Huang Evan/iStock via Getty Images

Thesis summary

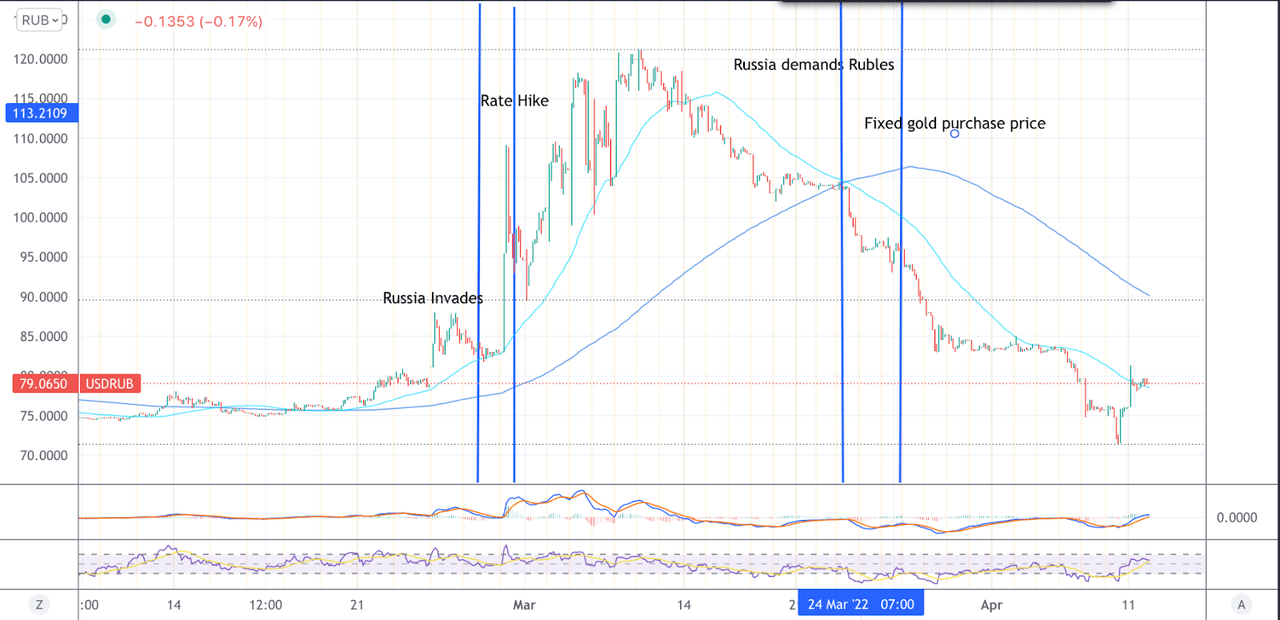

One of the first casualties of the Ukraine-Russia conflict was the ruble. Russia’s currency plummeted after the conflict broke out, but has now rallied strongly following numerous moves by Russia to defend it.

Most recently, Russia has enacted a temporary fixed ruble/gold exchange, which has led many to claim that it is back on a gold standard.

In this article, I discuss the effects of this policy on Russia and the world and dive into how this affects Bitcoin (BTC-USD), which is often described as “digital gold”

Is Russia on a gold standard?

Between March 28th and June 30th, Russia’s Central Bank will be buying gold from banks at a fixed rate of 5000 rubles per gram.

Does this mean that the ruble now has a fixed exchange for gold? Not exactly.

For a gold standard to be in effect, this arrangement would have to work both ways, which it doesn’t. The Russian Central bank is buying gold at that fixed rate, but it won’t be offering to sell it at that price.

In a “gold standard”, the value of the currency is supported because there are arbitrage opportunities when the price deviates from its peg. Let’s say the Russian Central Bank offers to buy and sell Rubles for gold at a fixed exchange, and the ruble is trading below this exchange. (It is weak) Demand for Rubles would go up, since countries and banks have a chance to buy gold at cheaper prices, but only with Rubles.

Alternatively, if the ruble became too strong, going above the exchange price, people would sell gold to the Central Bank at the established price, get Rubles, and then use these Rubles to buy more gold on the international market. Rinse and repeat until there is no longer a price disparity. That’s how arbitrage works.

As it stands now, 1 gram of gold is worth $63 in the international market, and 5000 rubles are worth close to $58. This means Russia is paying below-market prices for gold, which wouldn’t support the ruble.

For there to be an arbitrage opportunity here, the value of gold would have to decrease, so that Russia is paying above-market prices for gold. In that scenario, one could sell gold to the Russians for say $65, and then use the Rubles to buy $70 worth. This would eventually weaken the ruble in terms of gold, taking it back to parity.

What Russia has created, therefore, is not a floor price for the ruble, but rather a ceiling price. Russia is happy to buy all the gold in the world at 5000 ruble/gram, but it won’t be selling gold at this price or below it to “defend” the ruble.

With that said, the ruble has rallied in the last month, but this can be tied to other significant moves made by the Russians. All of these have to be put together to understand what’s going on behind the scenes.

Firstly, the Russian Central Bank has doubled its interest rate from 10% to 20% on the 28th of February. Secondly, and most importantly, the Russian government is forcing foreign governments to use Rubles to pay for their products, i.e energy, which is propping up demand for the ruble.

We can visualize how these events have affected the ruble/USD exchange on the chart below.

Ruble Price (Author’s work)

Russia has therefore created a link between energy, its currency and gold. Its exports are now priced in Rubles, which in turn are partially linked to gold. Ultimately, Russia is saying that it is happy to receive both Rubles and Gold for its exports.

Those that wish to trade with Russia can always obtain Rubles at a fixed price, for gold, but they can’t obtain gold at a fixed price for Rubles, which is an important distinction. However, they can obtain energy at a fixed price for Rubles, which means that there is indirectly a link between Russian energy and gold.

If a barrel of oil is worth 5000 RUB, which in turn are worth 1 gram of gold, then the barrel is worth 1 gram of gold. This won’t change, because the Russian Central Bank has agreed to buy 1 gram of gold for 5000 Rubles at all times, or at least until June 30th.

What does this mean for the world?

So Russia is now selling its energy for rubles/gold and based on how the market has reacted, it is getting away with it.

Russia, by itself, can hardly replace the USD denominated financial system. But with the help of strategic allies, very big steps can be taken to reduce the world’s dependency on it, which is very bad news for the USA.

Russia holds 1,688 trillion cubic feet of natural gas, accounting for 24% of the world’s reserves. China will soon become the largest economy in the world. Russia, China and India, collectively possess 16% of the Central Bank’s gold reserves. India and China also have close to 2.8 billion people combined.

An allegiance between these three countries could replace the world’s dollar-based financial system. Each of them has something to add, and a lot to gain from this, and gold would be the ideal vehicle to make this happen.

If something like this were to happen, it could cripple dollar-denominated economies. The west has built a very fragile system based upon increasing amounts of dollar-denominated debt. This has only been possible because this debt is accepted as a reserve. But what happens when it doesn’t?

What does this mean for gold?

Gold has been the world’s money of choice for millennia. The world was actually on a gold standard, of sorts, until as recently as 1971, when Richard Nixon closed the gold window. Since then, governments and central banks have done their best to eliminate gold from world trade, but even they know how useful gold is, which is why Central Banks hold it in their reserves.

The current move in Russia brings gold to the forefront of finance once more. Gold now has a very real utility for a lot of countries, enabling them to buy Russian gas.

Furthermore, a gold-backed currency is perhaps the only way to dethrone the US dollar. Foreign countries don’t want to switch from a US-controlled fiat, to a Chinese controlled one. However, gold makes money neutral, and that is something everyone can get on board with.

What does this mean for investors? Owning gold is now more important than ever, and though the yellow metal has underperformed in recent years, now could be its time to shine.

What does this mean for Bitcoin?

Russia is opening the doors to a new monetary paradigm, which creates a unique opportunity for countries around the world. The US dollar is being challenged as the standard of value. What will replace it?

Gold is the first choice. It has been used as a store of value for millennia, and countries like Russia, China and India have been accumulating it for years. But in the current conflict, we have seen evidence of a new standard of value emerge, one that has even outshone gold, and that is Bitcoin.

Bitcoin was designed, by no accident, to possess very similar characteristics to gold. It is hard to mine, with mining becoming increasingly difficult over time. The supply is finite, and around 80% has already been mined, a similar proportion to gold. And, like gold, it withstands the passage.

However, Bitcoin also has key characteristics that make it superior to gold, and Russia knows this first-hand. The G7 has actively tried to stop Russia from using its gold reserves, banning people and institutions from transacting with the Russian central bank.

What’s more, in a geopolitical conflict like this, it wouldn’t be unheard of for gold held in foreign banks to be seized, or mining operations to be disrupted.

And this is where Bitcoin makes a difference. For starters, Bitcoin is much harder to track and “sanction”. Speculation over how Russia could use Bitcoin to avoid financial repression has been common in the past few weeks.

To top things off, Russia also has a significant competitive advantage when it comes to mining Bitcoin. Russia is the third-largest contributor to Bitcoin’s hash mining power. Also, 11.9% of Russia’s total population already owns cryptocurrency.

But if Russia already has gold as the base of its monetary system, why would it want Bitcoin?

Beyond the reasons stated above, Bitcoin would provide a diversification element. It would also give Russia access to the flourishing DeFi market that is developing in crypto, of which Bitcoin is the store of value. And finally, the best defence is a good attack. Bitcoin would be a great way for other nations to compete with the gold-based system. So why not get ahead?

What does this mean for Bitcoin investors? The world’s reserve currency, the USD, is being put into question, and Bitcoin was created with the purpose of acting as a store of value. This makes cryptocurrency a more attractive investment than ever. Bitcoin can step in to feel this void, as there will be a real necessity for a neutral store of value, free of political agendas and government. control.

Final thoughts

In conclusion, as the world becomes less dependent on the US dollar, other standards of value will rise to take its place. Gold and Bitcoin are at the top of this list in my opinion. Together they bridge the gap between the past and the future. The physical and the digital. They complement each other.

While Russia is not operating a gold standard system, it is tying its exports to gold, which marks a very significant move. People should understand that the current conflict in Ukraine is only the tip of the iceberg. Another war is being fought between world superpowers. A world for control of money. And he who controls the money controls the world.

Be the first to comment