artiemedvedev/iStock via Getty Images

The environment for Bitcoin (BTC-USD) miners has been absolutely horrendous in 2022. And if you don’t want to take my word for, pull up the price chart of any miner you please; it’s been a bloodbath out there. Of course, any sort of growth-oriented industry has been hammered this year with growth paths being revised downward, as well as sharply lower multiples being paid for those companies given much higher interest rates. None of these things is a good development for Bitcoin miners, but there are other factors at play that have made the current environment especially harsh.

Glassnode recently published a terrific piece on Bitcoin price and miner financial success that raised some interesting points. Once one understands the state of Bitcoin miners halfway through 2022, it becomes clear why the stocks of these companies have performed much worse than the coin itself.

In this article, we’ll take a look at selected points from Glassnode and apply them to two Bitcoin miners: one that I think will stand the test of time, and one that is going to have a much tougher road ahead.

Increasing difficult + lower prices = bad news

There are all sorts of ways to determine if Bitcoin is near a bottom and the Glassnode article highlights some out-of-the-box ways of thinking about it. However, this article isn’t to argue about whether Bitcoin has bottomed or not; we’re specifically focused on what has already happened, and its impact on the miners.

Now, we all know that the difficulty of mining Bitcoin changes all the time. There are various factors in play but the point is that over time, mining becomes more and more challenging as more and more Bitcoins are “found” and put into the float. This means that it requires more and more computing power for the miners over time to mine the same number of Bitcoin – all else equal – which means it costs more and more over time for each coin. There are computing costs – hardware and software – and there are electricity costs, among others. As the difficulty rises, the breakeven point on each Bitcoin mined rises as well, which crimps profitability. Think of it like a factory that makes cars: as the price of steel, rubber, and other raw materials rises, in addition to the cost of labor, it becomes more and more difficult for the carmaker to operate profitably. But instead of labor and steel costs, Bitcoin miners grapple with ever more costly computing equipment and rising power costs.

Just about everyone can operate profitably during massive bull runs in Bitcoin price, but during prolonged weak periods – like what we’re in now – the wheat is separated from the chaff.

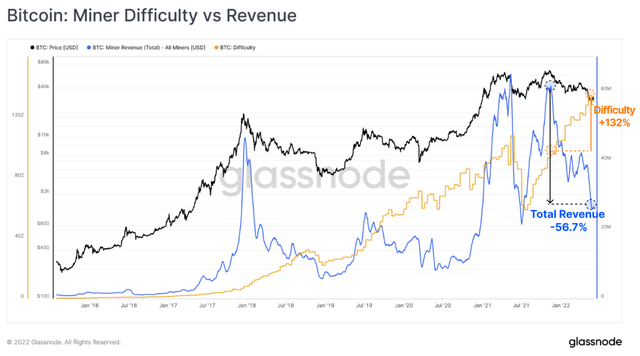

This chart sums up this phenomenon in terms of revenue versus difficulty over time to give some context to where we are today.

We can see that there are periods where difficulty and revenue greatly diverge, and today, we’re in a spot where revenue has absolutely plunged while difficulty has soared to record levels. What that means in practice is that mining Bitcoin has become exponentially more difficult to do profitably in recent months, putting strain on all Bitcoin miners’ income streams.

Since the all-time high in Bitcoin just a few months ago, difficulty has more than doubled, while revenue received is down almost 60%. This is in an incredibly bearish scenario for miners, and it’s a big reason why the stocks of these companies have been decimated.

When this occurs, it means the field of miners is overcrowded. In other words, there are too many companies and individuals trying to mine for it to be done with consistent profits. The extension of that is some of the entrants needing to exit the field for the good of the group. Few will willingly exit, of course, so those pushed out will need to be forced through financial pain and eventually, insolvency.

During good times, Bitcoin miners can fund the massive capex that’s needed through coin revenue. However, during times such as today, that becomes very difficult. Thus, they tend to turn to their balance sheets for capex, whether it’s through common stock issuance, preferred stock issuance, or debt issuance. Either way, they all carry implied or explicit costs, and that makes it even more challenging to move the needle financially for shareholders.

Now that we have the backdrop, let’s take a look at two miners I think will see diverging paths based upon their ability to weather this storm.

A potential winner: HIVE Blockchain

The stock I think stands to benefit from some of the weaker players leaving the field of miners is HIVE Blockchain (NASDAQ:HIVE), a company that I’ve covered before as a standout in the miner space. HIVE, like all the other Bitcoin miners, has been crushed this year, but when all of this ends and we see a bull market in Bitcoin again, I think it will be one of the top performers in the mining space.

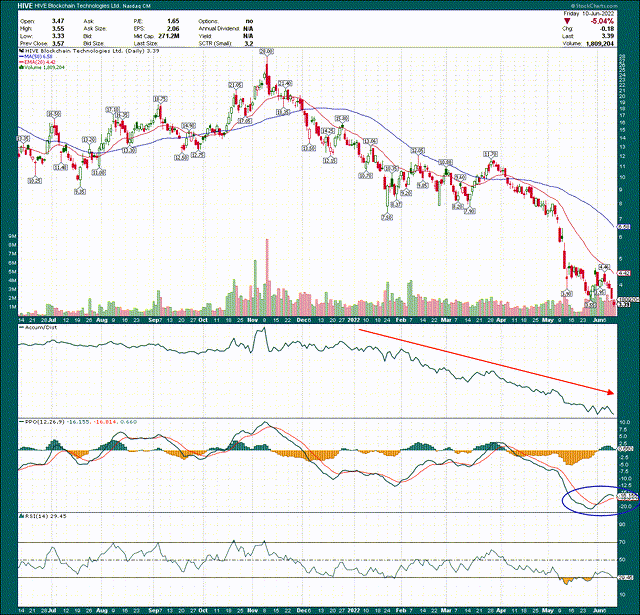

Let’s start with a price chart to see what kind of damage has been done, and see if there are any clues in terms of a potential bottom.

HIVE is trading for just over $3 today after peaking at $28 late last year. The stock has blasted through every support level imaginable during that time, and losses have been enormous for anyone that held during this decline. However, if you’re putting new money to work in Bitcoin miners, I think you can do a lot worse than HIVE at just over $3.

To be fair, this chart is really ugly and there’s not much to be bullish about. The stock continues to make lower lows, and until that changes, it’s going to be tough. On the plus side, the stock is about 50% below its 50-day SMA, which means it is tremendously oversold. The PPO is also -15, which is a value you don’t often see. That level of severity in terms of selling pressure is quite extraordinary. The good news on the PPO is that it made a bottom a couple of weeks ago, so it’s possible we’re seeing the beginning stages of some sort of bottoming process. To be clear a bottoming PPO doesn’t guarantee anything, but it is a good first sign that the worst of the selling pressure has passed.

Ultimately, what we need to see in conjunction with a bottoming PPO is for the stock to clear the 20-day EMA on a closing basis, and then rally up to the 50-day SMA, where you should expect rejection at least once. After a close above the 20-day EMA, it will be much safer to declare a bottom has been made, but much is to be done by the bulls before that happens.

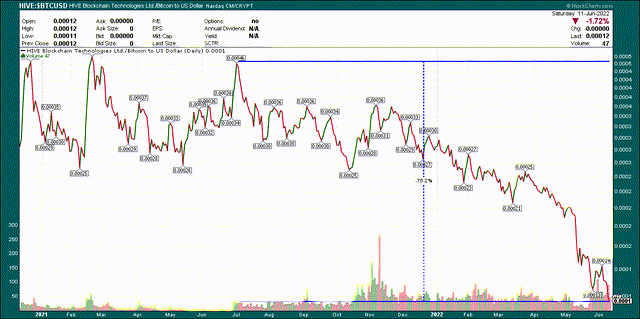

Now let’s take at HIVE’s value relative to the price of Bitcoin. This is a relative measurement of what investors will pay for HIVE against the price of the coin itself. If they moved in tandem, this value would never change, but of course, that’s not the case.

HIVE’s value relative to Bitcoin is down 75% just since last July, so HIVE’s value on a relative basis to Bitcoin has improved massively during this big selling episode. If you’ve held through it, I’m sure that’s little solace, but for new buyers, the value received here is really quite attractive, if you’re bullish on Bitcoin’s future.

We know that margins have suffered for all Bitcoin miners during 2022 because of the factors we discussed above; difficulty – and therefore costs to mine – has soared while the reward for miners has plunged on lower Bitcoin pricing. That means that leverage and balance sheet health become paramount during periods like this, because those that are already overleveraged likely won’t be able to continue to expand operations, and indeed, may need to consolidate in order to survive. It stands to reason, then, that those with strong balance sheets stand to gain, and that’s where I find HIVE.

A quick review of HIVE’s balance sheet shows that this company is much better positioned against the liquidity crisis facing the miners than most or all of its competitors. Long-term debt stands at $31 million, but net debt is -$55 million. In other words, HIVE has a positive tangible book value of $5.34 per share meaning it has a large net positive position on its balance sheet.

That has many implications, not least of which is the fact that the stock trades well below that value today. But on the leverage front, it means HIVE could theoretically borrow significantly against its balance sheet to fund operations, expand, or simply to have additional liquidity to ride out this storm.

Some of that cash is accruing through share issuances, so that’s something to keep in mind; dilution is all the rage among Bitcoin miners and HIVE is no different. However, from a debt servicing perspective, HIVE is outstanding because its trailing-twelve-months cash interest paid is just $0.5 million. Capex is eating up cash, not debt servicing costs, so HIVE is a great spot competitively during this tough period.

A potential loser: Core Scientific

On the other side is Core Scientific (NASDAQ:CORZ), which is struggling enormously in my view with its financing situation. Given that, this is one I think you want to avoid. Let’s begin, however, with the chart to see if there are any key differences to HIVE from a technical perspective.

The lower lows scenario is very much in play here as well, so that’s no different. However, the PPO is worsening for CORZ, rather than bouncing like it was for HIVE. CORZ is unbelievably oversold as well, but the difference is that bearish momentum is still accelerating, as incredible as that is at these levels. The stock is miles below its major moving averages, even more so that HIVE. So if there was little to cling to for bulls on HIVE, that becomes essentially nothing for bulls with respect to CORZ.

CORZ is expanding its mining capability rapidly, which is something that could be bullish if Bitcoin were to power higher. But its balance sheet is quite full at this point, and if this period of weakness in Bitcoin pricing lasts for another six or twelve months, CORZ could find itself in some hot water.

CORZ’s balance sheet shows a staggering $1.05 billion in long-term debt and a net debt position of $1.16 billion. The company has significant assets carried that help offset this but from a tangible book value perspective, CORZ sits at just 20 cents per share. That means the capacity on the balance sheet to finance rough periods compared to HIVE is immeasurably worse, and to me, this very weak period in Bitcoin pricing and sharply increased difficulty puts highly leveraged miners like CORZ at risk.

CORZ is paying $38 million annually at the moment just to service its debt, and for a company with operating cash flow of -$76 million in the TTM period, another $38 million to come up with every year just to stay solvent is a tall order.

Final thoughts

There are times in just about any industry where things get tough and weaker entrants are either made much weaker, or disappear entirely. I’m not ready to declare CORZ is going away but I do think it is at a significant disadvantage to stronger miners like HIVE, that actually have the financial capacity to ride out this storm. Keep in mind also that when industry consolidation takes place, the ones that survive are in a better competitive position than when the tough period began, simply because their share of the pie increases with others falling away.

Where HIVE thrives in terms of balance sheet and debt servicing capability is where CORZ struggles mightily. I think CORZ is way overleveraged, whereas HIVE has immense flexibility to fund itself until conditions improve. If you’re looking to put some money to work in Bitcoin miners, one important factor is solvency during this very tough bear market period. HIVE is in great shape, and CORZ just isn’t. I therefore much prefer HIVE to CORZ, and they could even work as a pairs trade where you’re long the former and short the latter, if that’s your sort of trade. Either way, the point is that not all Bitcoin miners are created equal, and the current environment will almost certainly see some weaker entrants exit the market, and not by choice.

Be the first to comment