redtea/iStock via Getty Images

On Tuesday, November 1, 2022, midstream master limited partnership Energy Transfer LP (NYSE:ET) announced its third quarter 2022 earnings results. We have been seeing a trend over the past few quarters of midstream companies generally posting stronger results than in the prior-year quarter. That continued here, as Energy Transfer managed to post higher revenues and earnings than in the third quarter of 2021.

The market was generally critical of the company’s performance, though, as Energy Transfer missed the expectations of analysts in terms of both revenues and net income. These results were certainly not at all bad, though. The company saw considerable growth in its natural gas segment in particular, and fundamentally this could be a major growth engine for it, particularly as the emerging liquefied natural gas sector becomes a more important player in the American economy. Energy Transfer is currently involved in a number of projects to take advantage of this trend and position itself for growth over the next few years. When we combine this with a rock-solid balance sheet and a very high distribution yield, we continue to see a lot of things to like here even if the market is rather disappointed with the company’s revenue and earnings misses.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Energy Transfer’s third-quarter 2022 earnings results:

- Energy Transfer reported total revenues of $22.939 billion in the third quarter of 2022. This represents a 37.66% increase over the $16.664 billion that the company reported in the prior-year quarter.

- The company reported an operating income of $1.973 billion in the most recent quarter. This compares quite favorably to the $1.437 billion that the company reported in the year-ago quarter.

- Energy Transfer transported an average of 14.878 trillion BTU of natural gas per day in the reporting period. This represents a significant 28.25% increase over the 11.601 trillion BTU of natural gas per day that the company transported on average during the equivalent period of last year.

- The company reported a distributable cash flow of $1.581 billion during the current quarter. This compares very favorably to the $1.312 billion that the company reported last year.

- Energy Transfer reported a net income of $1.006 billion in the third quarter of 2022. This represents a 10.92% increase over the $907 million that the company reported in the third quarter of 2021.

It is quite certain that the first thing that anyone reviewing these highlights will notice is that essentially every measure of financial performance showed considerable improvement relative to the year-ago quarter. This puts Energy Transfer’s earnings miss in a completely different light, as the company did indeed deliver growth, it just was not as strong as analysts expected. This growth is a continuation of the trend that we have been seeing in many of the company’s peers across the midstream industry and it is driven by many of the same factors.

One of the biggest reasons for this growth is the substantial increase in transported volumes that the company experienced compared to the prior-year quarter. As we saw in the highlights, Energy Transfer’s shipments of natural gas increased substantially but this is not the only area in which the company experienced volume growth:

|

Business Unit |

YOY Growth |

|

Natural Gas |

28.25 |

|

Crude Oil Transportation |

10% |

|

Natural Gas Liquids Transportation |

5% |

The reason why this resulted in growth is because of the business model that Energy Transfer uses. Basically, the company enters into long-term (typically five to ten years in length) contracts with its customers. The customer sends resources through Energy Transfer’s pipelines and other infrastructure to get them from the oil and gas fields to the market. Energy Transfer then bills the customer based on the volume of resources that are transported, not on the value of said resources. Thus, when transported volumes increase, revenues and cash flows increase. We see that reflected in these results. It seems likely that Energy Transfer will see further volume increases in the fourth quarter. This is because upstream producers have grown their own output to take advantage of today’s high energy prices. As we can see here, production in several basins throughout the country is currently higher than in the corresponding period of last year:

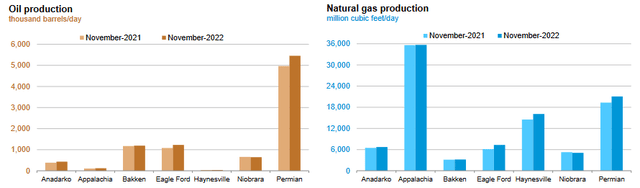

U.S. Energy Information Administration

We can see some increases in the Permian Basin, Appalachia, and Haynesville Shale, which are all areas in which Energy Transfer operates. This should result in the company’s fourth-quarter results being somewhat better than its fourth-quarter 2021 ones due to higher volumes. After all, someone has to transport the resources from the basins where they are produced to the market where they can be sold. This is the business that Energy Transfer is in, and given the company’s enormous size, it seems logical that it would get some of this business. Thus, we can conclude that Energy Transfer will likely see higher transported volumes than last year, and considering that the company’s cash flows tend to correlate with transported volumes, it should see higher cash flows.

Another one of the major factors that allowed Energy Transfer to increase its transported volumes so significantly year-over-year is the same thing that benefited the firm in both the first and second quarters of 2022. This is the company’s acquisition of Enable Midstream, which was consummated in December of last year. This acquisition significantly increased the company’s presence in the Haynesville Shale, which is generally considered to be the richest source of natural gas in the United States after Appalachia. As we can see above, the Haynesville Shale delivered fairly substantial year-over-year production growth, far exceeding the growth in Appalachia on a percentage basis. This benefited Energy Transfer for reasons that were already discussed, which management pointed out in the earnings press release.

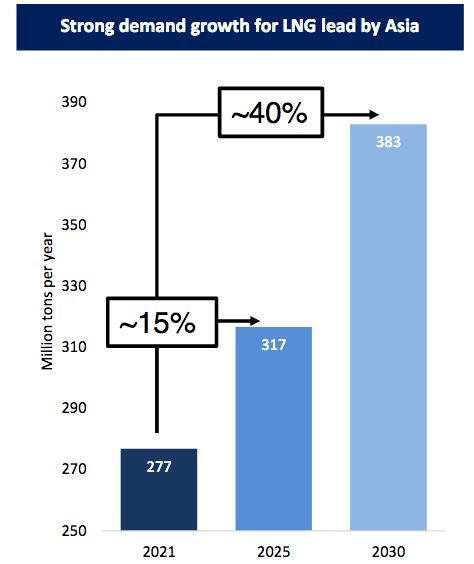

The Haynesville Shale is likely to continue to see fairly significant production growth over the next few years. This is due at least partly to the emerging liquefied natural gas export industry. As I have discussed in several previous articles, the demand for liquefied natural gas is likely to grow substantially over the next ten years due to climate change concerns around the world as well as a desire among numerous countries in Europe to reduce their dependence on Russian natural gas. In Asia, the demand for the substance is expected to increase by 40% by 2030 as Asia works to address their smog problems:

Golar LNG

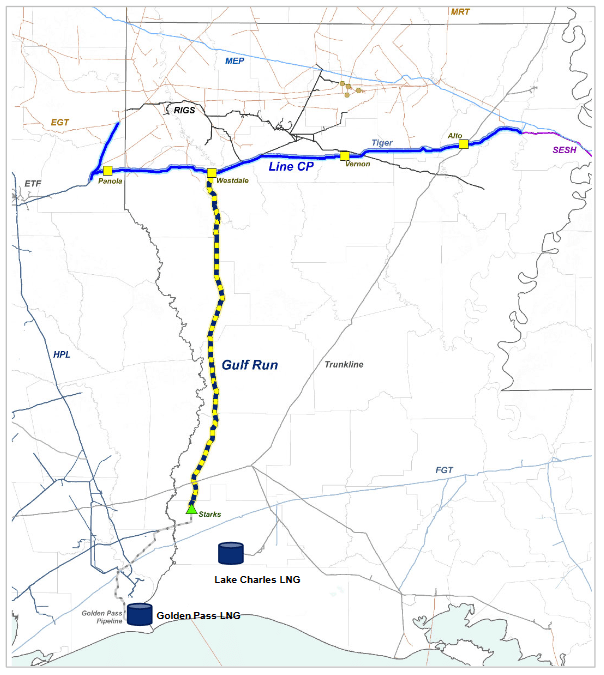

The United States is one of the few countries in the world that is capable of producing sufficient liquefied natural gas to meet this demand due to the incredible resource wealth in places like Appalachia and the Haynesville Shale. As a result, the energy industry has been constructing a number of liquefaction plants that convert natural gas into its liquid form. The majority of these plants are located along the Gulf Coast in Texas and Louisiana as that is where the American energy industry has been historically centered. Energy Transfer’s position in the Haynesville Shale, which is located in East Texas and Louisiana, positions it well to transport natural gas to the new liquefaction plants. The company is in fact already moving to take advantage of this opportunity. One of the company’s major projects to do so is the Gulf Run Pipeline Project, which runs 135 miles from Westdale to Starks, Lousiana:

Energy Transfer

When the project is complete, this pipeline will be capable of carrying approximately 1.65 billion cubic feet of natural gas per day over its length. As we can see in the map above, there are two liquefaction plants within close proximity to the pipeline’s destination point that could use this natural gas in their operations. Energy Transfer has already secured a contract with one of them. The Golden Pass liquefaction plant, which is owned by Exxon Mobil (XOM) and Qatar Petroleum, has agreed to purchase 1.1 billion cubic feet of natural gas per day for the next twenty years. That alone is sufficient for the pipeline to be cash flow positive and it still gives Energy Transfer room to increase its cash flow from the project by contracting out the remaining 550 million cubic feet per day of capacity. Thus, we can expect the pipeline to have a positive effect on Energy Transfer’s financial performance once it begins operation. The company reported in its earnings report that it has completed the construction of the pipeline itself and is now working to set up the necessary compression along the mainline with the goal of having the pipeline operational in early 2023. This thus sets the company up pretty well for more growth as we enter the new year.

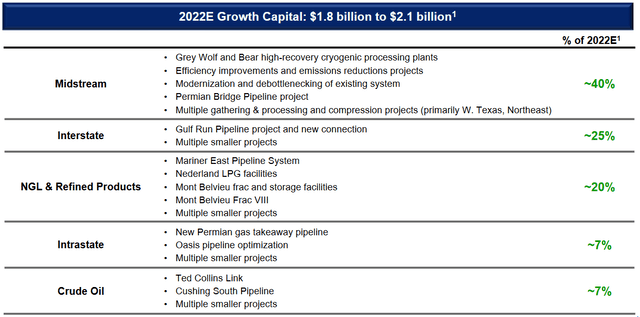

The Gulf Run pipeline is not the only growth project that Energy Transfer is currently working on. In fact, the firm currently has a number of projects that are scheduled to come online in the near future:

Energy Transfer reiterated that it will be spending approximately $1.8 billion to $2.1 billion on these projects for the full-year 2022. It did not, unfortunately, state how much it actually has spent so far this year. However, considering how close we are to the end of the year, this would seem to be a pretty reliable figure. The company stated that 90% of this money is being spent on things that will be operational and generating cash flow by the end of 2023 so we can see that the company should be able to enjoy consistent growth over most of the next year. This is something that we should be able to appreciate, especially for those who are seeking income.

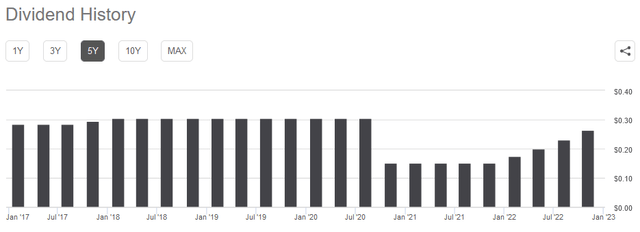

Energy Transfer has long been a favorite of income-focused investors due to its historically high yield, although it did ruin its reputation a bit back in 2020 when it cut it. The company has been steadily working to get it back up to the previous level, but it has not yet succeeded. We did see a distribution increase from Energy Transfer for the third quarter, however. The company announced a distribution of $0.265 per partnership unit, which represents about a 70% increase over the distribution in the third quarter of 2021. It also represents the fourth consecutive quarter in which Energy Transfer increased its distribution:

The company is clearly making some progress at getting its distribution back up to the pre-pandemic levels, although it does still have a way to go. With that said though, the 8.31% forward yield is certainly nothing to sneeze at for anyone that is purchasing the company’s partnership units today. As is always the case though, it is critical that we determine whether or not the company can actually afford this distribution. After all, we do not want to find ourselves the victims of a distribution cut since that would reduce our incomes and almost certainly cause the partnership unit price to decline.

The usual way that we judge a midstream company’s ability to pay its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by a company’s ordinary operations and is available to be distributed to limited partners. As stated in the highlights, Energy Transfer reported a distributable cash flow of $1.581 billion during the third quarter of 2022. This was sufficient to pay the distribution 1.93 times over, which is reasonable.

Analysts generally consider anything over 1.20x to be sustainable, so Energy Transfer clearly meets that requirement. I am somewhat more conservative and like to see the figure over 1.30x in order to add a margin of safety to the investment. Energy Transfer clearly exceeds even this more conservative requirement. Overall, we can clearly see that the company should have no real trouble paying or even increasing its distribution somewhat as its growth projects come online. Investors should have no real reason to worry about a cut here.

In conclusion, the market was certainly not impressed with Energy Transfer’s third-quarter results, but there is overall a great deal to like here. In particular, the company is quite well positioned for growth over the next year or two, as it will be bringing several projects online and is likely to benefit from the growing demand for liquefied natural gas. We could see Energy Transfer continue to raise the distribution as well, since the company is still generating much more cash flow than it needs to finance such activity. We may see that occur again as early as the fourth quarter considering that the company will probably report stronger results during that period. Overall, there is a great deal to like here about Energy Transfer.

Be the first to comment