sitox

Overview

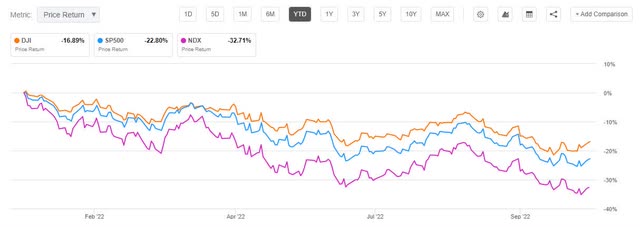

Timing the market is nearly impossible, where time in the market is key to finding success, given the history of long-term investing nearly always outperforming the markets. And while past performance is no guarantee of future results, the S&P 500 losing more than 20% of its value YTD, the Dow Jones -16% YTD, and Nasdaq -32% YTD have investors wondering where to put their money.

Major Indexes YTD Price Performance (S&P 500 vs. DJIA vs. Nasdaq)

Major Indexes YTD Price Performance (S&P 500 vs. DJIA vs. Nasdaq) (Seeking Alpha Premium)

Where tech and high-growth stocks have flourished over the last decade, energy has been a big benefactor of the latest economic regime, inflation, and geopolitical events. As investors look towards stability and value, in the past, equities have recovered quickly on the heels of a strong rally.

Growth stocks that have been pummeled in the current environment are trading at discounts. Many possess solid fundamentals and are attractive as a result of market declines. We know what the Fed plans to do. Tighter monetary policy can still allow some growth-oriented stocks to be insulated from the high interest-rate environment. As a result, I am highlighting two Top Growth Stocks with deep value to buy in a bear market.

Are October and November the time for growth stocks?

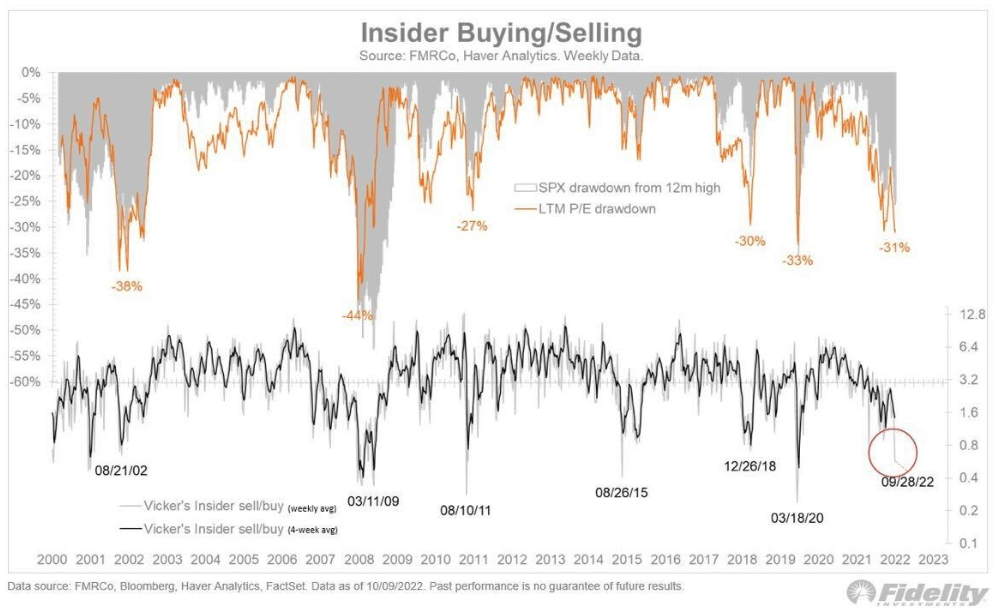

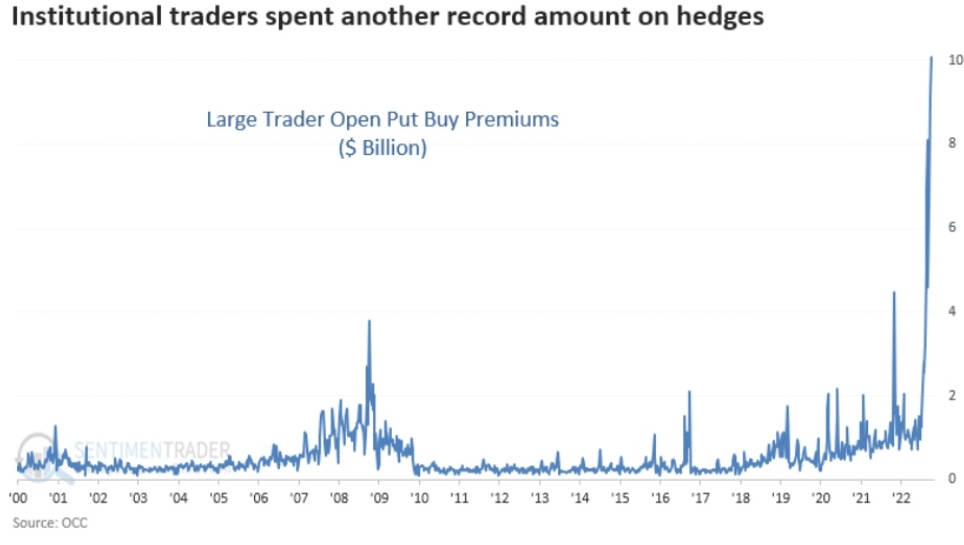

“You can’t have a big market crash when everybody has their seatbelts fastened,” says Zach Marx, CFA, Seeking Alpha Senior Quantitative Strategist. September’s market performance held up to its reputation as the ‘worst month of the year for stocks,’ with each major index down nearly 10% for the month, creating more fear. And while individuals are getting defensive and holding onto their wallets, institutional traders spent a record $10B in puts on individual stocks in the first week of October, an indication that insider activity has predominantly been on the sell side.

Insider Buying & Selling Chart (FMRCo, Haver Analytics)

This indicates that even the insiders’ optimism around future prospects is dwindling, and institutional investors expect a large move down. Institutional investors are hedging by purchasing puts, a form of insurance to protect downside and profit from market losses. Given that the last few months of the year tend to experience rallies, I feel it will be no different with the upcoming election.

Institutional Open Put Buy Premiums (OCC, SentimenTrader)

As I noted in a recent article titled Rally Monkey, “One of the biggest influences on stock market performance during midterm elections has been the health of the economy. Given the current bear market environment and recessionary outlook, many factors affect the markets,” including slow economic growth, increasing energy prices, and substantial inflation rates. As U.S. Bank analysis states:

“If you exclude the five midterm elections in the 1960s and 1970s, the average S&P return for pre-midterm election years is 8.1% – roughly in line with the average annual S&P 500 performance. Since then, the economy has grown steadily, with accommodating central bank policy keeping inflation low.”

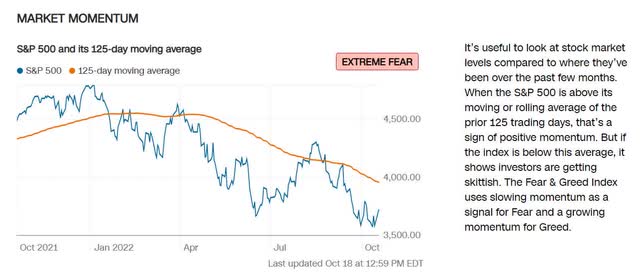

Growth stocks were on a tear during the low-interest, post-COVID environment. As inflation and hawkish Fed decisions eat into portfolios, rising rates concern investors, creating substantial outflows from equities. According to State Street Global Advisors (SSGA), investors’ de-risking is one of the most dominant behaviors, whose momentum signals fear as the overarching emotion moving the markets.

Fear & Greed Market Momentum (S&P 500 125-day moving average) (CNN Fear & Greed Market Momentum)

Although we may not be able to predict what moves the markets, what will trigger a rally, or if there will be one on the heels of midterm elections, Seeking Alpha’s Quant Ratings and Factor Grades System offers investors the ability to quickly identify stocks with strong fundamentals, improving growth and rising analysts’ confidence.

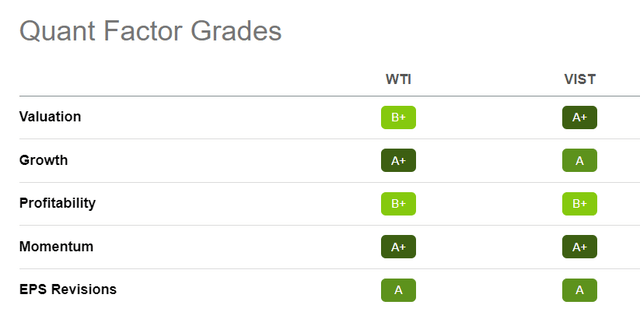

Quant Grades Display Strong Fundamentals on A Sector Relative Basis

Quant Grades Display Strong Fundamentals On A Sector Relative Basis (Seeking Alpha Premium)

Stocks with strong value, growth, profitability, rising earnings revisions, and momentum are best equipped to capitalize on a potential rally while minimizing downside risks. Check out our top two growth stocks below.

2 Growth Stocks for Potential Bear Market Rallies

My two stock picks are in the energy sector, the top performing sector (XLE), +42% over the last year and YTD. Despite the sharp sell-off for many growth stocks, focusing on those with macro tailwinds and strong fundamentals that have shown resilience by regaining 20% from June to July lows is an opportunity for navigating drawdowns and periods of high volatility. Focusing on quality is a great way to navigate the uncertain environment while growing a portfolio with sound companies based on strong financials and healthy free cash flows.

1. Vista Energy, S.A.B. de C.V. (NYSE:VIST)

-

Market Capitalization: $1.06B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/17): 2 out of 248

-

Quant Industry Ranking (as of 10/17): 1 out of 71

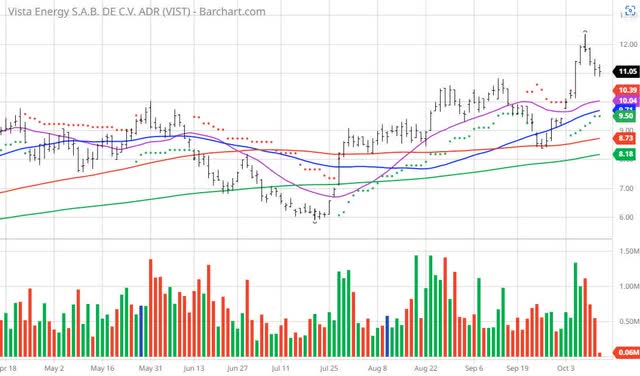

Mexico City Headquartered Vista Energy is an oil and gas exploration and production company with reserves and principal assets throughout Latin America. Not only is VIST a top-rated growth stock, but it’s also a Top Quant Stock whose main asset Vaca Muerta offers the world the largest shale gas reserves and the fourth-largest shale oil reserve. Although the stock has experienced pricing fluctuations amid OPEC’s production cuts and crude oil price volatility, Wall Street analysts, SA Authors, and our quant ratings share in the rating that this stock is a buy. As Seeking Alpha author Jim Van Meerten highlighted in the chart below, when comparing SA’s quant methods to Barchart’s technical analysis methods, Barchart’s Trend Spotter signaled that Vista was a buy on 10/5. SA has maintained its Strong Buy rating since August 15th.

Vista Energy Stock Barchart Trend Spotter (Barchart.com)

With tremendous momentum and valuation, let’s dive into the underlying metrics that make this stock such a popularly rated pick.

Vista Energy Valuation & Momentum

On a bullish trend, VIST continues to outperform its peers in the S&P 500 and energy, ranking #1 in its industry and #2 in the sector according to our quant ratings. With A+ momentum, Vista is showcasing a more than 400% difference to the sector for its three-, nine- and twelve-month price performance.

Vista Energy Momentum (Seeking Alpha Premium)

Vista also comes at a severe discount, possessing an overall A+ valuation grade and forward P/E ratio of 3.52x, a -58.80% difference to the sector. Given its tremendous YTD price performance of +112.13%, it should be no surprise that the company beat recent earnings and has excellent growth and profitability.

Vista Growth & Profitability

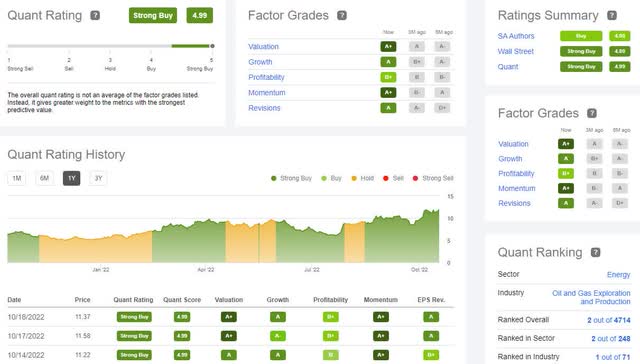

As illustrated by the quant ratings and factor grades below, Vista Energy is mainly in the green. Posting top and bottom-line Q2 earnings beats, the company delivered strong operational and financial results.

Vista Energy Quant Ratings & Factor Grades (Seeking Alpha Premium)

Vista’s total production experienced a 12% increase YoY, averaging 44,800 boes per day. Oil production jumped 70% amid favorable macroeconomic conditions and realized oil prices. Robust adjusted EBITDA resulted in a free cash flow of $62.6M, and the overall EPS of $1.06 beat by $0.46 with revenue of $294.29M beating by $26.29M.

“We continue to make great progress in our Bajada del Palo Oeste development. We have extended our core development to Aguada Federal with a driven and completion plant that is set to deliver 16 well tie-ins during the year…We remain focused on our de-carbonization plan, which will deliver a 25% year-over-year reduction in greenhouse gas emissions intensity during 2022. We have updated our guidance, reflecting a balanced capital allocation of incremental operating cash flow to additional growth and further debt reduction. Our plan is to remain flexible on this front in the coming months to strategically allocate our cash to grow and deliver.” –Miguel Galuccio, Vista Energy Chairman & CEO

With continued strength in the energy sector, in addition to Vista a strong buy, my next stock pick offers similar ratings and record free cash flow.

2. W&T Offshore, Inc. (NYSE:WTI)

-

Market Capitalization: $1.00B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/17): 3 out of 248

-

Quant Industry Ranking (as of 10/17): 2 out of 71

Next up, we have the #2 industry-ranked oil and gas exploration company, W&T Offshore, Inc. An independent oil and natural gas producer, WTI is headquartered in Houston, TX, with significant interest in the Gulf of Mexico. Like Vista Energy, WTI has had its share of volatile price swings that included September’s energy price drop below $80, erasing some of its gains. But that has not slowed the company’s momentum, as it continues to be on an uptrend, showcasing +101% YTD price performance, and the stock comes at a great value.

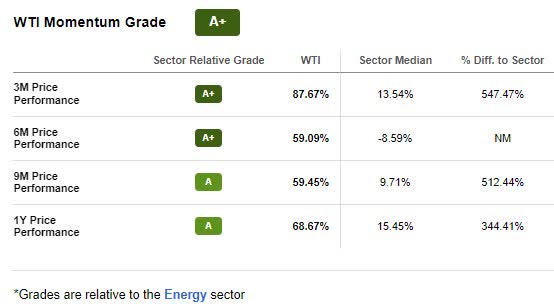

WTI Stock Valuation & Momentum

Posting a B+ valuation grade, WTI is trading below its sector peers. With a forward P/E ratio of 5.63x, a -33.98% difference to the sector, and forward EV/EBITDA of 2.81x, a -47.72% difference to the sector, this energy pick comes at quite the discount. Not only does it offer upside in a down environment.

WTI Stock Momentum (Seeking Alpha Premium)

Its strong momentum continues to outperform its sector median peers quarterly, WTI’s ability to capitalize on accretive opportunities continues to build shareholder value, showcasing its ability to grow and generate profits.

WTI Stock Growth & Profitability

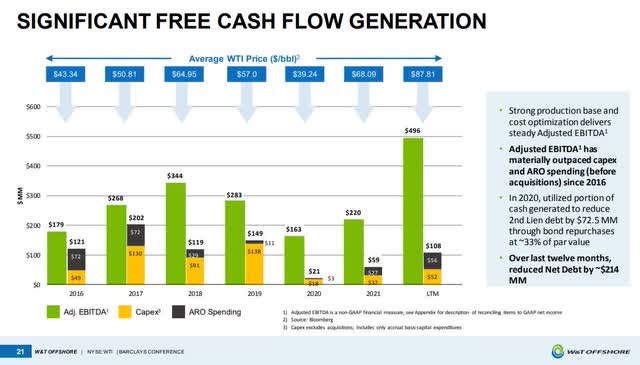

WTI is well positioned for success, showcasing a 40-year history of drilling in the Gulf and improved liquidity and leverage metrics. With record free cash flow year over year and a reduction in leverage, WTI started very strong in the first half of 2022 after coming back from the difficult market post-COVID, when energy and fuel stocks took a tumble. With a 12% production increase quarter-over-quarter and net income of $23.4M, WTI continues to showcase why it’s rated a strong buy.

WTI Cash Flow Generation Chart (WTI Q2 Investor Presentation)

The company has expanded its operations by offering valuable and diversified deepwater projects, adding to its solid results. Second quarter 2022 earnings were tremendous, with an EPS of $0.85, beating by $0.49, and revenue of $273.81M, beating by 106.14% YoY. Midyear reserves increased by 7% to $168.3M, and with more positive projections, WTI Chairman & CEO Tracy Krohn said,

“Looking ahead to the third quarter of 2022, our guidance for production is between 39,000 and 44,000 barrels of oil equivalent per day. We’re increasing our full-year production guidance by 2% at the midpoint to 39,500 to 42,000 barrels of oil equivalent per day, and that reflects the continued strength of our production base and the benefit of the acquisitions we’ve closed so far this year.”

As we continue to monitor these two stocks, which boast strong analyst revisions and ratings, financials, consider growth stocks that also come at a value for your portfolio. Many have been beaten down and could take advantage if we should see a bear market rally.

Growth stocks with solid fundamentals could see a rally

Growth stocks rated Strong Buys, especially those with fair valuations, can be a great way to capitalize on their momentum. In the current environment where VIST and WTI offer a good balance of growth and value, it’s a great play to diversify a portfolio before the November midterm elections.

We could see an about-face after Midterms, where tighter monetary and fiscal policies that resulted in market declines, experience brief bear rallies. Consider my top two growth stocks with strong analyst upward revisions. The professional analysts covering these stocks indicate that results will be better than expected, and each stock is undervalued with robust fundamentals.

Be the first to comment