M A X I M

Real Estate Earnings Preview

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 14th.

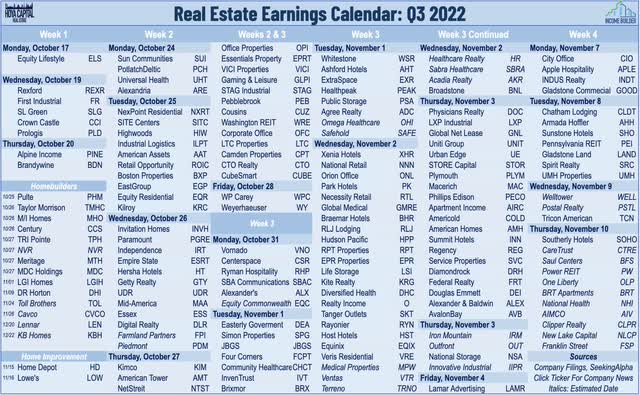

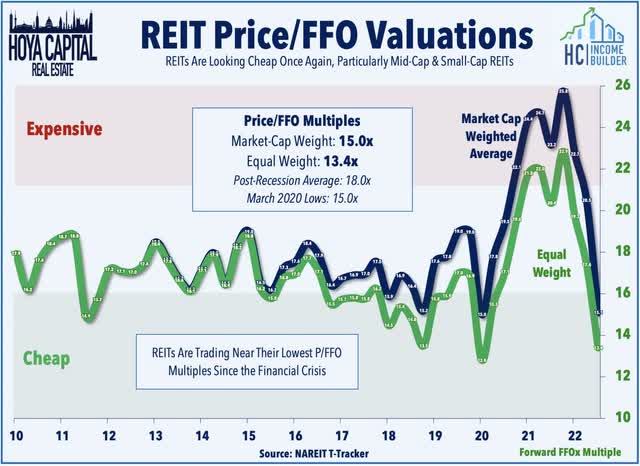

Real estate earnings season kicks off this week, and over the next month, we’ll hear results from more than 175 equity REITs, 40 mortgage REITs, and dozens of housing industry companies which will provide the first look into how the real estate industry is adapting to the most recent surge in interest rates following the Federal Reserve’s “hawkish pivot” in mid-August. Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest Price-to-FFO valuations – and highest dividend yields – since the Great Financial Crisis. This report discusses the major themes and metrics we’ll be watching across each of the real estate property sectors this earnings season. Below, we compiled the earnings calendar for equity REITs and homebuilders.

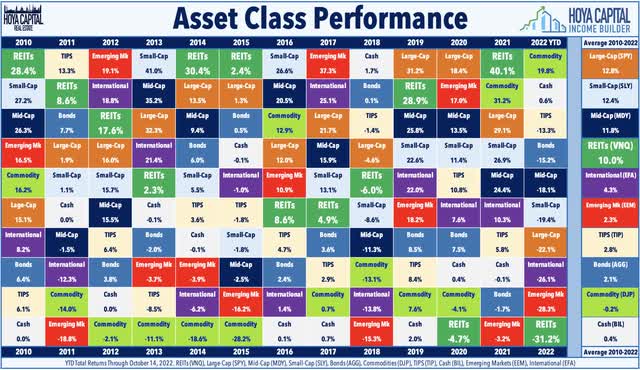

After running neck-and-neck for most of the year with the S&P 500, the rate-sensitive real estate sector has been a significant performance laggard over the past two months with the Vanguard Real Estate ETF (VNQ) now off by 34.4% on a price return basis for the year – the worst YTD performance for the REIT Index on record through this date – while the Mortgage REIT Index is lower by 40.6%. At 4.01%, the 10-Year Treasury Yield has surged 250 basis points since the start of the year to the highest weekly closing level since May 2010 – and well above its prior ten-year highs of 3.25% seen back in late 2018. As a result, the US bond market is on pace for its worst year in history with a loss of 15.8% on the Bloomberg US Aggregate Bond Index, which is 5x larger than the previous worst year back in 1994 (-2.9%).

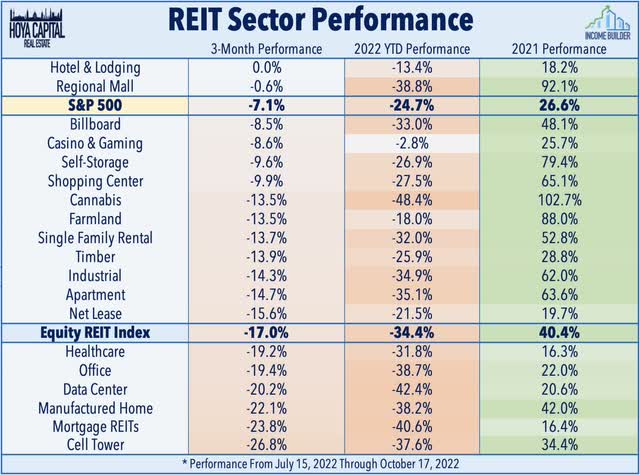

Despite the relatively strong slate of REIT earnings reports in Q2 in which nearly two-thirds of the REITs that provide full-year 2022 FFO guidance raised their outlook, the selling pressure has mounted over the past quarter. Since the start of last earnings season the week of July 15th, the Equity REIT Index is lower by roughly 17% compared to the 7% decline from the S&P 500. At the property sector level, performance trends continue to be dominated by macroeconomic factors, and we’ve recently observed a revision back to the “inflation-trade” dynamics seen earlier in 2022. Notably, the pro-cyclical and “cheaper” property sectors – hotels and retail – have significantly outperformed over the past quarter while the more defensive sectors and many of the “higher quality” names – notably technology and residential REITs – have lagged during this time.

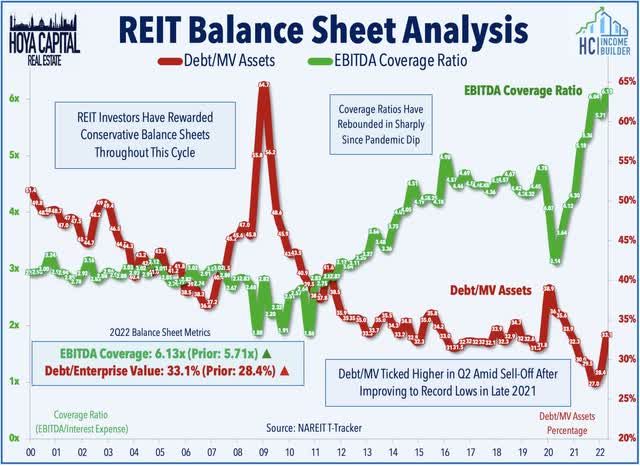

Last we heard from most REITs during Q2 earnings season, the 10-Year Treasury Yield was still in the 2.50-2.90% range (vs. 3.90% – 4.00% today) – and it was still “business as usual” for most of the sector. That likely won’t be the case in Q3 – and we’re expecting to see most REITs hunker down given the very challenging financing environment – a benefit that has been “earned” through the cautious balance sheet management over the past decade. As discussed in our State of the REIT Nation report, with the scars of the Great Financial Crisis still visible enough to be reminders of more dismal times, most well-managed REITs have been “preparing for winter” for the last decade, perhaps to the frustration of some investors that turned to higher-leveraged and riskier alternatives in recent years. Much the opposite of their role during the GFC, we believe that many well-capitalized REITs are equipped to “play offense” and take advantage of compelling acquisition opportunities if we do indeed see some degree of distress in private markets from higher rates.

Real estate asset values will also be a major theme – particularly on the residential side. The historic surge in mortgage rates this year has resulted in the sharpest slowdown in home price appreciation on record – decelerating from a nearly 20% annualized rate earlier this year to low-single-digits by September – while more than half of the top 50 markets have seen home prices decline from their peak earlier this year. Based on recent data from Zillow (Z), the median of the top-50 markets recorded a monthly decline in home values in September for the first since 2012. Lack of supply should keep a floor on home price and rental rates – and we think the public builders are well-positioned to weather the storm while the public REITs will see the shakeout of more highly-levered players as an opportunity to gain share.

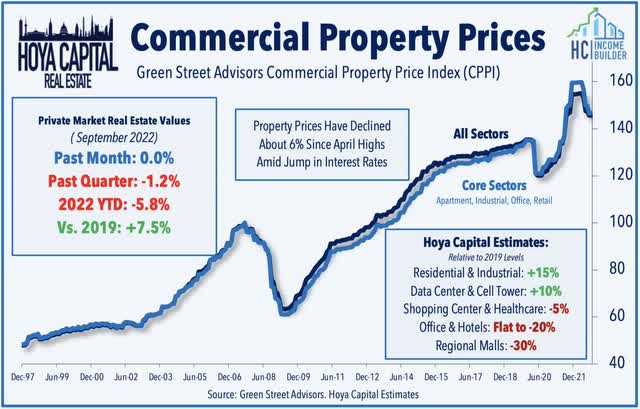

On the commercial side, we’re not yet seeing “distress” in the private real estate markets – which are notoriously slow to mark to market their portfolios – but the heat has certainly been turned up to an uncomfortable degree for many more highly-levered players which could facilitate some attractive opportunistic M&A for the more well-capitalized REITs. Per Green Street Advisors, commercial property values had declined only about 6% from their mid-2022 highs through September compared to a ~30% decline in public REIT values. The non-traded REIT (“NTR”) space would be one area we’d be watching for signs of stress given their typically-high leverage and sensitivity to investor fund flows – which we expect could eventually become an area that’s “ripe for picking” for the more conservatively-managed REITs. Of note, Blackstone’s (BX) NTR platform – BREIT – reported that its Net Asset Value has increased 9.3% this year through September 30 – claiming roughly 40% outperformance over the public REIT indexes despite paying “top-dollar” to acquire a half-dozen public REITs over the past two years whose closest public REIT peers are trading lower by an average of 30% this year.

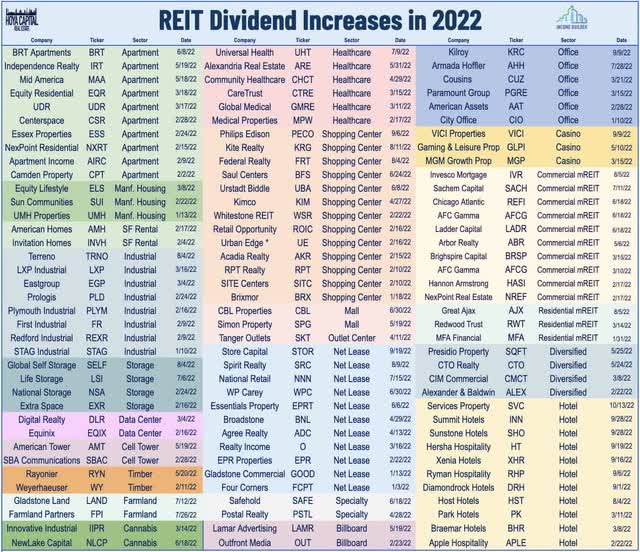

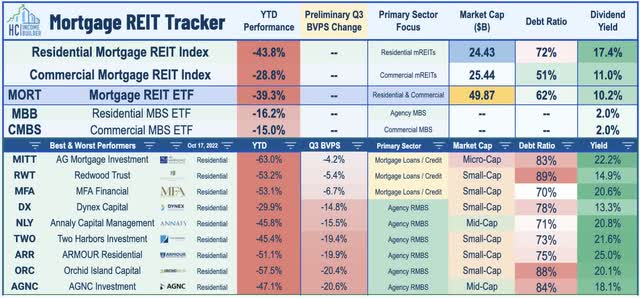

While we’d typically expect to see many REITs provide next-year guidance alongside their Q3 results, given the heightened interest rate uncertainty and potentially looming recession, we think most REITs will hold off on providing a 2023 outlook. Similar “wait and see” themes will likely apply to additional REIT dividend hikes with more than 110 REITs having already raised their dividend this year. With a historically low dividend payout ratio, most equity REITs have a significant buffer to protect current payout levels if macroeconomic conditions take a turn for the worse. The protective buffer to the dividend is all-but-gone on the mortgage REIT side, however, and while these REITs have fought hard to protect their dividend amid a historically brutal year for fixed income – and mortgage-related securities in particular – we expect a handful of dividend cuts from some of the more highly-levered mREITs but nothing like the bloodbath of dividend eliminations seen in early 2020.

Tech and Industrial REITs Earnings Preview

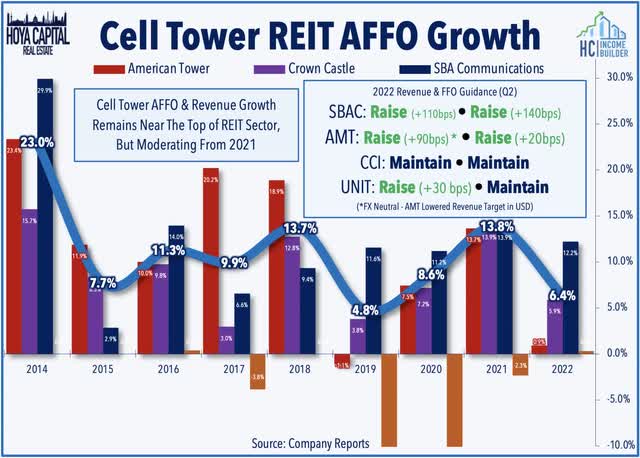

Cell Towers: Cell Tower REITs have been slammed harder than any property sector over the past three months, weighed down by tech-related weakness and disruptive threats to the long-term competitive positioning. Concerns over emerging – and potentially competing – satellite technologies came to a head when Apple announced that its new iPhone lineup would be capable of sending text messages over satellite networks. Awed by impressive rocket launches, the market has overlooked the more meaningful industry dynamics related to the accelerated rollout of fixed wireless access (“FWA”) which have further solidified the competitive positioning of land-based wireless networks – a market that is effectively “cornered” by the three cell tower REITs. We’re expecting American Tower (AMT) and Crown Castle (CCI) to be among the few to provide full 2023 guidance and we’re listening for commentary on industry dynamics related to FWA and satellite networks.

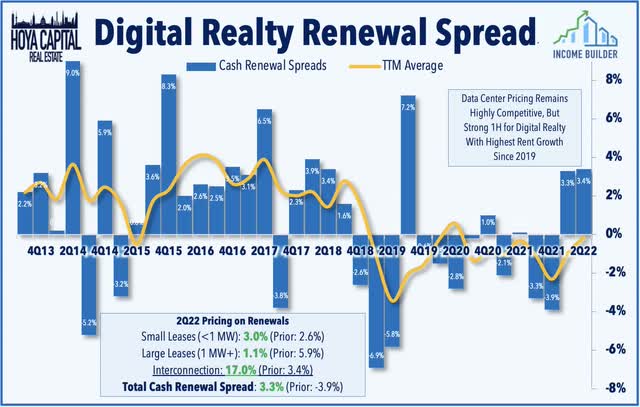

Data Center: Data Center REITs – a perennial performance leader in the REIT sector also dipped into “bear market” territory earlier for the just third time in the past ten years. Beneath the cloud layer, however, industry fundamentals are not nearly as shady as the recent performance suggests. Contrary to the short-thesis narrative, pricing power has exhibited signs of strengthening in 2022 after several years of softness as supply growth has moderated. Competition from the hyperscale giants – Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) – has been a well-established risk that the two major REITs have effectively managed. With negotiating power recently tilting back towards landlords, there appears to be enough economic value to be shared. We see a significant underestimation of the pricing power of the network-dense data centers, in particular, the major focus of Equinix (EQIX). Pricing trends and leasing demand will be closely watched this quarter.

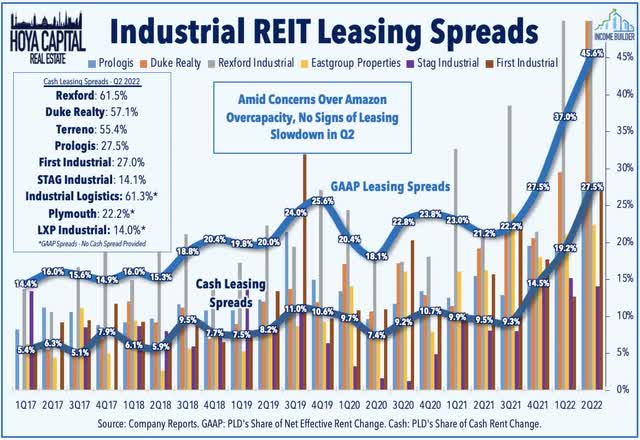

Industrial: Industrial REITs – which were in the basement of the REIT sector for much of the year amid a sharp selloff early in the summer – have regained some ground over the past several months, helped by another strong slate of earnings reports last quarter in which these REITs reported record-high leasing spreads of nearly 30%. Even as the effects of slowing global growth became visible, CBRE reported last month that industrial vacancy rates declined to fresh record-lows below 3%, while rent growth surged 15%. Absent an unexpectedly deep and prolonged recession, fundamentals should remain favorable for industrial REITs given longer-term demand tailwinds and constraints on new supply. We’re interested in hearing commentary on the status of supply chain issues from these REITs’ vantage points, and we’re focused on leasing spreads and expect 2023 guidance from several names.

Residential REITs Earnings Preview

Apartments: The state of the U.S. housing market will be a critical focus throughout earnings season as the historic surge in mortgage rates prompted a sharp cooldown in homebuying demand and pushed many potential buyers back into the rental markets. Cooling home prices will eventually filter into rental markets, but rents still have quite a bit of “catching-up” to do to equalize the Buy vs. Rent economics which favor renting by the most in over a decade. The latest report from Zillow (Z) showed that while rent growth has indeed cooled from the double-digit rates seen earlier this year, the month-over-month rent growth in September – the slowest growth in nearly two years – was still triple the average rates seen from 2015-2019. We’ll again be watching rent growth trends on new and renewed leases – and expect the Federal Reserve will be listening closely as well.

Homebuilders: With the pace of home sales moderating considerably amid the surge in mortgage rates, and with home price appreciation showing significant cooling over the past month – and even turning negative on a month-over-month basis in more than half of the top 50 – results from homebuilders will be a major macro focus this earnings season as well. Supply chain and land constraints prevented the type of overbuilding that we observed in the mid-2000s, and even with elevated cancellation rates, homebuilders still have enough of a demand backlog to work through to sustain some level of activity while overall housing inventory levels remain far below average resulting from a decade of underbuilding. With P/E valuations in the low single digits for “household names” like D.R. Horton (DHI), Lennar (LEN), and KB Home (KBH) homebuilders have a relatively low hurdle to beat.

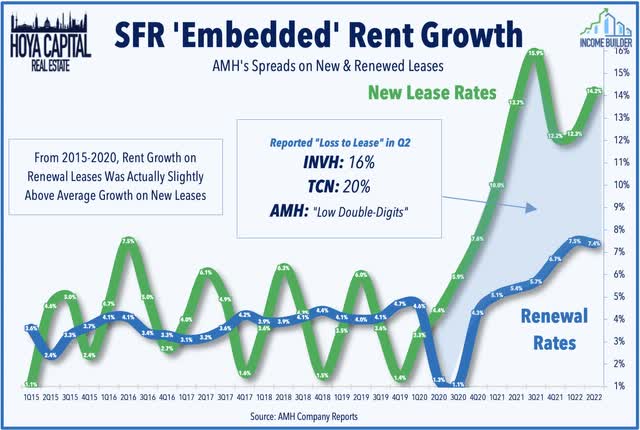

Single-Family Rentals: SFR REITs were born during the last economic crisis when a cascade of foreclosures enabled a new class of institutional rental operators to emerge by buying distressed properties en masse. Similar distress in the U.S. housing market is highly unlikely given the underlying supply constraints resulting from a decade of underbuilding, and ironically, due to the presence of these well-capitalized institutional investors. Second-quarter earnings reports showed notable strength with blended leasing spreads actually accelerating in the quarter while several REITs acknowledged that lease rates on existing units remain far below market, which should serve as a tailwind for sustained NOI growth even as new lease rates moderate. We’re focused on leasing spreads and the updated “loss to lease” estimate – and if these REITs are viewing the recent cooldown as an opportunity to accelerate the expansion of institutional ownership across the single-family space and the maturation of “built-for-rent” single-family development.

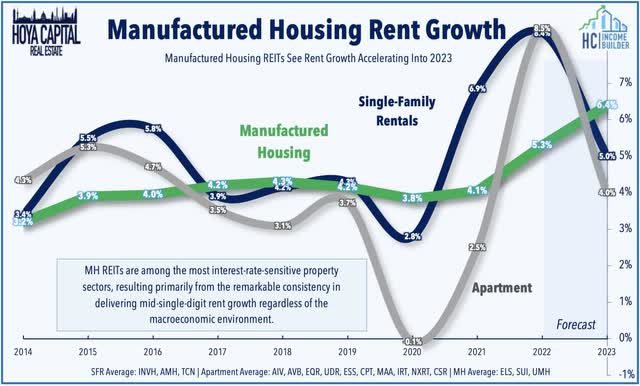

Manufactured Housing: One of the most “recession-resistant” property sectors given their countercyclical demand profile, MH REITs have uncharacteristically underperformed throughout early 2022 and the major focus of earnings results will be the financial hit from Hurricane Ian. We continue to expect MH REITs will leverage the record-setting cost-of-living adjustment (COLA) adjustments for their 2023 rent renewals which should result in a roughly 9% rise in benefits to a significant percentage of MH REITs’ resident base. MH REITs have remarkably delivered nine consecutive years of outperformance compared to the broader REIT Index, benefiting from strong operational execution, significant supply constraints, demographic tailwinds, and high barriers to entry and when all is said and done this year we expect MH REITs to extend their streak to a tenth-straight year of outperformance.

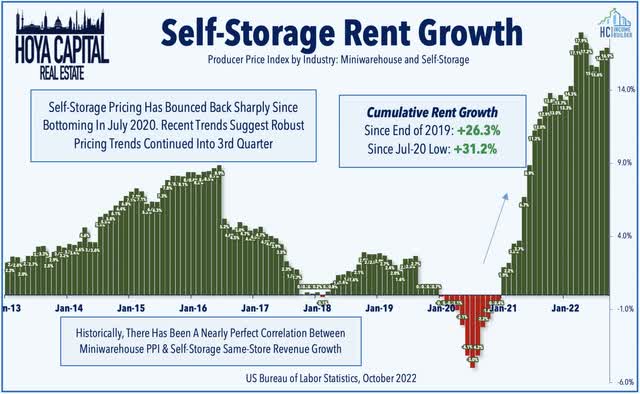

Self-Storage: Storage REITs have defied expectations to the upside as comprehensively as any real estate sector since the start of the pandemic, delivering earnings growth of over 50% since 2019. While the rate-driven slowdown in housing market activity is expected to temper incremental storage demand, recent data and interim REIT updates have indicated strong demand trends continued deep into Q3. The Producer Price Index for self-storage facilities – which has historically exhibited a near-perfect correlation with rent growth – showed another brisk month-over-month gain of 1.5% in September, pushing the year-over-year advance to 16.9% – just below the record-high rate of 17.9% set in April. Accelerated by tighter financing conditions, acquisition opportunities should be especially plentiful for these storage REITs which are still playing “offense” to some degree while smaller, more high-levered private players seek an exit.

Retail Real Estate Earnings Preview

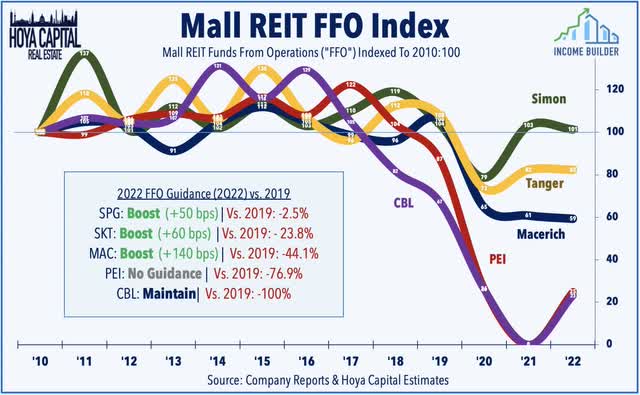

Malls: Despite the mounting recession calls, Mall REITs have actually been the second-best-performing REIT sector over the past quarter despite a still-troubled outlook for all but the most well-located malls. A microcosm of broader retail trends, mall sector dynamics remain a story of “haves and have not” and higher-tier malls have benefited from a ‘thinning-out’ of Class C and D malls. High-end mall occupancy rates and foot traffic returned to pre-pandemic levels by mid-2022 as record-low store closings since 2020 have helped to stabilize fundamentals and restore some modest pricing power, but a sharp retail slowdown would likely spark another wave of store closings and potential bankruptcies. We’re again focused on leasing spread this earnings season – which remained weak last quarter despite improving NOI and FFO trends – and want to see rental rates stabilize before we can officially call the bottom to the decade-long downward pressure on FFO.

Shopping Centers: Unlike their mall REIT peers, Shopping Center REITs entered 2022 with fundamentals that are as strong – or possibly even stronger- than before the pandemic with a full recovery in FFO and occupancy now complete. Occupancy rate trends and leasing spreads have been especially impressive with rents rising by double-digit rates last quarter, indicating clear signs of pricing power for the first time since the mid-2010s. The recent merger proposal between supermarket chain Kroger (KR) – the second-largest grocery chain and Albertsons (ACI) – the fourth-largest grocery chain will be a focus of discussion for the grocery-anchored REITs. We’ll be focused again on leasing spreads and occupancy rates which – unlike mall REITs – appeared to definitively bottom in early 2021.

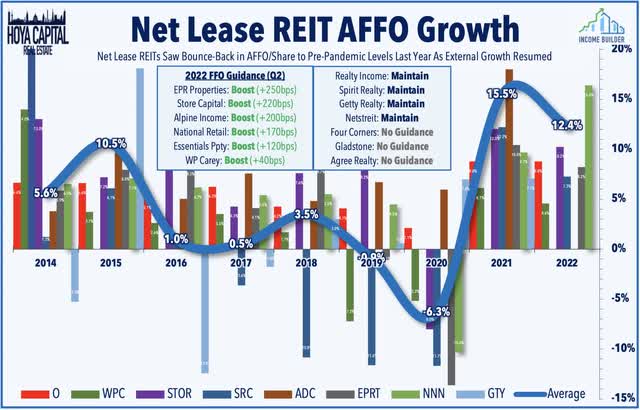

Net Lease: Understood to be one of the more “bond-like” and rate-sensitive REIT sectors, net lease REITs have actually held up surprisingly well in 2022 despite the historic surge in interest rates as net lease investors aren’t buying the “new normal” of permanently elevated inflation. We were a bit surprised to see the “business as usual” tone last earnings season with these REITs reiterating their guidance calling for over $15B in acquisition volume in 2022 and commentary suggesting that cap rates had increased only marginally. While our base-case is that inflation will return to the 2-3% level as pandemic-era fiscal policy normalizes, there appears to be some complacency in valuations and overall strategy of REITs more exposed to upside inflation risks and “spread” risks from higher financing rates. Potential M&A activity will be a topic of discussion following the acquisition of STORE Capital (STOR) by GIC and Blue Owl’s Oak Street, but we’re most interested in commentary around cap rates, investment spreads, and the updated acquisition outlook.

Office & Healthcare REIT Earnings Preview

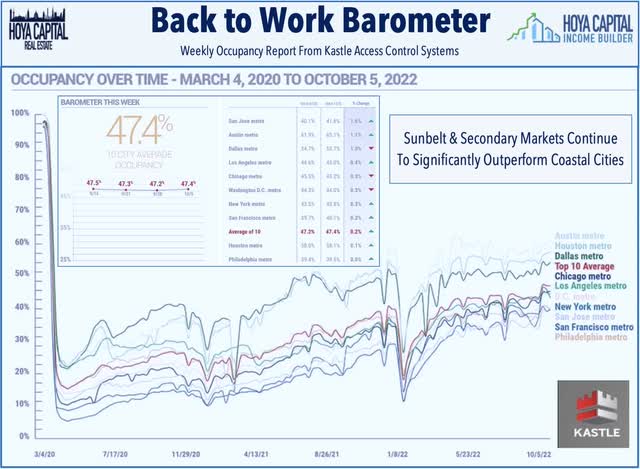

Office: The “Return to the Office” has been slow, to say the least. More than two years into the pandemic, data from Kastle Systems still shows that office utilization rates remain 40-60% below pre-pandemic levels and have trended more-or-less sideways since late 2021. Office leasing demand – and earnings results from these office REITs – have been surprisingly resilient, however, particularly for REITs focused on business-friendly Sunbelt regions and specialty lab space. Investors remain skeptical over how long companies will continue to pay full price for half-empty office space. Utilization rates remain far higher in Sunbelt markets with shorter commutes, and so long as labor markets remain tight and employees have the negotiating power, it’ll be tough to pull reluctant workers back into the office in coastal markets. Leasing velocity will be closely watched this quarter and we’re interested in updated expectations of what exactly “normalization” looks like for each REIT.

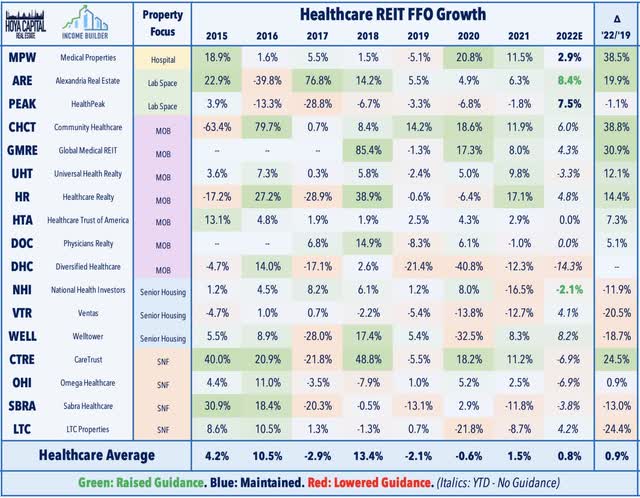

Healthcare: For healthcare REITs, a property is only as strong as the financial health of the operator that runs it. Skilled nursing REITs have surprisingly been among the best-performing REITs this year as Q2 results from Omega Healthcare (OHI) and Sabra Health Care (SBRA) provided some hope that tenant operator struggles can be contained as improving occupancy rates and signs of relief on labor shortages have helped some operators make their monthly rent. Senior housing REITs Ventas (VTR) and Welltower (WELL) have given back all of their YTD outperformance over the last month, however, after Welltower warned that its Q3 results would be shy of its prior guidance due to delayed disbursement of HHS Provider Relief Fund funds. Reduced government support and the waning of the COVID pandemic have also hit hospital operators particularly hard in recent months. Hospital owner Medical Properties Trust (MPW) – which has dipped more than 50% this year and recently come into the crosshairs of short-selling firms – will be one of the more closely-watched reports this earnings season. On the upside, lab space-focused REITs have been an upside standout over the past quarter after lagging earlier in the year as lab space demand cools amid the recent slowdown in biotech venture capital and IPO activity.

Hotel & Casino REITs Earnings Preview

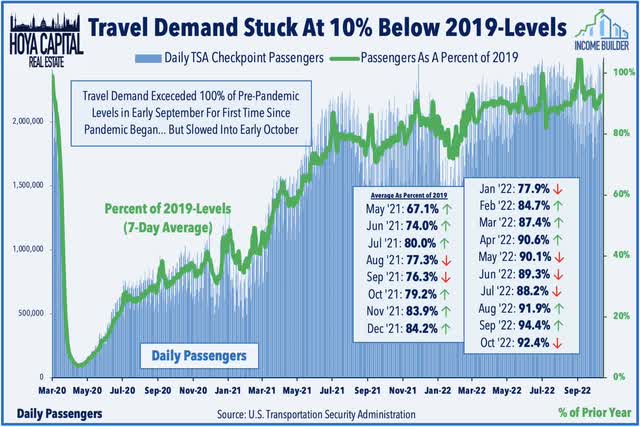

Hotels: Hotel REITs have held up surprisingly well throughout the recent market turmoil and remain one of the top-performing property sectors this year following a solid summer of operating performance. Several years of pent-up leisure demand from COVID delays helped to offset a slow business travel recovery and STR recently reported that profitability levels were above 2019-levels throughout the summer. Solid operating performance and improved balance sheet health have fueled the long-awaited return of dividend distributions with 11 of 16 hotel REITs now having either reinstated or raised their dividends this year. That said, we remain skeptical over the sustainability of the recovery in the upscale urban markets given the complexion of the RevPAR recovery, – driven by pent-up domestic leisure travel and surging room rates rather than an underlying occupancy recovery.

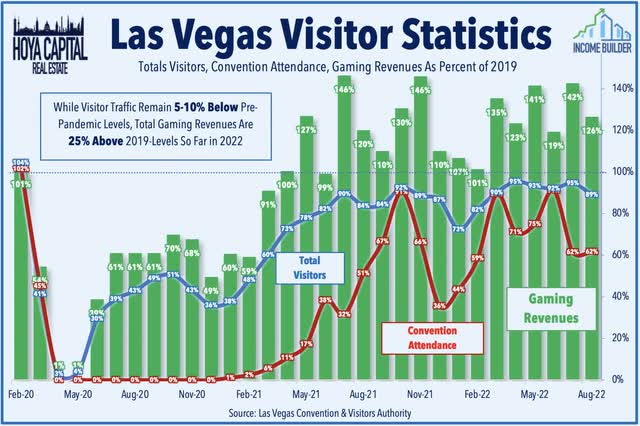

Casinos: Las Vegas is one of the hotel markets that continue to see relatively strong demand as resilient leisure demand has offset the continued slump in group and convention demand. Despite their ultra-long term triple net lease structures, casino REITs provide excellent inflation hedging characteristics. Casino REITs have become a favorite for investors seeking inflation-hedged assets. VICI Properties (VICI) boasts inflation-linked escalators on 96% of its leases while Gaming and Leisure Properties (GLPI) benefits from indirect inflation hedges linked to tenant performance. While the solid degree of inflation protection is certainly compelling given the macro environment – and should drive strong same-store growth in 2023 – with Casino REITs trading at 20-25% premiums to their historical P/FFO, we’re looking for a pull-back to re-enter the sector. We’re focused on commentary about future growth opportunities given the challenging financing environment.

Mortgage REITs Earnings Preview

Mortgage REITs have slid more than 20% over the past quarter as a measure of interest rate volatility – the ICE BofAML MOVE Index – soared to levels that matched that of the historically violent two-week period in early March 2020 during the initial wave of pandemic-related lockdowns, sparking fears of similar “forced selling” events. Recent preliminary updates over the past two weeks have indicated that conditions aren’t quite as dire as some feared amid the worst year of returns for credit markets in history. Among the nine REITs that have provided preliminary Book Value Per Share (“BVPS”) estimates, the average decline in book values is around 13% during the quarter as modest single-digit declines from credit-focused non-agency mREITs have been overwhelmed by steeper declines from more pure-play agency mREITs.

Sharp changes in interest rates in either direction can wreak havoc on mREITs that are caught over-levered or improperly hedged, but most mortgage REITs – particularly on the commercial mREIT side – have been able to navigate the turbulence more effectively than market pricing suggests. That said, the protective buffer to the dividend is all-but-gone on the mortgage REIT side, and while these REITs have fought hard to protect their dividend amid a historically brutal year for fixed income, we expect a handful of dividend cuts from some of the more highly-levered mREITs but nothing like the bloodbath of dividend eliminations seen in early 2020.

Key Takeaways: Real Estate Earnings Preview

Slammed by the historic surge in interest rates over the past six months, REITs enter third-quarter earnings season with the lowest valuations – and highest dividend yields – since the Financial Crisis. Performance trends across the REIT sector continue to be dominated by macroeconomic factors and “quality” once again appears to be unusually cheap within the REIT sector, particularly given the backdrop of mounting recession concerns. More broadly, with REITs being one of the most domestic-focused sectors, we believe that earnings season can be a catalyst to drive an upward re-pricing of the sector with a particularly strong rebound from high-quality REITs in the “essential” sectors – residential, technology, and industrial. As always, we’ll provide real-time commentary throughout earnings season for Income Builder members.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment