Oscar Gutierrez Zozulia

Hancock Whitney Corporation (NASDAQ:HWC) continues to weather the stormy market. Its strong positioning keeps its steady revenue growth and margins. It benefits from the solid balance sheet with the excellent loan and deposit mixes. Indeed, HWC enjoys its robust loan demand. It matches the excellent loan and deposit mixes. As such, the company leverages its top-line sensitivity to interest rate hikes.

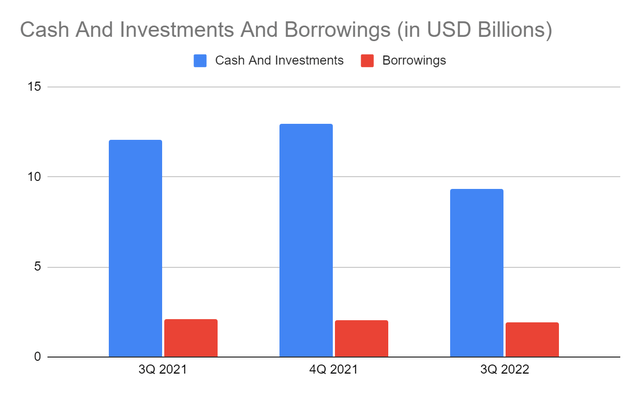

In addition, cash levels and borrowings are stable. It is no wonder dividend payments remain sustainable. Also, yields remain attractive, which is way better than market index averages. Meanwhile, the stock price remains consistent with fundamentals, with moderate upside potential. It is near the target price despite the continued decrease in the last month.

Company Performance

In the face of rising rates, Hancock Whitney Corporation demonstrates financial stability. It keeps exceeding market and company expectations as results remain enticing. Despite the market pessimism, the company remains well-positioned. Near-term growth may get hammered, but it maintains a high capacity for a solid rebound.

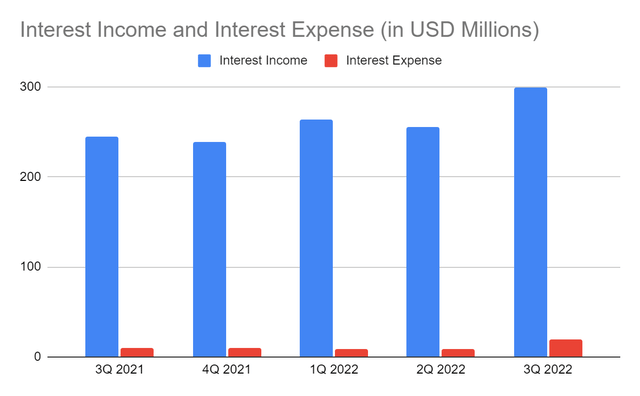

Interest Income And Interest Expense (MarketWatch)

Its interest income amounts to $299 million, a 22% year-over-year growth. Indeed, the recent quarter is one of the best in history. Several factors drive this substantial revenue growth. First, loan growth exceeds expectations, partially driven by HWC’s excess liquidity. It reaps the rewards of having rate-sensitive loans amidst interest rate hikes. Note that 57% of HWC’s loans are from the commercial and industrial segments. Even better, the majority of real estate loans are commercial loans. So if we combine them, 73% of the total loans are from the C&I segment. Hence, loans are more secure even when the recession hits the US. It is also no surprise that loan yields keep increasing. Yields for fixed-rate loans are now 5.28%, while 4.79% for variable loans. On average, loans have 4.9% yields.

Another growth driver is HWC’s prudent diversification of investment securities. There are mixed changes in securities, but their combined value remains stable. Despite the inverse relationship between interest rate hikes and securities, yields keep increasing. They are now at 2.17% compared to 1.91% in the comparative quarter. Also, they are in a continued uptrend, showing the excellent quality of securities. We can attribute it to the fact that most of these are backed by the government. So, they are more inflation-linked and resistant to inflationary headwinds. Overall, the change in loans and securities mix remains favorable for the company. Yields are more consistent with interest rate hikes.

Likewise, the interest expense of $19.5 million is already twice as much as it was in 3Q 2021. Despite the recent deposit outflows, costs skyrocketed due to interest rate hikes. It can be alarming as deposit costs are now 19 bps versus 7 bps in the comparative quarter. Even so, it remains way lower than the industry average. As such, HWC incurs more manageable interest expenses.

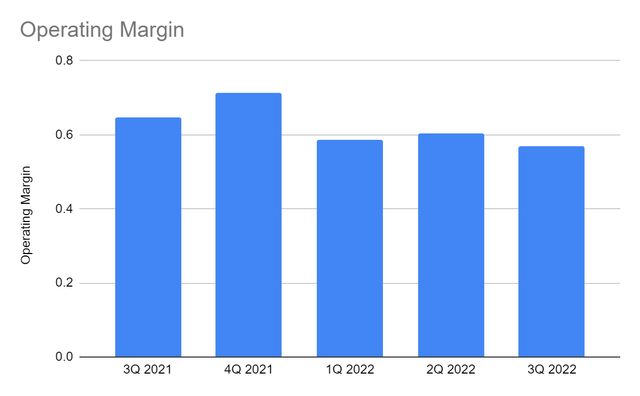

Meanwhile, the non-interest segment remains relatively stable. Fee income remains stable despite seasonality and interest rate hikes. But there’s a notable decrease in the secondary mortgage market and other income. The company’s operating margin is 57%, down from 65% in 3Q 2021. Nevertheless, results still show an improvement with an efficiency ratio of 52%.

Operating Margin (MarketWatch)

Another thing we can appreciate is how the loan and deposit mix responds well to market changes. Loan beta offsets deposit beta, so the interest segment remains sound and robust. Therefore, it continues to benefit from its top-line sensitivity to interest rate hikes. It can be shown by the ROA of 1.56% and ROTCE of 21.58%. Both are above company projections.

Looking ahead, I expect Hancock Whitney to remain a stable company. Although near-term growth may get hammered, its ability to withstand blows is evident. It is well-capitalized, allowing it to expand to other markets. Doing so may also support its growth potential. I expect its earnings growth to be at 5-8% in the following quarters. The improvement in utilization rates can be its primary growth driver. Its higher degree of operating leverage may also be helpful. It may allow the company to sustain its income on each incremental revenue. Note that a recession can lessen the impact of loan growth and earning assets.

Market Changes And Core Competencies

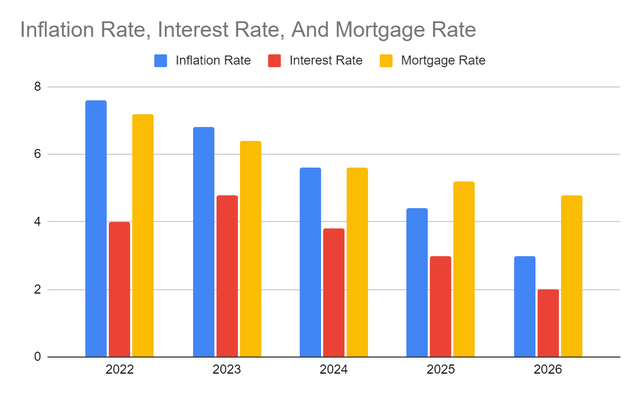

Inflation remains elevated, but it has started to cool down recently. It may have already reached its peak as inflation drops again to 7.1% this month. With that, I expect interest rates to increase still. But increments may slow down before stabilizing. Headwinds may stay but may give less pressure than expected. More importantly, unemployment remains stable, and so does the purchasing and borrowing capacity.

Inflation Rate, Interest Rate, And Mortgage Rate (Barron’s, Forbes, Author Estimation)

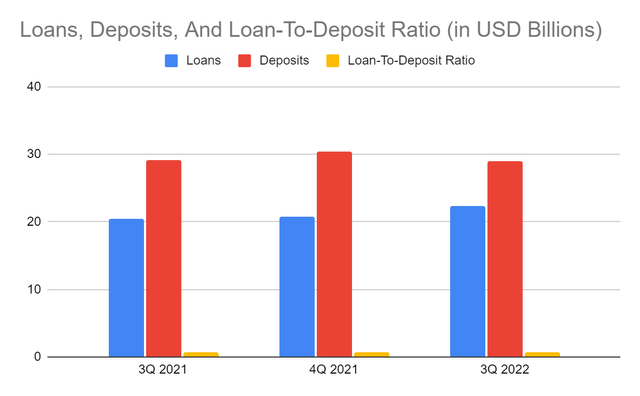

Despite the improvement, HWC remains well-positioned against potential headwinds. Loan growth remains the cornerstone that drives interest income growth. It must only watch out for deposit outflows, which may affect liquidity. Thankfully, loan and deposit betas remain better than the market average. Also, the loan-to-deposit ratio of 76% shows HWC’s sustainability. The company remains liquid and has more reserves even during defaults. Even better, non-performing loans are only 0.19% compared to 0.33% amidst interest rate hikes. HWC maintains impeccable loan growth and quality.

Nevertheless, the company keeps a conservative approach to growth with 1.35% provisions. I expect loan growth at 7-8% with the current market conditions and seasonality. Meanwhile, I expect more deposit outflows of 3-5% due to a potential increase in spending.

Loans, Deposits, And Loan-To-Deposit Ratio (MarketWatch)

Moreover, cash levels remain stable, with a slight uptrend at $590 million. Investment securities have mixed changes, but the combined value remains almost the same. Bank deposits are way lower than in the previous quarter. We can attribute it to the funding of deposit outflows and share repurchases. Borrowings are also stable, which can help manage expenses amidst interest rate hikes. HWC remains liquid as cash, deposits, and investments comprise 25% of the total assets. It is well-capitalized with a stable TCE, leverage, and total risk-based capital ratio. Given these figures, HWC can sustain its operations and expand to nearby markets.

Cash And Investments And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Hancock Whitney Corporation remains on an uptrend. There has been a slight downtrend in the last month, but the increase remains prominent. At $51.32, it remains 4% higher than the starting price. The difference remains narrow, showing more room for an upside. Given the current price-earnings multiple of 8.9x, it appears reasonable. NASDAQ adheres to it with an EPS estimation of $5.97-$6.18. If we multiply it with NASDAQ estimates, the stock price must be $53.13-55.09. It shows a potential 4-8% upside in the next 12-18 months.

Meanwhile, dividend payments are consistent with promising yields of 2.07%. It is way better than the S&P 400 and NASDAQ composite average of 1.21% and 1.24%. It remains well-covered since the Dividend Payout Ratio is only 17%. To assess the stock price better, we will use the DCF Model.

FCFF $288,800,000

Cash $590,000,000

Borrowings $1,900,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 85,686,000

Stock Price $51.32

Derived Value $55.

The derived value adheres to the estimation using the price-earnings multiple. There may be a 7% upside in the next 12-18 months. Investors may consider it an ideal entry point to make a position.

Bottom Line

Hancock Whitney Corporation enjoys its top-line rate sensitivity. It remains on a solid footing with its prudent earning asset management. Hancock Whitney Corporation’s solid and intact fundamentals help sustain the operating capacity and dividend payments. Also, the stock price is still attractive, with moderate upside potential. The recommendation is that Hancock Whitney Corporation is a buy.

Be the first to comment