designer491/iStock via Getty Images

Investment Thesis

High yield bonds are included in the fixed income component of many investor’s asset allocation plans. Also known as “junk bonds”, these bonds offer increased income but increased risk compared to investment grade bonds.

For investors with junk bonds in their asset allocation plans, the relatively rare significant declines (> 15%) offer an opportunity to establish attractive yield-on-cost positions.

The current market is very near that 15% decline point, yet even better opportunities may be on the horizon in the weeks ahead.

High Yield Bond Basics

Investopedia defines high yield bonds as “bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds.”

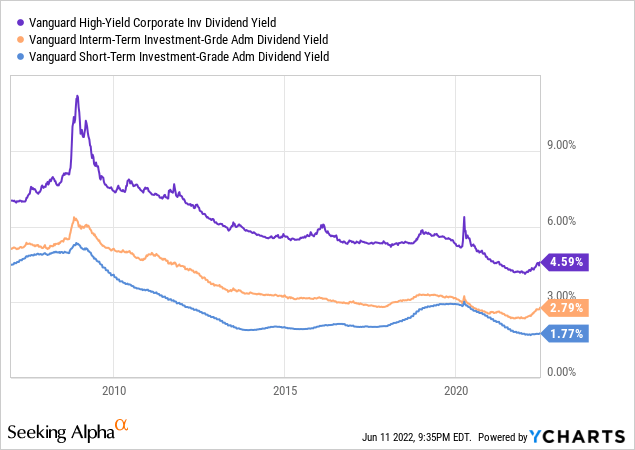

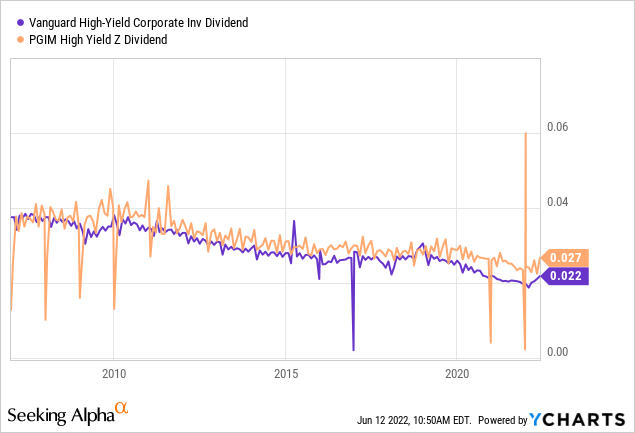

The chart below illustrates the impact of credit ratings on yield, using three Vanguard bond funds – high yield, intermediate term investment grade, and short term investment grade, and covers the past 15 years (Jan 2007 to June 2022). Note that this include both the Great Recession in 2009 and the COVID effect in March 2020.

Typically one can expect 2-3% higher dividend yields from junk bonds than from investment grade bonds of similar duration. The effective duration of the high yield fund in the above example falls between the intermediate term and short term investment grade funds shown above (currently about 4.2, 6.4, and 2.8 years respectively).

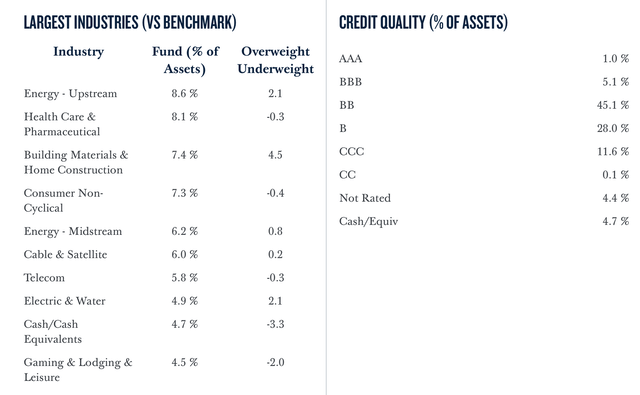

The difference in yield primarily reflects the likelihood of default. High yield funds by their nature have lower credit quality bonds than investment grade funds. As an example, here’s a snapshot of the PHYZX holdings at 4/30/2022, showing the focus on BB, B, and CCC grade bonds.

Source: PGIM Portfolio Attributes

Choose Wisely

Retail investors normally buy bond funds rather than individual bonds. There are about 650 high yield bond funds. Morningstar screens all of these high yield bond funds, and rates the best as Gold, Silver, and Bronze. Three funds are currently rated as Gold, and those funds are not shy about letting you know they are winners.

We are going to focus here on two of those Gold rated funds:

- Vanguard High Yield Corporate Fund, Investor Shares (MUTF:VWEHX)

- PGIM High Yield Fund – Class Z (MUTF:PHYZX)

Vanguard also offers an Admiral version of their high yield fund (VWEAX) which is identical except for a higher minimum investment and a 0.1% lower expense rate.

These two funds are more similar than different. We can look at some of the key characteristics.

|

VWEHX |

PHYZX |

|

|

Sponsor |

Vanguard |

Prudential Investments |

|

Morningstar Rating |

4 Star Gold |

5 Star Gold |

|

Yield (TTM) |

4.59% |

6.07% |

|

Payout (TTM)* |

$0.24 |

$0.29 |

|

Assets |

26.2 Billion |

20.7 Billion |

|

Number of Holdings |

639 |

773 |

|

Expense |

0.23% |

0.5% |

|

Effective Duration |

4.0 years |

4.2 years |

|

Turnover Ratio |

31% |

56% |

Data: Seeking Alpha, 12 June 2022

These are both very large funds, with 25+ year track records, sponsored by very large fiduciaries, with sophisticated and experienced management teams.

Both funds are very actively managed. Both weight their sector holdings fairly close to their benchmarks, seeking performance primarily via security selection. Both funds pay monthly dividends.

Analysis

In an asset allocation plan that includes field income, a slice of high yield bonds provide an opportunity to increase returns from that slice by 200 or more basis points. While the magnitude of price declines can be similar to stocks, prices have historically recovered.

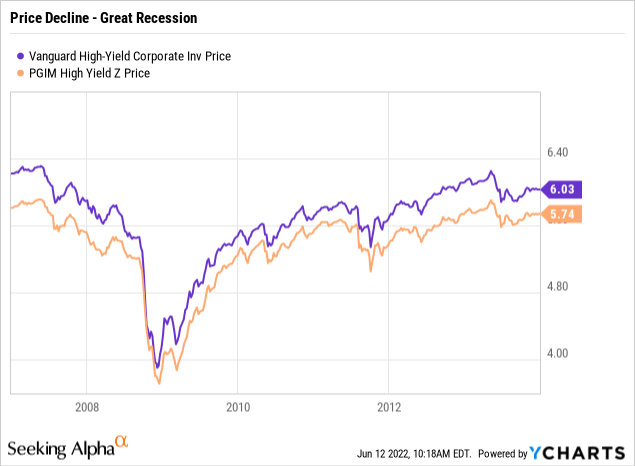

The best opportunity to achieve long term alpha is, unsurprising, to buy your planned allocation during periods of significant market decline. The chart below (1/1/2007 to 612/31/2013) shows the 35% decline during the Great Recession, and the subsequent recovery. The major part of the decline is notably very steep.

Seeking Alpha

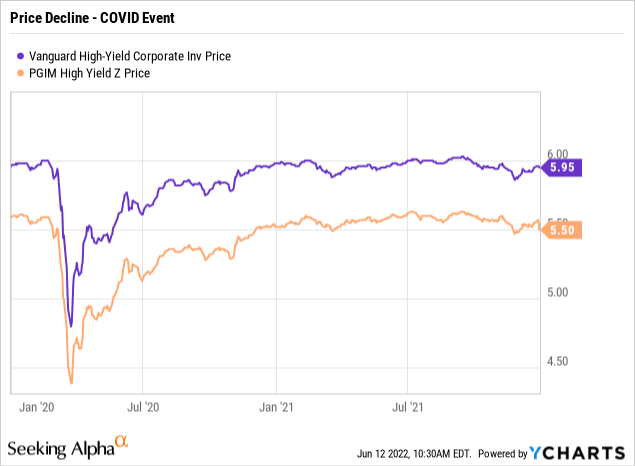

More recently, we saw a 20% price decline during COVID. The chart below (1/1/2020 to 12/31/2021) shows the steep decline and recovery.

Seeking Alpha

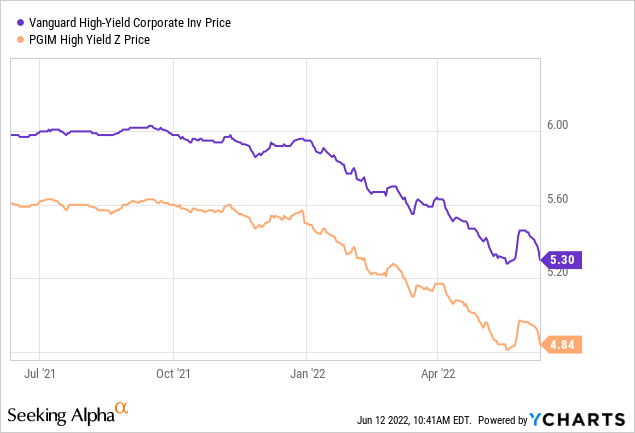

And now, we appear to be in what many believe to be the initial stages of a third major decline, with prices (12 June 2022) down 12-14% from 52 week highs.

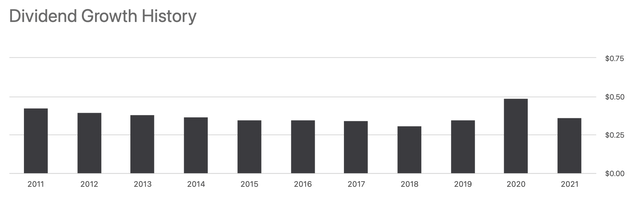

Annual dividends have been trending slightly downward since about 2010, and (particularly for PHYZX) appear a bit noisy in this data set. At least in recent years, this seems due to end of the year scheduling and capital gain effects (see for example the PHYZX distribution history detail available on Seeking Alpha, and in the annual chart below).

The chart below shows the annual dividends for PHYZX.

Risks

I would assess the primary risks here to be the macro environment (general business conditions, inflation and interest rates). Volatility for high yield bonds will likely be higher than for investment grade bonds.

With regard to general business conditions, Fitch Ratings reported on actual and projected default rates for high yield bonds in January 2022:

The 2021 U.S. high yield default rate finished at a record low 0.5%, with low default volume expected to continue through 2023 despite rising interest rates and continued pandemic uncertainty, according to the latest forecast from Fitch Ratings.

Fitch projects a 1% default rate for 2022 and between 1%-1.5% in 2023. Both rates are below the historical non-recessionary 2.2% average.

With regard to interest rates, on 10 June 2022, the U.S. government released the latest data on the Consumer Price Index, “The all items index increased 8.6 percent for the 12 months ending May, the largest 12-month increase since the period ending December 1981.”

To counter inflation, the Federal Reserve is widely expected to continue to increase the Fed Funds rate, with one recent poll of economists suggesting about a 2-2.5% increase over the next year. Opinions vary regarding how this plays out in a high inflation rate environment, but in general increased rates will result in lower prices for bonds.

As a rule of thumb, a 1% increase in interest rates will cause a 1% x Duration fall in the value of a bond. The two funds under discussion have duration of about 4 years, hence a 2.5% increase in interest rates is expected to yield about a 10% decline in price, all other things equal.

Investor Takeaway

Best in class high yield funds like VWEHX or PHYZX provide an option to increase the income provided by fixed income assets. This is particularly attractive in tax deferred accounts such as IRAs.

This effect is most powerful if the funds are purchased when “on sale”, however these opportunities have been infrequent. We are currently in or near the third such opportunity during the last 15 years.

While prices are down about 12-14% today, we saw declines of 20% during COVID and 35% during the Great Recession. Inflation is significantly higher today that any other time during recent decades, and inflation, and public policy responses, are likely to have significant effects on bond prices.

For those with an interest in high yield bonds, I believe a reasonable approach is split the funds allocated to investment in high yield bonds into several tranches, with established price or yield targets for each tranche.

To use my personal case as an example of how this might work, I am thinking about a multi-tranche strategy illustrated in the table below. As the tranche structure suggests, I believe we are likely to reach the 25-30% decline point, and I have thus focused my planned investment there.

To simplify comparison with other investment options, I’ve also added a calculation of the Yield-on-Price at each point, assuming an annual dividend equal to the regular (excluding capital gains) dividend actually paid in 2021 ($0.24 for VWEHX and $0.29 for PHYZX).

| VWEHX | Yield | PHYZX | Yield | Tranche | |

| 52 Week High | $6.03 | 3.98% | $5.63 | 5.15% | |

| 15% decline | $5.13 | 4.68% | $4.79 | 6.05% | 5% |

| 20% decline | $4.82 | 4.98% | $4.50 | 6.44% | 15% |

| 25% decline | $4.52 | 5.31% | $4.22 | 6.87% | 30% |

| 30% decline | $4.22 | 5.59% | $3.94 | 7.36% | 30% |

| 35% decline | $3.92 | 6.12% | $3.66 | 7.92% | 20% |

Be the first to comment