JuSun/iStock via Getty Images

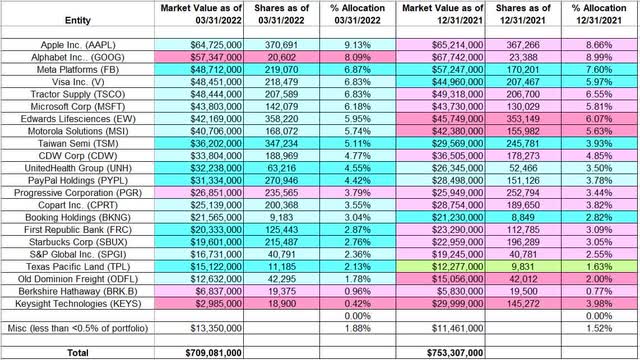

This article is part of a series that provides an ongoing analysis of the changes made to Wedgewood Partners’ 13F stock portfolio on a quarterly basis. It is based on David Rolfe’s regulatory 13F Form filed on 5/16/2022. The 13F portfolio value decreased ~6% from $753M to $709M this quarter. The holdings are concentrated with recent 13F reports showing around 30 positions. There are 22 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Apple Inc., Alphabet, Meta Platforms, Visa, and Tractor Supply. They add up to 38% of the portfolio. Please visit our Tracking David Rolfe’s Wedgewood Partners Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q4 2021.

Wedgewood has generated significant alpha since their 1992 inception: 12.37% annualized returns over the 30-year period compared to 10.57% annualized for the S&P 500 Index. David Rolfe also sub-advises Riverpark/Wedgewood Fund (MUTF:RWGIX) as portfolio manager, a mutual fund incepted in 2010.

Stake Increases:

Apple Inc. (AAPL): AAPL is currently the largest position in the portfolio at 9.13%. The original stake was purchased in the 2005-2006 timeframe at prices between ~$1.25 and ~$3.50. The position was since sold down but the 2012-2013 timeframe saw a 4x stake increase at prices between ~$15 and ~$25. The next five years through 2018 had seen the stake reduced by ~85% at prices between $18 and $57 through consistent selling almost every quarter. 2019-20 timeframe had also seen another 85% selling at prices between ~$38 and ~$137. The three quarters through Q3 2021 saw a further ~20% reduction at prices between ~$116 and ~$157. The stock is now at ~$137. They are harvesting huge long-term gains. Last two quarters have seen only minor adjustments.

Note: the prices quoted above are adjusted for the 4-for-1 stock split last August.

Meta Platforms (META), previously Facebook: META is a top three 6.87% of the portfolio position purchased in Q1 2018 at prices between $158 and $190. The next three quarters saw minor selling while in 2019 there was a ~50% reduction at prices between $138 and $209. The six quarters through Q2 2021 had seen another ~70% selling at prices between ~$146 and ~$356. Last quarter saw an about turn: ~50% stake increase over the last two quarters at prices between ~$187 and ~$348. The stock currently trades at ~$161.

Visa Inc. (V): Visa is a 6.83% of the portfolio position built during the 2008-2010 timeframe at prices between ~$15 and ~$24. Visa had an IPO in 2008 and the first purchases were made soon after. 2013-2014 saw a stake doubling at prices between $39 and $68. The position saw a ~30% selling in 2015 at prices between $64 and $80 and that was followed with a ~70% selling during the 2017-2018 timeframe at prices between $82 and $150. The last two years had seen another ~78% reduction at prices between ~$134 and ~$218. Q1 2021 saw a further ~28% selling at prices between ~$193 and ~$226. There was a ~50% stake increase last quarter at prices between ~$190 and ~$234. The stock is currently at ~$198. This quarter also saw a minor ~5% stake increase.

Tractor Supply (TSCO): TSCO is a 6.83% of the portfolio position first purchased in Q4 2016 at prices between $62 and $77. Next year saw a one-third stake increase at prices between $51 and $79 while in 2018 there was a ~45% selling at prices between $58 and $97. 2019-20 timeframe saw another ~85% reduction at prices between ~$76 and ~$155. The three quarters through Q3 2021 also saw a ~20% selling at prices between ~$140 and ~$212. The stock currently trades at ~$195. Last two quarters have seen only minor adjustments.

Microsoft Corp. (MSFT): MSFT is a 6.18% of the portfolio position established in Q1 2020 at prices between $135 and $189. The stake was almost doubled in Q3 2020 at prices between ~$200 and ~$232. The stock is now at ~$257. There was a ~9% stake increase this quarter.

Edwards Lifesciences (EW): EW is a ~6% of the portfolio stake. It was established in Q1 2017 at prices between ~$30 and ~$33. Next year saw the position reduced by ~40% at prices between $38 and $58. 2019-20 timeframe saw another ~70% selling at prices between ~$50 and ~$82. The three quarters through Q3 2021 also saw a ~25% selling at prices between ~$79 and ~$123. That was followed with a similar reduction last quarter at prices between ~$106 and ~$131. The stock currently trades at ~$95. There was a marginal increase this quarter.

Note: the prices quoted above are adjusted for the 3-for-1 stock split in September.

Motorola Solutions (MSI): MSI is a 5.74% of the portfolio stake purchased in Q2 2019 at prices between $141 and $167. Q1 2020 saw a ~20% selling at prices between ~$125 and ~$186 while in the following quarter there was a similar increase at prices between ~$126 and ~$158. Last year saw a ~30% selling at prices between ~$168 and ~$272. The stock currently trades at ~$210. There was a ~8% stake increase this quarter.

Taiwan Semi (TSM): The 5.11% TSM stake saw a ~80% stake increase in Q3 2021 at prices between ~$108 and ~$125. That was followed with a two-thirds increase over the last two quarters at prices between ~$99 and ~$141. The stock currently trades at $84.34.

Note: Their Q3 2021 letter had the following regarding their Taiwan Semi thesis: market is pricing in a down-turn in the semi-cycle. But they see strong demand and supply constraints in the leading nodes which should enable price increases.

CDW Corp. (CDW): The 4.77% of the portfolio position in CDW was established in Q3 2019 at prices between $107 and $124 and increased by ~20% next quarter at prices between $120 and $145. Q3 2020 saw a ~15% stake increase at prices between ~$109 and ~$120. The four quarters through Q3 2021 saw a combined ~25% selling at prices between ~$123 and ~$203. The stock currently trades at ~$159. There was a minor ~6% increase this quarter.

UnitedHealth (UNH): UNH is a 4.55% of the portfolio position established in Q3 2021 at prices between ~$391 and ~$430 and the stock currently trades well above that range at ~$508. There was a ~20% stake increase this quarter at prices between ~$456 and ~$521.

Note: Their Q3 2021 letter had the following regarding their UnitedHealth thesis: UNH controls ~20% of Medicare Advantage which is a huge tailwind given the market is growing at 10K boomers per day. Further, OptumHealth is aggressively consolidating the fragmented physician market and OptumRx has vast leverage as they have ~$100B in purchasing power.

PayPal Holdings (PYPL): PYPL is a 4.42% of the portfolio position purchased in Q3 2015 at prices between $33 and $39 immediately following its spinoff from eBay. Since then, the position was reduced by over 95% at prices between ~$32 and ~$305. This quarter saw an about turn: ~80% stake increase at prices between ~$94 and ~$195. The stock currently trades at $71.82.

Copart, Inc. (CPRT): The 3.55% CPRT stake was established in Q4 2019 at prices between $77 and $91 and the stock is now at ~$109. Q1 2020 saw a one-third reduction at prices between ~$59 and ~$105 while next quarter there was a ~25% stake increase at prices between ~$62 and ~$92. Q3 2020 saw another one-third increase at prices between ~$82 and ~$106. Last six quarters have seen only minor adjustments.

Booking Holdings (BKNG): The ~3% BKNG stake was purchased in Q1 2021 at prices between ~$1886 and ~$2462. Next quarter saw a ~17% stake increase at prices between ~$2172 and ~$2505. That was followed with a ~40% stake increase last quarter at prices between ~$2067 and ~$2648. The stock is now at ~$1838. There was a minor ~4% stake increase this quarter.

First Republic Bank (FRC): FRC is a 2.87% of the portfolio position purchased in Q3 2020 at prices between ~$101 and ~$119 and the stock currently trades well above that range at ~$147. Last five quarters saw minor trimming while this quarter there was a ~11% stake increase.

Note: they believe FRC is an exceptional growth company, although they are in the stodgy banking sector.

Starbucks Inc. (SBUX): The 2.76% SBUX stake was purchased in Q1 2019 at prices between $63 and $75. The ten quarters through Q3 2021 had seen a ~70% selling at prices between ~$58 and ~$126. The stock is now at $76.34. Last quarter saw a ~4% trimming while this quarter there was a ~10% stake increase.

S&P Global Inc. (SPGI): The 2.36% SPGI stake was established in Q4 2019 at prices between $236 and $275. Q1 2020 saw a one-third reduction at prices between ~$192 and ~$311. That was followed with minor trimming in the next seven quarters. The stock currently trades at ~$333. There was a marginal increase this quarter.

Texas Pacific Land (TPL): TPL is a small 2.13% of the portfolio position purchased last quarter at prices between ~$1152 and ~$1422 and the stock currently trades at ~$1633. There was a ~14% stake increase this quarter.

Old Dominion Freight Line (ODFL): ODFL is a 1.78% of the portfolio position established in Q1 2021 at prices between ~$191 and ~$241 and the stock currently trades above that range at ~$251. There was a one-third selling last quarter at prices between ~$283 and ~$364. This quarter saw a marginal increase.

Stake Decreases:

Alphabet Inc. (GOOGL) (GOOG): The ~8% GOOGL stake is the second-largest position in the portfolio. It was a small stake first purchased in 2007 at prices between ~$233 and ~$356. The next two years saw only minor adjustments. There was a ~6x stake increase in the 2010-2013 timeframe at prices between ~$234 and ~$553. That was followed with a ~85% reduction over the 2015-2018 period at prices between ~$500 and ~$1110. The next two years had also seen a ~58% selling at prices between ~$1057 and ~$1827. Last five quarters saw another roughly one-third selling at prices between ~$1728 and ~$2997. The stock is now at ~$2240.

Progressive Corp. (PGR): PGR is a 3.79% of the portfolio position purchased in Q4 2020 at prices between ~$87 and ~$101. There was a ~82% stake increase in Q1 2021 at prices between ~$85 and ~$99. The stock currently trades at ~$115. There was a minor ~7% trimming this quarter.

Berkshire Hathaway (BRK.A) (BRK.B): BRK.B position has been held continuously since 1998, except for a brief period in 2010 when they sold it following a spike in the share price. The 2011-2014 timeframe saw the stake rebuilt to a huge ~4M share position at prices between $66 and $152. The position has since been sold down. The 2015-2016 time-frame saw a ~75% reduction at prices between $125 and $165. Since then, the position was reduced to a very small 0.96% of the portfolio stake at prices between ~$160 and ~$300. The stock currently trades at ~$274.

Keysight Technologies (KEYS): The KEYS stake was purchased in Q1 2020 at prices between ~$78 and ~$106. Q3 2020 saw a one-third increase at prices between ~$91 and ~$104. Last two quarters saw a one-third selling at prices between ~$153 and ~$208. The position was reduced to a minutely small 0.42% position this quarter at prices between ~$144 and ~$203. The stock currently trades at ~$139.

The spreadsheet below highlights changes to David Rolfe’s US stock holdings in Q1 2022:

David Rolfe – Wedgewood Partners’ Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment