Drew Angerer

Introduction

There we are again. Another Federal Reserve rate hike, another press conference. The Fed just hiked by 50 basis points as it tries to control what looks to be persistently high inflation. Moreover, the bank now sees higher unemployment and lower growth in 2023 and 2024 than it previously expected.

In light of the hawkish versus dovish discussion, it bothers me that we might very well be in a new age of investing, as the Fed is unlikely to go back to normal anytime soon. Yes, inflation is coming down, but it needs a lot to push inflation to normal levels – let alone keep it there.

In this article, I will discuss the latest Fed decision, Powell’s comments, my view on the bigger macroeconomic picture, and why I believe that we’re in a new investment era.

So, bear with me!

Sea Change & A Hawkish Fed

Let’s start this article by ignoring what just happened. I first want to talk about the bigger picture.

As some of my followers may know, I’m a huge fan of investing legend Howard Marks. He just wrote another one of his famous memos titled “Sea Change”.

He basically makes the case that we’re in a new investment environment. It’s something I have been working on since 2021 and communicated through multiple articles. He’s just way more experienced and nailed it in his latest memo.

In his memo, he made the case that we’re in a new era of investing. The period between 2009 and 2021 saw mostly low inflation, accommodative central banks (they were not pressured to hike), strong innovation from i.e, major tech firms, and high growth in emerging markets like China. It was the perfect environment to put money to work in i.e., high beta stocks.

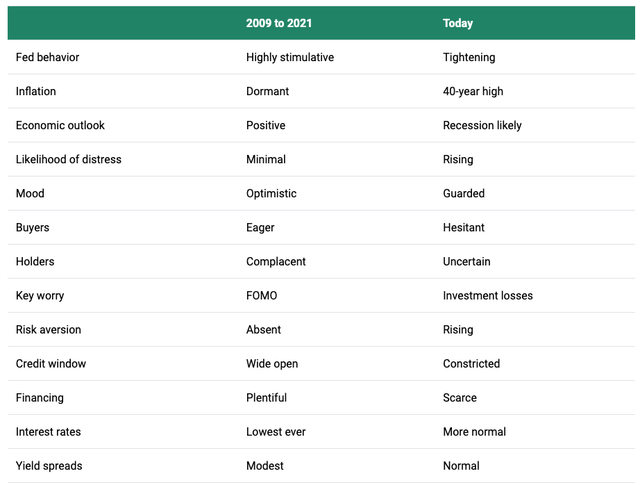

Oaktree Capital

Now, that is changing. While I might be wrong (who can predict the future?), it seems that the current wave of inflation isn’t something we saw between 2009 to 2021. Not only is inflation higher now, but it’s also driven by secular factors. For example, structural labor deficits, commodity supply issues (made worse by ESG initiatives), and deglobalization.

In other words, I don’t believe that inflation will come straight down to 0-2% again with global central banks maintaining rates close to zero percent on a long-term basis. You know, the stuff we enjoyed before the pandemic.

Allow me to quote some parts of his conclusion. The parts that really stood out.

– While some recent inflation readings have been encouraging in this regard, the labor market is still very tight, wages are rising, and the economy is growing strongly.

– Globalization is slowing or reversing. If this trend continues, we will lose its significant deflationary influence. (Importantly, consumer durables prices declined by 40% over the years 1995-2020, no doubt thanks to less-expensive imports. I estimate that this took 0.6% per year off the rate of inflation.)

– Before declaring victory on inflation, the Fed will need to be convinced not only that inflation has settled near the 2% target, but also that inflationary psychology has been extinguished. To accomplish this, the Fed will likely want to see a positive real fed funds rate – at present, it’s minus 2.2%.

– The Fed faces the question of what to do about its balance sheet, which grew from $4 trillion to almost $9 trillion due to its purchases of bonds. Allowing its holdings of bonds to mature and roll off (or, somewhat less likely, make sales) would withdraw significant liquidity from the economy, restricting growth.

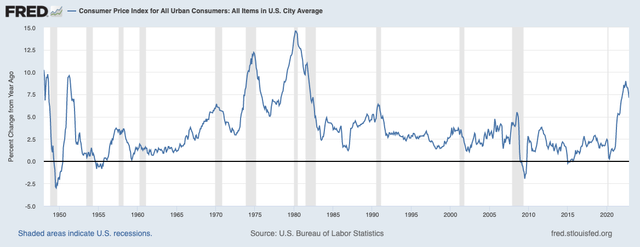

I believe one of the single most important things (some) people forget is what happened in the 1970s (and 1980s). Rapid switches from hawkish to dovish caused inflation to rebound, which then required a hawkish Fed intervention again.

St. Louis Federal Reserve

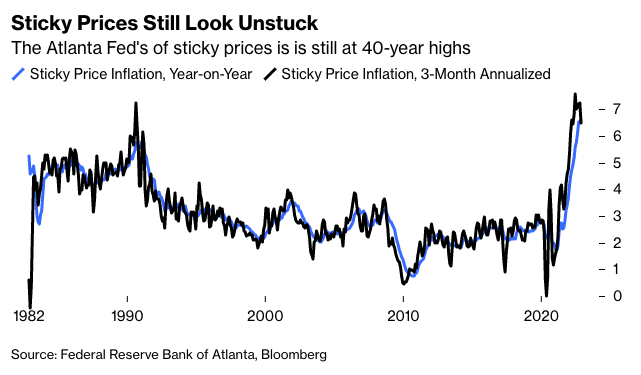

Moreover, while inflation is coming down, sticky inflation remains strong (or should I say “sticky”?). That’s an issue. The same goes for wage inflation. Getting these numbers down might mean hiking in a situation where “average” inflation makes it look like everything is back to normal again.

Federal Reserve Bank of Atlanta, Bloomberg

Given what we just discussed, I see a lot of reasons that could lead to accelerating inflation the moment the Fed makes it look like we’re going back to “normal”.

The Wall Street Journal hit the nail on the head when it highlighted these issues in a recent article:

Several Fed officials, including Mr. Powell at a news conference last month, have suggested it would be worse for the country if inflation resurges and they have to restart rate increases later in 2023 than to raise rates too much and trigger a recession.

Mr. Volcker’s experience shows “when there are recessions triggered by tight monetary policy to crush inflation, the recovery can be very quick from that,” said Minneapolis Fed President Neel Kashkari during a panel discussion on Oct. 18. Since joining the Fed system in 2016, Mr. Kashkari was among the central bank’s biggest doves. This June, he revealed his rate-rise projections were among the most hawkish of his colleagues.

Essentially, the plan Powell had in mind is working its way to a level that feels right. After that holding rates longer at higher levels, instead of cutting too early.

Now, there are a lot of uncertainties in that sentence. What are levels that feel right? What are high-interest levels, and what is cutting too early?

Answering these questions is what makes the market so nervous. It’s also the reason why I do not believe in a sudden stock price rally to new highs. I believe the market will remain in a very volatile and wide sideways range until at least 2024. It’s also the reason why I increasingly focus on higher-yielding stocks.

With that said, here’s what Powell just said.

Powell’s Hawkish

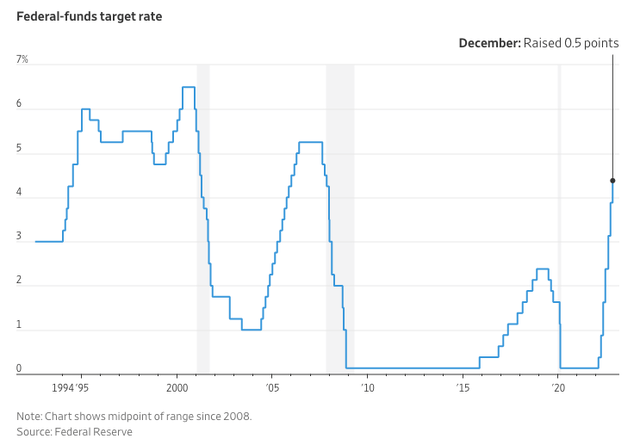

As you may be aware by now, the Fed hiked interest rates by 50 basis points to the 4.25% to 4.50% range.

Wall Street Journal

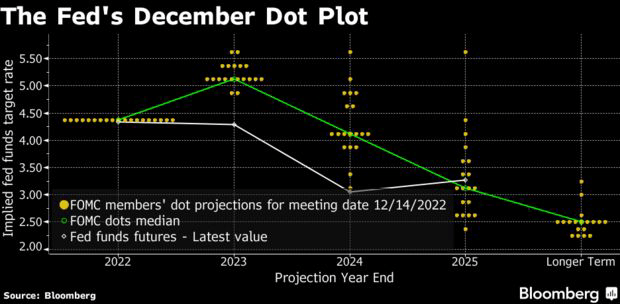

The median policymaker forecast is that rates would end next year at 5.1%. In 2024, we might see the Fed cut rates.

Bloomberg

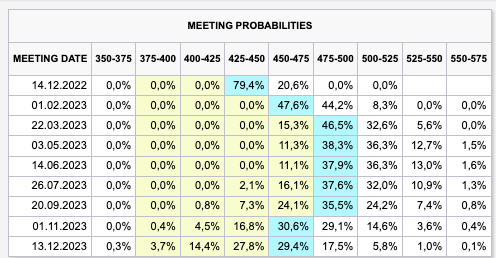

This is more hawkish than the market expected. CME Group (CME) fed funds rate futures show that the market expected the Fed to cut rates in late 2023. Moreover, the market did not expect the terminal rate to cross the 5.0% mark.

CME Group

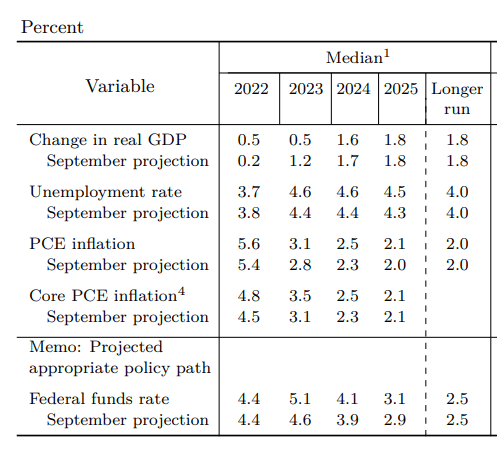

It also doesn’t help that the Fed is now seeing higher unemployment in the years ahead. GDP growth is expected to be significantly lower next year.

Federal Reserve

Moreover, Powell basically said what I expected – in light of the comments in the first half of this article:

Powell restated that policy will need to remain tight for “some time” to restore price stability. He provided no dovish relief and emphasized that the Fed needed more evidence beyond October and November’s softer consumer price index numbers to have confidence that inflation is coming down meaningfully. He also said that the size of February’s rate hike will depend on incoming data.

Moreover:

“The Fed still remains coy about the possibility of recession, but with most Fed officials considering risks to be tilted to the downside, it’s fair to say they are far more worried about the economic outlook than they are willing to admit,” said Seema Shah, chief global strategist at Principal Asset Management. “This should mark the death knell for the most recent bear market rally.”

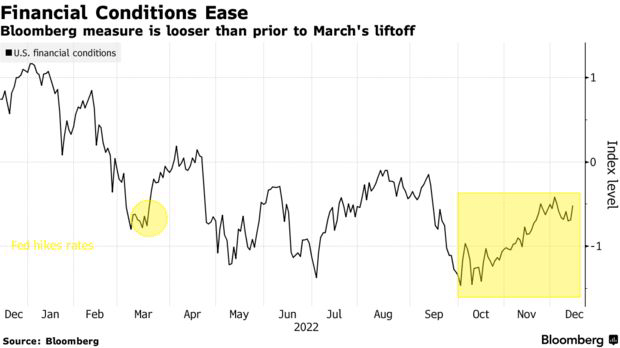

Unfortunately, the fact that the market has bet on the Fed becoming dovish has caused financial conditions to ease. That’s not what Powell wants to see in order to fight inflation.

Bloomberg

With all of this in mind, here’s my takeaway.

Final Thoughts

Predicting markets is hard. More often than not, it’s based on luck. I’m not pretending that I know where this market is headed. Especially not in the short term.

However, I am convinced that the odds are in my favor when I make the case for a prolonged sideways trend in the market. We’re truly in a new market environment. Inflation is high and very sticky, economic growth is weakening, and the Fed is more hawkish than the market expected.

Even worse, the Fed may be hawkish for longer as Powell is likely to do whatever it takes to avoid what happened in the 1970s.

Hence, I believe that investors need to be aware that this isn’t a temporary thing. We’re likely stuck with a hawkish Fed well into 2023.

Don’t get me wrong. I’m not bearish. I have zero shorts and almost all of my money is in dividend stocks. The only thing I’m changing is that I keep a bit more cash to buy bigger corrections. Also, I’m buying more high-yield than I did prior to the second half of 2022.

Other than that, I’m fine with my current holdings (as seen in my bio) and my strategy. Even if I’m wrong and we’re going back to normal, I won’t be in a bad spot.

Going forward, we’ll continue to discuss these issues and work on investment ideas.

For now, the takeaway is to be prepared for what could very well remain a tough market for longer than most market participants expect.

Buckle up!

(Dis)agree? Let me know in the comments!

Be the first to comment