Fatih Kardaş/iStock via Getty Images

Wahed FTSE USA Shariah ETF (NASDAQ:HLAL) is a Sharia-compliant ETF that aims to limit exposure to companies that are in violation of Islamic principles, allowing devout Muslims to invest in public equities without violating core principles of their faith. The world of Islamic Finance is developing and rapidly growing with the introduction of various “sharia-compliant” investment options, but in my view, still leaves a lot to be desired. I consider this ETF to be a step in the right direction, and I offer my suggestions for improvement.

Overview of Sharia-Compliant Guidelines

The ETF has a host of restrictions to ensure that its holdings’ sources of income are primarily sharia-compliant. Companies that receive income in excess of 5% of their total revenue from Shariah-prohibited activities are removed from the list of companies eligible for inclusion in the Index. According to Wahed’s Summary Prospectus, examples of such prohibited activities include:

• Conventional finance (non-Islamic banking, finance and insurance, etc.);

• Alcohol production or sale;

• Pork-related products and non-halal food production, packaging, and processing or any other activity related to pork and non-halal food;

• Casino management, gambling, or adult entertainment;

• Tobacco manufacturing or sale; and

• Weapons, arms, and other defense manufacturing

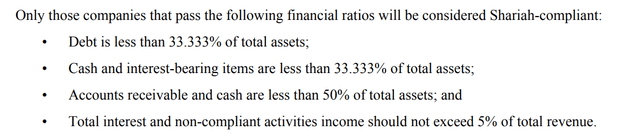

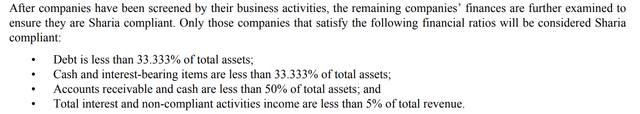

In addition to these restrictions, the ETF also has restrictions on particular financial ratios in an attempt to limit exposure to overly leveraged companies. This is due to the Islamic prohibition on receiving and paying interest. The following is an overview of the financial ratios that are utilized to assess sharia-compliance from a leverage perspective.

Critique of Utilized Financial Ratios

As it is impossible to entirely avoid non-sharia compliant activities such as leverage in a portfolio, the ETF aims to limit exposure to these activities to a reasonable level. Given that the exercise of excluding non-compliant companies is based on the limitation of non-compliant activities rather than complete elimination of said activities, it is important that a key distinction is made to ensure that we are limiting the correct activities.

33% Debt to Asset Ratio Seeks to Limit Debt Levels, Rather than Interest Payments

The Islamic prohibition is not on the usage of debt, but rather on the payment of interest. A theoretical 0% interest rate loan would not fall under an Islamic prohibition, as no interest is paid even though debt is incurred. It appears that the ETF seeks to limit debt levels rather than interest payments.

This is a key distinction as different companies can have substantially different costs of capital, borrowing at different interest rates depending on their size and credit rating. Large and healthy blue-chip AAA rated corporates can issue bonds at interest rates slightly above U.S. Treasury rates, while smaller companies with lower credit ratings may have to borrow at a 300-500 basis point spread above U.S. Treasury rates.

Prior to rates rising, McDonald’s was able to issue debt at an interest rate of 3%, while AMC issued second-lien notes at a much higher 10% due to financial struggles in the pandemic. Using a debt-to-assets ratio treats both of these debts as equivalent, despite AMC’s debt resulting in 230% more in interest payments for the same level of debt. See below for an illustration.

| McDonald’s | AMC | |

| Actual Coupon (Interest rate) | 3% | 10% |

| Theoretical amount borrowed | $100M | $100M |

| Interest paid | $3M | $10M |

This shows that debt is not necessarily a good proxy for interest payments. My view is that financial ratios such as debt service coverage ratio (often used with real estate investment trusts) or interest coverage ratio are better ratios that can be used to better achieve the ETF’s objectives of limiting exposure to non sharia-compliant activities.

HLAL Asset Restrictions Penalize Hard Assets and Reward Intangibles

I often write about stocks trading at below NAV (net asset value), or theoretical liquidation value. In calculating NAV, the unanimously accepted approach is to include tangible assets such as cash and cash equivalents, restricted cash, short-term investments, and market value of property. In fact, cash and cash equivalents are the preferred form of asset, as their market value is indisputably as represented on the balance sheet. Property value recorded on the balance sheet is often misrepresented as it is recorded at cost in accordance with GAAP rules, and then further depreciated via the accumulated depreciation line item, when the market value is actually above cost due to appreciation of value.

In other cases with an equipment heavy PP&E line item, actual depreciation may be far in excess of the recorded depreciation on the balance sheet, leaving the market value of equipment to be far lower than that recorded on the balance sheet.

Intangible assets such as goodwill that cannot be sold are not considered “real” assets and such are not usually included or are marked down substantially when determining the underlying asset value of a company.

As such, the order of confidence in the individual asset line items as listed on the balance sheet is as follows:

1) cash and cash equivalents: (no mark-down)

2) restricted cash and short-term investments: (no mark-down)

3) Accounts Receivable: (~20% mark-down)

4) PP&E (Property, Plant, and Equipment): (70% mark-down to 100% mark-up depending on true market value of property and equipment)

5) Intangible Assets such as Goodwill: (80-100% mark-down)

Given this order of confidence, it is surprising to see that there is a limitation on the amount of cash and accounts receivable as a percentage of asset value, while there is no limitation on the percentage of intangible assets as a percentage of asset value.

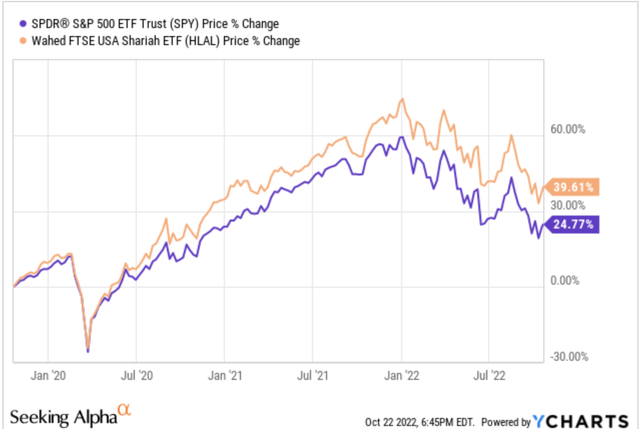

HLAL Recent Outperformance vs S&P 500

HLAL has outperformed the S&P 500 over the past 3 years, with total price return (excluding dividends for simplicity) of 39.61% versus 24.77% over the 3 year period.

HLAL also experienced a more limited drawdown YTD, down 19.12% versus 21.2% for the S&P 500.

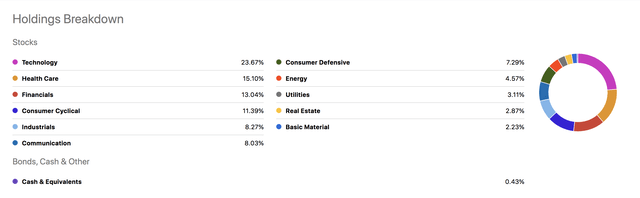

HLAL Overweight Technology & Healthcare, Together Making Up 62.5% of the ETF

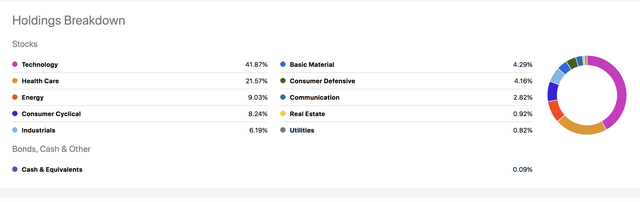

HLAL is restricted in its investment options by its sharia-compliance guidelines. As such, the industry breakdown of its holdings are not representative of the broader market index. HLAL is overweight technology and healthcare, with tech representing 42% of the ETF’s holdings and healthcare representing 21.5% of the ETF’s holdings.

Meanwhile, tech represents just 23.5% of the S&P 500 and healthcare represents just 15% of the S&P 500; together they make up 38.5% of the index.

Seeking Alpha S&P 500 Holdings

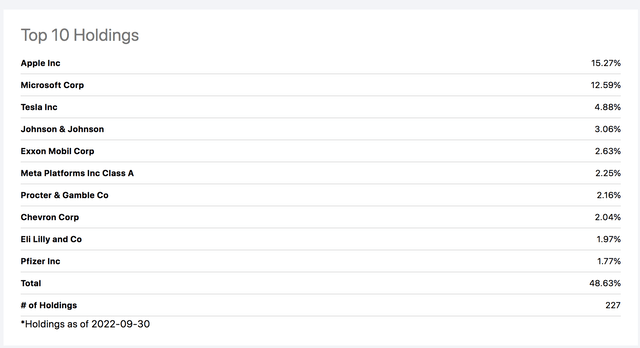

Three Stocks Make Up 33% of HLAL’s Holdings

HLAL also is subject to portfolio concentration risk, with its top 3 holdings representing 33% of its portfolio and its top 10 holdings making up ~48.5% of the portfolio. Its top 3 holdings are Apple, Microsoft Corp., and Tesla, representing 15.27%, 12.59%, and 4.88% of the portfolio, respectively.

SPRE: A Sharia-Compliant Real Estate ETF Alternative for Muslim Investors

HLAL does a solid job of eliminating exposure to non-sharia compliant companies, but I find that the end result is an overexposure to tech and healthcare. I also have some concern around the measure of assets in the debt to asset ratio; there may be companies that are overleveraged from a tangible asset to debt ratio perspective due to assets being comprised of large amounts of goodwill, but are still included within the index.

SP Funds S&P Global REIT Sharia ETF (SPRE) may solve both of these problems, as it has the same sharia-compliance restrictions as HLAL, but focuses on the real estate industry where the asset restrictions, when applied, are not overbearing or misleading. Below is a summary of SPRE’s financial leverage restrictions, which are identical to HLAL’s restrictions.

However, as REITs carry the vast majority of their asset value in the form of real estate and carry very little cash and accounts receivable as a percentage of assets, the restrictions of “cash and interest-bearing items are less than 33.333% of total assets” and “accounts receivable and cash are less than 50% of total asset” become less overbearing and exclusive.

REIT balance sheets, while not 100% reflective of the market value of assets, are also generally more accurate than those of other companies. Real estate is conservatively recorded at cost and then marked down with accumulated depreciation, so the reflected value on the balance sheet is generally lower than the market value of the properties. Stocks within the HLAL index and the broader market index face an opposite problem; assets are often overstated with intangible assets and PP&E that is overstated in value. This means that sharia-compliant investors investing in SPRE will not need to worry as much about stocks passing through the 33.33% debt to assets ratio filter when the market value of their assets would actually put them below the 33.33% filter.

Additionally, REITs do not hold almost any goodwill on their balance sheets, so their assets are almost entirely tangible assets that we can have confidence in.

SPRE also provides a source of diversification for sharia-compliant investors that may be invested in HLAL, providing the opportunity to diversify away from the overallocation to tech and healthcare within the HLAL portfolio.

Suggestions to Wahed

I would advise Wahed to re-examine the financial ratios they are utilizing, in order to optimize for the reduction of interest expense rather than debt in general. I also find that the restrictions around the types of assets that can be held on the balance sheet are unnecessarily restrictive and do not clearly serve a purpose in making the portfolio more sharia-compliant. In particular, I would re-examine the “cash and interest-bearing items are less than 33.333% of total assets” and “accounts receivable and cash are less than 50% of total assets.”

I believe that these 2 restrictions are limiting the world of possible investment options for the ETF, and are resulting in unusual levels of portfolio concentration.

My view continues to be that private real estate is the best avenue for sharia-compliant investments, with Islamic lenders such as UIF and Guidance Residential providing sharia-compliant financing for real estate acquisitions. Outside of private real estate, SPRE & HLAL are directionally great developments for Muslim investors.

Be the first to comment