Editor’s note: Seeking Alpha is proud to welcome EPK Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

jimfeng

Investment Thesis

I currently rate eXp World Holdings (NASDAQ:NASDAQ:EXPI) as a hold rating based on a projected 2022 forward EV/EBITDA multiple of 17.59, pricing eXp at a premium to its peers. The market and I both believe in EXPI’s potential to leverage its cash flow and agent base moving forward. However, I believe that EXPI does not represent enough value to initiate a new position at this time. If management signals a change to their commission structure in order to retain more of the value generated by their agents, then EXPI would be a strong buy.

Background

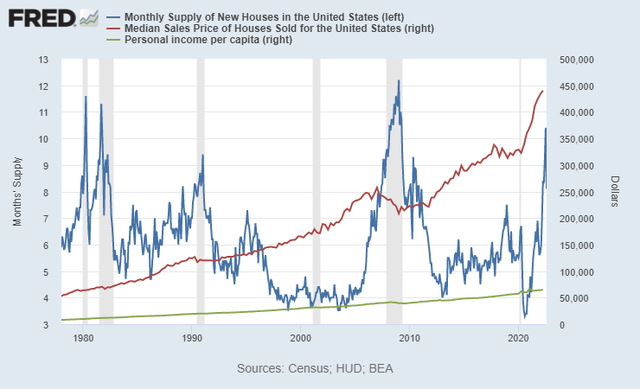

It is no secret that the housing market is facing serious headwinds for the remainder of 2022 and 2023. Mortgage rates are at their highest level since 2008, causing buyers to have their preapprovals slashed in half. Meanwhile, most homeowners locked in low rates in 2020 and 2021, and they have a compelling reason to hang on and build equity. As you can see in the chart below, Monthly Supply of New Houses is approaching 1980 and 2008 territory and affordability has fallen off a cliff.

FRED St. Louis FED

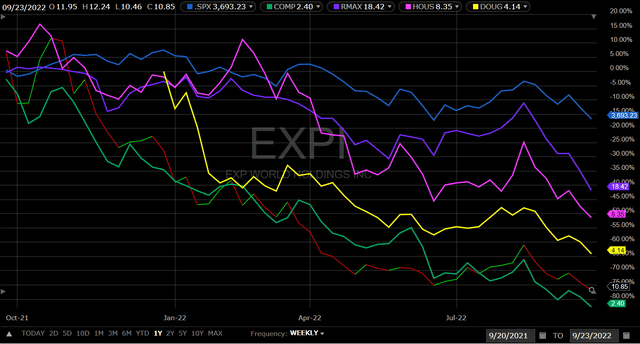

However, a quick look at the chart below will show that everyone knows carnage is coming to the housing market. All major Real Estate brokerages have significantly underperformed the S&P 500 in the past year. Compass (COMP) is down 82%, EXPI 77%, Douglas Elliman (DOUG) 65%, Anywhere Real Estate (HOUS) 55%, and RE/MAX Holdings (RMAX) 42% over the past year.

1Y Brokerage Price Performance vs S&P 500 (Fidelity)

EXPI, like Compass, has branded itself as a technology enabled Real Estate Brokerage. EXPI employs a cloud-based platform to cut overheads with no brick-and-mortar locations, which has led to a quicker path to profitability and less cash burn. They offer an attractive split with all agents of 80/20, up to a cap of $16,000 in commissions paid to EXPI after which agents retain 100% of their commissions. EXPI also charges their agents an $85 a month cloud brokerage fee and $65 per transaction. All in all, EXPI claims to return 90% of commissions to their agents, which has helped them rapidly recruit over 83,000 agents. A more complete picture of their agent compensation structure can be found on their investor presentation.

Analysis

Financially everything looks good for eXp, good liquidity, healthy balance sheet, strong cash flow, and profitability. EXPI has a debt/equity ratio of 0.00, has $0.87 per share of cash paying out $0.18 a year in dividends, yielding 1.61%. Over the last 5 years they have averaged 134% revenue growth and most recently 42% revenue growth in Q2 2022 vs Q2 2021. EXPI has a quick and current ratio of 1.60, overall indicating a healthy balance sheet. Valuation metrics are a little more scattered. Both P/FCF and P/S are attractive at 8.26 and 0.38 respectively. P/E and P/C are a little less attractive but still reasonable at 30.54 and 12.95. Both PEG and P/B are in ranges that usually signal red flags at 3.05 and 6.59. Any earnings-based measures, such as PEG and P/E, are going to look worse because EXPI has almost no debt on the books. P/B is the more worrying metric, not because of the valuation, it speaks to the larger problem that the barriers to entry are just not that high.

Not only are the barriers to entry fairly low, I question if EXPI has done enough to build a moat in terms of agent retention. The recruiting has been impressive, the question is can they retain their agents and can they hold up to business model emulators. EXPI has tried some initiatives to increase switching costs of their agents, such as stock awards that fully vest after three years. I would like to see them do more in order to retain their agents. For example, eXp offers $400 when an agent successfully recruits another agent and that agent closes their first transaction. These are good initiatives if the goal of the firm is growth. If the goal of the firm is agent retention, then a structure that pays a smalls percentage on every transaction of an agent you recruit is better. Another way to build agent loyalty is through the power of the brand. Agents want to be associated with a well-known, reputable brand. eXp is on their way but other more established brands still have a clear edge in this regard.

Opportunity

This is not meant as a knock against EXPI management as they have done an incredible job to grow and recruit rapidly in a competitive market. Perhaps it is part of EXPI’s strategy to expand first and then recapture value, but currently they are leaving far too much value on the table.

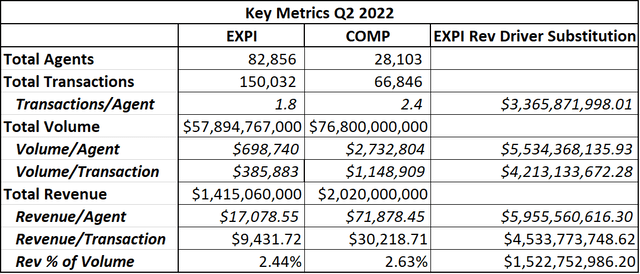

The chart below shows the difference between COMP and EXPI in terms of agent productivity, luxury market penetration, and value capture in commission structure. EXPI has three times the number of agents of COMP and yet they produced 30% less revenue than COMP during Q2. The Revenue Driver Substitution Column shows what EXPI’s revenue would be if they were able to match each COMP’s revenue driver metric. For example, if EXPI agents were able to complete 2.4 transactions like COMP agents then EXPI Q2 revenue could be $3.36 billion. As you can see the largest difference between COMP and EXPI is revenue per agent, EXPI’s revenue per agent is largely hampered by their commission cap. Total agents, transactions, volume, and revenue can be found on the Q2 10-Q of EXPI and that of COMP as well.

Respective IR Pages

I believe EXPI has the ability to unlock key revenue drivers that will not only fuel growth but also boost their bottom lines. EXPI has two main ways to dramatically increase their value capture. 1) EXPI could make a cost-of-living adjustment to their commission cap. Currently, an agent in L.A. or N.Y. needs to make one $3.3 million dollar sale in order to meet their cap, and EXPI would see no benefit from that agent the rest of the year. 2) EXPI can scrap the capped commission structure all together. Ideally, EXPI would offer a sliding scale based on production targets up to a maximum of 95/5 splits for top-producing agents. Hypothetically, EXPI could only open the 95/5 splits to agents that have previously reached certain production targets, like $50 million in total production volume in any previous year. In this scenario, EXPI would still be extremely competitive in terms of recruiting top agents while still sharing in the upside of their top-producing agents. We are all aware of the pareto principle, or the 80-20 rule, where 80% of revenue comes from 20% of agents, real estate is no different.

EXPI Valuation

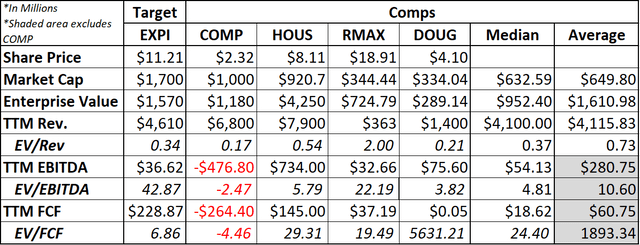

I choose to use EV/EBITDA because it is capital structure neutral. Both EXPI and DOUG use very little debt with debt/equity ratios of 0.00 and 0.02 respectively. HOUS and RMAX have debt/equity ratios of 1.38 and 0.89. HOUS and RMAX’s use of debt would inflate their valuations if we were to only consider P/E ratios. Margins in the industry are fairly stable so revenue is a good predictor of earnings. To project EBITDA for fiscal year 2022 and 2023, I made some simple assumptions.

– I projected revenue to be $5.25 billion in 2022 and $6.5 billion in 2023, consensus estimates are $5.04 billion and $5.98 billion.

– I projected gross margins to be a steady 8.50% for 2022 and 2023. Gross margins have averaged 8.34% over the previous 4 years.

– I projected operating expenses as a % of revenue to be 6.8% and 6.75%. Slight margin improvement, decreasing at a decreasing rate. (2017-2021= 12.54%, 9.47%, 7.12%, 6.94%)

– I projected that shares outstanding would remain constant.

All assumptions are general and meant to provide a baseline EBITDA projection. These assumptions are not set in stone and are open for debate.

EXPI Comps (Seeking Alpha)

My assumptions project EXPI’s EBITDA to be $89.25 million and $113.75 million or $0.59 and $0.75 EBITDA/Share in 2022 and 2023. The average EV/EBITDA multiple of EBITDA positive real estate brokerages HOUS, RMAX, and DOUG is 10.23 which would give EXPI a 2022 price target of $6.23 and a 2023 price target of $7.94.

Based on NYU Stern data from January 2022, the average EV/EBITDA multiple for EBITDA positive Real Estate Operations and Service firms was 20.84, providing a 2022 price target of $12.25 and $15.62 for 2023.

EXPI is trading toward the upper end of it range but still within reason. I currently recommend EXPI as a hold. However, EXPI wields extreme potential with its agent base to quickly increase both its top and bottom lines.

EXPI Risks

- Revenue is highly correlated to the number of agents. Capped commissions and monthly fees provide more revenue transparency, but revenue growth is almost exclusively tied to agent acquisition. Total NAR membership fell from a peak of 1,357,732 in 2006 to a trough of 999,824 in 2012, a decrease of 26%. All else equal, EXPI’s revenue will likely be more resilient in the face of a housing crash, but slower to recovery and growth.

- Lack of infrastructure is intimidating to new agents. EXPI does assign a mentor to new agents for their first 3 deals, but with a lack of physical infrastructure, formal training programs, or company-provided leads the sink or swim environment at EXPI is tough for new agents. However, recruiting and training new agents is not the aim of their business model or commission structure. EXPI’s model is clearly directed towards established agents.

- Nominal commission caps are highly sensitive to inflation. High inflation quickly eats away at the amount of value that EXPI captures from their agents with a nominal commission cap. They will need to prove that their commission cap can be elastic to adjust for inflation.

- Lack of value capture in luxury and high property value areas: An EXPI agent can be capped after one sale of a $3.33 million property. They are simply leaving too much money on the table in the luxury market. However, this could be a tactic to penetrate luxury and high property value areas. If a cost of living or other adjustment is made to capture more value in this area in the future, it could be a massive tailwind to the top and bottom lines.

- Other brokerages engaging in a price war with EXPI: Their rapid rise has largely been fueled by an extremely competitive and clear commission structure, enabled by their low overhead, allowing them to recruit agents effectively. The real test will come when and if more brokerages begin to imitate their strategy.

Final Thoughts

It is hard to dislike what EXPI has been able to accomplish thus far. They are cash flow positive, generate great revenue growth, are already returning cash to investors, and have unbridled potential. However, these are the exact reasons that they are trading at a premium to their peers. At current valuation, I cannot recommend any more than a hold rating for EXPI. If EXPI management signals that they are going to make changes to their commission structure in order to capture more value from their agents, then buy and ask questions later. EXPI, with their agent base and cash flow, is sitting in an enviable position but it is time to for management to shift from agent recruitment to agent retention and value capture.

Be the first to comment