imaginima

Head to any financial markets news website, and most headlines you’ll read will likely refer to a story featuring inflation, Ukraine, COVID, interest rates or all 4. With all the chaos and uncertainty, it’s easy to get jitters about equities and a recession, but smarter, more experienced investors will find plenty of opportunities amidst the panic. As Rudyard Kipling said in “If”;

And if you can keep your head when everybody round you is losing his,

(But, of course, those who know Kipling’s works know that’s only half the story…)

Amplify Energy Corp. (NYSE:AMPY) is involved in the production of oil and natural gas, so is poised to enjoy the heightened energy prices from the geopolitical turmoil while the energy industry, in general, remains relatively insulated from inflation and high interest rates. So let’s dive into the spreadsheets and break AMPY down and assess the stock as an opportunity.

(Data & prices correct as of pre-market 6th September 2022)

(The Top Oil and Gas Exploration and Production Stocks referred to can be found on this Seeking Alpha screener)

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Oil & Gas? Download my research for free here

Amplify Energy Corp.’s Base Financial Health

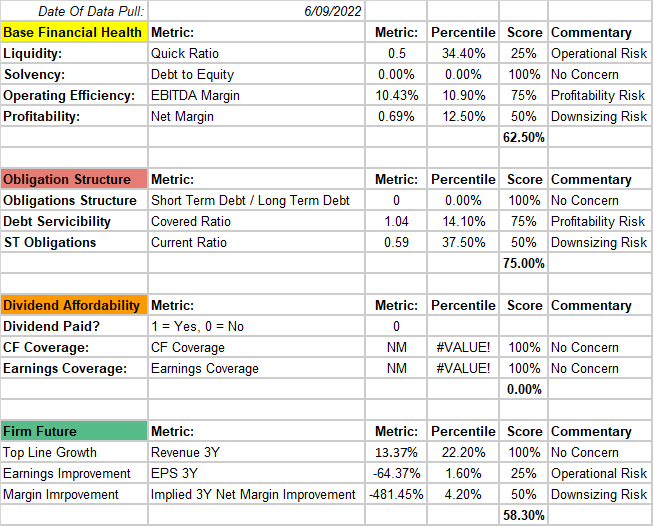

To begin an analysis of AMPY, it pays to look at the firm’s base financial health to try and identify any areas of concern we might have. The following analysis compares AMPY’s financial metrics to its 65 industry peers and shows us both the metric on its own, and where it sits compared to its peers. We then assign a score and a “level of concern”, to guide our views.

Straight away we see concerns with the firm’s quick ratio, and its ability to quickly cover its obligations in a “worst case scenario”, along with skinny EBITDA margins and almost break-even net margins.

Further along, we see some tight serviceability of the firm’s obligations which presents a profitability risk, along with significantly larger short-term obligations vs the firm’s short-term assets.

AMPY does not pay a dividend, so we don’t need to put any consideration toward that.

Lastly is a review of the firm’s future expectations, which again, we see some solid top-line growth (albeit considered small growth for the industry, but double-digit growth is still acceptable to me), however, EPS projections are significantly negative, giving us concern about the firm’s ability to capitalize on high energy prices both now and into the future.

Author

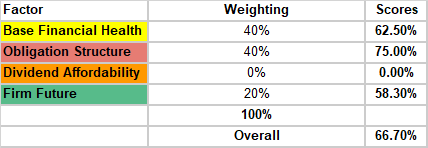

Finally, we tally up the scores and apply weights, giving us an overall base financial health score of a worrying 66.7%. I believe AMPY has financial health risks in its liquidity, profitability and its obligations structure. While the firm doesn’t risk closing down overnight, there are certainly profitability risks and potential downsizing risks.

Author

Assessing Amplify Energy Corp.’s Pricing Attractiveness

Perhaps there’s more to like for AMPY in its valuation metrics.

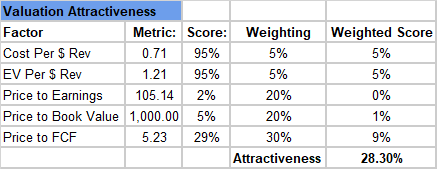

If you’re chasing value in price per $1 of revenue in a firm, AMPY has plenty to offer, with a $0.71 amount per dollar earned, there are some serious discounts on offer here. The same value goes for enterprise valuation per dollar of revenue, both metrics in the top 5% for value compared to the peer group. Unfortunately, that’s about where the good news ends.

Price to earnings and book value suggests that AMPY is trading at a very significant premium, and price to free cash flow places the firm in the bottom 30% of value firms.

We then weight these metrics on an arbitrary scale of importance, and we see a weighted valuation attractiveness score of 28.3%, indicating there’s not a lot to love here.

Author

Finding An Appropriate Valuation Method For Amplify Energy Corp.

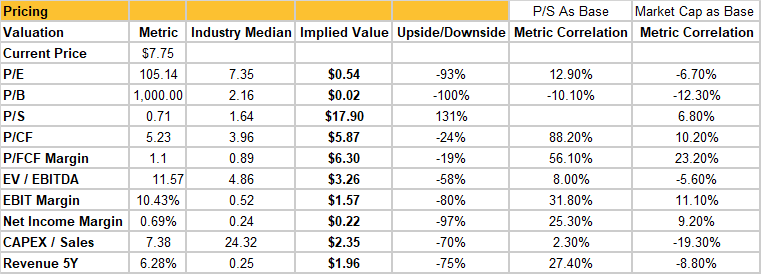

With a base financial health and a valuation attractiveness score assessed, it’s time to try and find a suitable pricing mechanism for AMPY, based on how investors price firms within the oil & gas industry. To do this, we consider the variation across all firms when considering valuation metrics and their correlation to price/sales valuation, and market cap correlation.

Having gone through the process already for Crescent Point Energy Corp. (CPG), we already know the weights for each of the metrics we’re going to focus our attention on.

Author

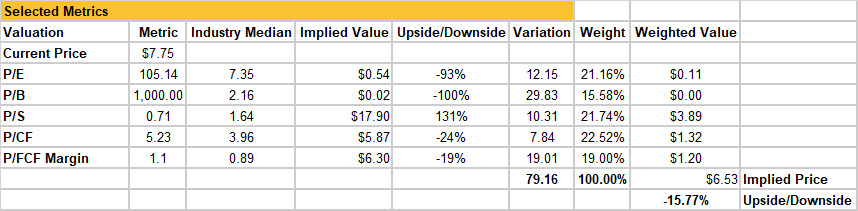

Unfortunately for AMPY, these metrics suggest the firm is a touch over-priced compared to the peer group, with a 15.77% downside target price. With that said, this is a peer group analysis, which does not necessarily look to uncover deep value within the firm’s operations that aren’t captured in these metrics.

Author

Closing Remarks

I would suggest that investors consider AMPY currently over-priced compared to the industry peer group, however, there’s a very real possibility that industry valuations might shift and change in the coming months, and AMPY might have some deeper value within its operations not visible from financial statements.

I rate AMPY as a hold, pending improvements in its balance sheet and profitability. There are some solid revenue numbers here that suggest the firm could see big price movements, but I’d need to see a real turnaround in EBITDA first.

With my own views around the likelihood of an impending Fed-driven recession, paired with the energy market’s historical outperformance in high-inflationary environments and geopolitical instability driving higher energy prices, I see a period of opportunity ahead for energy firms.

Be the first to comment