mammuth/E+ via Getty Images

Investment Thesis

ToughBuilt Industries (NASDAQ:TBLT) sells hardware tools for professionals, DIYs (“Do-It-Yourselfers”), and passionate builders. At one glance, from the product catalog listing, it does not look like an appealing, forward-looking product offering that is often characterized by the likes of high-margin SaaS cloud businesses. My first thought was that TBLT belongs to one of the companies of the old economy ready to be written off as an investment vehicle.

But if we look at the company’s expansion plans, the management has made significant investments in distributing its products through popular eCommerce channels like Amazon (AMZN). Most importantly, it has achieved considerable success in doing so. This is a stark contrast to a typical ‘sunsetting’ company that belongs to the old economy.

The company also has the ambition to enter other international markets in Italy, Germany, and Spain.

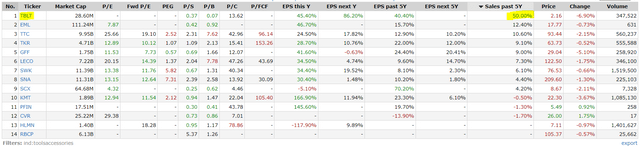

In spite of being one of the smallest players in the market, it is growing much faster than its much more established peers by market capitalization.

If we infer from Finviz, TBLT’s long-term sales performance is represented by ‘Sales past 5Y’. And if we compare it with other players in the ‘Tools & Accessories’ industry, it is the highest among all the players at 50%. The next 3 best performing players by the same criteria do not come close.

The company is currently burning cash on a consistent basis to sustain such high growth. But though additional cash flow achieved by non-operating financing means, TBLT might be able to buy itself enough time to follow through on its growth plans to achieve profitability and positive cash flow eventually.

Company Overview

TBLT develops and distributes home improvement and construction product lines under the TOUGHBUILT brand. From the company’s latest annual report 2021, these are the reported revenue from its main products:

- Soft Goods – These include kneepads, tool bags, pouches, and tool belts. This segment has contributed 40.0M in revenue in 2021.

- Metal Goods – These include sawhorses, tool stands, and workbench. This segment has contributed 26.8M in revenue in 2021.

- Electronic Good – These include digital measures and levels for the homebuilding professionals. This segment has contributed 3.2M in revenue in 2021.

Geographically, the group’s revenue comes from Australia, Canada, Europe, the United States, and other countries, with the largest revenue coming from the United States.

Strong Presence In Popular Online Platforms

When we think of ‘glamourous’ retail companies with high-profit margins, what comes to mind are online eCommerce platforms like “Amazon”, “Walmart”, and “Lowe’s”. These businesses are ‘great‘ because the platforms are able to reach large masses of potential customers with minimal costs incurred.

TBLT, with its portfolio of mainly manual, functionally tough-looking hardware tools used by individual customers, hardly fits the category of a ‘great‘ business. Its products also do not form an ecosystem that is interdependent in usage to create a network effect.

However, the silver lining is the company has made significant efforts to leverage these great eCommerce platforms to advance its selling efforts. As described in the company’s annual report 2021:

In 2021, our online sales through Amazon totaled $12 million, an increase from $7 million for fiscal 2020, a 71% increase from 2020 to 2021.

From the company’s Q2 Quarterly Report:

Revenues increased in 2022 over 2021 by $2,034,287, or 12.83%, primarily due to wide acceptance of our products in the tools industry and receipt of recurring sales orders for metal goods and soft goods from our existing and new customers, and introduction and sale of new soft goods products to our customers. An increase in sales through Amazon was a major factor of the increase.

Apart from Amazon, the company also has significant product placement in Walmart and Lowe’s online marketplace.

As consumer progressively buys from these online platforms instead of physical retailers, TBLT’s progressive pivot to these online platforms to advance its selling could result in long-term revenue growth and reduced costs from maintaining physical stores.

Expansion In Europe Through Amazon And Distributor Agreements

As mentioned in the previous section, TBLT has had significant success in selling through Amazon. As such, the company is reusing this successful playbook to expand into specific European markets of Italy and Germany.

For a start, the company is launching 93 products on Amazon.it (“Italy”) and Amazon.de (“Germany”).

To gain a deeper penetration in the German market, TBLT also secures new distributor agreements with 4 major retailers in Germany

If these initiatives prove to be as successful as in the US, we expect the company to increase its product catalog.

Expansion In The Spanish Market

While the company is based in the US, it is making significant expansions to the Spanish market as well.

TBLT has signed supply agreements with California purchasing and service centers Elecktro3 and NCC to strengthen its presence in the Spanish hardware market.

‘Cecofersa‘ is Spain’s largest single-sourcing group for industrial hardware and consumables. The group has 120 members and operates 250 stores in Spain and Portugal.

We expect this synergistic partnership to greatly expand TBLT’s presence in the Spanish market.

Income Statement Analysis

Earlier, we mentioned briefly that TBLT is growing much faster than its more established peers. Let’s look at the company’s income statement to have a sense of whether the growth is sustainable.

Income Statement (Seeking Alpha) Income Statement (Seeking Alpha)

Inferring from Seeking Alpha’s Income Statement since 2014, we can derive the following insights:

- TBLT has enjoyed stellar growth in top-line revenue since 2015. YOY, it grows at a high double-digit of greater than 20% in most years. In 2020, its revenue even doubled from the previous year and in the last financial year of 2021, it grew by 77.58% from its previous year. The cost of revenue has been kept low allowing these stellar gains in revenue to trickle down to its gross profits.

- Unfortunately, maintaining such tremendous top-line growth comes with huge operating costs. The total operating cost has been increasing consistently since 2014.

- Due to its high operating costs that outstripped its gross profits the company’s operating income has been increasingly negative in most years since 2014. TBLT’s latest reported operating loss is 53.8M, the largest recorded since 2014.

- In the latest reported TTM period, TBLT recorded some additional income from non-operating means, which help to ‘cushion’ the operating loss (but just a little).

- Overall, the company still recorded the highest operating loss of 48.3M in the latest TTM period.

With an ever-increasing operating loss sustained since 2014 despite its extraordinary revenue growth, it is questionable whether its growth is sustainable over the long run.

Cash Flow Analysis

TBLT’s huge ‘accounting’ loss might have spooked investors enough to create a huge sell-off. The stock price has fallen from a high of about $3600 in 2019 to a current price of just slightly above $2.

Despite the huge ‘accounting’ loss, at the end of the day, ‘Cash Flow’ pays the bills to ensure the company survives long enough to follow through with its growth plans to ensure future profitability.

Selected Data From Cash Flow Statement (Seeking Alpha)

Looking at the Net Cash Flow, it is not sustaining losses on a ‘consistent’ basis, unlike its accounting loss. In most years, it is either break-even or mildly positive.

TBLT’s operating cash flow is not positive. Therefore, most of its cash was derived from non-operating means of financing.

Cash Flow Detailed Line Items (Seeking Alpha)

If we look at the detailed line items of where the company’s non-operating cash flow comes from, it’s mostly by:

- issuing more company shares (in 2020 and 2021)

- and incurring more debt (in 2016 and 2019)

Point 1 depressed the value of investors’ holdings and point 2 reduces the company’s valuation. Both approaches are not ideal means of generating cash flow in the long run. But still, for now, it has generated the much-needed cash to sustain its expenses to maintain a high revenue growth rate.

Ideally, we would want to see the company sustain increasingly positive net cash flow. Right now, TBLT is not in this ideal situation now. But it still suggests that TBLT is able to ‘pay the bills’ most of the time, for now.

Cash Burn

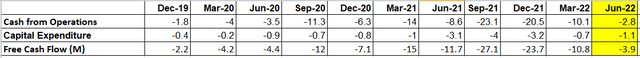

The company is already burning cash from its current business ‘operations’. If we include the capital expenditure required to maintain and expand its scope of operations to secure its stellar revenue growth, the resulting Free Cash “Outflow” is even greater:

Selected Data From Cash Flow (Seeking Alpha)

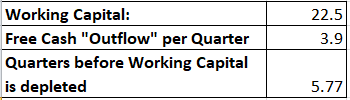

The next logical question is how long can the company burn its cash at the current rate. From the company’s Q2 2022 earnings call, management called out their working capital to be $22.5M.

Our balance sheet as of June 30, 2022, our cash position was $2.1 million, our accounts receivable were $15 million, our inventory was $40.2 million, our prepaid and other current assets was $2.6 million. Subtracting our current liabilities, $37.4 million, this gives us a working capital of $22.5 million.

If TBLT maintains its current cash outflow of 3.9M per quarter, the company will run out of working capital within the next 5.77 or ~6 quarters (1.5 years)

Depletion of Working Capital (Calculated by Author)

If the company is still not profitable in free cash flow after 1.5 years, it will need to take on additional non-operating financing activities of issuing more stocks and taking on more debt, as it has done since 2016.

Valuation

TBLT is not profitable in net income. Neither is it cash flow positive. As such, we cannot value the intrinsic value meaningfully using discounted cash flow or discounted net income. We shall compare the valuation of TBLT using its Price / Sales ratio and compare it with its competitors with comparable market capitalization:

- The L.S. Starrett Company (SCX) – 64.68M in market capitalization

- Chicago Rivet & Machine Co. (CVR) – 25.22M in market capitalization

- P&F Industries, Inc. (PFIN) – 17.51M in market capitalization

From the value of ‘Price/Sales’, TBLT is clearly the most undervalued among its competitors. The current price may look relatively cheaper compared to its competitors but without a proven record of being consistently profitable in bottom lines, cheap can get even cheaper and so I will not regard this undervalued status as a buy signal.

Investment Risk

The company is still unprofitable. Although TBLT is growing much faster than its competitors in terms of the top line, investors should only invest a significantly smaller amount to mitigate the risk of TBLT not being able to turn around and achieve profitability eventually.

Conclusion

At first glance, TBLT sells a portfolio of products that is reminiscent of those belonging to a sunset company in the old economy. However, the management has been forwarding looking to sell these products through highly popular online channels like Amazon which are producing results.

The company is also ambitious in pursuing growth opportunities in international markets to further advance its presence beyond its home US market. These efforts are yielding results as observed from its much higher growth in top-line revenue compared to its more established competitors.

While investors should be aware of the downside of the company sustaining negative free cash flow on a consistent basis, investors should also observe that the company’s revenue growth has also been extraordinarily favorable compared to its peers, as discussed in earlier sections.

Still, the company is not profitable in net income and sustaining negative free cash flow. Conservative investors should only invest significantly in TBLT only when it becomes profitable and has a positive cash flow.

Investors who are more aggressive should still insist the company achieve at least a positive free cash flow, even if it is not profitable in accounting terms.

TBLT is now selling at just $2 and is considered a nano-cap by market capitalization. If investors feel compelled to take a position right now to take advantage of the small firm effect, the position size should be much smaller than usual. Without a consistent track record of profitability, I consider such an investment as ‘speculative’.

Be the first to comment