Grafissimo/iStock via Getty Images

The Community Financial Corporation (NASDAQ: NASDAQ:TCFC) is one of the few banks that are initially hurt by rising interest rates. The company’s liability side is more sensitive to rate changes than the asset side in the short term; therefore, the margin will likely decline during the twelve months following a rate hike. Apart from contraction in the margin, provision normalization will likely drag earnings this year. On the other hand, loan growth will likely improve year-over-year due to favorable economic factors, which will, in turn, support the bottom line. Overall, I’m expecting The Community Financial to report earnings of $4.29 per share in 2022, down 4% year-over-year. Despite the decline, earnings will likely remain much higher than the pre-pandemic level. The year-end target price suggests a decent upside from the current market price. Based on the total expected return, I’m adopting a buy rating on The Community Financial Corporation.

Better Loan Growth Likely

After the loan portfolio declined by 1.5% in the first nine months of 2021, loan growth picked up in the last quarter of the year. The portfolio increased by 4.4% (annualized) in the last quarter. Part of the loan decline earlier last year was attributable to the Paycheck Protection Program (“PPP”) loan forgiveness. PPP loans outstanding declined from $110.3 million at the end of December 2020 to $27.3 million at the end of December 2021, as mentioned in the 10-K filing. As the PPP loans outstanding made up just 1.7% of total loans at the end of December 2021, the remaining forgiveness will put limited pressure on the loan portfolio size going forward.

Further, the economic environment will help loan growth accelerate this year. The Community Financial Corporation mainly operates in Maryland with some presence in Virginia. Maryland is yet to fully recover from the pandemic as the state’s unemployment rate was at a high level of 5.0% in February 2022. Further, the latest data available reveals that the state’s economy grew by only 1.8% in the third quarter of 2021, below the national average of 2.3%, according to official sources.

Considering these factors, I’m expecting loan growth in 2022 to be better than last year but remain at the lower end of the historical loan growth range. I’m expecting a loan growth of 5.7% in 2022. Meanwhile, I’m expecting other balance sheet items to grow mostly in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Net Loans | 1,141 | 1,337 | 1,445 | 1,594 | 1,587 | 1,678 | |

| Growth of Net Loans | 5.7% | 17.2% | 8.1% | 10.3% | (0.5)% | 5.7% | |

| Other Earning Assets | 170 | 230 | 220 | 271 | 535 | 566 | |

| Deposits | 1,106 | 1,430 | 1,512 | 1,746 | 2,056 | 2,174 | |

| Borrowings and Sub-Debt | 178 | 90 | 80 | 59 | 44 | 46 | |

| Common equity | 110 | 154 | 181 | 198 | 208 | 229 | |

| Book Value Per Share ($) | 23.8 | 27.8 | 32.6 | 33.6 | 36.0 | 39.6 | |

| Tangible BVPS ($) | 23.8 | 25.4 | 30.3 | 31.5 | 33.9 | 37.5 | |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Margin Likely to Contract this Year

The Community Financial Corporation’s loan portfolio is not very sensitive to rate changes. This is because commercial real estate loans, CRE, make up a majority, i.e. 70.66% of total loans. These loans have an initial fixed-rate period that is generally between three and ten years, as mentioned in the 10-K filing. Therefore, most of the loan portfolio will remain unaffected by an increase in interest rates this year.

At the same time, the liability side is fairly sensitive to rate changes. Transaction deposits including savings, demand deposits, and money market deposits, made up a whopping 62% of total deposits at the end of 2021. These transaction deposits will reprice soon after every rate hike.

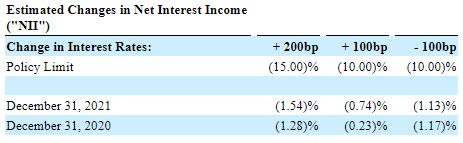

In my opinion, the repricing of liabilities will most probably outweigh the repricing of assets. The management’s interest-rate sensitivity analysis also shows that the Community Financial balance sheet is liability-sensitive amid a rising interest-rate environment. A 200-basis points increase in interest rates can decrease the net interest income by 1.54% over twelve months, according to the management’s sensitivity analysis given in the 10-K filing.

2021 10-K Filing

Considering these factors, I’m expecting the margin to remain mostly stable in the first half of the year and decline by two basis points in the second half of 2022.

Provision Expense Normalization on the Cards

Due to substantial asset quality improvement during 2021, The Community Financial Corporation released some of its loan loss reserves last year. Non-performing loans improved from 1.21% of total loans at the end of December 2020 to 0.48% of total loans at the end of December 2021.

For 2022, I’m expecting mid-single-digit loan growth to require further provisioning for expected loan losses. Moreover, I’m not expecting further big provision reversals as the allowance level has now declined to a somewhat comfortable level relative to the credit risk. Allowances made up 1.17% of total loans at the end of December 2021, while non-performing loans made up 0.48% of total loans at the end of December 2021, according to details given in the 10-K filing.

Overall, I’m expecting provision expense, net of reversals, to return to a normal level this year. I’m expecting the provision expense to make up around 0.21% of total loans in 2022, which is the same as the average position-expense-to-total-loan ratio during the last five years.

Expecting Earnings to Decline by 4% Year-Over-Year

Earnings will likely dip this year as loan growth will be unable to compensate for margin compression and provision normalization. Moreover, the non-interest expense will likely increase due to inflationary pressures and efforts to grow the loan portfolio. Overall, I’m expecting The Community Financial to report earnings of $4.29 per share in 2022, down 4% year-over-year. Despite the dip, earnings this year will likely be much higher than the pre-pandemic level. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 43 | 51 | 54 | 61 | 66 | 70 | |

| Provision for loan losses | 1 | 1 | 2 | 11 | 1 | 4 | |

| Non-interest income | 4 | 4 | 6 | 8 | 8 | 9 | |

| Non-interest expense | 30 | 38 | 36 | 38 | 39 | 42 | |

| Net income – Common Sh. | 7 | 11 | 15 | 16 | 26 | 25 | |

| EPS – Diluted ($) | 1.56 | 2.02 | 2.75 | 2.74 | 4.47 | 4.29 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Decent Total Expected Return Justifies a Buy Rating

The Community Financial Corporation is offering a dividend yield of 1.7% at the current quarterly dividend rate of $0.175 per share. The earnings and dividend estimates suggest a payout ratio of 16% for 2022, which is close to the five-year average of 19%. Therefore, I’m not expecting another increase in the dividend level this year.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value The Community Financial. The stock has traded at an average P/TB ratio of 1.06 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 25.4 | 30.3 | 31.5 | 33.9 | ||

| Average Market Price ($) | 34.7 | 31.6 | 24.8 | 34.8 | ||

| Historical P/TB | 1.37x | 1.04x | 0.79x | 1.03x | 1.06x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $37.5 gives a target price of $39.6 for the end of 2022. This price target implies a 1.4% downside from the March 29 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.86x | 0.96x | 1.06x | 1.16x | 1.26x |

| TBVPS – Dec 2022 ($) | 37.5 | 37.5 | 37.5 | 37.5 | 37.5 |

| Target Price ($) | 32.1 | 35.9 | 39.6 | 43.4 | 47.1 |

| Market Price ($) | 40.2 | 40.2 | 40.2 | 40.2 | 40.2 |

| Upside/(Downside) | (20.1)% | (10.7)% | (1.4)% | 7.9% | 17.3% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.4x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.02 | 2.75 | 2.74 | 4.47 | ||

| Average Market Price ($) | 34.7 | 31.6 | 24.8 | 34.8 | ||

| Historical P/E | 17.2x | 11.5x | 9.1x | 7.8x | 11.4x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.29 gives a target price of $48.8 for the end of 2022. This price target implies a 21.5% upside from the March 29 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.4x | 10.4x | 11.4x | 12.4x | 13.4x |

| EPS 2022 ($) | 4.29 | 4.29 | 4.29 | 4.29 | 4.29 |

| Target Price ($) | 40.2 | 44.5 | 48.8 | 53.1 | 57.4 |

| Market Price ($) | 40.2 | 40.2 | 40.2 | 40.2 | 40.2 |

| Upside/(Downside) | 0.1% | 10.8% | 21.5% | 32.2% | 42.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $44.2, which implies a 10.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.8%. Hence, I’m adopting a buy rating on The Community Financial Corporation.

Be the first to comment