Inflation Meter

asbe/iStock via Getty Images

Everyone paying attention at the grocery store, gas pump, or to the financial media has noticed inflation. For real estate investors, inflation is an especially important topic. Real estate is often suggested as a potential inflation hedge, but different types of real estate investments are affected by inflation in different ways. I’m going to go through how I see the value drivers for different components of a real estate investment, and then discuss a few specific examples including my current favorite real estate investment.

How Does Inflation Affect Real Estate

The average real estate investment is comprised of four components: a land parcel, a building, a mortgage, and a lease. With the financialization of everything, you can slice and dice those pieces and buy only what appeals to you in various ways. The value of the different pieces is also dependent on each other. For example, a net-lease REIT property with a 25-year lease has most of the value in that lease. If the land and building appreciate dramatically, they can’t capitalize on that higher value until the end of the lease.

Generally speaking, inflation increases the value of the land and building portions of a real estate asset, because they are hard assets. Replacing a building in the current environment (high labor costs, high lumber/input prices) is more expensive, so existing buildings are more valuable. Land is getting more valuable in dollars because the dollars it is measured in are getting less valuable. Land generally appreciates more quickly with inflation, because it mostly doesn’t get old, wear out, or require maintenance, whereas a building will require maintenance capital spending at newer high prices.

On the other side of the coin, mortgages and leases are generally both hurt by inflation, because they are denominated in dollars that are getting less valuable. Also, as interest rates increase to combat inflation, the present value of future cash flows is reduced.

So in summary, the land and building components of a real estate investment generally appreciate with inflation. The value of a mortgage owed decreases, and the value of fixed lease cash flows also decrease. So to find a real estate firm that would benefit from the current environment, we would want one where the land value is high, the debt is long term/fixed rate, and the leases are short (or indexed to inflation).

Probably the best pure inflation hedge among real estate operations would be a highly levered hotel REIT. These firms have significant hard assets (land in good locations) and their leases are very short (generally only a few nights) so it doesn’t take long for them to reprice. However, they are also the most economically sensitive sector – if higher rates cause a recession or another wave of COVID-19 shuts down travel they would be at the most risk. Hotels also have some of the highest need for maintenance capital spending.

Instead, my picks are largely firms with significant land value.

Three Real Estate Picks for Inflationary Times

My three picks are VICI Properties (VICI), Pure Cycle (NASDAQ:PCYO) and St Joe (JOE). VICI has significant land assets, owning the real estate underlying casinos across the country, with a significant concentration on the Las Vegas strip. Pure Cycle is based in the Denver area, and they own significant water rights. They are using those water rights to support land development in the area, and are also developing a master planned community. Finally, JOE is a real estate owner and developer focused on NW Florida.

St Joe

St Joe owns large amounts of land in the areas surround Panama City Beach and Port St Joe in northwest Florida. The company has reached an inflection point where continued migration to Northwest Florida has caused significant growth in their business. They still own a very significant amount of land in the path of growth in the area, and they are converting it to money (through lot sales) and to ongoing cash flow assets (by developing commercial and hospitality properties on their land). The value of their existing in place leases is relatively small compared to the size of the company as a whole, because of the size of the undeveloped land base. In many ways that is the perfect combination for inflationary times – they are developing rental real estate with current dollars on land with a very low cost basis, and will be able to rent it in the future at higher lease rates (post-inflation). The market has realized the attractiveness of the setup here, and the shares are up dramatically, so this is one where I’m choosing to wait for a pullback for now.

VICI Properties

VICI Properties owns large casino properties, and trades at a more attractive valuation than other net lease type firms. From an inflation point of view, their long leases are a downside, as they won’t be able to capture the increase in the value of the underlying properties for decades. However, there is a big offset. Their largest leases (with Caesars (CZR) for 42% of revenue) adjust for inflation yearly with no upside cap. So if inflation goes to 10% their revenue under that lease also goes up by 10%. Their other leases are generally also adjusted for inflation but with maximum adjustments per year, generally in the low single digits. That does mean that their rents for those properties are losing purchasing power yearly while inflation stays high. That said, they do also have some relatively long fixed rate debt that provides a partial offset here. I think once their deal to purchase the MGM Growth Properties (MGP) closes they will have enough diversification that they will get a credit upgrade, which should help them to keep their cost of financing down even as interest rates rise. For more on VICI, see my full article on the firm here.

Pure Cycle

Pure Cycle is my top real estate choice at present, so I’ll go into the most detail here. The firm owns a very significant amount of water rights in the Denver area, and the stock has recently declined even though the news has been good. To further the goal of monetizing their water rights, they bought a large parcel of land during the 2008-2009 downturn to build a master planned community. That has two benefits – they earn land development margins, but are also able to use the sale of the land to monetize their water. The first phase sold out quickly and is now complete, while the second phase has also sold out and is under development now.

They have also started keeping some of their lots and having houses built on them for rental purposes. This allows them to capture a development margin (which is very lucrative when prices are rising like they have been recently). It is also quite capital efficient, as they have been able to get 30-year amortizing mortgages for essentially the entire construction costs as they are contributing both the land and water and only require funding for hard construction costs.

Sky Ranch Master Planned Community

Phase 1 has been developed and the payments have been received as of the most recent financials for all the lot sales and the vast majority of the water sales. Phase 2 has been pre-sold at much higher prices than Phase 1, and they have provided a breakdown of expected costs and revenues in their corporate presentation. Given they have already pre-sold the lots and those lots require water taps at the agreed prices, the revenue side is locked in. The costs could (and have) escalate, but given they are almost entirely reimbursable that isn’t a huge issue. I get a net revenue of $78.6 MM for Phase 2. Given that is already being received and should be complete within a year or so I’m not going to discount it.

Subsequent phases of the master planned community are also extremely valuable. They estimate 3200 residential lots in total, and after the currently filed lots for phase 2 they will have used up 1359 of them. That leaves 1841 lots remaining. I’m going to assume these lots have the same present value as the Phase 2 lots. I think that’s extremely conservative. While the sales of these lots will be a few years out, they had firm commitments on the Phase 2 lots immediately when they offered them, and home prices in the area have been rising quickly. The builders are all making money, and so I believe they will be able to take margins for the land higher to, at minimum, offset the time value of money for the delay. They estimated Phase 2 sales were at prices 40% higher than Phase 1, and real estate pricing has accelerated since then, so I believe this estimate has a significant margin of safety. They also have a monopoly on providing water in the area, so they could increase the price for water taps as well. That produces an estimate of $180.0 MM for future residential phases at Sky Ranch.

The commercial land at Sky Ranch is also extremely valuable. They have 160 acres with commercial zoning adjacent to an interstate exit in a fast growing new community. There is plenty of opportunity to develop retail/industrial/commercial property on the land, and by holding it longer it has definitely appreciated in value. While it is hard to value as there aren’t direct comparables in the public record, I think $0.75 MM per acre is extremely reasonable, and that produces a value of $120 MM for the land alone. The development costs would be reimbursable from their municipality, and given the higher value of commercial properties getting them developed will actually improve the ability of the municipality to repay all of the costs to Pure Cycle. They estimate 1800 single family equivalents [SFE] from a water point of view, which at their current costs of $28.3k per SFE adds $50.9 MM.

Water Assets

This is a piece about real estate so I’m not going to go in depth into the water assets, but in my Microcap Review piece on PCYO I estimated $140 MM for their future water rights, and $80 MM for their water utility operations.

Single Family Rentals

They have started holding back lots to develop single family houses for rental. This will increase their recurring revenue, but it is also an asset that earns a relatively low return on the capital to hold them. However, there is an immediate uplift. The finished homes from the first batch of three are worth at least $500,000 each, and they had hard construction costs of $342,000. They contributed a lot and a water tap, so they effectively monetized them at $160,000 per lot, which is better than what they’re getting from lot/tap sales alone.

They have three single family rentals completed and 46 lots reserved for single family rentals. Given they have been able to finance essentially the entire construction cost, the $160,000 is a reasonable estimate of the value of these. Because of the amortizing mortgages free cash flow won’t be significant, but they will benefit from both appreciation and mortgage paydown over time. I suspect the eventual end game here will be to build a portfolio large enough to sell to one of the scale players in single family rentals for a premium. I’m not including anything for that, and will just value it at my estimate of the finished values for the Phase 1/2 homes, which would be equity of $7.4 MM.

PCYO Valuation and Conclusion

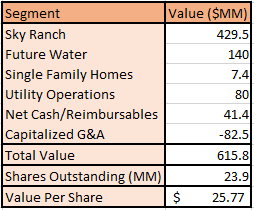

I’ll add up the segments above for the valuation, and deduct the G&A. It was $5.5 MM per year in the last fiscal year. 15X is the highest multiple I used in the analysis, so I’ll use that for the G&A as well, which comes to a deduction of $82.5 MM. I’m also going to add their cash less their small amount of debt, and add the receivables they are owed by their municipality. Those bear interest at 6% and given the growth in real estate prices will be money-good, so marking them at face value seems fair. That adds another $41.4 MM.

PCYO Valuation Table (Author’s Analysis, SEC Filings)

This is a little better than double the $11.45 they are currently trading at, which is obviously a potentially very attractive opportunity. Even if you deducted the value of the future water rights from the valuation you’re still materially over the current share price, which means that a buyer at present is paying a discounted price for Sky Ranch and getting 55,000 houses of water rights in Denver for free. The shares have sold off recently, and so I think this is a reasonable entry point from a short-term perspective as well.

PCYO Inflation Risk

I believe the market is worried about interest rates potentially impairing demand for housing, which would obviously hurt them. However, while equity markets are high and interest rates are likely to rise, I don’t feel like the current economic situation is anything like the 2008-2009 time period. That boom period was led by housing, so there was significant oversupply, which I don’t think is the case now. There are also demographic pressures with millennials entering prime suburban home buying years. The land portion (and water rights behave similarly) should appreciate here as the currency becomes less valuable, and they have almost no exposure to leases at all, only their single family homes which have one year leases.

Conclusion

I believe JOE, VICI, and PCYO are all reasonable choices for real estate investments in an inflationary environment. JOE has had by far the best recent performance, so I’ve allocated to VICI and PCYO going forward. VICI will likely perform best in a more moderate inflation scenario, whereas I expect PCYO to outperform under basically any inflationary circumstances because of the significant undervaluation.

Be the first to comment