Vincenzo Pace/iStock Editorial via Getty Images

JetBlue Airways (NASDAQ:JBLU) went too far into debt when winning the bid for Spirit Airlines (SAVE). The airline business is booming, yet the stocks aren’t seeing any boost due to recession fears and a misunderstanding of the sector now. My investment thesis still doesn’t like owning JetBlue on this deal set to close up to 18 months from now.

Booming Sector

American Airlines Group (AAL) just reported preliminary Q3 numbers ahead of expectations. The legacy airline reported Q3 revenues soared 13% above Q3’19 numbers with revenues per available seat mile up 25% and costs only up 14%.

JetBlue generated Q3’19 revenues of $2.09 billion and analysts forecast impressive revenues of $2.52 billion for the just ended September quarter. The smaller airline is forecasting revenues up over 20% from 2019 levels.

The Northeast alliance partners are firing on all cylinders despite still being capacity constrained. While business is booming for JetBlue, the stock trades at the covid lows after having rallied all the way up to $20 in early 2021.

Analysts have JetBlue producing a 2024 EPS of nearly $1.50. The airline earned nearly $2.00 a share back in 2019 before the covid shutdowns. The company had guided to 2020 EPS targets of $2.50 to $3.00 per share and what investors wanted was an airline focused on reaching those previous goals now with revenues topping 2019 levels.

Merger Pain

The buyout of Spirit Airlines is puzzling considering the need to take on excessive debt levels to close the deal. JetBlue is already set to pay a $2.50 fee for shareholder approval and the company will ultimately pay $3.8 billion in cash to close the deal, assuming DoJ approval.

The airline has a long path ahead to close the deal. JetBlue could’ve spent the next year focusing on the booming air travel demand and the American Airlines partnership, instead of moving the airline into massive debt after having survived the covid crisis without taking on massive debt loads.

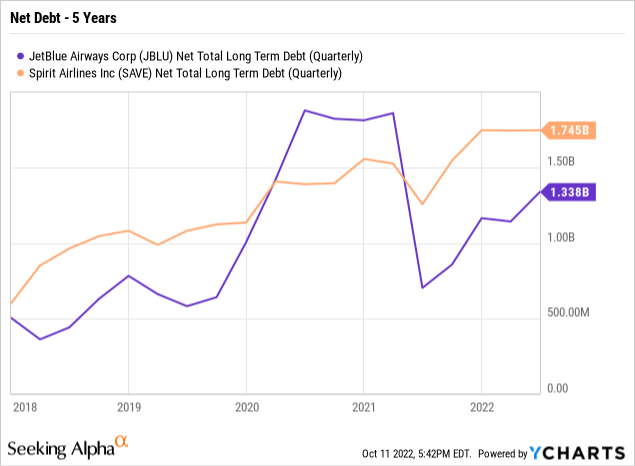

JetBlue only has net debt of $1.3 billion, barely above the ending 2019 levels. The airline has a massive PP&E balances via aircraft assets to offset the limited debt levels. Spirit Airlines brings over $1.7 billion of additional debt to the airline.

Proxy firms Institutional Shareholder Services and Glass, Lewis & Co. both recommended the Spirit shareholders approve the deal at the upcoming shareholder vote. After voting down the deal with Frontier Group Holdings (ULCC), naturally a shareholder is going to vote for a deal for $33.50 in cash when the stock only trades at $18 now.

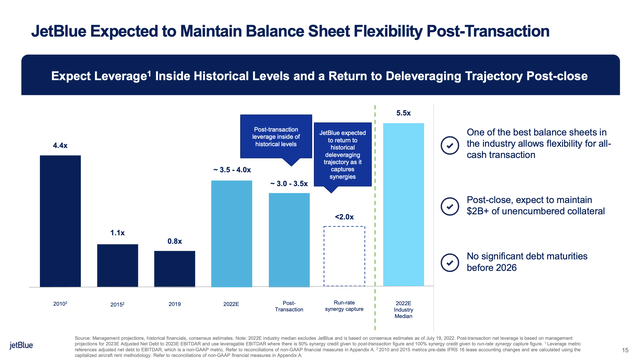

The problem is that JetBlue shareholders shouldn’t want to take on the debt. The combined airline will have net debt approaching $7.0 billion with a leverage ratio target of ~3.5x EBITDAR for 2023 assuming 50% of the synergies of up to $700 million.

Source: JetBlue Q2’22 presentation

The deal isn’t likely to close until early 2024 and the synergies won’t actually hit 2023 financials. The leverage ratio is likely to be much larger as the integration of JetBlue and Spirit Airlines should be messy with strong legacy airlines set to take advantage of the integration interruptions at JetBlue with two diverse airlines not easily matching the same target demographics.

The airline predicts not flying under a single operating certificate until 1H’25 with full integration taking four to five years. JetBlue will have to retrofit the full fleet and integrate complicated IT systems while the legacy airlines are full speed ahead and new ULCC startups like Avelo and Breeze start attacking markets.

Spirit shareholders don’t exactly care about this leverage ratio issue. These shareholders will approve the deal and cash out looking to grab the $2.50 cash payment for approving the deal and ultimately collecting the full $33.50 cash price.

Takeaway

The key investor takeaway is that JetBlue has cratered to only $6 due to market dynamics and a pending debt fueled merger. The airline should’ve just focused on recapturing the profit levels from the last cycle, which would’ve boosted the start far above the current levels.

Be the first to comment