adaask

Both Main Street Capital (NYSE:MAIN) and Owl Rock Capital Corp (NYSE:ORCC) have investment-grade (BBB- Stable from S&P) credit ratings, vaulting them into the upper echelon of quality Business Development Companies (i.e., BDCs) (BIZD). Both also happen to offer mouthwatering dividend yields, with MAIN boasting a 5.8% dividend yield and ORCC boasting a 9.7% dividend yield.

In this article, we will review their Q2 results and then compare them side by side and offer our take on which one is a better buy.

Q2 Results

ORCC’s Q2 results beat analyst consensus expectations with net investment income of $0.32 per share, up 6.7% year-over-year. That said, net asset value declined year-over-year to $14.48 from $14.90. However, it was not due to deteriorating credit quality. As management explained on the earnings call:

I want to underscore the importance of our valuation process to accurately mark each investment in our portfolio every quarter. As I mentioned, our NAV declined due to unrealized losses driven by a widening credit spread environment and is not a reflection of deteriorating credit quality in our portfolio.

MAIN also beat Wall Street’s expectations with $0.78 per share in net investment income, up 1.3% sequentially and up 18.2% year-over-year. Net asset value per share also increased significantly year-over-year from $23.42 to $25.37, though it was down sequentially from $25.89 at the end of Q1.

Balance Sheet

As was already stated, both MAIN and ORCC have the same investment-grade credit rating and outlook from S&P, which puts them on similar footing in terms of perceived risk and access to capital.

MAIN has $518.4 million in total liquidity (~10.2% of its enterprise value) with a leverage ratio of 0.98x. Only 20% of MAIN’s debt is negatively exposed to floating rate.

ORCC, meanwhile, has $1.7 billion in total liquidity (~14.5% of its enterprise value) and a leverage ratio of 1.2x. Only ~50% of ORCC’s liabilities are floating rate and exposed to rising rates.

While both appear to be in solid shape, MAIN seems to have the stronger balance sheet as its significantly lower leverage ratio and lesser exposure to floating interest rates outweighs ORCC’s greater liquidity.

Investment Portfolio

ORCC’s portfolio consists of 88% senior secured debt and 99% of its debt investments are floating rate, meaning that ~90% of the total portfolio is floating rate debt. ORCC’s portfolio is overweight more defensive sectors, with its top five sectors being software, financial services, insurance, food and beverages, and manufacturing. Non-accruals were very low as of 6/30/22 with only one investment on non-accrual, amounting to just 0.1% at fair value.

MAIN’s portfolio consists of ~69% senior secured debt and 73% of its debt investments are floating rate, meaning that ~59% of the total investment portfolio benefits from rising interest rates. Similar to ORCC’s portfolio, MAIN’s portfolio is also mostly overweight more defensive sectors, with its top five sectors being software, machinery, construction, commercial services, and diversified consumer services. Non-accruals were very low as of 6/30/22 at just 0.7% at fair value, though a much higher 3.2% on a cost basis.

Both businesses appear very well positioned to benefit from rising interest rates, with ORCC’s management stating on its Q2 earnings call:

we will see a meaningful benefit from rising rates starting in the third quarter. As you will recall, at the beginning of the second quarter, many of our borrowers reset their interest rate election to three months LIBOR, which was approximately 1% at the time and slightly above the average floor in our portfolio. So there was a limited benefit to our interest income in Q2.

The second quarter ended with three months LIBOR at 2.3% which meaningfully increase the base rate for those borrowers. Holding all else equal had our base rates as of June 30, has been in effect for the entirety of the second quarter, we estimate NII would have increased $0.02 per share, to a total of $0.34 per share in Q2. Additionally, borrowers will continue to reset their interest rate elections throughout the third quarter which will continue to benefit the yield on our portfolio and be accretive to NII.

Meanwhile, MAIN’s CEO stated in its earnings call:

One additional item that I wanted to touch on is the impact of rising interest rates. During the quarter, LIBOR rates increased by approximately 130 basis points from those in effect as of March 31st to June 30th. At the end of the second quarter, 80% of our outstanding debt obligations maintain fixed interest rates. On the other hand, approximately 75% of Main’s debt investments for interest rates at floating rates with weighted average contractual interest rate floor of low current market index rates. As a result, in a rising interest rate environment, our exposure to higher interest expense is largely mitigated and over time, increases to our interest income will exceed the increases to our interest expense. It is important to note that the majority of our variable interest rate investments are based on contracts which reset quarterly, whereas our credit facility resets monthly. As a result, we generally will have a quarterly lag in the realization of benefits from rate increases in our interest income and net investment income.

ORCC’s more favorable exposure to rising interest rates, more defensive positioning with greater exposure to debt rather than equity, and its much lower non-accrual rate all combine to make its portfolio appear much more favorable than MAIN’s in the current environment.

Dividend Safety

ORCC generated $0.32 in net investment income per share in its most recent quarter while paying out $0.31 as a dividend. While the dividend coverage was tight, management noted that it was likely a short-term issue given that they had very little repayment income due to a seasonally quieter M&A environment as well as the fact that income is set to rise with higher interest rates in Q3. That said, ORCC’s management was not prepared to guide for meaningfully higher earnings moving forward and would not commit to raising the dividend or paying out a special dividend in the near term.

MAIN’s dividend coverage was pretty strong during Q2, with distributable net investment income covering the monthly dividends by 1.21x. As a result, management declared a special dividend, stating:

Based upon our results for the second quarter and the positive performance of our existing portfolio of companies, combined with our favorable outlook in each of our primary investment strategies and for our asset management business and the benefits of our efficient operating structure, earlier this week, our Board declared a supplemental dividend of $0.10 per share payable in September and an increase in monthly dividends for the fourth quarter of 2022 to $0.22 per share payable in each of October, November and December. These monthly dividends represent a 4.8% increase from the fourth quarter of 2021 and a 2.3% increase from the third quarter of 2022.

The supplemental dividend for September is due to our strong performance in the second quarter, which resulted in DNII per share, it was over $0.13 or 21% greater than the monthly dividends paid during the quarter. This represents our fourth consecutive quarter of paying a supplemental dividend and result in total supplemental dividends paid over the last year of $0.35 per share, representing an additional 13% paid above our monthly dividends and an increase in total dividends paid for the trailing 12-month period of 18.5% over the prior year. We are pleased to have been able to deliver this significant additional value to our shareholders.

While ORCC’s portfolio is more conservatively positioned at the moment, MAIN’s regular dividend coverage still looks stronger at the moment, so we give them the edge here.

Track Record

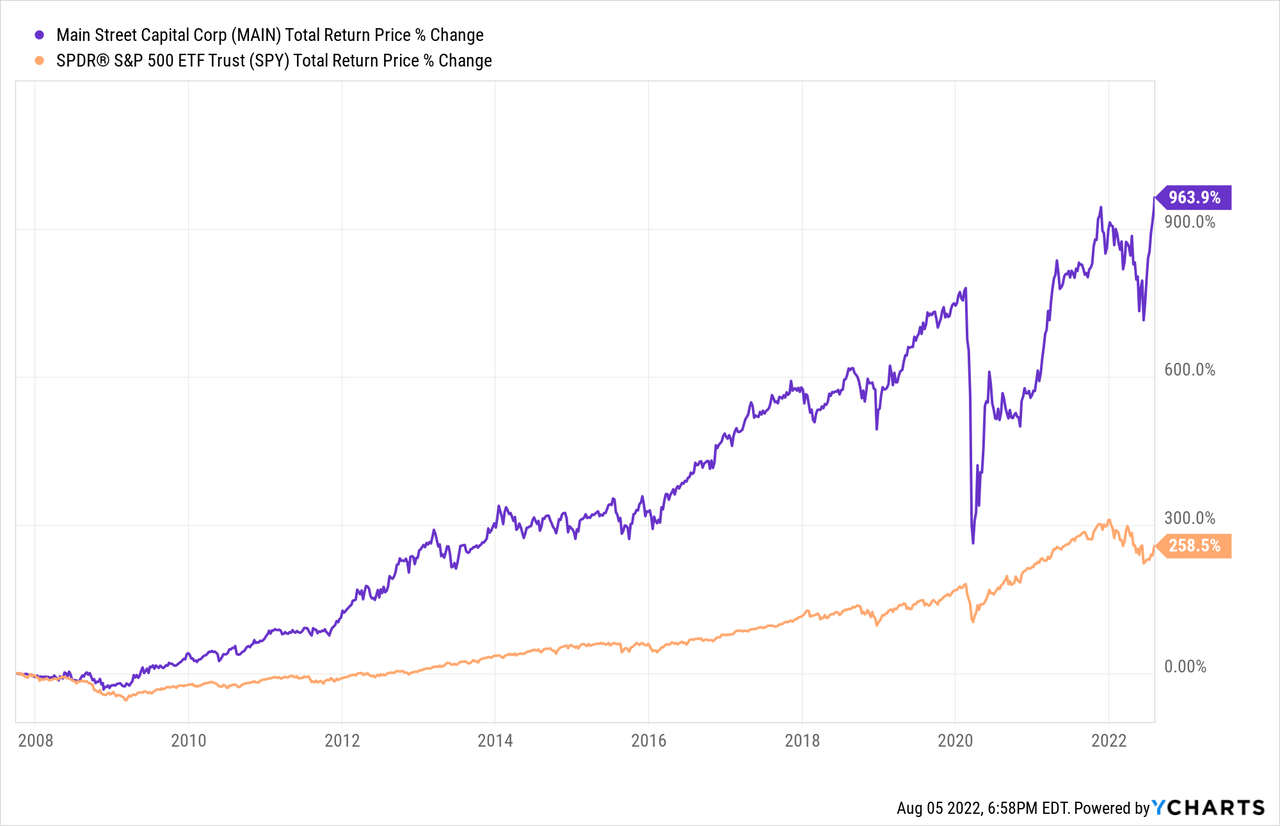

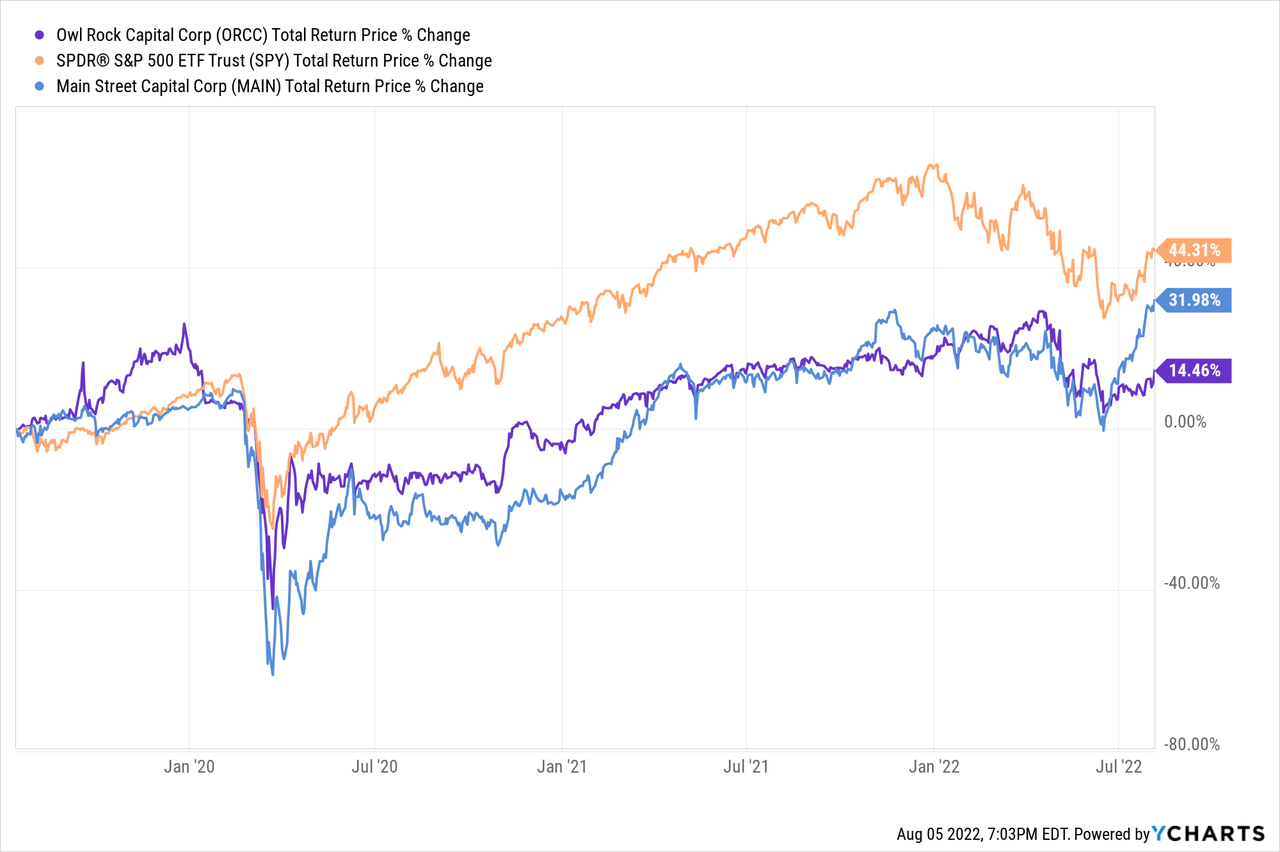

MAIN has a great track record, as it has crushed the market since it went public:

Meanwhile, ORCC has underperformed both the SPY and MAIN since going public:

As a result, MAIN clearly wins the track record competition.

Valuation

ORCC does have some significant valuation items going for it, however. First and foremost, its dividend yield is 374 basis points higher than MAIN’s. Second, MAIN currently trades at a huge 74.93% premium to NAV, whereas ORCC trades at an 11.4% discount to NAV. On the other hand, however, according to CEFdata.com, MAIN’s expense ratio is much lower at 5.94% compared to ORCC’s 10.18% expense ratio. While MAIN’s lower expense ratio certainly warrants a higher valuation, the valuation gap between the two is simply massive.

Investor Takeaway

MAIN is certainly hard to pick against given its impressive long-term track record, strong balance sheet, and low expense ratio. However, ORCC has more favorable exposure to rising interest rates, a more conservatively positioned investment portfolio, and – most significantly – a vastly superior dividend yield and much more favorable valuation relative to NAV. Overall, the valuation discount is just too great for us, and ORCC’s better positioning for a recession and/or rising interest rate environment is another big factor, so we believe that ORCC is a much more attractive BDC at the moment. We rate ORCC a Buy and MAIN a Hold.

Be the first to comment