hapabapa

Fortinet (NASDAQ:FTNT) recently reported a pretty good Q2 and despite the challenging macro environment, management largely reiterated guidance for the remainder of the year.

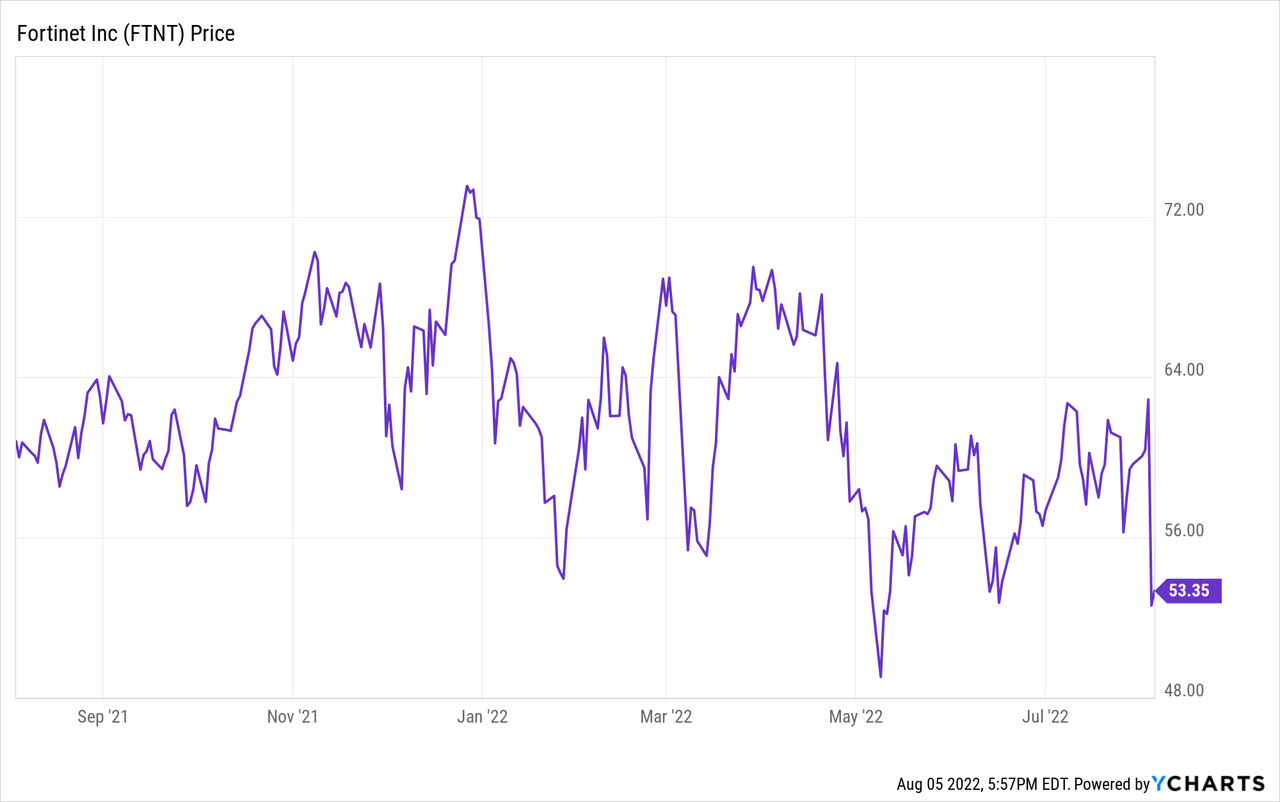

Calling out some delays in deal closings and impacts from the company’s business in Russia (which represents <2% of revenue), management did have a more cautious tone regarding their outlook. Combined with underlying strength in the IT security market and investors likely expecting a guidance raise, the stock pulled back ~15% since reporting earnings.

The stock has remained pretty volatile over the past year, with the stock trading between $48-75 with many ups and downs along the way. The company has consistently reported revenue growth of 25%+ and with operating margins around 25%, FTNT has surpassed the Rule of 40 score for many consecutive quarters.

The global pandemic highlighted the need for enterprises to upgrade their IT security systems and move away from legacy on-premise hardware solutions. In today’s current environment, macro impacts such as high inflation, rising interest rates, and economic uncertainty, many companies are taking a more cautious approach to their forward outlook, and FTNT is no different.

However, longer term, I believe the company’s fundamentals remain robust and even with forward revenue multiple above 9x, I believe long-term investors can still be rewarded. I view this 15% pullback as a good buying opportunity for those looking to gain exposure to IT security.

Financial Review and Guidance

Revenue during the quarter grew 29% yoy to $1.03 billion and was pretty similar to consensus expectations. Not surprisingly, product revenue growth remained strong at 34% yoy growth and while this slowed from the 54% growth last quarter, Q2 had a much tougher growth comparison.

In addition, billings growth during the quarter remained robust at 36% yoy, remaining pretty similar to the past two quarters. Billings tend to be a good indicator of future revenue growth, so the consistent billings growth should instill come confidence for revenue growth over the coming quarters.

On top of the consistent revenue and billings trends, margins and profitability remain healthy. During Q2, gross margin was 76.5% and while this was down from 77.5% in the year-ago period, gross margin improved from 74.4% last quarter. Also, while margins contracted ~100bps yoy, the company did see less gross margin pressured compared to last quarter’s ~450bps contraction.

Nevertheless, continued operating expense efficiencies led to operating margins of 24.8%, down only ~60bps yoy and improving from the ~250bps yoy contraction seen last quarter.

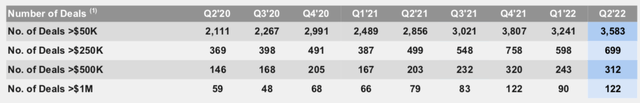

Even though the macro environment has remained challenged in recent months, the company has done a great job continuing on their path towards larger deals.

During Q2, they had nearly 700 deals >$250k, up ~100 from last quarter. In addition, they had 122 deals >$1 million, which is tied for the most in the company’s history.

Largely deals are typically stickier and more recurring, as enterprises are less willing to walk away from a large deal. Yes, the macro environment may cause some deals to take longer to close as companies re-visit their investments, but these large deals are likely to remain a stronghold for the company.

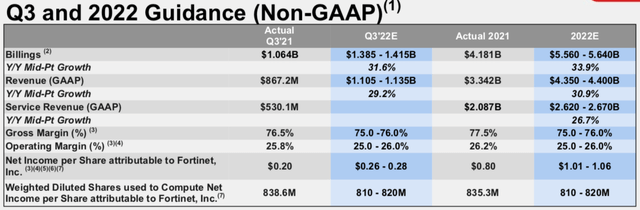

For Q3, the company is expecting revenue of $1.105-1.135 billion, reflecting 29% yoy growth at the midpoint. In addition, gross margin is expected to remain healthy at 75-76% and operating margins at 25-26%.

For the full year, the company continues to expect revenue of $4.35-4.40 billion, which compares to expectations for $4.38 billion. Billings for the year are expected to be $5.56-5.64 billion, compared to the previous guidance range of $5.50-5.58 billion. In addition, both gross margin and operating margin were raised by ~100bps at the bottom end.

Even though the company continues to see supply chain challenges in the market, management talked about demand continuing to be higher than supply, which indicates a generally strong market.

We are continuing to address the supply chain challenges in a number of ways, including by increasing inventory purchase commitments, redesigning products, qualifying additional suppliers, and certain pricing actions.

We believe that even with these actions, demand will continue to outstrip supply. As a result, we expect backlog to continue to increase in 2022; and while the situation is very dynamic, we believe we will have access to sufficient inventory to meet our guidance.

Before reviewing our guidance, let’s offer a few Fortinet specific observations in areas you may have heard discussed elsewhere. In Q2, we noted certain larger transactions with increased negotiating cycles. Also, linearity pushed to later in the quarter, and later in the last month of the quarter, due mainly to supply constraints. Lastly, close rates were strong and, importantly, the aggregate value of deals that pushed out were within our historical norms.

Even with a more challenging macro environment, includes larger deals having longer sales cycles, the reiteration of guidance and margin guidance raise at the midpoint should have been viewed as at least a neutral event, if not positive. I believe investors may have been expecting a guidance raise given the continued strength across the IT security market.

In addition, I believe management may be being prudent with their guidance given the uncertain environment. Guidance may prove to be conservative, but with expectations high heading into the quarter, investors might have been expecting more than reiterated guidance.

Valuation

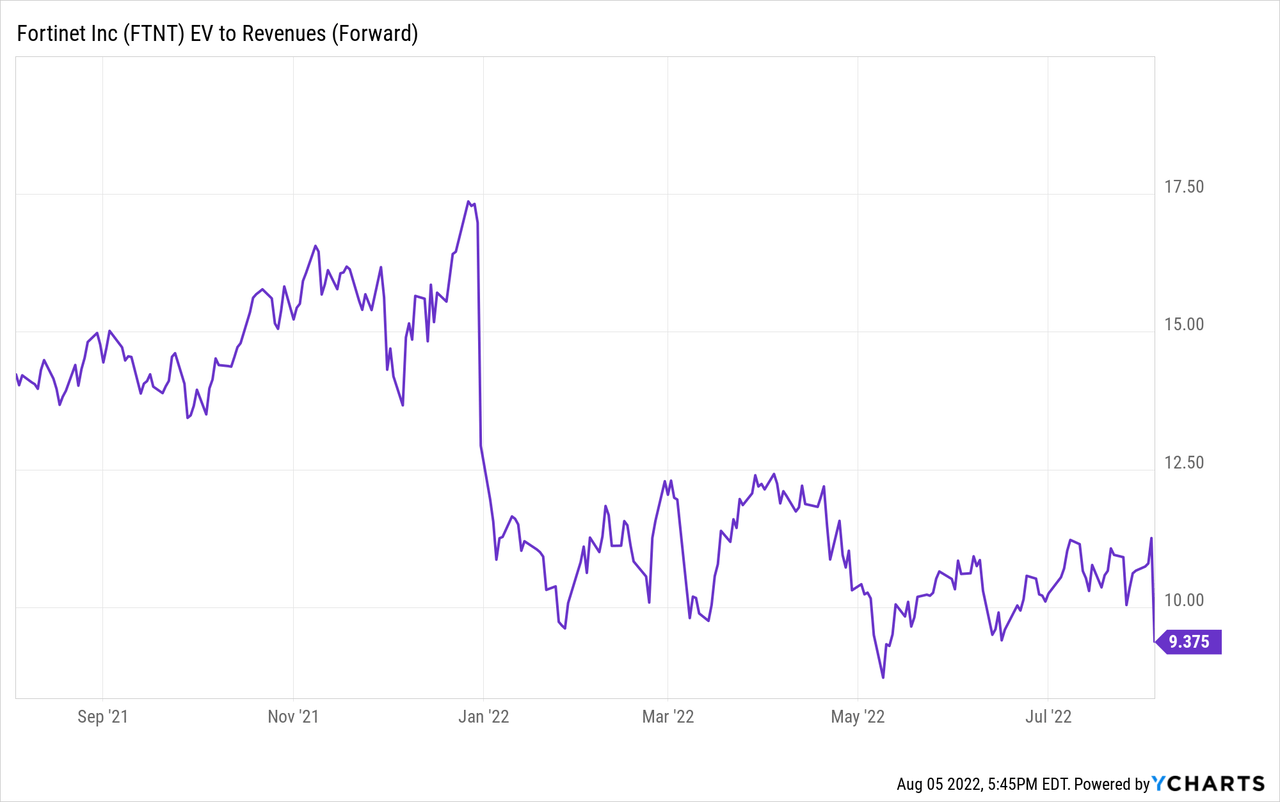

Since the company reported earnings, the stock has fallen around 15%, significantly underperforming the broader market. Yes, valuation continues to be a challenge for the company as the stock receives a premium multiple, but FTNT has consistently shown their ability to produce a Rule of 40 score above the targeted level.

I believe the premium valuation could be the main thing investors focus on over the coming weeks as justification as to why the stock should trade lower. However, from a fundamental standpoint, the company continues to execute and perform according to expectations.

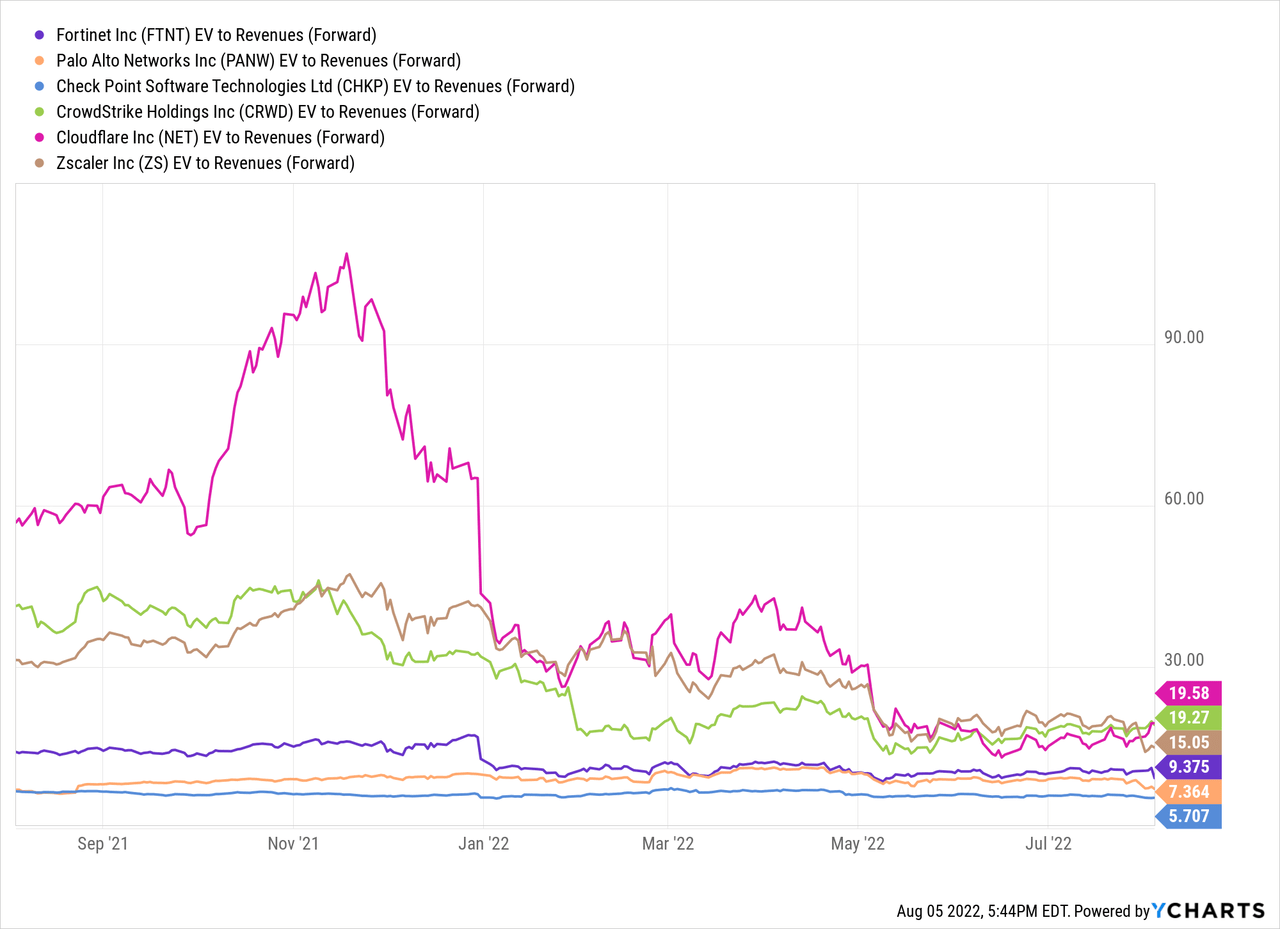

While the broader IT security landscape continues to receive premium forward revenue multiples, these have pulled back in recent months, and rightfully so. Even with some of the faster growing companies like Cloudflare (NET), CrowdStrike (CRWD), and Zscaler (ZS) trading above 15x forward revenue, their valuations have pulled back quite a bit.

When it comes to FTNT, their forward revenue valuation has pulled back from over 15x forward revenue, now to under 10x forward revenue. Yes, revenue growth continues to remain healthy at 25%+ and operating margins of ~25%, but the current valuation does imply a lot of success is priced into the stock.

Typically any stock trading over 10x forward revenue should have revenue growth well above 30% with continued margin expansion.

In the case of FTNT, revenue growth has consistently been 25%+ with operating margins maintaining around 25%. While some could argue valuation is appropriate, I believe there could be some downside risk to valuation as investors re-set expectations around appropriate revenue multiples.

For now, I remain bullish around the company’s operating trends, though am hesitant to become overly bullish. The 15% pullback does make me feel more comfortable around the long-term alpha potential and long-term investors should look to pick up some shares. While the stock may remain volatile in coming weeks as the remaining IT security companies report, I believe there is still a lot to like long-term.

Be the first to comment