AerialPerspective Works/E+ via Getty Images

Thesis

Cohen & Steers Limited Duration Preferred & Income Fund (NYSE:LDP) is a closed-end fund from the Cohen & Steers family. As per its literature, the fund is:

Designed for investors seeking high current income and capital preservation by investing in low-duration preferred and other income securities issued by U.S. and non-U.S. companies

What attracted our attention was the “low duration” aspect present in both the name of the fund and its mandate. In a year with a violent rise in risk-free rates, we would expect short-duration investments to outperform. Especially in an asset class such as preferred securities, which in many cases are perpetual (i.e., very long duration).

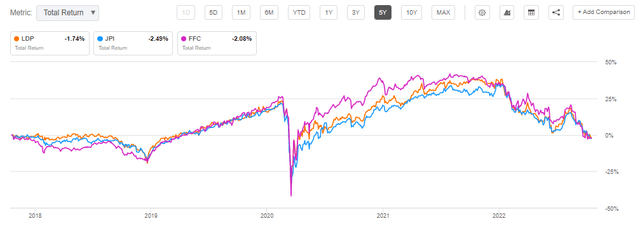

Unfortunately, LDP disappoints, exhibiting the same performance year to date as other “regular” preferred CEFs, namely Nuveen Preferred & Income Term Fund (JPI) and Flaherty & Crumrine Preferred and Income Securities Fund Inc. (FFC). All three names are down almost -30% in 2022. When looking at their longer-term performance, the cohort exhibits a fairly well-correlated and cohesive total return, thus denoting the lack of a true duration differentiator. Traditional fixed income sees long-duration bonds outperform during a decreasing interest rate environment, for example.

When dissecting the LDP collateral, an investor will notice that the fund tries to lower its duration profile via floating rate securities. However, given the significant maturity profile for preferred securities, the spread component for the cohort is fairly high, thus not reducing enough of the duration sensitivity for the fund. The CEF focuses on bank and insurance-preferred securities, and layers a 34% leverage on top of the structure. We believe that we are currently in a recession, but it is not going to be credit punitive, with financials in a very healthy state. Moreover, we are seeing a trend for banks where they increase their interest income by not passing the current high short-dated yields to consumers. Just have a gander at what your savings bank account offers you currently versus where 6-months treasury bill yields are.

LDP is a preferred securities CEF with a robust collateral that is sound from a fundamental perspective. We are of the opinion that the current recession will not be credit driven, and most of the negative performance this year is due to higher rates. Although the fund has “limited duration” in its name and posts an average modified duration of only 2.7 years as per its Fact Sheet, its performance this year has been in line with other “regular” preferred securities CEFs. An investor who would have wanted to switch to a lower duration profile to avoid the negative performance from higher rates would have not benefited from switching to LDP. Furthermore, a longer-term total return profile exhibits a close correlation with the entire preferred CEF cohort.

LDP Holdings

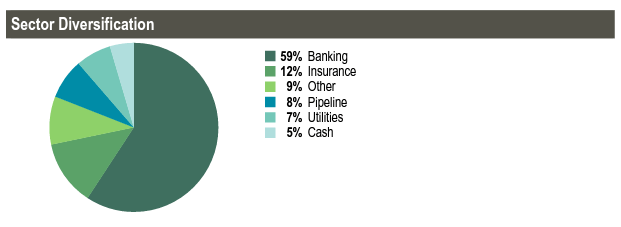

The fund focuses on bank and insurance preferred securities:

Sector Diversification (Fact Sheet)

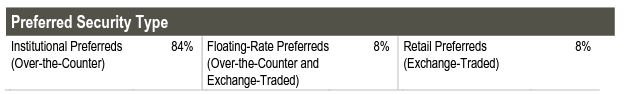

Despite the shorter duration assertion, the vast majority of the collateral is fixed rate:

Security Type (Fact Sheet)

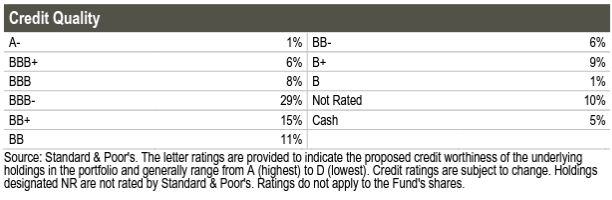

From a credit quality perspective, the fund is well-balanced, with a granular distribution between investment grade and junk securities:

Credit Ratings (Fact Sheet)

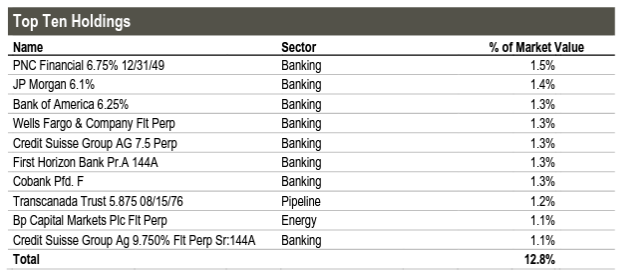

The top holdings are mostly banking names:

Top Holdings (Fact Sheet)

While we believe we are currently in a recession, we do not think this will be credit-driven, and specifically, financials are not set to suffer. From that angle, we saw that Citi (C), JPMorgan (JPM) and Bank of America (BAC) posted healthy results, with the banks taking advantage of the higher yields on treasuries which are not passed back to depositors.

Performance

The fund is down almost -30% on a year-to-date basis:

YTD Performance (Seeking Alpha)

The fund is now flat from a total return perspective on a 5-year time frame:

5Y Total Return (Seeking Alpha)

We can see that the entire preferred CEFs cohort is fairly well aligned, with no outperformers. In traditional fixed income, longer-duration funds tend to outperform when rates decrease and lag when rates rise. Not here.

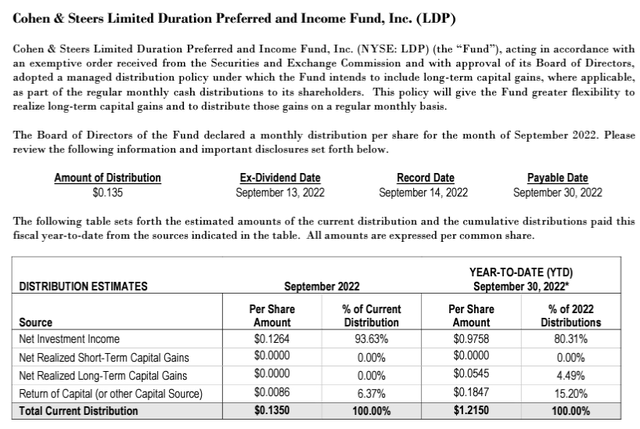

Distributions

The fund has a good coverage ratio, with de minimis ROC utilized on a fiscal year to date:

That is a healthy behavior for a CEF and ensures NAV stability long term. We like to see de minimis ROC utilization because it denotes a well-covered dividend, and an asset manager that does not play any games via artificial yields. The CEF structure uses leverage to magnify returns and should not be utilized to present dividend yields which come from ROC.

Premium/Discount to NAV

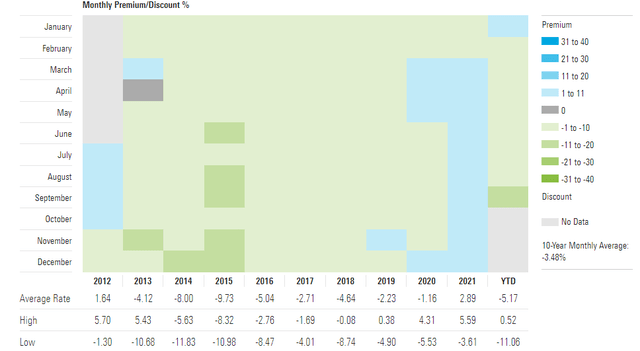

The fund usually trades at a discount to net asset value:

Premium/Discount to NAV (Morningstar)

We can see that, historically, the fund has traded at a discount to NAV in the past decade. On average, the fund exhibits a -5% discount. The only consecutive quarters when the CEF was at a premium were in 2021, when interest rates were close to zero and the Fed was incentivizing the market to increase portfolio risks.

Conclusion

LDP is a closed-end fund focused on bank and insurance-preferred securities. The vehicle has a short duration of 2.7 years, which unfortunately did not translate into an outperformance versus other CEFs in the space in 2022. An investor, who would have switched to LDP at the beginning of the year expecting a rise in rates, would have obtained the same return as in other preferred CEFs. The fund is currently trading at a discount of -10.5%, towards the wider side of its historic range. The CEF’s collateral is robust, and we expect no fundamental-driven issues dragging performance going forward. After a tumultuous 2022, we expect LDP to revert to a positive performance in 2023 as rates stabilize, but despite its name, this CEF is not a safe harbor when it comes to protection against higher rates.

Be the first to comment