 50% from the 15th of July 2022.

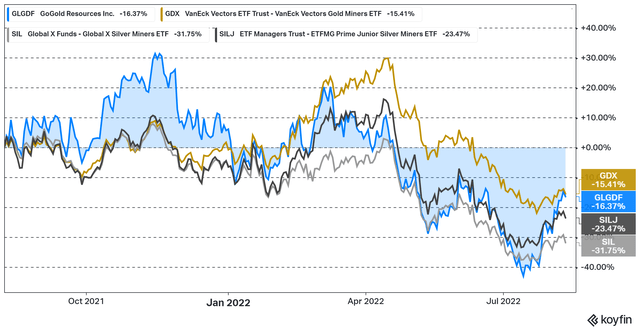

Ove the last year the stock price has been more volatile than the regular precious metals mining ETFs, but has had a comparable return over the period.

The company has drilled up a large resource at Los Ricos North over the last year, which is set to increase over the coming year with a resource update. GoGold is also expected to release a PFS for Los Ricos South within a year. So, I continue to think GoGold is very likely to outperform over the next few years.

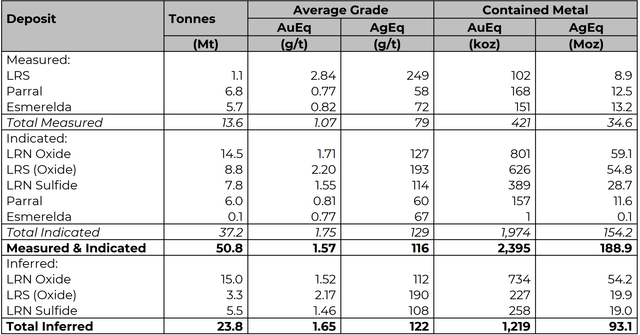

Figure 2 – Source: Corporate Presentation – Company Wide Resources

The company has so far managed to grow the resource base substantially over the last few years.

Parral

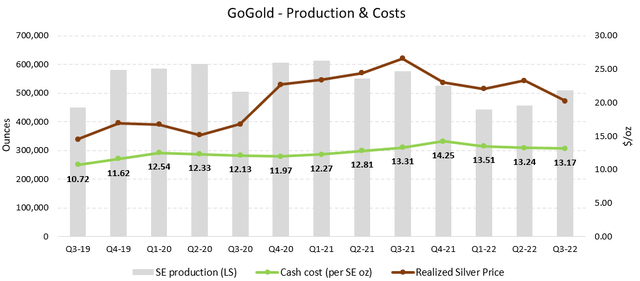

GoGold released the Q3-22 financials on August 11, 2022. The most notable part in my view was the costs at Parral, where cash cost in quarter came in at $13.17/oz, which is down marginally year-over-year.

In fiscal year 2021, the company saw cash cost creep up from about $12/oz to end just above $14/oz. GoGold has managed to keep costs down following since then. This is very encouraging since many other miners have suffered much more from inflation, especially given that Parral is a heap leach operation, impacted by higher consumable prices.

Figure 3 – Source: Quarterly Reports

Parral is only a small portion of the estimated value of the total company, but it provides important cash flows to cover general & administrative costs and contribute cash to the large ongoing drill program.

Los Ricos

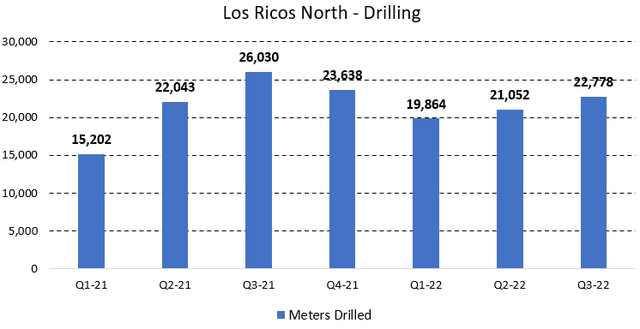

GoGold has been known for delivering very frequent drill updates over the last couple of years. However, over the last 4-5 months, there have been very few updates. The lack of results was initially due to some minor infrastructure work and delays at the labs. More recently, GoGold has likely held back drill results during the quieter summer period.

The company has however continued to drill in Q3-22, where the Q3-22 MDA highlights that GoGold has drilled more than 20,000 meters in the most recent quarter. So, we can likely expect a lot of drill results once GoGold decides to start releasing them again.

Figure 4 – Source: Quarterly Reports

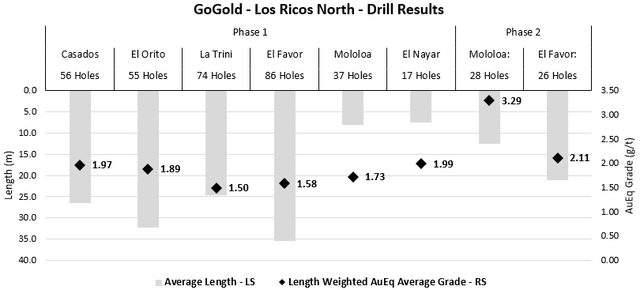

The drill results from Mololoa and El Favor which have been released following the resource update late last calendar year have so far been very encouraging, with grades above the ones seen in the phase 1 drilling. I have little doubt Los Ricos North will grow substantially over the coming year once the new drill results get incorporated into the resource.

Figure 5 – Source: My Calculation

There has also been some drilling at Los Ricos South, which naturally has the potential to boost the value of the resource there as well. We have yet to receive any results though, so it feels premature to assign any value to that at this point. GoGold has had a very impressive hit ratio for the drilling at Los Ricos over the last few years, so if recent history is to be our guide, it can get very interesting.

Valuation & Conclusion

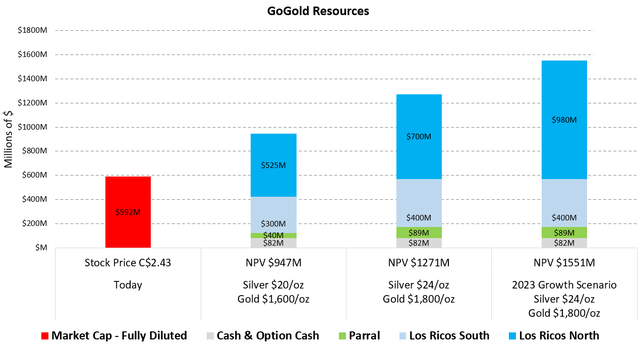

The below chart relies on my best estimates for the value of Parral, Los Ricos South, and Los Ricos North at a couple different metal price scenarios. I have used the latest share price, fx rate, and the financial information is from the Q3-22 report. Note that I have also included a growth scenario, where I expect the value of the resource at Los Ricos North to grow by 40% over the coming year, which I don’t think is an aggressive assumption.

It is worth highlighting that there is still a large degree of uncertainty in these numbers given the inflation we have seen over the last couple of years and the fact that there are no independent 43-101 economic estimates for Los Ricos North yet.

Figure 6 – Source: My Estimates

There is no doubt the valuation was even more attractive last month around the lows, but I still think GoGold is one of the better risk-rewards in the industry at this level. The cash burn is relatively low thanks to Parral, despite a very large drill campaign, which will likely boost the stock price once the sentiment turns more favorable. Management has also made few mistakes and has a large insider ownership, so I would be less concerned about poor capital allocation decisions than elsewhere in the industry.

Be the first to comment