VGR’s sales team has done a good job of getting Montego branded products into stores, showing strong growth within the distribution/retail channel. LeventKonuk/iStock via Getty Images

When it comes to investing in tobacco companies with significant operations in the United States, we generally have little interest, especially as there is a lack of M&A possibilities and the Food & Drug Administration, FDA, is most likely going to be more aggressive moving forward as it pertains to industry regulations. However, from time-to-time, we do find interesting plays, and today we want to look at one of those names.

Vector Group Ltd. (NYSE:VGR) is a small player in the U.S. tobacco industry (the company’s market cap is just below $1.7 billion, and they have single-digit market share), focused on the value/discount portion of the market. The company has been around for quite a while, but many investors are unaware of the company because their brands are lesser known, and they target the lower end of the market. While the company may be one of the lesser followed tobacco-related names, management has done a decent job running the company over the years.

Background

Vector Group has benefitted from the terms of the Tobacco Master Settlement Agreement, or MSA, which gave smaller players in the industry favorable treatment versus the majors in order to get them to quickly sign onto the agreement. Vector Group, like other smaller players, has benefitted from the structure of the MSA and taken advantage of what they are allowed to do under those terms in order to grow the company. That is what really sets Vector Group apart from the industry; the company is growing, not just revenues or EPS, but actual volumes and gaining market share with each of their brands while doing so.

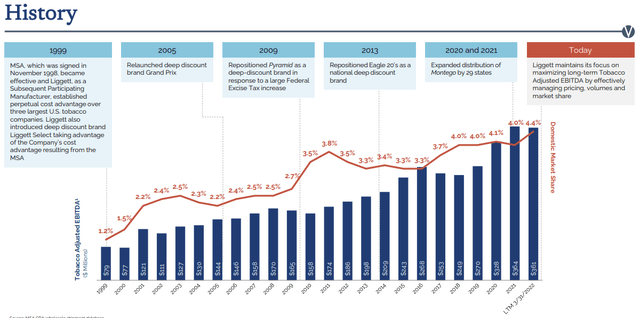

Since 1999, Vector Group has steadily grown market share and tobacco group EBITDA. (Vector Group Investor Presentation)

The above graphic, taken from Vector Group’s most recent investor presentation, shows that management is capable of growing the company in a very difficult environment.

Story Moving Forward

Now that Vector Group has had some time to operate as a predominately tobacco-focused company following the completed spin-off of Douglas Elliman (DOUG), we think that management will refocus on the tobacco business and use the company’s free cash flow (which there is admittedly less of now) to help grow the company and also make the dividend safer. In fact, management has already discussed how they have focused on the company’s Montego brand in the most recent quarterly results conference call.

The growth there looks promising, with market share having increased nearly 5x (growing from 0.40% to 1.90%) and distribution (measured by stores) increasing by 2.33x. Diving deeper into the market, Montego has a roughly 19% market share of the deep discount segment in Q1 of 2022 versus last year’s 4.5% market share in the same period. Management also stated that, “for the most recent 13-week period Eagle 20s and Montego are now the third and fourth-largest discount brands respectively, in the U.S. market,” which in our opinion demonstrates management’s ability to grow brands in a segment of the market where they have developed a niche.

Also helping the company grow volumes was the decision from competitor KT&G to exit the market. Management believes that they were able to grab 40% of KT&G’s 2.8% U.S. market share. Couple that with consumers deciding to migrate to lower-cost tobacco products due to inflation, and Vector Group begins to look like an interesting play.

While it appears that Vector Group is one of the few tobacco names actually growing volumes organically, the company also should be able to increase free cash flow via financing activities. The company has ample liquidity with their next bond maturity in 2026, and those bonds look ripe for some type of action by Vector Group because they carry a 10%+ coupon (not yield, but COUPON!). That issuance has a call feature where Vector Group could call the bonds at $105.25 by 8/26/2022, but with the bonds trading in the mid-90s right now, the market thinks that it is highly unlikely that the bonds are called. We like the growth prospects for the company, but the easiest way to create cash flow and increase EPS might be to pay down these bonds and/or refinance them. For each $100 million that the company could retire, they would save $10.5 million annually in interest costs.

Also of importance for investors is that the company will be less impacted by the FDA’s preliminary ruling prohibiting menthol use as a characterizing flavor in cigarettes. Liggett’s retail sales volume attributable to menthol was 19% of total volumes versus the industry’s 35% sales volume. This ruling will most likely take years to implement, but the good news is that Vector’s sales will be much less impacted compared to competitors.

Dividend

Vector Group currently pays a 7.35% dividend at a rate of $0.20/share per quarter, or $0.80/share annually. While some question how safe the dividend is after the Douglas Elliman spin-off, we think that the moves that management took during the depths of COVID have benefitted the company and positioned the dividend to stand a better chance of not getting cut again.

While the dividend is now half of what it was before, we believe that management’s decision to not bring the 5% annual stock dividend back was prudent, as it will now keep the share count relatively stable and allow the company to keep overall dividend outflows capped (unless they issue more shares). Our point here is that while a 5% stock dividend may have been nice for investors (and we assume their employees via retirement plans), that policy made it quite tough on the company’s finances because even if the dividend rate remained unchanged in any given year, overall the company was still having to pay out 5% more in dividends.

Currently, the dividend is covered (whether you measure this on payout ratio, dividend coverage via traditional means, or dividend coverage utilizing cash flow), and with management working on building up another brand, we suspect that the dividend might be safer than it appears. Once the Montego brand moves from growth mode and into profit mode, the resulting increase in margins might very well solidify the dividend in the eyes of those currently questioning it. We say this because management believes that margins will improve once they decide to focus on profits with Montego instead of growth. If we look at the growth, year-over-year, the Q1 tobacco revenues were up from $268.5 million to $309 million – and if margins rose to their 2021 Q1 levels (roughly 29.39%), the tobacco operating income would be close to $91 million instead of the $75.6 million that the company reported in 2022’s Q1.

Our Take/Conclusion

First, we want to be clear that we do not really get excited over tobacco names. Very rarely have tobacco names ever been ranked as buys on our equity buy lists (we would note that quite often they have been ranked as buys for individual bonds the companies were issuing), but we have included them as ‘Holds’ for equity portfolios, especially when they were priced in a manner to serve as a bond proxy.

Vector Group currently looks like a tobacco name that might be running into headwinds finally, but we believe that management is already delivering on their latest brand-building strategy and that the market is underappreciating their assets in the current market. Whether or not the growth strategy plays out as management is predicting, we believe that the company has enough liquidity and assets to provide management with the maneuverability to keep the dividend intact. The way we see it, management has three ways to keep the dividend at its current rate:

1. Deliver on growth strategy with the Montego brand

2. Begin paying down debt when possible

3. Buy back company stock with the cash on hand (which reduces outflows via dividend expense)

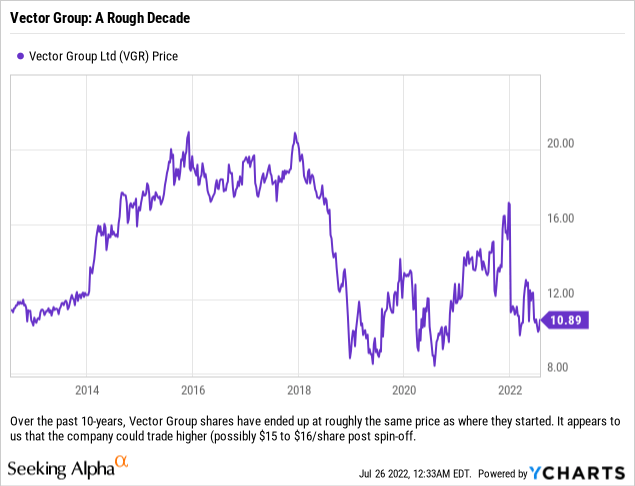

With that said, right now we believe Vector Group to be a viable candidate to serve as a bond proxy in an equity portfolio due to the fact that its current yield is 7.35%. It appears to us that the company’s business could be relatively stable to growing in the next few quarters. Due to this, we think that Vector Group could be a suitable purchase for those looking to get comparable yield in equity form rather than investing directly in high-yield debt. We will look to add Vector Group shares to appropriate portfolios at or below $11/share.

Be the first to comment