Sundry Photography

The market has hit year-to-date lows. Interest rate spikes and fears of a global recession have put investors on edge and into “risk-off” mode; but now is a great time for intrepid investors to be bargain-hunting.

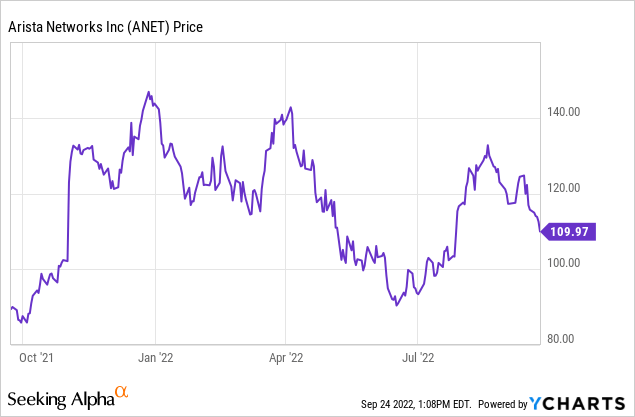

Conversely, there are many stocks in the growth/tech sector that have performed relatively well this year that should be considered for a rotation out of the portfolio on account of rising relative valuations. Arista Networks (NYSE:ANET) sits in this bucket. This networking hardware company, one of the main rivals to legacy incumbent Cisco (CSCO), has held up much better relative to tech peers this year. Down only roughly 20% year to date, Arista has enjoyed relatively strong fundamental performance during a time that many companies have reported slowing enterprise spend trends.

I’d advise caution on Arista, however. While I agree that the company retains a best-in-class product portfolio that continues to grow rapidly and take share from Cisco every quarter, and that Arista’s 60%+ pro forma gross margins mark the company as a rarity among hardware vendors, there are a number of downside factors that investors should consider.

The first is valuation. At current share prices near $110, Arista already trades at a 24.0x forward P/E ratio relative to Wall Street’s FY23 EPS consensus of $4.59 (which, by the way, represents 14% y/y earnings growth. That’s not bad, but that strength is already factored into a mid-20s P/E multiple). Right now, many stocks are trading incredibly cheaply – I’d advise investors to look carefully at the small/mid-cap software sector for many high-quality names that are trading at multi-year lows and historic low valuations. Some names I particularly like right now include Okta (OKTA), Palantir (PLTR), and Coupa (COUP).

The second is – how much of Arista’s current growth momentum is sustainable? Yes, Arista saw impressive 49% y/y revenue growth in Q2 (which we’ll discuss in more detail in the next section), both beating Wall Street’s expectations by a wide mile and accelerating sharply over Q1. But with hardware, business is lumpy. Especially because Arista relies on a core set of high-spending “cloud titan” customers, one quarter of strong revenue may mean the order book may be thinner in future quarters. We note as well that Arista completed a number of tuck-in acquisitions in Q2 without disclosing organic growth, so there’s some amount of inorganic lift being factored in.

All in all, I don’t doubt that Arista remains a solid company with a share-gaining product, rich margins, and expanding earnings – but with the stock market at YTD lows, there are just far better bargains to be had than Arista.

Keep adopting a “watch and wait” stance here. I’d buy Arista in a heartbeat if its P/E multiple sank to 18x FY23 EPS, implying a price target of $83 (25% downside from current levels). Until Arista starts sinking downward again, stay on the sidelines.

Q2 download

Let’s now go through Arista’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Arista Q2 results (Arista Q2 earnings release)

Arista’s revenue in the second quarter grew 49% y/y to $1.05 billion. This was the first time that the company crossed the $1 billion revenue mark in a single quarter, and it beat Wall Street’s expectations of $980.0 million (+39% y/y) by a significant ten-point margin. Revenue growth also accelerated from 39% y/y growth in Q1.

The company noted that strong purchases from cloud titans remained the key driver in Q2 results. Anshul Sadana, the company’s COO, gave the following commentary during the Q2 earnings call on the company’s deepening relationships with its two main customers, Microsoft (MSFT) and Meta (META), who are each expected to contribute more than 10% to this year’s revenue:

As we disclosed in previous calls, Microsoft and Meta are very special customers and expected to each be over 10% of our revenue for the full year. At Microsoft, we are deployed in all layers of their network, from the leaf switches at the top of rack to data center spine and regional spine to WAN and cloud edge layers across the globe. We have partnered together to create the DCI layer with encryption and long-reach pluggable optics, which has now become a gold standard in the industry. Microsoft deploys our products, both with SONiC and EOS, and the engineering partnership to codevelop the next-gen network is stronger than ever. Our newer 400-gig products are deployed in production, and we continue to receive very positive feedback about our quality and execution and continue to be the preferred supplier for Azure.

We have also had a strong partnership with Meta and have been involved with their network design since the early days. We have codeveloped multiple generations of products with them, including the latest 25.6-terabit 7388 platform with unmatched power efficiency and time-to-market advantages. We have deployed in their colorful cluster fabrics with parallel planes. We’ve also deployed in several use cases, including Meta’s backbone layers, where there is a constant need for higher-speed networks.”

As previously mentioned, however, stronger than expected cloud titan orders this quarter may mean a slowdown in the order book in future quarters. In addition, though the company noted that the “supply environment remains challenging”, another portion of the company’s revenue growth could be due to backlog collapsing from the prior quarter.

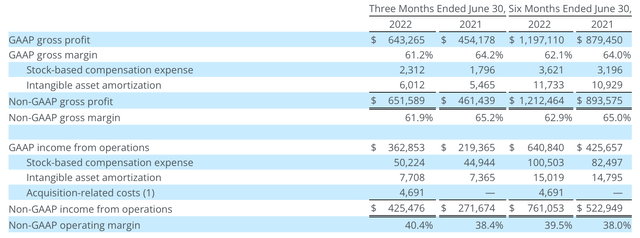

On the margin front, Arista’s pro forma gross margins declined 330bps to 61.9%, down from 65.2% in the year-ago Q2. This was driven both by increased component costs as well as a higher mix of revenue to cloud titans.

Arista margin trends (Arista Q2 earnings release)

However, the company was able to tightly manage opex, allowing for a 57% y/y gain in pro forma operating income to $425.5 million, representing a 40.4% pro forma operating margin – 200bps richer than the year-ago Q2.

Key takeaways

In my view, Arista’s strengths are already priced into its stock at $110. Steer clear here unless earnings estimates come meaningfully up, or the stock continues to slide.

Be the first to comment