photovs

Investment Thesis

Xylem (NYSE:XYL) is an excellent hundred-year-old business with only one problem. It is a slow-growing value stock priced like a fast-growing growth stock. This is a stock where you should be very patient to find the right entry point, but unfortunately, it is not now.

Solving water

Water is one of the biggest challenges in this century. Providing enough clean drinking water and wastewater treatment will be a massive challenge. All this at a time when the world population is growing, and now developing countries are starting to consume more and more resources. At the same time, the climate could change dramatically, creating even more challenges. At least weather and rain patterns seem to change, whether by climate change, magnetic pole reversal, or whatever; it doesn’t matter.

Our vision is simple. We devote our technology, time and talent to advance the smarter use of water. We look to a future where global water issues do not exist.

Xylem offers many different solutions through many brands. For agriculture, closed water loops for aquaculture, water solutions for ships and water parks, water analysis systems, and water analysis for the food industry. All kinds of products are used, such as pumps, turbines, fans, pipes, and smart meters. But the company also offers software to monitor, e.g., river levels. This is a complex company with many branches, but all are water-related.

Worldwide diversified

I like it when companies are globally positioned. Xylem operates in the U.S., Europe, and some emerging markets, but the U.S. accounts for about 60% of sales. For a company like Xylem, with its focus on water, it is also a significant tailwind when countries become more prosperous, i.e., the middle and upper classes grow since people’s demands then rise.

Recent results & financials

The market has received the latest quarterly figures very positively, and overall the share has been on an upward trend for several months. However, I do not view the results too positively and would like to explain why here.

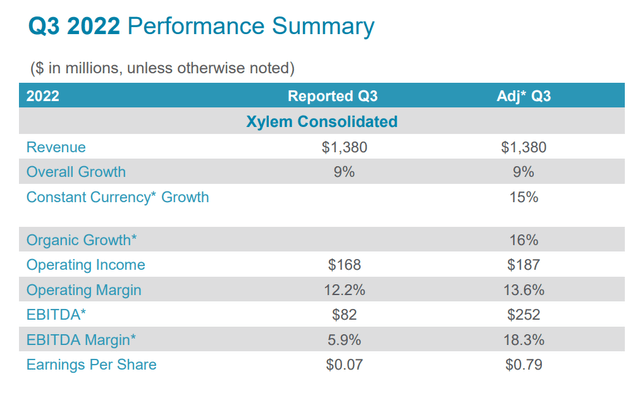

Xylem Q3

There was a one-time non-cash settlement charge of $140M for a buyout of the UK Pension Plan; that´s why there is a considerable difference between reported and adjusted EBITDA. Overall, year-on-year revenue growth was 16%, and EPS growth was 15% – both on an adjusted basis. However, I think it is getting excessive with the adjusted numbers. At the moment, almost all companies are adjusting their figures to currency fluctuations. But that’s part of the business, and it’s not clear whether this is a one-off event or whether the Euro has depreciated permanently against the dollar and will stay that low. Do they then adjust their figures downwards in times of positive currency fluctuations?

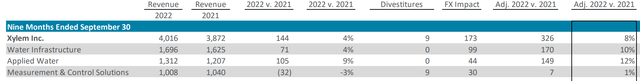

Anyway, I would like to compare the nine months of 2022 with 2021. For a slow-growing company like Xylem, this makes more sense to get a clearer picture. This approach is overall less fluctuating than a quarter against quarter.

Xylem Q3

As we can see here, total sales increased by only 4% for the entire nine-month period. Even with the adjusted figures, sales only increased by 8%. Orders increased by only 2% (not shown in this picture). Xylem has been able to make up for this difference through price increases. However, price increases cannot be a permanent solution. The percentage increase in orders is a crucial indicator. And 2% is very close to stagnant. Overall, I’m not entirely convinced that Xylem is really a recession-proof stock because they are active in many different areas. Some businesses are recession-resistant, such as wastewater systems. But what about building new ships, water parks, and other commercial buildings? For these things, there might be less demand for Xylem’s solutions during recessions.

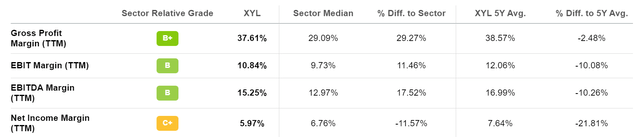

Overall, the margins also seem to be developing in a rather negative direction – at least the current margin is below the 5-year average for all key figures in this screenshot.

Seeking Alpha

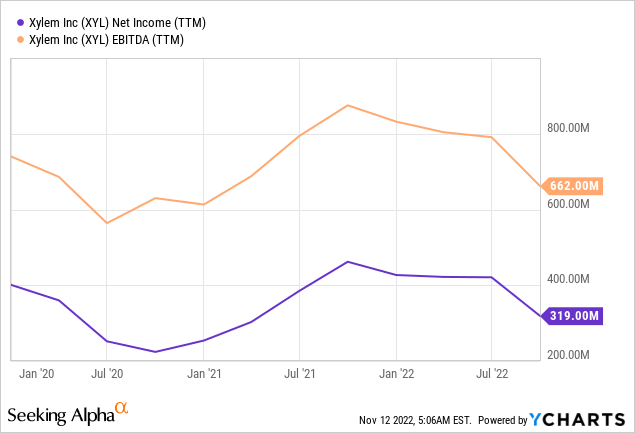

EBITDA and net income are also moving rather slowly up and down.

Valuation

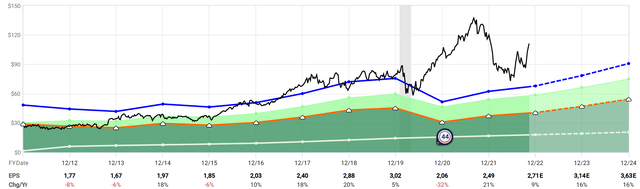

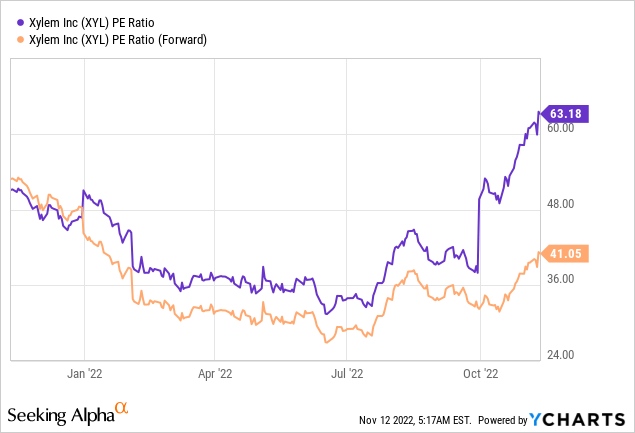

Given this slow growth, the share price has developed very well over the past few years, but this is not due to the business itself but to an increasingly high valuation. This can be seen nicely in FAST Graphs. The blue line is the long-term average P/E ratio. The share has moved further and further away from this line. This began in 2020 when more and more hype arose around ESG, environmental stocks, electric cars, and so on.

fastgraphs

Also, we can see here that there have always been years where EPS have fallen. So overall, this is a relatively slow-growing industry stock. This is no surprise because the company deals with physical products and is not as easily scalable as a tech company. As such, however, the stock is overvalued at the moment.

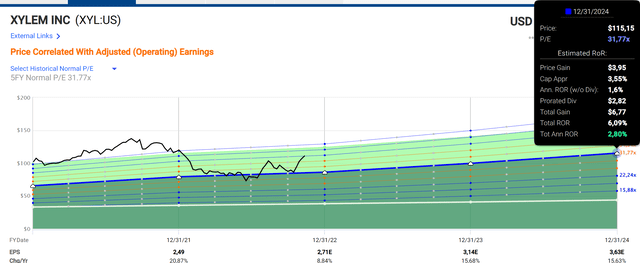

Depending on your portfolio and preferences, there may have been a good buying opportunity in July. However, the share has run away again, so I consider it clearly overvalued. If the stock were to fall back to its historical average P/E, a meager annualized return of about 2.8% would be possible by the end of 2024. And even this average P/E is still relatively high.

fastgraphs

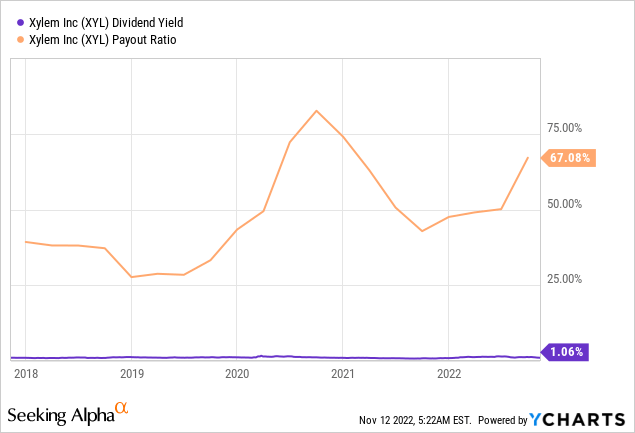

The dividend is only a tiny one percent yield. In contrast, the payout ratio has been increasing for years. The dividend increase rate of the last five years was, on average, 11%. Therefore the increase will probably be lower in the future.

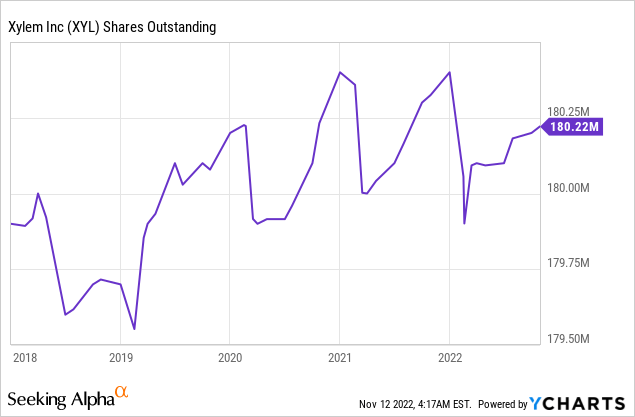

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. There has been a little bit of both, but rather minimal.

Risks

High valuations mean the ideal world is already priced in, and nothing should go wrong. This is probably the biggest risk for Xylem in general. If the stock were valued like other slow-growth value stocks, it would be at most half as high. The risk for shareholders is that the average P/E will approach this value more and more over the next few years. However, of course, this does not have to happen. The stock may remain permanently valued higher than other stocks simply because it fits so well into the zeitgeist with water, ESG, and the environment.

Otherwise, I do not see too many risks here. The business model will remain in demand, and the debt is not too high; the company is profitable and has been established for years.

Conclusion

I first became aware of the company because I own a water ETF where Xylem is one of the top positions. I looked briefly over it but was quickly deterred because of the valuation. I think interested buyers have to be patient here and wait for situations like it was already there this year in July. Even then, the forward P/E was still high at about 28, but the stock seems to be permanently trading higher than other stocks. For my taste, the expected return is now too low, or in other words, the risk is too high. However, I would not short here, so I rate the share with a hold rating.

Be the first to comment