Lea Toews/iStock via Getty Images

Whether or not green hydrogen has a promising future, Plug Power (NASDAQ:PLUG) shareholders will struggle to be rewarded with the company constantly missing financial targets when producing large losses. While the company does constantly continue to grow, Plug Power racks up large losses due to building a business for a far bigger revenue base than actual results. My investment thesis remains very Bearish on the stock due to the constant revenue misses and plant delays from over promising on business opportunities.

Double Whammy

Prior to the annual symposium, Plug Power cut the revenue targets for the year to 5% to 10% below a prior revenue target of $900 to $925 million. The new guidance suggests revenues only reach $821 to $867 million for the year for up to a $100 million cut to revenue estimates in the 2H of the year alone.

The company has only produced quarterly revenues in the $150 million range, so any target topping $800 million for the year would equate to substantial growth in the period. Analysts still have revenues jumping to ~$250 million in Q3 with another big leap to $317 million in Q4.

Plug Power missing financial targets by a large amount is where the company will struggle to reach profitability with fixed costs ramping up with the corresponding revenues rolled into future periods.

In addition to the pushed-out revenue targets, Plug Power apparently abandoned two plants in Pennsylvania and Canada and expects delays in a third plant in New York. True to the form of the company, management immediately announced a JV for another 15-tons/day hydrogen plant with Olin Corp. (OLN) in Louisiana.

As discussed in my previous research, the company promises a lot of action and doesn’t deliver with the recent warnings fitting this bill to a tee. A prime example of this situation is that Plug Power doesn’t actually have the backlog to achieve the proclaimed financial targets in the short term.

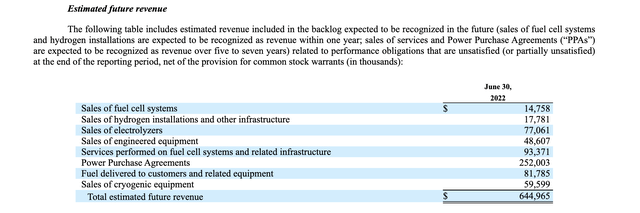

At the end of June, Plug Power listed estimated future revenues (backlog) of $645 million in total. The key to this number is that the backlog is generally expected to be realized over a year period, except for the Power Purchase Agreements that amount to 5 to 7 years of backlog.

Otherwise, the backlog for the next year is actually closer to only $400 million, yet management originally guided to 2H revenues of closer to $600 million. Plug Power cut 2H revenue estimates to closer to $550 million at the midpoint now, but the company would need a backlog of at least $1 billion to generate half those revenues in just 2 quarters.

Remember, this backlog included projects now cancelled or pushed out into 2023. Plug Power didn’t provide the impact on the backlog of these figures, but one can generally assume a nearly $100 million worth of this backlog got pushed out to 2023, at the earliest.

Even worse, the backlog from Q2’21 was ~$474 million and the company generated ~$598 million in revenues over the next year. In addition, most of the backlog gains in the year were the $55 million for Power Purchase Agreements and $49 million for the discontinued Oil & Gas Equipment business along with the $60 million for the Cryogenic Equipment.

The key Hydrogen backlogs are down to flat and the other gains come from acquired businesses such as the Cryogenic Equipment business unit acquired via the Applied Cryo Technologies purchase during Q4 last year.

Higher Costs

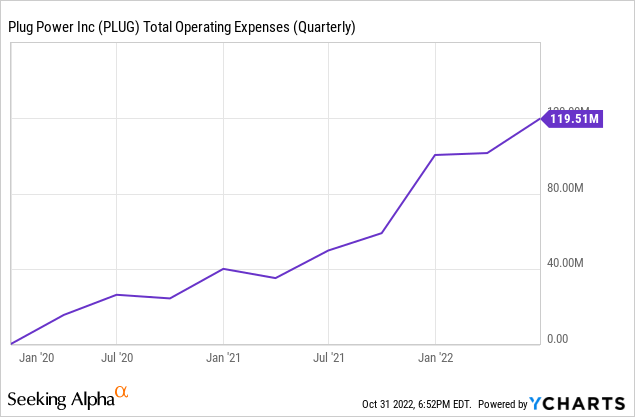

The worse part is that these increases in backlog and expected business came at a massive cost of higher expenses. Plug Power now spends vastly more in operating expenses due to the acquisitions that helped provide the additional backlog.

In the last quarter, the company had total operating expenses of $119 million, up from only $49 million in the prior Q2. Plug Power only boosted R&D spending in the quarter to $24 million, up from just $11 million last Q2.

The company has to spend substantially on SG&A to run the operations and sign new deals. The costs clearly require Plug Power to hit revenue targets considering the company doesn’t have any positive gross margins to offset operating expenses.

Remember, good companies with a competitive advantage can sell products at premium prices and command strong margins. Plug Power might still be in the startup phase, but the company needs to start delivering better financial results.

Takeaway

The key investor takeaway is that Plug Power has a market cap of over $9 billion now. Investors have no reason to rush into the stock here until the company shows better fiscal responsibility.

Green hydrogen has a lot of potential, but I think the company hypes growth opportunities too much and investors should require management to meet targets and improve margins before investing.

Be the first to comment