Mark Makela/Getty Images News

By Brian Nelson, CFA

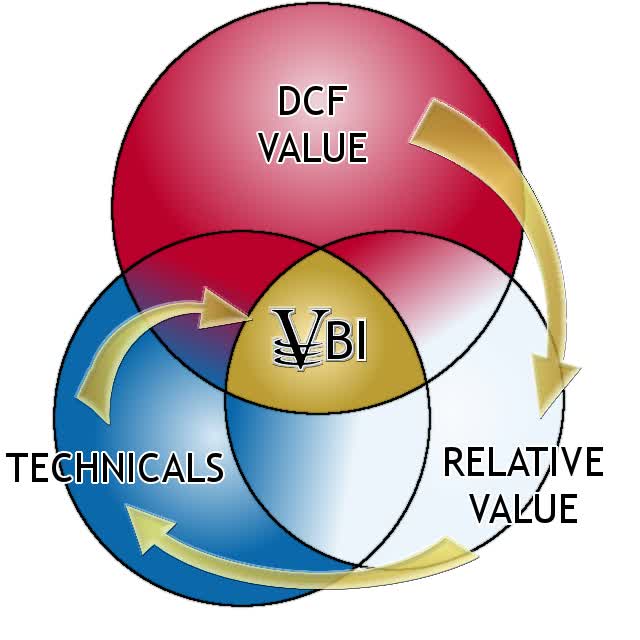

At Valuentum, we use discounted cash-flow analysis as the bedrock of our process. However, we also use relative valuation and technical and momentum indicators and blend that into an output called the Valuentum Buying Index rating, or the VBI rating.

The center of the Venn diagram above, the Valuentum Buying Index (VBI) combines rigorous financial and valuation analysis with an evaluation of a firm’s technicals and momentum indicators to derive a rating between 1 and 10 for each company (10=best). Because the process factors in a technical and momentum assessment after evaluating a firm’s investment merits via a rigorous DCF and relative-value process, the VBI attempts to identify entry and exit points on what we consider to be the most undervalued stocks. (Image Source: Valuentum)

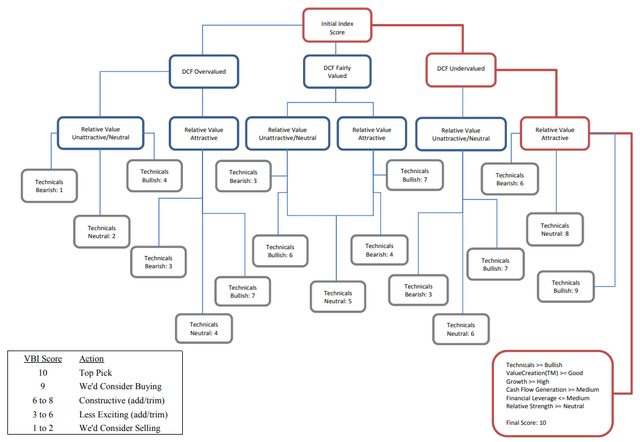

The flow chart on how we rank stocks in our coverage universe. (Image Source: Valuentum)

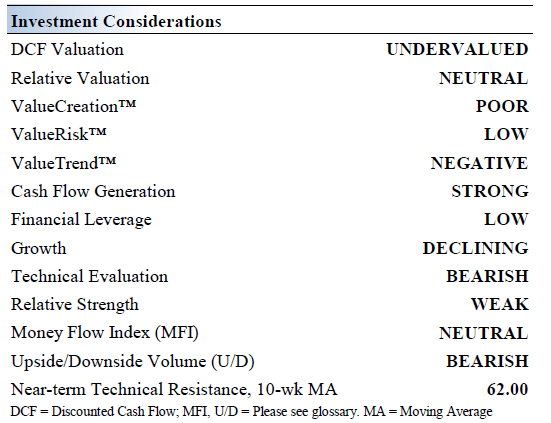

DuPont de Nemours, Inc. (NYSE:DD) currently registers a 3 on the Valuentum Buying Index on the basis of three of its key investment considerations that we’ll talk about soon. This rating means we’re constructive on shares, but it also means we’re not as excited as other highly-rated stocks included in the simulated newsletter portfolios.

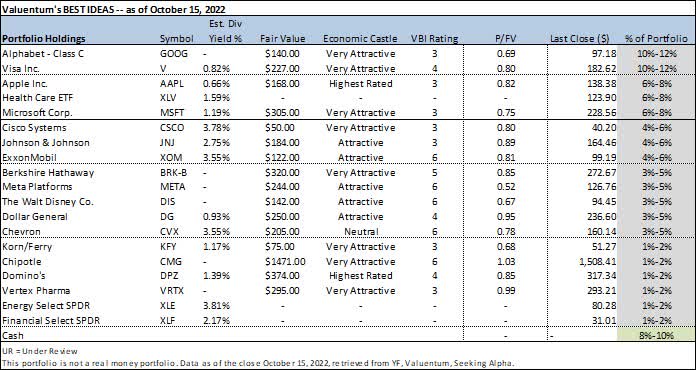

We use the Valuentum Buying Index to source ideas for the simulated Best Ideas Newsletter portfolio, as shown below, for example. Though other companies may have a similar rating as that of DuPont, generally to be considered for inclusion in the Best Ideas Newsletter, the company must register a high rating first. Other considerations such as strong free cash flow generating capacity, a pristine net-cash rich balance sheet, as well as solid secular growth prospects are very important, too.

Portfolio information as of published date in top, left corner of table above. The Best Ideas Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. (Image Source: Valuentum)

With that backdrop clearly stated, let’s now dig into our fundamental, cash flow and valuation analysis of DuPont.

DuPont’s Key Investment Considerations

Image Source: Valuentum

DuPont de Nemours retains the specialty products operations of DowDuPont, which split into three different companies. The spin-off of the company’s materials sciences (Dow Inc) and agricultural (Corteva Inc) businesses were successfully completed in 2019, leaving DuPont de Nemours as a standalone entity.

Inflationary pressures are still a major concern, and while some commodity prices have come in during the past several months, we believe that things have changed fast across the broader economic environment. Here is what we wrote in our October 7 note:

FedEx (FDX)recorded a big miss for the period ending August 31, 2022, earnings released September 16, and while this, itself, isn’t too much to worry about, the package delivery giant also withdrew its guidance for fiscal 2023. Visibility has been significantly reduced. FedEx’s stock has been hammered as a result, and while there are some firm-specific execution issues at FedEx, the implications on the broader economic environment are hard to ignore. Here’s what FedEx CEO Raj Subramaniam had to say in the press release:

“Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations. While this performance is disappointing, we are aggressively accelerating cost reduction efforts and evaluating additional measures to enhance productivity, reduce variable costs, and implement structural cost-reduction initiatives. These efforts are aligned with the strategy we outlined in June, and I remain confident in achieving our fiscal year 2025 financial targets.”

Let (us) reiterate what FedEx is saying: Things have deteriorated fast!

Readers have to remember that inflation was a big tailwind to equity returns in 2021. For example, we started getting inflationary readings on the CPI of 5% as early as May 2021, 6% as early as October 2021, and 7% as early as December 2021. The markets rallied through all of this, as we interpreted this as higher prices à higher nominal earnings à higher valuations. However, when we started seeing the food cost inflation in August of this year, that was the straw that broke the camel’s back, so to speak, especially with the rising 10-year Treasury rate as the backdrop.

DuPont aims to realize meaningful long-term cost savings, now that it is a standalone company. Such efforts should help to mitigate any revenue pressures from an economic slowdown. Reducing G&A expenses as a percent of its DuPont’s revenues remains a top priority for management, and we are keeping a close eye on the firm’s cost structure.

DuPont’s key end markets include electronics, automotive, water, construction, and industrial markets. On the industrial front, that includes customers in the realms of aerospace, defense, and oil & gas. As the global economy recovers from the COVID-19 pandemic, DuPont’s outlook should improve, though serious near-term headwinds remain.

DuPont targets a long-term net debt-to-EBITDA ratio of 2.75x. The firm has an investment grade credit rating (Baa1/BBB+/BBB+), though Moody’s had its credit rating on downgrade watch as of January 2022. DuPont launched a $1.0 billion share buyback program in February 2022 set to run through March 2023.

Managing R&D and capital investment levels as a percent of sales going forward represents a big way DuPont seeks to augment its future free cash flows. The company’s debt maturity schedule is manageable but note its total debt load is quite high.

DuPont’s Economic Profit Analysis

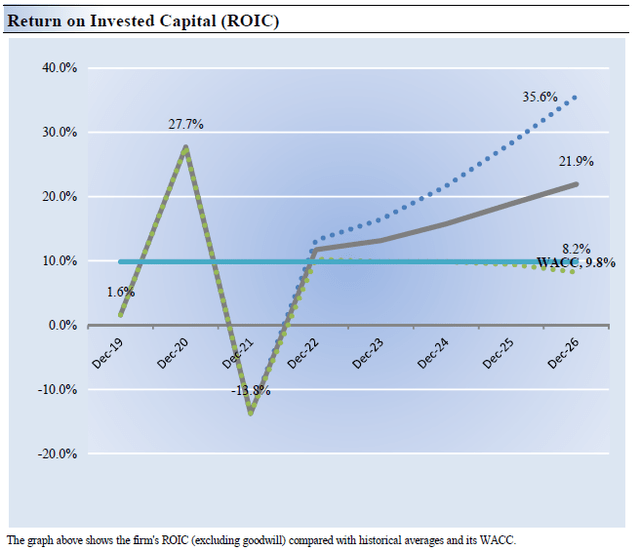

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. DuPont’s 3-year historical return on invested capital (without goodwill) is 5.2%, which is below the estimate of its cost of capital of 9.8%.

As such, we assign the firm a ValueCreation™ rating of POOR. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. A focus on improving ROIC gives Dow an attractive Economic Castle rating.

DuPont’s Cash Flow Valuation Analysis

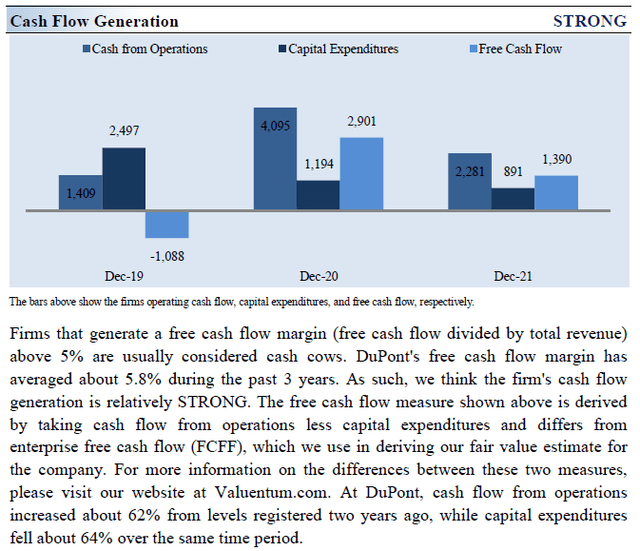

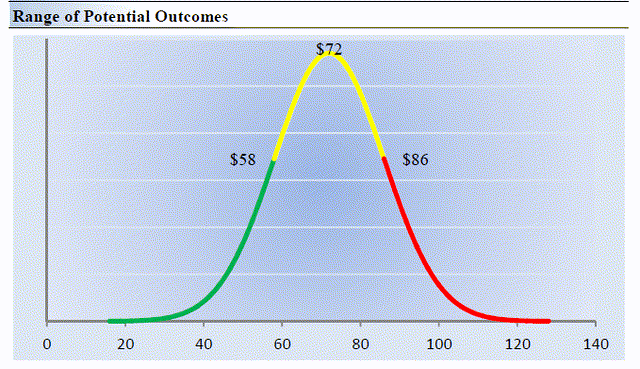

We think DuPont is worth $72 per share with a fair value range of $58.00 – $86.00. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk™ rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of -0.1% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of -9.7%.

Our model reflects a 5-year projected average operating margin of 22.5%, which is above DuPont’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3.6% for the next 15 years and 3% in perpetuity. For DuPont, we use a 9.8% weighted average cost of capital to discount future free cash flows.

DuPont’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate DuPont’s fair value at about $72 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for DuPont. We think the firm is attractive below $58 per share (the green line), but quite expensive above $86 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Now that DowDuPont has successfully separated into three standalone businesses, with DuPont de Nemours retaining its specialty products operations, we’re cautious in the near term. Its total debt load is quite high, but a combination of its decent free cash flow profile, investment grade credit ratings, and meaningful cash and cash equivalents on hand provides some support for future refinancing activities. The firm aims to significantly improve its cost structure going forward, in part by reducing G&A and R&D expenses as a percentage of its annual revenues.

Beyond DuPont de Nemours’ large net debt load, we caution that inflationary headwinds will pressure its financial performance. Innovation will be key going forward, as DuPont needs to stay ahead of the competition if it wants to maintain pricing power. We are wary of its large debt load, and Moody’s had DuPont’s credit rating on downgrade watch as of January 2022. The trajectory of raw material expenses needs to be monitored. DuPont targets a long-term net debt-to-EBITDA ratio of 2.75x, though that is rather high, in our view. Though its share price is below our estimate of its fair value, it does not make the cut for inclusion in the simulated Best Ideas Newsletter portfolio.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment