flyingdouglas/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate Mid-America Apartment Communities Inc. (NYSE:MAA) as an investment option. The company is a “real estate investment trust that focuses on the acquisition, selective development, redevelopment, and management of multifamily homes throughout the Southeast, Southwest, and Mid-Atlantic regions of the United States”.

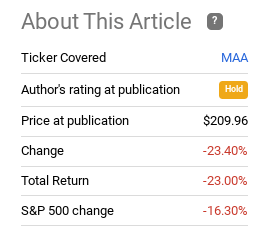

I have owned (and suggested) MAA for a long time, but I turned cautious during my last review because I believed the share price had simply gotten a bit frothy. I expected some type of correction, and believed if I stayed patient, I could add at a better price. In hindsight, I was absolutely correct, although I will admit I did not expect the loss to be this sharp. For perspective, MAA is down 23% since that February article, outpacing the S&P 500’s loss as well:

MAA Performance (Seeking Alpha)

It is clear that MAA has not been doing very well in the open market. With so many doom and gloom articles and pundits coming out these days, it would be easy to remain on the sidelines. Yet, I see this drop as an opportunity to add to a quality company at a price I didn’t expect to see this year. As a result, I am adding to my position, and placing a buy rating on MAA. In the following paragraphs, I will explain the reasoning as to why.

2022 Has Not Been Kind

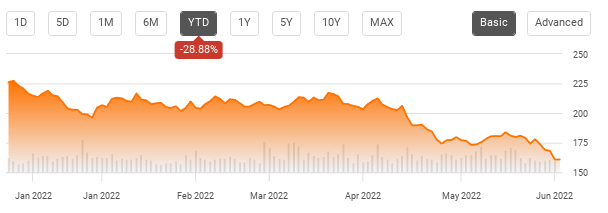

To start, let us take a look at how we got where we got. While the market is forward-looking, taking stock of how and why the market has been reacting is just as important when deciding if now is a good time to buy. This is true for MAA, or any other REIT or stock. With this in mind, we should acknowledge that MAA is having a terrible year. The share price is down almost 29%, which means the return is probably a -27% after we account for dividends:

MAA YTD Performance (Seeking Alpha)

With this backdrop, the question is – why is this happening? One reason is inflation and the corresponding impact it has had on yields. When inflation rising the way it has been, the Fed has been forced to act. This has sent treasury yields shooting higher, along with the Fed’s benchmark rate. The impact on REITs can often be pressure on share prices, since investors can now find higher risk-free yields elsewhere. With REITs like MAA climbing to frothy levels, their yields got correspondingly compressed. As a result, the income story behind MAA became less attractive just at the time treasury yields were about to climb. As the performance in 2022 shows, that end result was not pretty.

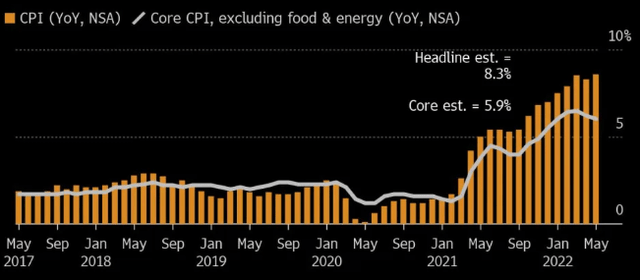

Another problem is that inflation is not over. MAA pushed down another 4% on Monday as the market became increasingly concerned the Fed is going to move faster than previously anticipated. This is because inflation has remained stubbornly elevated, as seen below:

This is an extremely important point because it is going to remain a headwind for MAA going forward. While I do believe there are enough positives to justify positions at these levels, I don’t want to give the impression that this is a “sure thing” or risk-free. Inflation/Fed rate hiking are both very real and very serious headwinds facing MAA, and readers need to evaluate their own outlook on those topics prior to deciding if this REIT is right for them.

Any Good News? The Dividend Is One

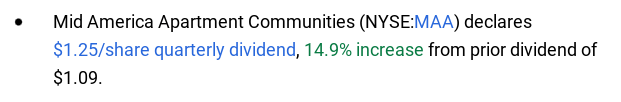

Now, some of the bright spots. A significant one for me as a “dividend seeker” is the recent boost to the quarterly payout. While inflation has been eating away at income streams, MAA’s recent increase is higher than inflation, which is a really good sign:

Dividend Increase (Seeking Alpha)

This is a straightforward metric and suffice to say I view it as a reason to stay long/initiate new positions. The yield is near 3% now, and it is well-supported, given that the company just hiked it. All things considered, I like a 3% yield with a chance at capital appreciation, as opposed to a treasury bill that offers that in income, but little else.

Apartment Values Have Been Resilient

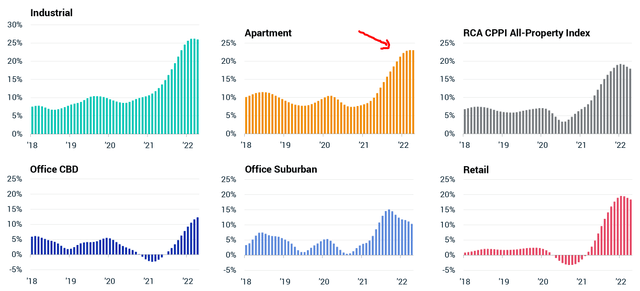

Another positive is a broad attribute, impacting MAA but also other apartment REITs across the market. In particular, this is the value of the underlying properties. Not surprisingly, commercial real estate values took a bit of a tumble in 20202. Fortunately, there was a broad recovery that began last year and has continued in to 2022 as well.

Of note, this rebound has not been consistent across sub-sectors. While property values are up as a whole, this is being driven primarily by Industrial and Apartment properties. Office space has struggled (relatively), and Retail is seeing gains but saw bigger drops in 2020, so that balances out the multi-year return a bit. To illustrate, the year-over-year gains for each sub-sector are displayed in the graphic below:

YOY Price Growth Each Month (By Sector) (Real Capital Analytics)

My take from this is that the companies who own these properties (like MAA) are seeing net improvements on their balance sheets. Their assets are rising in value, and that helps support a rising share price. While this trend shows signs of peaking, year-over-year gains are still very elevated. If this “peak” holds, I’ll take it.

Vacancy Rate Has Ticked Up, But It’s Still Low

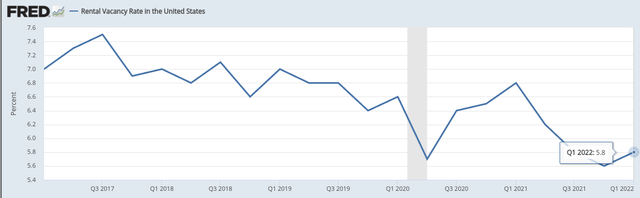

Another bright spot for apartments is that national vacancy rates are sitting near multi-year lows. The sore point is that this metric ticked up slightly in Q1 to 5.8% from 5.6% in Q4 2021. While not wildly encouraging, one quarter does not a trend make. Further, even with that uptick, the national vacancy rate is still a positive catalyst in my view:

Rental Vacancy Rate in U.S. (St. Louis Fed)

This is an important attribute for MAA, and its entire sector. The American populace is being forced into apartment living, given the single-family housing crunch and a lead-time to new housing builds that will keep this occupancy rate low for some time ahead. This means more rent collected for MAA, and higher profits to follow.

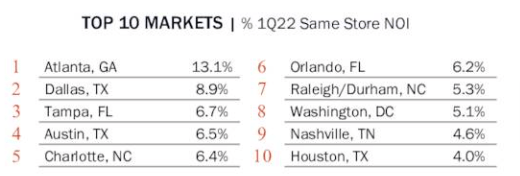

MAA Focuses On The Right Markets

My next topic is an area that I have talked about in all of my reviews since my inception of MAA coverage. Because of this, I will keep it relatively short, but it is worth mentioning that MAA focuses on some of the fastest growing regions in the country. The southeast and the southwest (especially Texas) are seeing a surge of internal migration. This has been the case for a while, but has been amplified since the pandemic. Top markets for MAA include Georgia, North Carolina, Virginia/D.C., Florida, and Texas:

MAA’s Top Markets (MAA Investor Center)

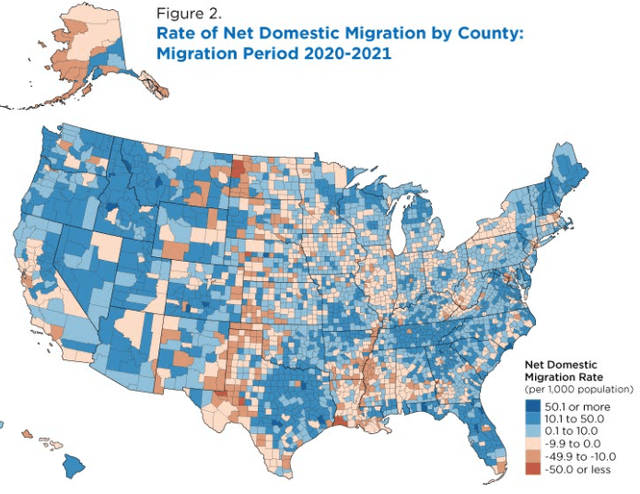

My thesis here is that MAA is in the regions where people are moving and where labor markets are strong. The southeast and southwest have been on a positive migration trend for a while, but going in to 2020, we saw this trend continue in a big way:

Domestic Migration (U.S. Census Bureau)

There is not much on the horizon that make me doubt this trend going forward. MAA’s primary markets are growing fast, and continue to be magnets for Americans – especially young people and young professionals. These are precisely the individuals MAA targets, and it bodes well for occupancy and rental rates in the year ahead.

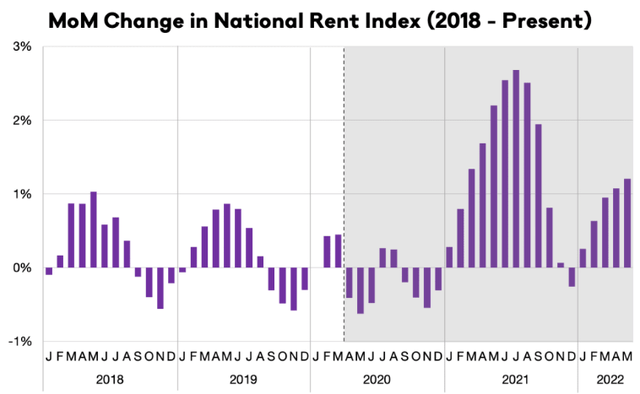

A Way To Manage Inflation – Rents Are Rising

As I led with early on in this review, inflation is a major pain point for equity markets right now. Income vehicles are hurt by rising yields, and growth stocks become less attractive as investors get less willing to wait for future revenues or profits to materialize.

So, how does one beat this market? In fairness, it is very difficult. Finding “winning” plays in this market is going to be difficult. Stocks and bonds, crypto and precious metals, and other types of assets are all selling off of late. But the one way to truly beat inflation is to own things/property/goods that other people want and are willing and able to pay for. Apartments are one such way. People need a place to live, and are going to prioritize paying their rent to keep their living space intact. Further, rents are going up each month, helping investors in those properties keep up with inflation:

Change in Rents (Nationwide) (Apartment List)

The conclusion I draw here is that owning rental exposure is one way to battle inflation. While MAA has been pummeled in the short-term by Mr. Market, I am optimistic the reality of the strength of this business will outweigh the negatives in the second half of the year.

Bottom Line

MAA has been a poor performer in 2022, there is no getting around it. While I held a cautious outlook on this REIT when the year got underway, I have been taken aback by just how hard its fortune has fallen. Yet, I see this sell-off as an opportunity. I had been wanting to add to my position for some time, but hadn’t felt the time was right. After a drop over 25%, I think that time has finally come. MAA services fast-growing regions in the U.S., benefits from the national trend of rising rents, and just had a dividend hike. When I couple all this together, I have a bullish outlook. As a result, I will be buying MAA this week, and I suggest readers give this idea some consideration at this time.

Be the first to comment