khyim/iStock via Getty Images

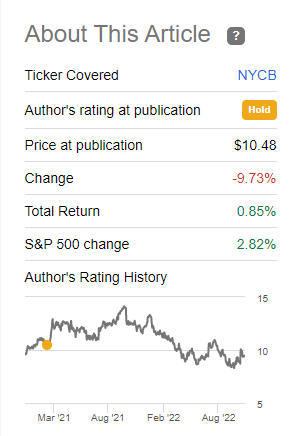

It has been some time since we wrote about New York Community Bancorp Inc. (NYSE:NYCB). On last coverage, we gave it a pass for a buy and suggested investors play it defensively via cash secured puts. That turned out to be the correct call overall as NYCB produced poor total returns, about in line with the S&P 500 (SPY).

Seeking Alpha- Returns Since Last Article

We examine the setup today in light of the recently approved merger with Flagstar Bancorp Inc. (NYSE:FBC) and tell you why we are nudging this into a buy.

Q3-2022

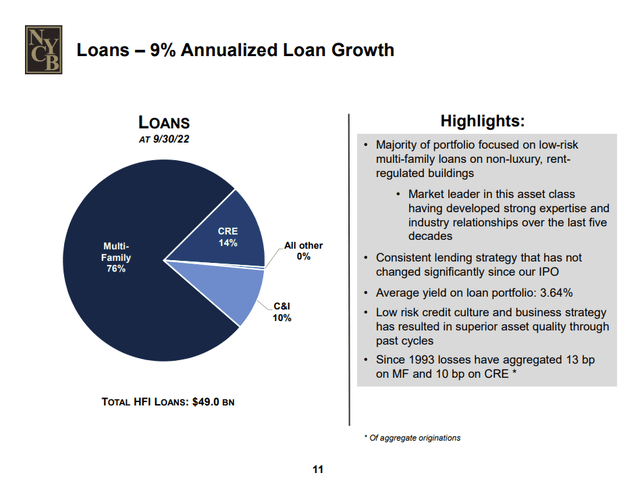

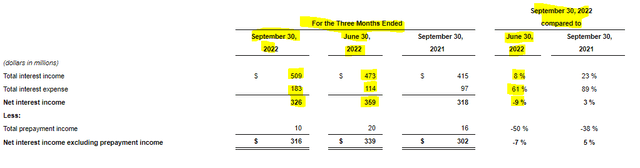

Investors might have been a tad disappointed at the third quarter numbers as NYCB missed estimates. Q3-2022 adjusted earnings of $0.31, was a penny below analyst numbers. It also dropped from $0.35 in Q2 and signaled that peak earnings were well in the rear-view mirror. This was despite a steady expansion of NYCB’s loan portfolio.

NYCB Q3-2022 Presentation

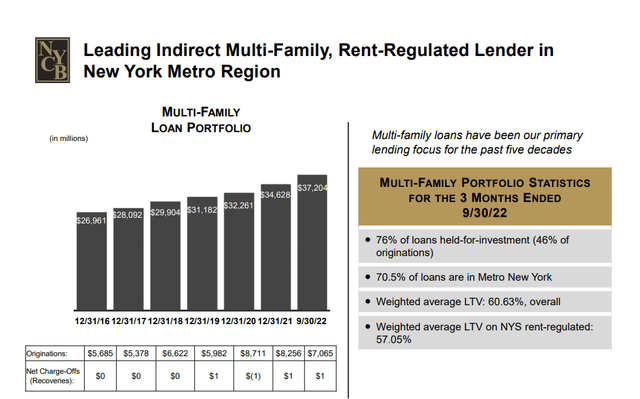

Expansion was in NYCB’s primary domain, multi-family low-risk, low loan to value, lending.

NYCB Q3-2022 Presentation

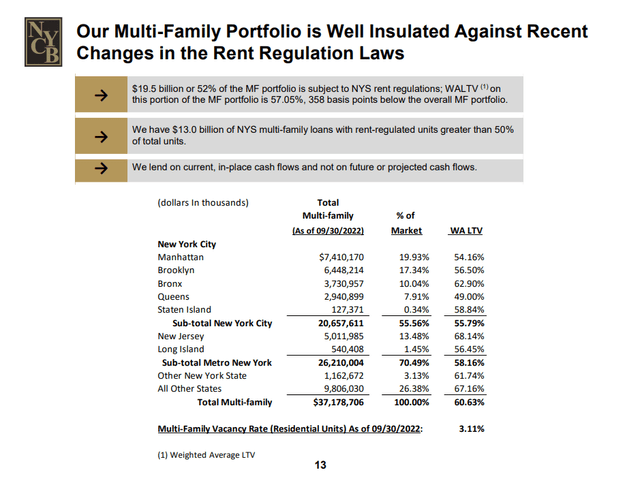

The statistics here continue to be extremely conservative. This is despite the rent regulation rules.

NYCB Q3-2022 Presentation

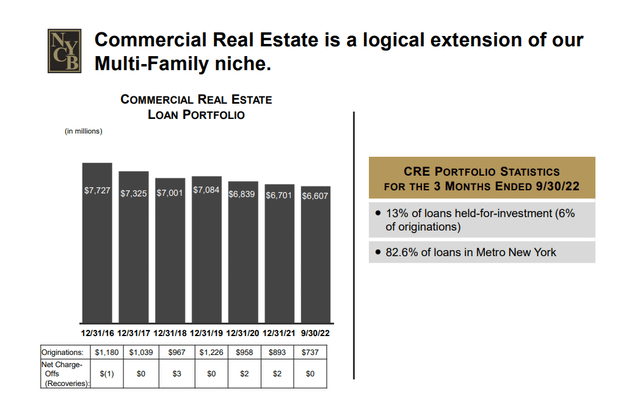

Interestingly, commercial lending portfolio contracted as lending did not keep pace with paydowns.

NYCB Q3-2022 Presentation

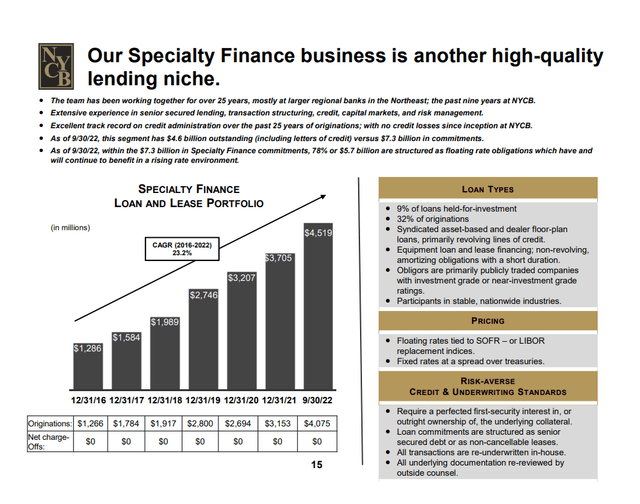

Finally. specialty finance continued to deliver, and we saw yet another quarter of fantastic loan growth. Q3-2022 total loans of $4.519 billion were 3.2% higher Q2-2022.

NYCB Q3-2022 Presentation

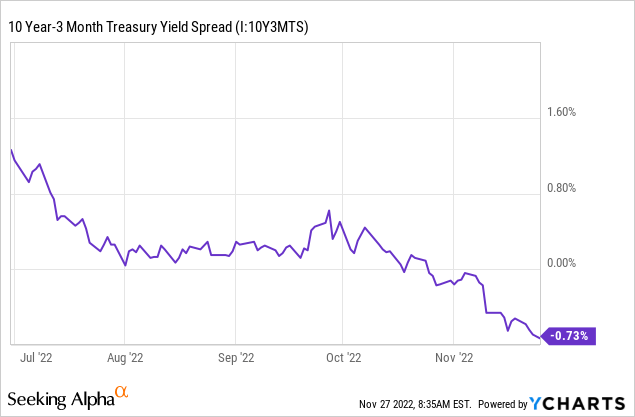

While those numbers looked fine, the crux of the issue for the banking sector in the third quarter was the rapid curve flattening. Long rates edged up, but shorter-term rates moved up with vengeance. A good proxy for this is the 10 Year and 3-month Treasury yield spread.

You can see that this number was well over 1% at the end of Q2-2022. By end of Q3-2022, we were seeing it down to about 0.4%. Things got even worse after that. As we write this, at the end of November 2022, the spread has gone strongly negative with the 3 months Treasury bill exceeding the 10 year by 0.73%. This is a very hostile environment for most bank lending and NYCB will not be immune from this. We already saw this in a relatively benign quarter. Net interest income contracted by 9% from Q2-2022. While interest income expanded by 9%, interest expense expanded by 61%.

NYCB Q3-2022 Press Release

You can rest assured that there is way more of this coming as banks tend to move up rates for deposits with a big lag.

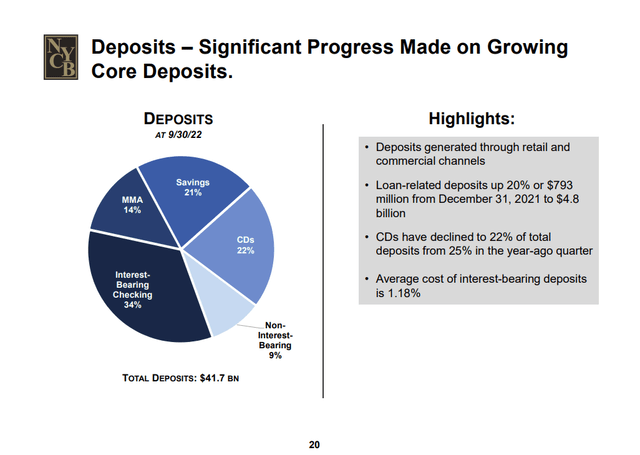

NYCB Q3-2022 Presentation

Flagstar Bancorp Merger

While the Q3-2022 results were ho-hum, FBC finally got approved to merge with NYCB.

The consummation of the acquisition of Flagstar by NYCB is expected to take place on December 1, 2022, subject to the satisfaction of the remaining customary closing conditions set forth in the merger agreement between the two companies. The Company will continue to be known as New York Community Bancorp, Inc. and trade under the “NYCB” ticker symbol.

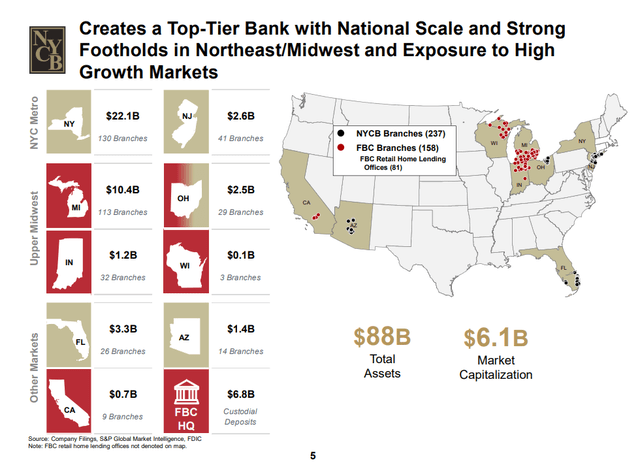

The acquisition would create one of the largest regional banks in the country, operating 395 branches across a nine-state franchise, including strong footholds in the Northeast and the Midwest and exposure to high growth markets in the Southwest and West Coast. Through the Flagstar Mortgage division, the Company will operate nationally through 81 retail home lending offices in 26 states and a wholesale network of approximately 3,000 third-party mortgage originators.

Source: Seeking Alpha

This was quite a delay compared the original timeline (merger announced on April 26, 2021), nonetheless, investors were likely pleased to put this uncertainty behind them. NYCB-FBC tie-up will create additional scale in the northwest markets and there are high hopes that this will help NYCB break out of its long consolidation.

NYCB Q3-2022 Presentation

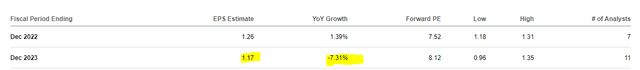

At announced date, the transaction was expected to be 16% accretive to NYCB’s earnings per share in 2022. Of course, all of that is pushed out to 2023, but analysts have a very different opinion of where earnings are now headed.

Seeking Alpha

This is all of course from where the interest rate curve has moved, and has little to do with the merger itself. In fact, we don’t doubt that NYCB can deliver the accretion to earnings and possibly exceed the promised synergies. Nonetheless, the interest rate curve is the boss here and earnings could contract far more sharply than what analysts currently expect.

Outlook & Verdict

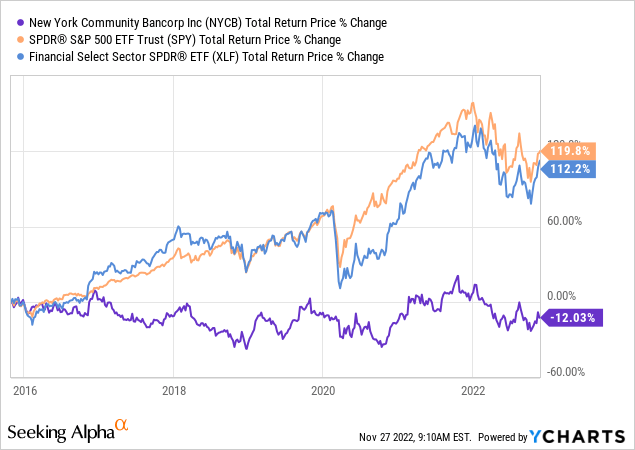

The struggles to generate a sustainable growth model have been real for NYCB. This combined with what was a lofty valuation to begin with, in late 2015, has produced really poor total returns.

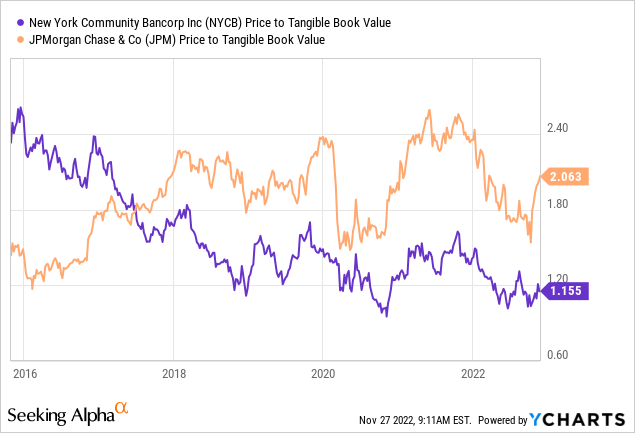

You can see above the extraordinary lag compared to SPY and the Financial Select Sector SPDR (XLF). Another interesting factoid here is how NYCB valuation has changed relative that of JPMorgan (JPM), another bank we cover. While NYCB moved from 2.40X to 1.15X tangible book value, JPM went from 1.40X to 2.06X.

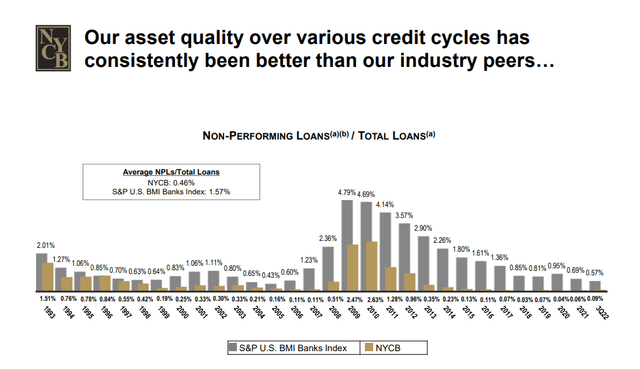

So, this is what things come down to. If you paid a premium valuation for NYCB in 2015, you are probably hurting and wondering why you are suffering with such poor returns. That said, the bank itself has done little wrong. Heck, you need 6/5 vision just to spot the bank’s non-performing loans in recent years.

NYCB Q3-2022 Presentation

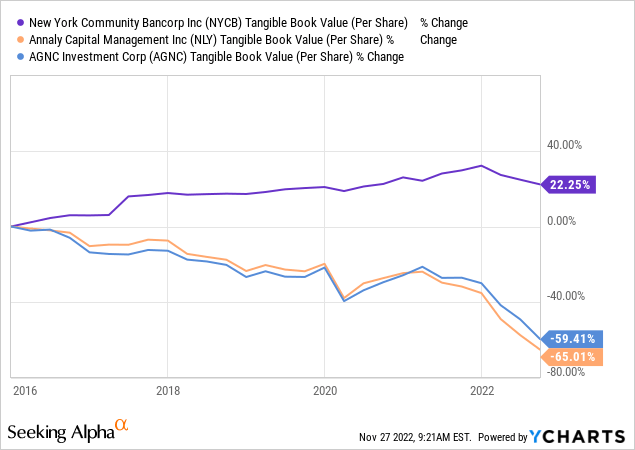

So, this to us is a good kind of stock decline. Where the underlying fundamentals are strong and the company continues to deliver. Contrast this with the value destruction we have seen in mortgage REITs like Annaly Capital Management Inc. (NLY) and AGNC Investment Corporation (AGNC) which have been Class A value destroyers over this same timeframe.

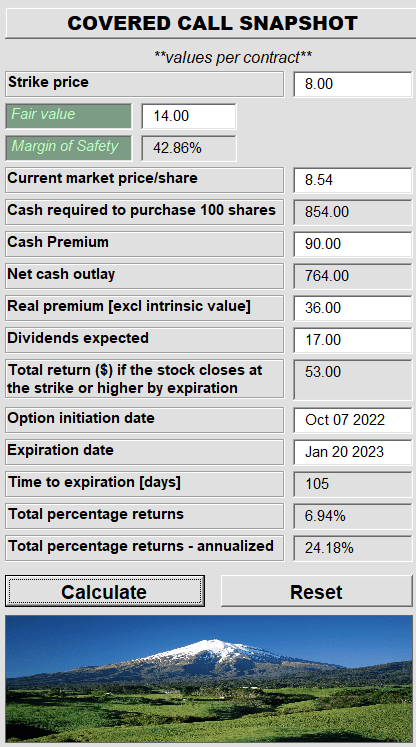

We are not comfortable with averaging down when underlying value is eroding faster than the stock price. On the other hand, NYCB has actually become cheaper. We like it here and rate it a buy but think investors will have to be patient for solid returns. As usual, we took a conservative approach in our trade with an extremely defensive covered call.

Conservative Income Portfolio

That is working out and we are looking for opportunities in the weeks ahead.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment