Feverpitched

Yesterday saw more gains for stocks on the coattails of better-than-expected corporate earnings for the third quarter. The S&P 500 is up two days in a row and three of the past four, climbing back above its long-term technical support level in the 200-week moving average. Regardless, most consider this to be just another bear market rally, due in part to the tremendous volatility in both directions that is indicative of high levels of uncertainty. I sense otherwise and see strong profit reports reining in volatility and paving the way for a stronger finish to the year for the market.

Finviz

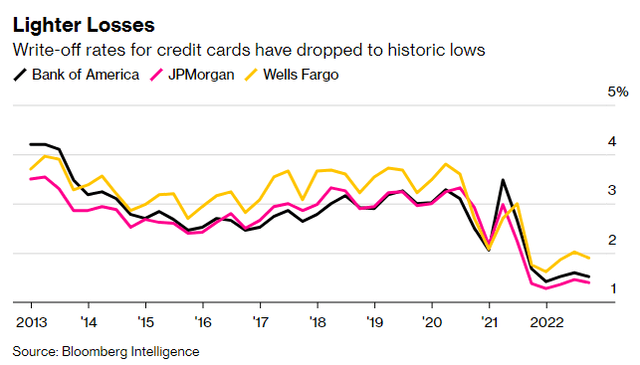

The consensus continues to see a recession either this year or next, but the consensus has consistently underappreciated the strength of consumer balance sheets, which is what fuels more than two thirds of our economic growth. Bank of America indicated as much in its latest earnings report on Monday. Consumer spending on BofA credit cards increased an annualized 13% in the third quarter, which could be perceived as stress if not for its lower-income customers maintaining five times the savings they held before the pandemic. The loan delinquency rate for the bank fell to its second lowest level on record. The story was the same the week before when Wells Fargo and JPMorgan reported results. No signs of recession here. It isn’t just consumers that are in good shape, as BofA CEO Brian Moynihan noted that the corporate customers it lends to are seeing more credit upgrades than downgrades.

Bloomberg

This is why spending has been able to keep pace with price increases, maintaining very modest real (inflation-adjusted) growth. I don’t see this balance sheet strength as the primary cause of the inflation we see today. Instead, it is serving as more of a bridge between now and when the macroeconomic shocks to the economy over the past 18 months wane. Obviously, it won’t last forever. Still, it should fuel a continued expansion in the economy through 2023, especially as the rate of inflation falls rapidly next year.

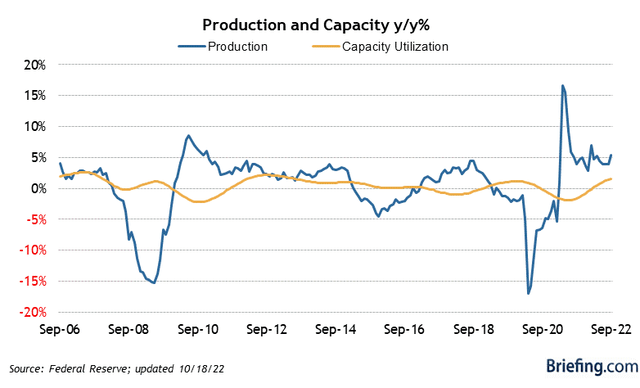

There have also been concerns about the manufacturing sector in recent months, as consumers shifted their spending from goods to services, but yesterday’s industrial production report showed surprising strength.

Briefing.com

Factory activity was better than expected, rising 0.4% in September compared to a consensus estimate of 0.1%, and prior months were revised higher. While utility output fell 0.4% due to weather, mining activity increased 0.6%, as high prices incentivized the drilling for oil and natural gas. Most importantly, manufacturing activity showed surprising strength, despite the softening demand for consumer goods. Whereas the production of consumer goods rose at an annualized rate of 3.9% during the third quarter, the production of business equipment increased 12.1%. This suggests that businesses are increasing their spending on capital equipment, which is offsetting the softness in demand for consumer goods. Again, no signs of recession here, which can be seen in the chart above.

The monetary policy tightening to date is sufficient to slow the economy enough that it brings the Fed’s preferred rate of inflation (personal consumption expenditures price index) down to 2-3% by the end of next year without causing a recession. I expect the market to sense that before the Fed admits it, which should be reflected in a decline in the 2-year Treasury yield from its current 4.5%. That decline should be the key catalyst to a sustainable recovery in risk asset prices.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment