2021 was a phenomenal year for the Retail Sector (XRT), with retailers benefiting from wardrobe refreshes post-lockdowns, government stimulus, and pent-up demand to get out and spend again after an unusual 2020. This led to more full-priced selling, record earnings for many retailers, and a new all-time high for the S&P Retail ETF. Unfortunately, 2022 couldn’t be more different. Not only is the environment significantly more promotional due to elevated inventory levels, but retailers have had to lap record results in the year-ago period.

The result is that the S&P Retail ETF has tumbled nearly 50% from its Q4 2021 highs, and outside of a handful of names, most retailers with a discretionary tilt are sitting at new 52-week lows. One name that’s been hit especially hard is Zumiez (NASDAQ:ZUMZ), a small-cap specialty retailer selling apparel, footwear, and hard goods in the skateboard/snowboard categories. The stock has found itself down 60% from its highs, and after another rough Q2 report that missed guidance, it’s tough to justify rushing into the stock just yet. Let’s take a closer look below:

Zumiez Brands (Company Website)

JHVEPhoto

Q2 Results

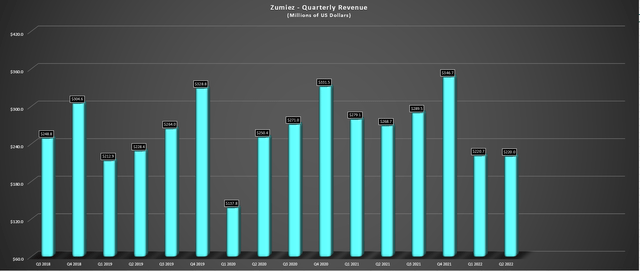

Zumiez released its Q2 results last month, reporting quarterly revenue of $220.0 million, a significant miss vs. guidance of $232 million to $239 million, and an 18% decline in sales year-over-year. This sharp decline in sales was well below management’s expectations for the period and was driven by a significant pullback in its US business. The company noted that all categories were down on a year-over-year basis, with the men’s category and hard goods being the hardest-hit categories. Given the significant miss and more conservative guidance for the back half of the year, it’s no surprise that the stock is one of the worst performers sector-wide.

Zumiez – Quarterly Revenue (Company Filings, Author’s Chart)

If we look at sales a little closer, net sales fell 3.7% below 2019 levels, a shocking figure that can be attributed to the considerable macro headwinds, with a recessionary and inflationary environment impacting discretionary budgets. The silver lining was that while the US business was down 20% year-over-year and 8% vs. 2019 levels, Australia and Europe have performed well, up 40% from 2019 levels and up 10% year-over-year excluding foreign exchange headwinds (down 3.4% on a non-adjusted basis). However, looking at early Q3 sales, the trend isn’t improving yet, with sales up to September 5th down 18.1% year-over-year, or 19.7% on a comp sales basis.

Based on management’s guidance of $220 million to $228 million in sales, the significant decline in net sales is expected to continue, with sales expected to slide 24% year-over-year at the low end of the range (Q3 2021: $289.5 million). Fortunately, the store count is growing in the same period, which is helping to lessen the blow, with 4%+ unit growth on deck this year based on plans to open 35 stores. The bulk of these stores will be in its better-performing markets, with 54% of the 35 stores in Europe and Australia combined. Assuming the company meets this guidance, it will finish the year with approximately 775 total stores.

Zumiez Store (Company Website)

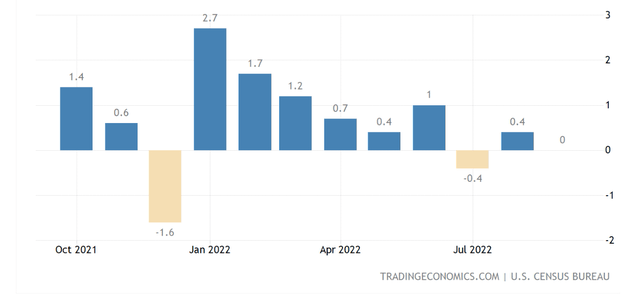

Industry-Wide Trends & Earnings Trend

One of the major themes we saw in Q2 was that inventory was much higher than planned sector-wide, contributing to a very promotional environment for the sector to clean up higher-than-planned inventories. The other theme we’ve seen is that retail sales clearly remain under pressure, as evidenced by September sales data, which showed retail sales flat year-over-year, which missed expectations of a 0.2% increase. This sharp pullback in sales and negative trend is not overly surprising when personal savings rates are at multi-year lows, and consumers are being hit from every angle with rising gas, utility, mortgage, rent, and food prices.

US Retail Sales (TradingEconomics, Census Bureau, BLS)

Fortunately, while the industry has seen a pullback in traffic, most brands have benefited from significant price increases, and there’s been minimal change in consumer behavior regarding trading down. However, as discussed on Zumiez Q2 Conference Call, the company has seen a shift from higher-priced brands to value, meaning it will have to find ways to promote value while maintaining its position as a full-priced retailer in the current environment. This trend places Zumiez in a tricky spot, given that it is not interested in promoting heavily like its peers, but its value proposition erodes short-term on a relative basis when many other retailers are looking to clear inventory at heavily discounted prices.

Fortunately, Zumiez has done a great job of managing inventory, with inventory up just over 2% year-over-year to $151.1 million. In addition, the company is confident that while its margins have come under pressure due to reduced sales leverage, it can return to double-digit operating margins long-term. So, while this year has been very unusual, and Zumiez certainly isn’t in the best position within the Retail space, it has done a solid job of managing inventory, and this is a company with a 40-year history that has survived worse economic downturns, suggesting it isn’t going anywhere.

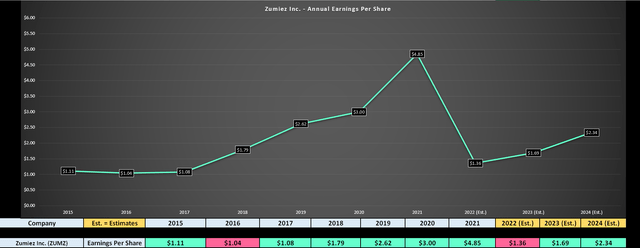

Zumiez Earnings Trend (Company Filings, FactSet, Author’s Chart)

Unfortunately, while the company has done a better job than most managing inventory and staying true to its core (full-priced selling), even if this is at the expense of sales, its share repurchases have been less impressive. As of Q1 2021, on a trailing twelve-month basis, the company bought back a massive portion of the float (6.5 million shares) at $43.00 per share, and year-to-date has repurchased 1.9 million shares at an average of $43.50. Although this has reduced the share count considerably, the company didn’t get much bang for its buck on these purchases, which hasn’t provided as much help as more opportunistic share buybacks would have in terms of softening the blow from an earnings standpoint this year.

The result is that annual EPS is expected to decline more than 70% year-over-year ($1.36 vs. $4.85) despite the benefit of considerable share buybacks and will fall below FY2018 and FY2019 levels despite unit growth. The good news is that this looks to be a severe aberration in the long-term earnings trend and that FY2022 should mark the trough as the pace of promotional selling moderates post-2022. The bad news is that despite the 60% decline in the share price, the stock still trades at the same earnings multiple, given the decline in annual EPS expected this year. Let’s see whether this is priced into the stock:

Valuation & Technical Picture

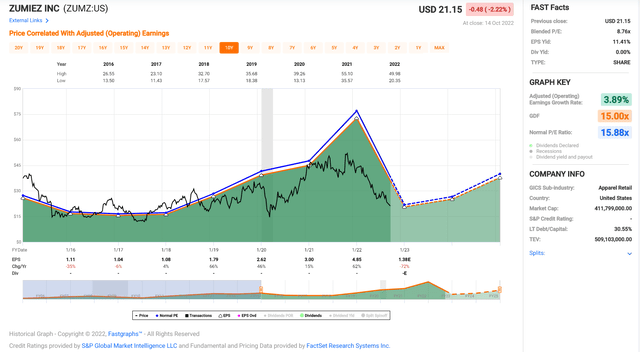

Looking at the chart below, we can see that Zumiez has traded at an average earnings multiple of ~15.9 over the past ten years, normally suggesting that the stock has become undervalued at a share price of $21.10 (12.5x forward earnings). The problem is that this earnings multiple is not nearly conservative enough for the current market environment, which is arguably nothing like the past ten years, with the potential for a very hard landing as the Federal Reserve raises rates aggressively into a slowdown. So, based on what I believe to be a more conservative earnings multiple of 12.7 (20% discount to 10-year average) and FY2023 earnings estimates ($1.69), the stock has limited upside.

Zumiez – Historical Earnings Multiple (FASTGraphs.com)

The good news is that if estimates are correct and annual EPS will improve considerably in FY2024 as margins increase, the stock has an upside case closer to $30.00 per share (12.7x FY2024 earnings estimates of $2.34). In addition, if the company can be more opportunistic with future share buybacks and continue to see unit growth, this FY2024 estimate of $2.34 in annual EPS might be far too conservative. That said, I prefer a significant margin of safety when buying small-cap stocks, and with ZUMZ trading at only a slight discount to conservative fair value ($21.50 based on FY2023 earnings), I don’t see any way to justify rushing into the stock here.

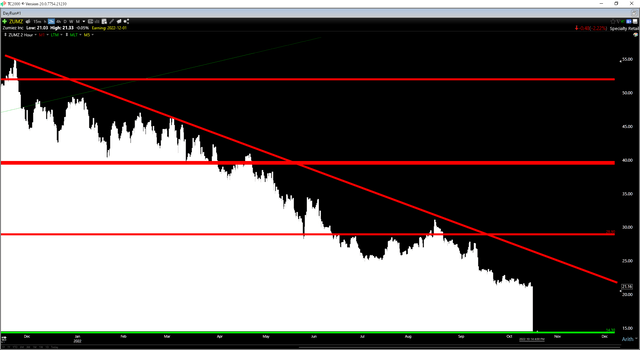

ZUMZ Daily Chart (TC2000.com)

If we look at the technical picture, it corroborates this view, with ZUMZ’s having a reward/risk ratio that’s not nearly favorable enough to justify starting a new position. This is because the stock has resistance at $28.90 and no strong support until $14.30, placing it in the middle of its support/resistance range. Given this setup, the stock would only become interesting if it declined below $15.00 within 5% of support, and any sharp rallies in the stock above $26.00 should present profit-taking opportunities.

Summary

Zumiez has had a rough year with significant revenue and earnings per share declines, exacerbated by the very difficult year-over-year comps. Unfortunately, the company’s opportunity to buy back a significant portion of its stock at depressed levels was missed, given that the company did a massive amount of buying at a much less favorable price of $40.00 per share. The good news is that Zumiez should have no trouble surviving, unlike weaker retailers, given its strong balance sheet and long history.

That said, I don’t see nearly enough margin of safety yet, and the macro backdrop remains very challenging, which favors owning names with a less discretionary tilt in the retail space. One name that looks much better positioned is BJ’s Wholesale (BJ), which is seeing accelerating unit growth but gaining market share as consumers look to save on gas/grocery due to rising prices. So, if I were looking to add exposure to the Retail Sector, I see BJ’s Wholesale as the much better option, and I’d only become interested in Zumiez stock below $15.00 near multi-year support.

Be the first to comment