wildpixel/iStock via Getty Images

REITs, perhaps to a greater extent than other stocks are traded as a group. There is relatively little granular analysis with the market price being most directly tied to broad based trading like ETFs.

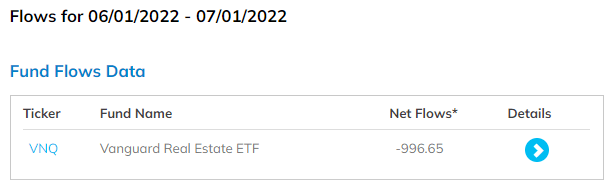

June was a rough month for REITs with the index down 7.4% and unsurprisingly this coincided with massive outflows from REIT ETFs. The Vanguard Real Estate ETF (VNQ) alone had outflows of nearly $1B

ETF.com

It is not granular analysis driving broad ETFs, but rather big notions about how macro events affect REITs. In the first portion of 2022 REITs materially outperformed the S&P on the broad belief that REITs are good inflation hedges. Downward movement is also dominated by broad strokes and in studying the market as well as its participants I believe there are 7 main bear notions that have been driving the June selloff.

7 Most Prevalent REIT Bear Beliefs

- Work-from-home is killing office

- Zero Interest Rate Policy (ZIRP) created a real estate bubble

- REITs are high debt

- High gas prices and e-commerce are killing retail

- Rising construction costs hurt REITs

- Real estate is oversupplied

- Rising interest rates are killing REITs

Some of them are fundamentally true, others are flat our wrong and a few are more nuanced, partially true but should not be broadly applied.

Work from Home killing office – True

Office was predisposed to weakness due to chronic oversupply. Technology enabled work from home was already picking up steam prior to COVID, but the pandemic kicked it into high gear. Office bulls maintain that as the pandemic gets further behind us people will return to office. That may be true, but given the pre-existing oversupply of office, even a marginal work from home contingent of say 15% of workers would be enough to make office real estate suffer.

The problem is most pronounced in areas that were already oversupplied and suffering from out-migration such as NYC and the West Coast. Some office in key job growth cities will still perform well, but even that I wouldn’t buy except at a healthy discount.

ZIRP created a real estate bubble – False

This notion is derived from a combination of history and factual data. In this recent period of near zero interest rates real estate prices did soar. Industrial prices, housing prices and land values are up dramatically so I can see why it would seem bubbly.

A bubble, however, is not synonymous with high prices. The prices of real estate went up because the earnings power of real estate went up and cap rates came down. It was rational price movement driven by sensible economic activity.

A bubble is more speculative in nature. Compared to previous cycles there has been relatively little speculation. People aren’t buying with the hope of flipping the property in a year at a profit. They are either buying real estate to use it or for the cashflows.

The other main characteristic of a bubble is its tendency to pop. If the high prices of real estate were the result of a zero interest rate bubble they would have come back down when rates rose. This did not happen. As the 10 year treasury yield increased by about 200 basis points, real estate prices continued to rise, just at a slightly slower pace.

Real estate prices are nicely tethered to fundamental value.

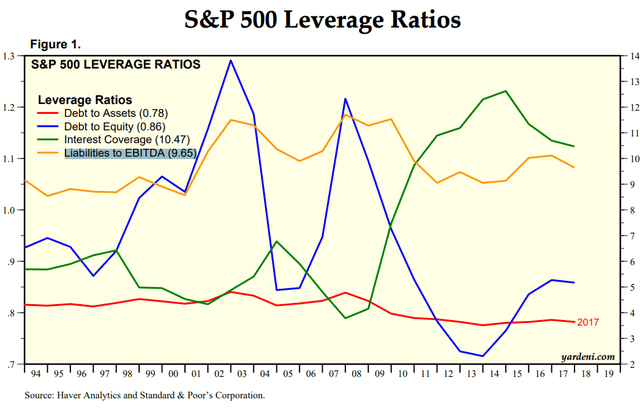

REITs are high debt – False

REITs used to be high debt. The market’s perception of REITs as highly levered investments is just outdated.

Today, REITs are actually lower debt than the S&P. The S&P 500 has debt to EBITDA of 9.65X (slightly old data at the end of 2019).

In contrast, the median REIT has debt to EBITDA of 6.17X

In the past decade, REITs have shown great interest in shoring up their balance sheets causing the sector to become among the more fiscally responsible.

Mortgage REITs are a different story with sometimes astronomical debt loads, but for the purposes of this article we are discussing equity REITs.

High gas prices and e-commerce are killing retail – half true with nuance

Mechanistically there is no doubt that e-commerce and gas prices are hurting retail. Each competes with retail for consumer dollars. Gas prices have gotten worse while e-commerce has moderated a bit with 2022 featuring the first ever increase in market share of brick and mortar over e-commerce.

So while the directionality of this notion is true, I think the market is overly worried about the size of its impact. Retail real estate is actually in a good place right now as supply has been extremely constrained. There has been minimal shopping center development for 15 years resulting in the U.S. moving from oversupply to a level of supply that is about right.

I anticipate shopping center REITs experiencing significant fundamental growth in the next few years.

Rising construction costs are hurting REITs – extremely false

While rising construction costs do make REIT developments less accretive, it is unequivocally a positive for REITs overall.

The economic math is quite straight forward. Less accretive development causes less development which improves the leasing outlook of standing inventory.

The REIT universe consists overwhelmingly of standing inventory with development pipelines just being a fraction of the overall valuation. The benefits of reduced supply going forward will outweigh slightly less accretive developments.

Real estate is oversupplied – partially true partially false

Supply is not an issue that can be painted with a broad brush. It is location specific and property type specific.

There are certainly subsectors that are oversupplied, but there are also areas of undersupply. These could be further broken down to be more nuanced by submarket, but generally speaking:

|

Oversupplied |

Undersupplied |

|

Office |

Apartments |

|

Southern timberland |

Southern mills |

|

Data center (hyperscale tenancy) |

Manufactured housing |

|

Self storage |

Factories |

|

Cold Storage |

Arable farmland with ample water |

|

Senior housing |

Single-family-homes |

Supply of real estate in general has been more muted since the financial crisis due to tighter lending standards. In order for developers to get a loan now the project has to have reasonable underwriting which has substantially curbed speculative development.

Rising Interest rates are killing REITs – Mostly false, but with nuance

This is a topic I have discussed multiple times before, but it continues to be a massive driver of market prices. As I write this, REITs are up almost 2% on the day (July 1st) and it just so happens that the 10 year Treasury yield is down substantially to well under 3%.

The market in general has been responsive to interest rates in that when rates are up the market is down and vice-versa, but the effect has consistently been about 1.5X to 2X for REITs. The market’s fear of interest rates is so strong that it has recently started interpreting bad news as good news.

Interest rates are largely down today because of the weak manufacturing data which in turn makes people think the Fed might be closer to easing up on its hikes.

It is a financial fact that interest rates impact the valuation of investments and it is an inverse impact so in some ways the market is correct to be up when interest rates are down. The part the market is getting incorrect is in thinking REITs are more sensitive to interest rate changes than the S&P.

Interest rates act upon fundamental valuation in 2 key ways:

- Discount rates

- Cost of capital

As discount rates increase, the magnitude of impact on financial instruments should be proportional to their duration.

Cash does not get hurt from rising interest rates because it has a duration of 0.

Duration of bonds is a function of the weighted average of interest payments and maturity balloon payment. Equities do not have a balloon payment, so it is a matter of how near term the average cashflow is.

REITs have a higher dividend yield than the S&P, so the duration of REITs is lower in the same way that the duration of a 30 year coupon bond is shorter than a 30 year zero coupon bond.

Based on this factor, REITs should be slightly less sensitive to interest rates.

In terms of cost of capital, we established above that REITs are a bit lower leverage than the S&P in terms of Debt to EBITDA. Lower debt makes the eventual refinancing of liabilities marginally less painful for REITs. Further, REITs have specifically termed out their debt such that refinancing is not a near term or even medium term event.

Overall, fundamentals suggest REITs should be fractionally less interest rate sensitive than the S&P and substantially less interest rate sensitive than the Nasdaq.

Wrapping it up

I like to maintain an awareness of the forces impacting price action and keep tabs on whether that price action is fundamentally warranted. The practical implication is this:

- A price drop caused by fundamentally valid reasons is not an opportunity

- A price drop that is not fundamentally valid is an opportunity

By differentiating what is moving the market and what should move the market, one can spot deals as they come along.

Be the first to comment