Andrii Yalanskyi/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO California Municipal Income Fund (NYSE:PCQ) as an investment option at the current market price. The fund invests primarily in California municipal bonds, and therefore seeks to provide current income which is exempt from federal and California income tax. The fund normally invests at least 90% of its net assets in municipal bonds that pay interest that is exempt from federal and California income tax. It also seeks to be “AMT-free” by investing only up to 20% in bonds generating interest that may subject individuals to the alternative minimum tax.

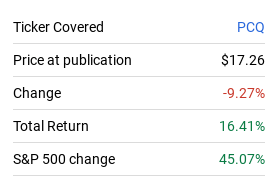

I initiated coverage on PCQ almost exactly five years ago. Over time, I have been generally reluctant to recommend it. But it is worth noting that in that five year stretch PCQ has performed reasonably well. The above-average yield has produced a positive total return in that time period even though the share price has declined:

Fund Performance (Seeking Alpha)

With this in mind, it may seem reasonable to suggest PCQ as a buy or a hold. In fairness, if one has held PCQ for a long time, is sitting with gains, and is willing to own a fund with a sharp premium to NAV – then holding does have merit. But for me, I see too many immediate headwinds to justify any type of bullish opinion. I expect PCQ to see a drop in price in the coming months and that suggests a “sell” is the right rating here. I will explain why below.

The Premium Is Just Nutty

As my followers know, I am generally a value-conscious investor. I have been known to buy CEFs at premiums – but small ones. I simply cannot justify double-digit premiums to NAV in the CEF universe when so many alternative funds exist. For those looking for California muni exposure, it may seem like the options are limited given this niche market. But that isn’t true – a number of funds exist from a variety of asset managers. Many of them overlap in terms of sector weightings and individual holdings, so valuation plays an important role in deciding which one I am going to buy.

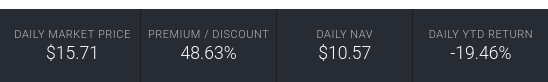

Therefore, it should not be a surprise I view PCQ quite negatively here. A “double-digit” reference doesn’t really capture just how expensive this fund is on the open market. It is the priciest PIMCO CEF available (and that is saying something!) and sits with an astronomical 48% premium to NAV:

PCQ Valuation Metrics (PIMCO)

The basic conclusion is I cannot recommend investors buy pretty much anything with this kind of valuation. That includes PCQ. Back in December 2017, when I first started writing about PCQ, the fund seemed pricey with a 21% premium. It has more than doubled since that time, suggesting the positive return from this fund is being driven by market excess. That is not a comforting backdrop and is critical to why I see PCQ as a sell at the moment.

Income Cut Is Extremely Likely

My next concern is just as important and is about the fund’s distribution. On the surface this is a major benefit of PCQ. With a stable payout and a declining share price in 2022, the fund’s current yield has soared. It rests just under the 5% mark and, once tax savings are factored in, likely yields California residents in the 7-8% range. That is very significant.

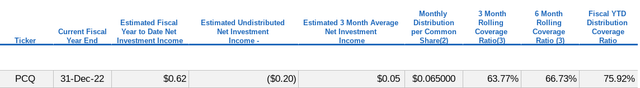

On this front, PCQ could have some merit on income alone. In all honesty that is true and I won’t argue that point much except to say other funds exist with similar yields – so this alone is not a complete differentiator. Further, I am of the opinion that a distribution cut will be announced soon – possibly even in January. The reason is two-fold. One, the fund’s UNII balance is very negative and distribution coverage ratios are very weak:

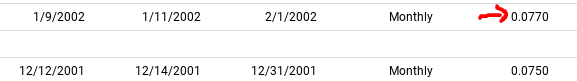

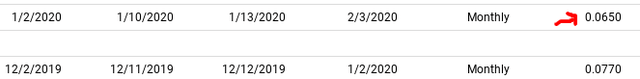

Two, while PCQ’s income story has been very steady over time, it will typically announce changes in January. This is true for both of the distribution changes in the past two decades. The first when the payout was raised slightly in 2022 and also when the distribution was cut in 2020:

PCQ Distribution Change (PIMCO) PCQ Distribution Change (PIMCO)

This suggests that if a cut is coming, January is probably the time. With a UNII balance that shows the fund is $.20/share in arrears and coverage ratios that are quite low, I don’t see how this is avoidable.

The good news is that PCQ will still offer a fairly attractive yield even after a cut. So I am not suggesting a calamity for the share price. But as we have seen in the past with PIMCO CEFs, an income cut often results in an immediate sell-off. This is true for muni and non-muni CEFs alike. Since I expect this to happen, it makes little sense to buy now, but rather to wait for this eventuality and then evaluate if a position in the fund makes sense.

High Leverage/High Duration Are Risks

Other challenges with respect to PCQ are that the fund remains highly leveraged and has a very long-dated duration. This exposes the fund to more downside if the Fed keeps on hiking interest rates. These attributes have pressured the fund in 2022, given the Fed’s rate hiking path, as seen below:

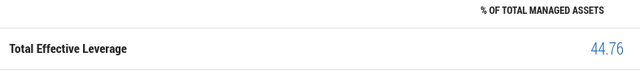

This issue has been (partly) that as interest rates rise, leverage gets more expensive. Given that the yield curve has inverted at multiple times throughout 2022, this has limited the yield pick-up by investing further out on the curve. So PCQ has seen its interest expenses rise and investment opportunities become limited. That is not an ideal situation. Given how large the percentage of leverage the fund uses is, we can clearly see the problem:

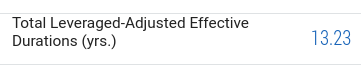

In addition, the fund is heavily exposed to longer-dated bonds. So, again, when short-term interest rates spike but long-term rates do not follow, this makes for a challenging environment:

PCQ’s Duration (PIMCO)

What I am trying to convey here is that PCQ is very exposed to more drops if the Fed continues on a hawkish path. While I personally expect the Fed to shift its tone in Q2 or Q3 in 2023, that is just a prediction. I need to plan for a hawkish-for-longer scenario. This doesn’t mean going completely risk-off, but it does mean managing that risk to ensure my portfolio’s duration is not too high. Buying a fund like PCQ wouldn’t fit with this scenario.

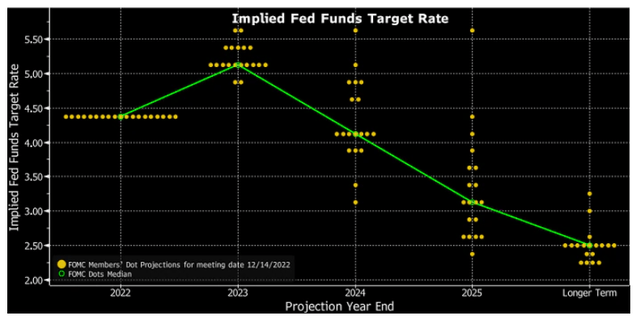

The reality readers need to contend with is the market does expect rates to peak throughout the next twelve months. But the market has mistimed the Fed’s moves before and the current dot-plot suggests that further hikes are on the way:

Fed’s “Dot-Plot” (Federal Reserve)

This chart does show that an end is in sight. But that end for higher rates may or may not be accurate. The bottom-line is there is no need to rush in here. Higher rates are still expected, opening up the chance for more favorable buy-in points across the fixed-income realm. This includes PCQ, and again supports my bearish take for now.

Munis As A Whole Have Seen Limited Defaults

In this review I have seen quite pessimistic. But I want to balance this with some favorable traits for munis overall. I stand by my call that PCQ is not a good value right now, but that doesn’t mean that the muni sector shares this backdrop. Personally, I see a fair bit of value in the muni space, especially with challenging economic conditions on the way in 2023.

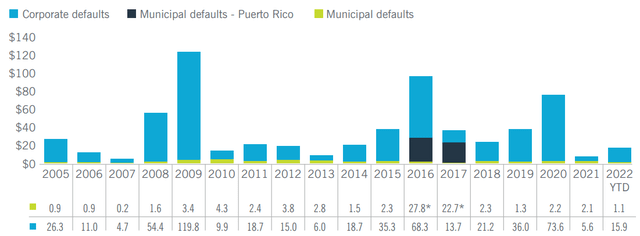

A good part of this outlook stems from the credit quality of the sector. Muni bonds have some of the lowest default rates out there. This includes during recessions and other periods of economic stress. When compared to the corporate debt sector, we see that the majority of defaults rest in that space, and not with munis:

Municipal and corporate bond payment defaults (billions) (Nuveen)

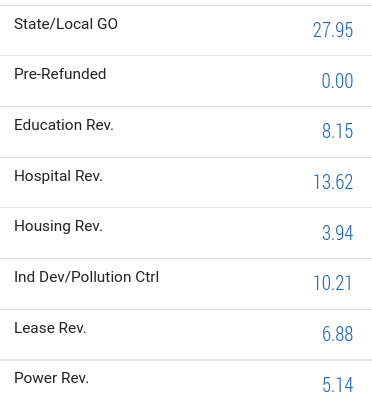

Of particular note, however, is that when muni defaults do occur, they are often in the nursing home, health care, and higher education spaces. This excludes the Puerto Rico debacle in 2016-17. While defaults even in those muni sectors are still relatively rare, consider that PCQ has an overweight allocation to the hospital revenue sector:

PCQ Holdings Breakdown (PIMCO)

This is not inherently “bad”. It helps provide diversification and above-average yields for the fund (which helps produce that tax-free 5% income stream!). But it is a risk that readers should evaluate carefully – especially when we consider we need to pay a 48% premium for this exposure.

“SALT” Here To Stay

My last point is simply to encourage residents in high-tax states, including California, but elsewhere, to keep muni bonds on their radar. While my outlook for higher taxes in 2023 is muted given the Republicans win in the House of Representatives, I similarly don’t see much of a chance of broad tax relief. This is especially true for higher-income households. The fact is that I don’t expect much in the way of tax changes in 2023 (or 2024) and this provides a reasonable backdrop for muni bonds as those in high-tax states seek shelter.

One implication from the 2022 November elections is that removing the “SALT” provisions seem mostly dead in the short term. This was part of President Trump’s significant tax reform which limited state and local tax deductions to $10,000. Many residents in high-tax jurisdictions pay much more than that and this limit pushed their federal tax burden higher. The net result was a sharp increase in retail interest in muni bonds.

Since then, opposition to the SALT cap has been fierce, especially among vulnerable representatives in states like New York, New Jersey, and other infamous high-tax jurisdictions. This proved to be a cloud on the horizon for munis. The logic being, if the SALT cap is removed (or raised) then muni interest could drop and hurt the sector.

So far, that has not materialized, and some vocal opponents of the SALT cap lost re-election. These include Sean Patrick Maloney from New York and Tom Malinowski from New Jersey. The point I am making is that changes to the tax code to favor residents in upper-income brackets are not likely to pass, and that will keep tax-free munis top of mind for residents in states like California, which has one of the highest tax burdens in the country. This tells me that if funds like PCQ and others that represent Cali’s muni sector see drops, I will likely be a continuous buyer.

Bottom-line

PCQ looks very risky to me at this stage. This comes at a time when I am generally bullish on munis as a whole – but at not any price. PCQ’s premium to NAV at over 48% is just silly and it is hard for me to envision a scenario where investors bid it up much more than that. Fortunately for current holders, PCQ has a long history of trading at an expensive price. This means a complete fallout in the shares is unlikely. Still, I see downside ahead on the backdrop of a distribution cut that I believe will occur in the short-term. As a result, I will suggest investors avoid PCQ for now, and look to get in only if the fund sees a meaningful drop in price.

Be the first to comment