Prykhodov

Introduction

While I was reading some of this summer’s earnings report, I came across a theme that I had not noticed so far and that made me think about an upcoming trend that I haven’t seen much highlighted. This is going to be my second article of the series “this is what X told us about Y”, the first one being “This Is What Costco And Target Told Us About Booking and Airbnb“. Hopefully, we can develop a way of picking useful information here and there in order to build up an investing case.

In this article, I would like to share some of the words that struck me and in order to share the investing thesis I developed. In summary, I noticed that many companies declared that they had to cut on marketing expenses in the past quarters and that now they are planning to increase this spending. This made me consider that an advertising business like Google (NASDAQ:GOOG) should enjoy some new tailwinds.

What some companies revealed

Without any further ado, I would like to show the first words that struck me, to give the opportunity to every reader to guess the topic before I will state it.

While I was researching The Hershey Company (HSY), I noticed that during the earnings call, Michele Buck, the CEO, said (bold is mine):

So we always want to be spending to the consumer advertising our brands, having the right levels of promotion, the right levels of innovation.

And as we mentioned earlier, given some of those supply constraints, we did have to pull off on that a bit just because it didn’t make sense to make those investments given some of those constraints. But we very much look forward to re-upping the investments as we look at the second half. We have always planned an increase both in DMEs as well as incremental merchandising coming back online.

I have to admit that, while I was aware of the big issue caused by supply constraints, I had not yet thought that this would lead many companies to pull back on advertising in order to reduce a bit of demand and thus be able to close a bit of the gap between supply and demand. Furthermore, during the last two years, demand has been so strong that it took almost no effort to sell anything.

I noticed this when I wrote an update on AGCO and CNHI, highlighting how among tractor and farming machinery manufacturers the sole driver of sales during the past quarters has been none other than availability. When it is enough to have a product available before the competitors it means that demand is so strong and that there is almost no need of advertising or marketing expenses that raise some brand awareness.

Brian Chesky, CEO of Airbnb (ABNB), at the Goldman Sachs Communacopia & Technology Conference had the opportunity to tell the whole trajectory of Airbnb’s development. Aside from the fact that it is a very interesting interview to read, Chesky spoke about the problems Airbnb had to face during the pandemic. The company decided that the priority to weather that period was to preserve as much cash as possible. And so they did an experiment:

We cut out a huge amount of cost. We did the experiment that every CMO (Chief Marketing Officer) in the United States wish to do.

What happens if you turn off all your marketing? You know what happened? Almost nothing. Google did not want anyone to know this. But our traffic came back to more than 90% of what it was after we turned off all of our marketing.

Of course, here Airbnb plays a bit against Google. And, even though Airbnb gets known mostly by word of mouth, the company has started spending on marketing once again to educate hosts and customers about its new features. We can see this in the last quarterly report. While the first half sales and marketing expenses are almost flat YoY ($50.3 million vs. $49.9 million last year), we see that if in Q2 2022 Airbnb did up its marketing expense by 20%, from $24 million to $29 million. And most of this spending is for online marketing. I know $5 million is almost invisible for Google, but here we are trying to understand a trend and its possible implications on a larger scale than just a single company.

Also, Hershey declared in its quarterly report, during the past quarter it started increasing once again its marketing expense, stating that in the second half of the year they will bet more heavily on this investment:

Advertising and related consumer marketing expenses increased 3.2% in the second quarter of 2022 versus the same period last year. Moderate advertising increases across brands and segments without capacity constraints were largely offset by cost efficiencies related to new media partners.

Let’s move yet to another industry and let’s take a look at what Church & Dwight (CHD) reported. This is a company I am starting to follow a lot both because of its ability to keep on compounding and because of its intelligent way to do M&As. Now, during the last earnings call, I saw our topic once again coming forth:

Regarding support, we have key promotional events lined up in the second half, and two-thirds of our full year advertising spend is concentrated in the second half. Moving to marketing. Marketing was down $14 million year-over-year. Marketing expense as a percentage of net sales was 7.8%, and we expect two-thirds of advertising to be concentrated in the second half as case fill improves. We do have a fair amount of support, both advertising and trade behind our detergent in the second half. So that’s the reason, the context for why we think things are going to accelerate.

Again, as Church & Dwight improves its case fill and feels an easing on supply constraints, it is able to ramp up supply and foster new demand. In fact, in the quarterly report, the company stated that “in the second half, marketing dollar spend is expected to be significantly higher than the first half”. Church & Dwight spent about $577 million on marketing last year.

This year, it has spent in the first half only $204 million. This means that if two-thirds of advertising are to be spent in the next six months, the company will deploy around $400 million. And a big chunk of this amount is going to go to online marketing since the company is expecting to reach about 40% of its net sales through online orders.

One last case: Procter & Gamble (PG). This huge dividend investor favorite did, too, hit a capacity ceiling that’s now been resolved. As a consequence, the company had to slow down promotional activity on some products. However, the management has said that is going to lean back into more advertising, now. In fact, during the last earnings call Procter & Gamble CEO Andre Schulten explained that marketing expenses are going to go up and that a lot of this is going to go to digital advertising:

From a media standpoint, we have delivered significant productivity over the past years, but we have reinvested all of that productivity and incremental media spend ahead of sales leverage, ahead of the productivity numbers even that we generated. And that productivity continues to strengthen. We have developed strong capability to target better both on TV as well as in digital. Our ability to improve effectiveness of reach and quality of reach is allowing us to drive cost per effective reach down both in digital and in TV. We’ve shifted more and more spend into digital. Now more than 50% of our advertising is in digital.

Procter & Gamble also closed its fiscal year and in its annual report we can read that (bold is mine):

Total SG&A decreased 4% to $20.2 billion, due to decreased overhead costs, marketing spending and other operating costs. SG&A as a percentage of net sales decreased 240 basis points to 25.2% primarily due to the positive scale impacts of the net sales increase and, to a lesser extent, a decrease in overhead costs and marketing spending. Marketing spending as a percentage of net sales decreased 120 basis points due primarily to the positive scale impacts of the net sales increase and, to a lesser extent, due to increased media and production cost savings and decreased media spending.

Once again, we see the recurring theme: a cut on marketing expenses with an outlook of resuming them in the new market conditions.

If I think about it, it makes sense: as the economy deteriorates a bit with a recession looming on the horizon, companies will have to struggle more to keep up sales. Nowadays, online marketing is a relatively small and affordable expense that prevents a company from investing heavily into hiring new salesmen.

Google is going to be the winner

I shared some insights to give an idea of what I think may be a current trend. On one side, it is well-known that companies are shifting online as the digital economy evolves. However, not many have considered that this shift, while at first was boosted up by the pandemic, has been somewhat hindered by the facts outlined above: huge demand that didn’t need as much marketing as usual to be driven and supply chain bottlenecks that made companies more cautious on marketing spending. While we head into a difficult economic situation, it is still to be seen whether or not the economic contraction will offset on advertising the impact of companies that resume or even increase their ordinary marketing expenses.

Alphabet is a huge collection of businesses, the largest branch of which is Google. Google is also split into two segments: Google Services and Google Cloud. At the moment, the real way Alphabet makes money is through its advertising solutions from Google Services. The company itself states this in its annual report:

We generated more than 80% of total revenues from the display of ads online in 2021.

Google advertising revenues are comprised of these three sources:

- Google Search & other, which includes revenues generated on Google search properties and other Google owned properties, such as Gmail, Google Maps, and Google Play. Paid clicks and cost-per-click pertain to traffic on Google Search & other.

- YouTube ads

- Google Network, which includes revenues generated on Google Network properties in AdMob, AdSense, and Google Ad Manager. Impressions and cost-per-impressions pertain to traffic on Google Network partner’s properties.

While we all know more or less about the fact that Google makes money through advertising, it is useful to recall the process through which Google earns its revenue.

Google charges advertisers for each engagement by users, that is, Google charges the advertisers for each click on advertisement by end-users on Google search properties. Another way of monetizing advertising is by charging for impressions displayed to users. These revenue drivers can be positively affected by increasing competition for keywords, which drives the cost-per-click or the cost-per-impression upwards.

Now, at the end of 2021, Alphabet’s revenue reached $257.6 billion, a 41% increase YoY. This means that around $206 billion came from advertising. Despite the huge tailwind provided by the pandemic and despite the results that other companies like Meta (META) and Snapchat (SNAP) which saw their advertising revenue decrease, Google has been able to increase its revenues YoY even in the last quarter at a rate of 13%, which would have been 16% CC (international sales make up 54% of the advertising revenue). Even though we don’t see the huge growth of 2021, 13% is still very decent and fast growth, given the fact that other competitors are actually experiencing a decline. But, very interestingly for the purpose of this article, Google Search and other advertising revenues were up 14%, driven by both Travel and Retail, as Ruth Porat, CFO of Alphabet and Google, reported. The two categories are among the ones we have seen in the first part of the article and they help us connect the dots. The company also stated that it felt some pullbacks in advertising spending in YouTube and Network, even though they were both up 5% and 9% YoY respectively.

The general consensus expects a 2022 revenue of $290 billion, which would equal to a 12.5% growth. However, if we factor in that some companies are expected to increase their advertising spending in the next two quarters by 10-20%, the company’s revenues can be expected to grow a bit more. If we do some math, we know that in 2022 Google Services revenue has been so far $124.3 billion which is equal to 90% of total revenues. If Google Service sees an extra 10-20% spending from advertisers, we could expect this to translate in an extra $10-13 billion on top of the $137 billion that the segment is expected to reach in the second half of the year. This would bring the total revenues above $300 billion, topping the high-end estimates that are currently available. With a net income margin above 25%, this revenue would turn into a $75 billion net income. If we take into account the effect of the huge $70 billion buyback, $28.5 billion of which have been deployed in the first six months of the year, we can expect the EPS to beat the current $2.68 estimate for the second half by a range in between 10-20%. This would give further support to a stock that has seen a 30% reduction in price YtD and that, according to many, is becoming more and more an appealing buy.

Risks

There are some risks. Google itself states that advertising competition is becoming fierce (we have all seen the consequence of Apple’s moves against Meta). Forex can also undermine results, as Google has wide international exposure. And it is still true that advertising, in theory, is somewhat linked to cyclicality.

However, Google has a massive moat with 84% of total Internet searches running on its website. In addition, while FX may give some temporary headwinds, the impact of international growth, especially in the emerging markets, can be far larger than expected and give further impulse to the company’s results. Keep in mind that South America, at the moment, is performing really well in the most recent quarters. As per cyclicality, the whole point of this article is to show that, in the current environment, it is not so clear whether advertising spending will diminish or not. I personally know more than one company where the management is choosing not to hire new salesmen in order to deploy the budget on online marketing.

Valuation

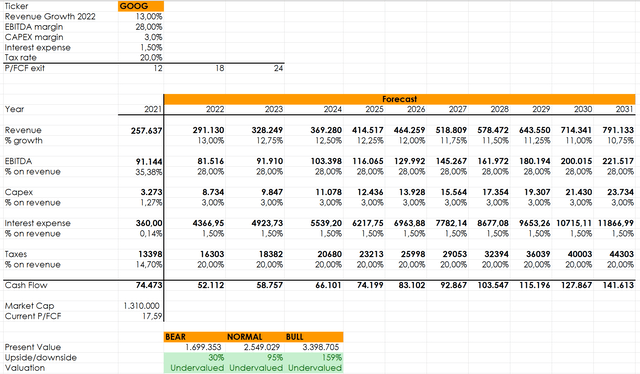

Let’s use some of the numbers we figured out during this research and let’s plug them in a discounted cash flow model to give us a sense of what the implications may be on the valuation. Below, SA readers can find the model I used which is based on five assumptions and three different price/FCF exit multiples. As shown, I expect Alphabet’s 2022 revenue to grow at least 13% and then I assume that year after year it will slightly decrease to 10.75%. I also chose to bring down the EBITDA margin which currently stands above 35%. In fact, Alphabet has repeatedly stated that if some of its bets do become profitable they may be at lower margins compared to the current profitable businesses of the company. Therefore, I assumed a 28% EBITDA margin which I think is a bit conservative. I also assumed that capex will go up to around 3% and that the interest expense as a percentage of revenue will increase to 3%. Finally, I used the assumption that even the tax rate will go up to at least 20%.

Author, with data from Seeking Alpha

As we can see, even with a price/FCF multiple of 12, which is low for a company such as Alphabet, we are still before an undervalued stock, with a certain margin of safety. In the other situations, we may be before a stock that can still deliver a 2x, which wouldn’t be bad at all given the current size of the market cap. Let’s cut the normal case scenario by 35% just to take into account any unpredictable downturn. We could still be before a stock whose price target is around $128, which would confirm a 30% minimum implied upside.

I would also like to point out that with my assumptions, Alphabet will see its cash flow reduced for the next three years compared to its 2021 result. Nonetheless, the stock would still be qualified to deliver outstanding results. This is because the real strength of Alphabet is its ability to leverage its high-quality assets, such as Google, and their moat, making them very strong compounding machines. As long as Google can compound with an ROTC of almost 19%, I really don’t mind that the company doesn’t pay any dividend and I actually like that it is doing buybacks because it enhances and speeds up its compounding energy which will eventually turn into high profits for its shareholders.

Conclusion

We have seen unpredictable economic conditions in the past two years and many laws of historical economic cycles have been turned upside down. This is why it is ever more important to pay attention to the economic signs we can see around us and this is why I am paying more and more attention to what companies are doing and reporting currently.

I am long Alphabet, as I think Google has a massive moat and is an incredible profitable machine, with high margins and high return on capital invested. What I found out and shared in this article made me even more bullish on the company as I am starting to believe that it will beat current expectations.

Be the first to comment