PavloBaliukh/iStock via Getty Images

Thesis

CNH Industrial N.V. (NYSE:CNHI) will not become the market leader in the near future, but I believe the agriculture sector is large enough to support more than one strong player. At its current price – CNHI offers enough upside, and a positively skewed probability of outcomes to warrant consideration.

Overview

CNHI was formed in 2013 after a series of mergers and acquisitions between Fiat Industrial, Case Corporation, and New Holland NV. The company has a dual listing on the NYSE as well as the Borsa Italiana in Milan. The company is currently headquartered in London, but it has operations and distributors worldwide.

It operates primarily as a heavy equipment and machinery company, and consists of the following Global Business Units:

Segments (Author)

Up until the end of 2021, the company also operated an on-highway segment. The intention to split was first announced in 2019, and since the start of 2022, Iveco (OTC:IVCGF) has been spun off.

The company now owns a stable of 5 prominent brands:

CNHI Brands (CNHI Website)

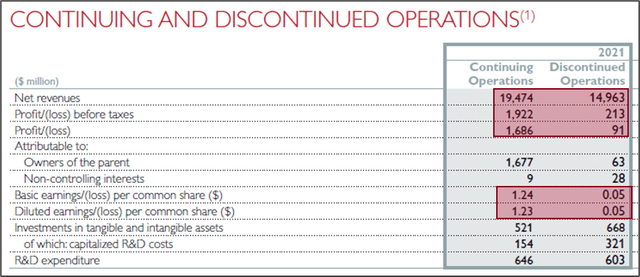

The demerger has created what seems to be a much higher quality business. Even though about 40% of revenue and 50% of staff have been spun off – almost all the profitability remains. (Red blocks below).

Pre vs Post demerger (CNHI Website)

Breaking down the business

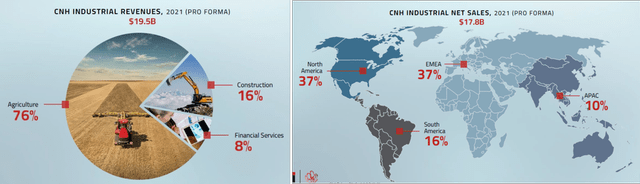

Agriculture is CNHI’s bread and butter.

Revenue breakdown (CNHI Website)

Agriculture (Ag)

CNHI designs, manufactures, and sells some of the worlds most advanced farming equipment such as tractors, combine harvesters, cotton-and-grape pickers, sugar cane harvesters, planting-, seeding-, and soil prep equipment etc.

Ag is CNHI’s strongest suit, and they have won numerous design awards for their combines and tractors over the years.

They have a presence is over 200 countries, and more than 6 500 independent dealers/services centers/sales points worldwide. This accessibility is vital – as one of the main reasons farmers might decide to switch their allegiance from one brand to another, is the availability of parts and service centers.

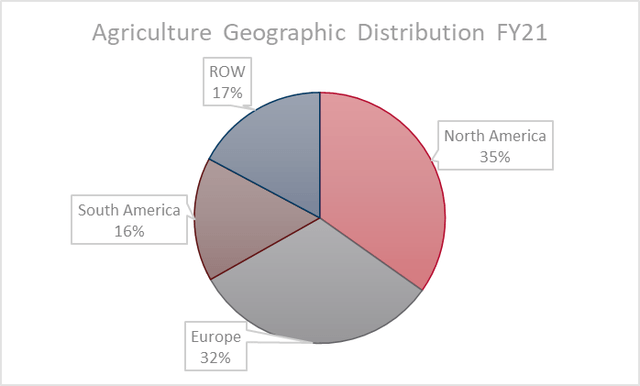

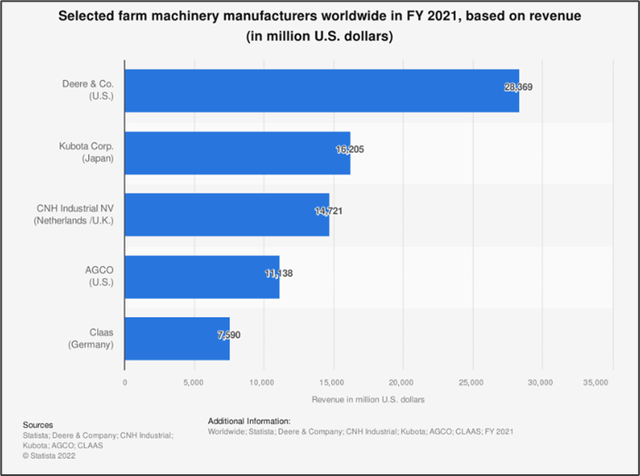

CNHI is the number 2 player in the NA Ag market, and depending on which equipment is being discussed, they range between number 1 and 3 in EMEA and South America. John Deere (DE) is currently still firmly in control of the US market, and their Ag business is still multiples the size of CNHI’s.

Agriculture revenue breakdown (Created by author)

Sales have been flattish for a number of years, after experiencing inflated volumes almost a decade Ago…

However CNHI has achieved meaningful Ag margin expansion during this time. CNHI expects this margin to increase to between 14.5% and 15.5% from the 12.3% that was achieved in 2021. This is largely in line with my modelling for this segment.

CNHI states that the biggest determinant of Ag equipment purchases is the level of net farm income. This, of course, can be influenced by a whole host of issues ranging from inflation and interest rates to weather patterns (which can greatly influence the farm’s yield), trade policies and government subsidies.

Usually high commodity prices, like we are currently seeing, would be a positive catalyst for equipment purchases going forward. However, steep increases in energy prices, as well as input costs like fertilizer and a rapidly rising interest rate will likely cancel out many tailwinds from the commodity price boost.

Some of the biggest drivers for this market going forward are thought to be precision Ag, automation, and electrification/alternative fuel sources.

CNHI recently released the world’s first methane powered tractor, and in their biggest acquisition yet, they bought Raven, a company that specializes in precision Ag for $2.1B. This is a clear indication that they intend to keep up and potentially lead into this new era of Ag.

Size of the Agriculture Business

Statista estimates that the size of the Ag market was roughly $103 billion in 2021. That would give John Deere almost 30% of the market, basically double the share of CNHI.

Expectations are that the market will reach about $136 billion by 2026 (5 yr. CAGR of 5.7%), and $190 billion by 2030 (9 yr. CAGR of 3.8%).

Construction Equipment (CE)

CNHI is a much smaller player in the CE game than in Ag. They are, however, still a top 5 player in both North and South America, and have a presence in more than 180 countries, with 2 600 sales and service points worldwide.

The sector is dominated by much larger players, notably Caterpillar, Komatsu, John Deere and Volvo.

As would be expected – the demand for CE generally follows the economic cycle. Expansions lead to increased demand and usage, and vice versa. The current global economic and monetary environment, with increasing mortgage rates, is likely to put a brake on new housing starts, and therefore might put pressure on this division of the business in the near term.

Size of the Construction Business

According to Statista, the CE market size was roughly $136 billion in 2020. It is forecast to reach $186 billion by 2026 (6 yr. CAGR of 5.4%) and $234 billion by 2030 (4 yr. CAGR of 5.9% from 2026 onwards)

This would give CNHI a market share of roughly 2%.

Financial Services

The financial services section is the smallest revenue contributor to the business, but it delivers a much larger portion of net income.

In the simplest terms, it supplies financing options to retail customers as well as wholesale customers (essentially financing the floor plan of a dealership). This is done for most of the independent dealers. This also includes financing for taking in used equipment to trade, have parts inventory available etc. They also provide leasing options to retail customers, as well as insurance products.

Competition would come in the form of banks and independent leasing and finance companies. They are to a large extent reliant on accessing funds at favorable rates.

In a rising rate environment, this section should expect to see higher default levels and less new applications, potentially putting pressure on earnings.

Financial Snapshot

CNHI’s share price has been lagging its peers YTD. This is a similar trend to what we’ve seen over longer periods where CNH has meaningfully underperformed.

Over the past 5 years, they have managed to grow revenue at a CAGR of 6.1%, while managing to grow GP at 7% and OP at 11.4%, indicating improving expense management. This was pre-demerger. I believe the more streamlined version of the business will continue to improve their profit margins.

At first glance – it seems like CNHI has a mountain of debt. In excess of $20 billion, (more than their market cap), to be precise. However, only about 25% of this is related to their industrial activities – with the rest being receivables from their financing segment. The remaining portion of “real” debt is serviced relatively easily – as indicated by an interest coverage ratio of 6.2x at the end of 2021. CNHI is targeting to be net debt by 2023.

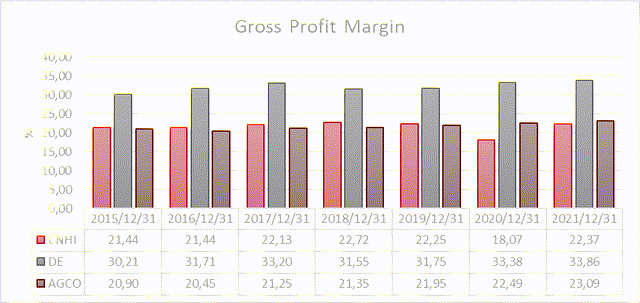

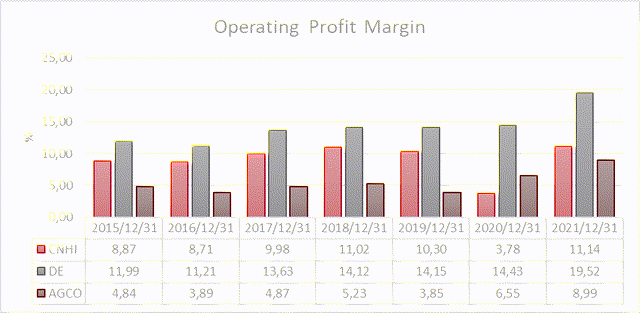

In terms of margins, CNHI has not been able to achieve the same level of gross margins as its biggest competitor, John Deere, and has been very much in line with the next big competitor, AGCO Corp. (AGCO).

However, they do seem to have a better grip on operating expenses than both John Deere and AGCO, leading to better operating margins than AGCO, but still below JD.

In terms of returning money to shareholders, CNHI has a dividend yield of 2%, and they also announced a buyback program in March 2022 – with authorization to buy back 100 million Euros worth of shares until October 2022. As of 11 May, they have purchased 1.6 million shares for a total of 20 million Euros, about 20% of the authorized amount.

The John Deere Problem

John Deere is the obvious leader in the worldwide Ag market, and they are even more dominant in the NA Ag market – which is the most profitable region in the world. It provides them with a large, loyal customer base.

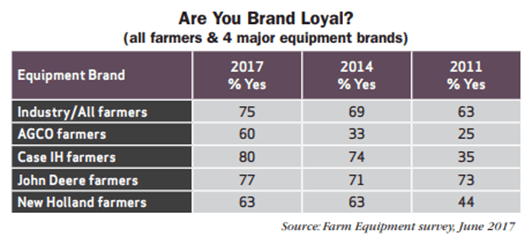

Famers usually stick with brands that work for them – and seldom change their allegiance if not forced to do so. You are either a green man (John Deere), a blue man (New Holland), a red man (Case IH), or something similar, but chances are slim that you often move around between them. Farm Equipment conducts a study every 3 years, starting in 2011, polling farmers on their brand loyalty, among other things. The study is conducted across 12 states that encompass the Corn Belt (Illinois, Indiana, Iowa, Ohio, Missouri), Lake States (Michigan, Minnesota, Wisconsin) and Northern Plains (Kansas, Nebraska, North Dakota, South Dakota) – a significant part of the U.S. Ag market.

Brand Loyalty (Farm Equipment)

It is clear that there is somewhat of an upward trend for farmers owning all brands of equipment, with JD and Case scoring the highest in this category. While JD does not score higher than the opposition, they do score high from a high base – meaning they are unlikely to loss customers en masse to other brands, and therefore unlikely to cede their lead in the Ag market.

According to Agrimarketing.com – their surveys indicate that dealers play an important role in building customer loyalty. They state that of the top 5 factors that were noted as possible reasons for farmers to move between brands, 3 of them were linked to the dealer. These are parts availability, repair service availability, and technician specialists. Both JD and CNHI have a big sales and services network in NA as well as the other regions in which they operate – and thus I do not believe this will be a big factor in one brand taking share from the other.

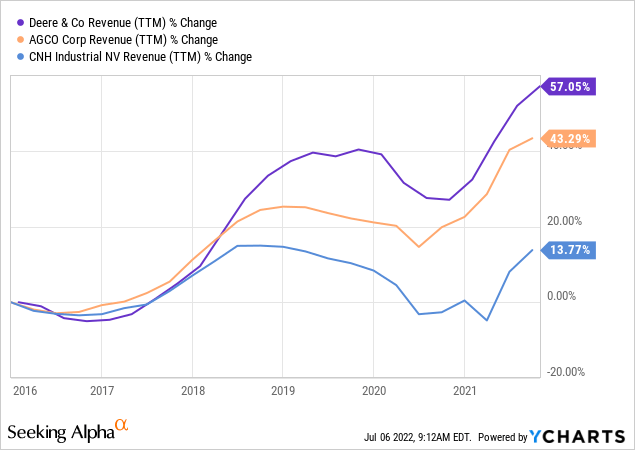

Even though JD is already the largest player in the industry – they still seem to be growing their revenue faster than competitors as well, as indicated in the graph below.

While there might be a number of factors that affect this – it seems that the main is that JD is simply regarded as being better, more advanced, and generally leading the pack. Below are a number of extracts from three different interviews and Guidepoint calls that I believe illustrate this point.

“As John Deere goes, the market goes” John Gillie – founder of TruckTractorTrailer – via Guidepoint call

“Deere has had specialised software and electronics since acquisition of Phoenix which happened many years Ago. They’re further ahead”. Jeff Rohlena – Former Global Business Development Director at Raven Industries (now acquired by CNHI) – former Deere and CNHI employee

Many of the comments essentially boil down to John Deere doing things better (perhaps supported by higher levels of R&D historically). They might not be first to the market with everything, but when they do come – they seem to be regarded as better, their customers believe this, and therefore are willing to pay a premium – leading to John Deere being able to obtain higher margins than competitors.

SWOT

Strengths

Proven brands and product history. CNHI’s brands have stood the test of time and proven themselves worthy workhorses. They, like most other brands in this industry, will have a loyal customer base. Furthermore, their large geographic footprint and thousands of sales and service points ensure that they will always be a top option when customers enter the market looking for new equipment.

Intellectual Property. CNHI’s brands have been in the game for a long time, and they’ve built up a log of 1000’s of patents, with many more pending.

New CEO. Scott Wine has served in multiple leadership roles throughout his career. Most recently, he completed a 13-year stint as CEO and chairman of Polaris. He seems to be quite highly rated and Polaris handsomely outperformed the SPX during his tenure at the helm.

Credit Rating Upgrades. Following the demerger, CNHI has received credit rating upgrades from both Fitch (January), and Moody’s (February).

Weaknesses

Vulnerability to the business cycle. GDP growth in the different regions where CNHI operate will be a big driver of their performance. I do not see them having the ability to stimulate growth if macro factors do not allow.

Exposure to a multitude of factors outside of their control, in each country they operate in. As mentioned earlier in this report, I believe CNHI has to “compete” or deal with a plethora of factors that could negatively influence their business.

- Rainy when it shouldn’t be? Lower yielding crops, lower farm income. Lower equipment sales. Dry, hot, cold when it shouldn’t be – same story.

- Fed raises interest rates? Repayments too high. Lower equipment sales.

- Government trade disputes? Lower prices for crops. Lower equipment sales. Etc.

Loyalty voting structure. Shareholders are encouraged to hold on to shares for longer, which will grant them more voting power. This could lead to situations where voting power is concentrated – making it more difficult to affect management – even if it would be in the best interest of shareholders. The Exor group already hold a much larger portion of the voting rights than shares outstanding. (42% vs 27%)

Opportunities

Precision Ag. This seems to be the biggest trend in the market at the moment. Increased input costs mean farmers will certainly be looking for ways to reduce these (think less use of pesticides & fertilizers) and improve their yield. This represents a major opportunity going forward – and could lead to margin, and ultimately also multiple expansion. Machinery costs make up roughly 25% of the expense when growing corn, with close to 60% being seeds and chemicals – reducing this is clearly a big opportunity. This would also be very beneficial in times of shortage in any of the input markets (such as fertilizer), as we are experiencing at the time of writing this report. Fertilizer prices have increased nearly 30% in 2022, after a whopping rise of 80% in 2021. The Raven acquisition has put CNHI much closer to the forefront of innovation in this arena. When looking at automation and precision Ag – I believe there is no question that JD has a meaningful dominance over the rest of the industry – given their acquisition of Phoenix about 15 years ago. This gave them inhouse software and design capabilities – something other OEMs used to outsource but are now also looking to get this inhouse.

Electrification and Alternative Propulsion. Another trend in the Ag and CE market is alternative propulsion methods. There could potentially be several benefits to this, including more environmentally friendly products and processes, less noise pollution, less moving parts within machines etc. CNHI is one of the leaders in the field, and plan on bringing a number of products to market in the near future. CNHI states that they are currently the only company with a commercially available methane powered tractor – putting them ahead in the race for a more environmentally friendly propulsion system. However – during a call with IR they did state that this is currently a niche product (i.e., and expensive product – and not something that I believe will lead to them stealing market share in the near future). One needs to take into account that the infrastructure behind something like a methane powered tractor also needs to be in place. It will still be a long time before this becomes a practical solution, and I’d bet that JD will have a similar offering by that stage.

Alternative Propulsion (CNHI Website)

US Ag Inventory Stock. Reports indicate that inventory of U.S. Ag stock is currently sitting at 2.6 months. This is the lowest level it’s been at in years, and the 10 year average is almost 2.5x at 6.2 months. Supply chain issues, including semiconductors, have caused a shortage of equipment, and this could potentially provide some added demand in the near term. (Dealers have to restock their inventory on top of normal customer demand)

High commodity prices. In a normal environment, this would lead to higher farm income, and more equipment sales. However, current high prices of fuel and fertilizer might well cancel out any gain from the commodity prices. A 9 March report from Bernstein does mention that the majority of farmers they spoke to did expect to be more profitable in 2022 vs 2021 – which could be a positive catalyst in 2H22 and 2023.

Possibility of joining the S&P. There are currently active discussions underway with the board about the benefits of joining the S&P. This could provide an immediate bump to the share price, as well as increased liquidity as passives would need to buy the stock.

Threats

Rising rates environment. The current rising interest rate environment will definitely weigh on customers’ mind and might prevent them from making large equipment acquisitions at this stage.

Raven Integration. Should the Raven integration not be as successful as thought, CNHI might be left behind John Deere in the race for Precision Ag dominance/relevance.

Execution. Failure to capitalize on the new streamlined business and subsequently generating higher margins (more comparable to De), will lead to the market continuing the punish CNHI.

Valuations

CNHI had an analyst day earlier in 2022 – outlining their growth expectations and margin targets for 2024. These were generally regarded as too conservative by the market.

- CNHI is targeting industrial net sales CAGR of roughly 6% through 2024. ($17.8 B in 2021 to $20 B – $22 B in 2024. 6% would be $21.2 B) vs 6.9% in my model. ($17.8 B to $21.7 B)

- CNHI is targeting total revenue of between $22 B and $24 B by 2025 (net sales + financial revenue) vs 23.7 B in my model.

- Guiding for R&D expenses of $2.6 B between 2022 and 2024 (vs $2.7 B in my model)

- Operating profit margin improvement of between 2% and 3% by 2024 (vs 2% in model)

- Operating cash flows of $6.2 B between 2022 to 2024 (vs $6.8 B in model)

- Capex of $1.8 B between 2022 and 2024 (vs 2.1 B in model)

- Leading to FCF of $4.4 B between 2022 and 2024 (vs 4.7 B in model)

Growth assumptions

CNHI does not operate in a fast-growing industry. They are not a disruptor, and they face significant competition. I believe their top line growth is largely capped by overall economic growth. Between 1998 and 2013 – US Agriculture grew at 4%, which was double the 2% growth achieved by the US economy.

Margin Assumptions

Margin improvement is a large part of the theses behind a possible investment in CNHI. They are lagging market leader JD by a large margin of roughly 6% in Ag, however they currently have higher margins than smaller peer AGCO and Kubota. So, while there is an opportunity, achieving it is certainly not a given.

Fair Value

My base case leads to a base case of $21, roughly 100% upside to the current share price.

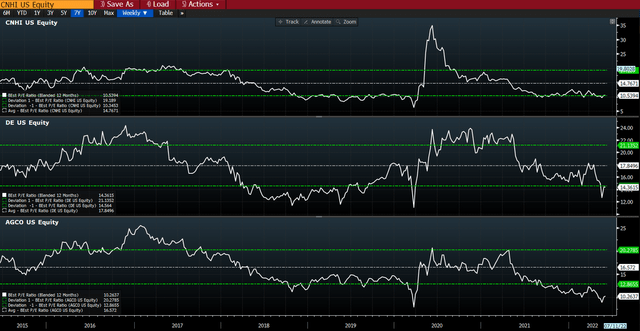

In my bear case, I model revenue for 2022 at the lower end of guidance, model only 1% improvement in gross margins, leading to operating margins remaining roughly flat over the forecast period. I use a forward multiple 1std deviation below the long-term average. This would basically be a complete failure of execution, however this steal leads to a small amount of upside.

Conclusion

I do not believe the market has yet given CNHI credit for the new and improved business post demerger. The current degree of fear (as evidenced in the forward earnings multiple contraction of competitors on the graphs below) is certainly not contributing to the market accepting a more structurally positive view on the stock’s outlook.

12 month forward P/E Ratios (Bloomberg)

CNHI has underperformed the market over almost all periods, and there is a fair amount of execution risk present in the business. Failure to capitalize on the precision Ag opportunity, or failing to execute on expanding margins to be more in line with John Deere, will likely lead to the market continuing to take a dim view of the stock, as it has done in the past, leading to further underperformance.

However, the probability of outcomes in this case is heavily skewed to the positive side. My bear case represents complete failure on execution – and does not pose a great amount of downside risk, while I believe the assumptions in my base case are mostly achievable, leading to upside of roughly 100%.

Be the first to comment