rfwil/E+ via Getty Images

It may be premature to think that the bottom for the S&P 500 or any equity index is near. Today’s ISM manufacturing data came in lower than expected, indicating that the next leg for markets could shift from rates and central bank risk to earning risk. Earnings estimates are already in decline, and as earnings season begins to ramp up, it seems likely that the risk is for those earnings estimates to fall further.

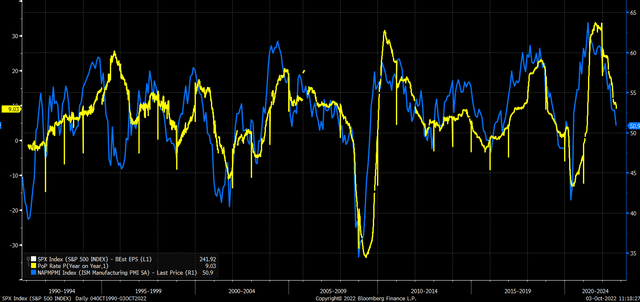

The ISM data, while still signaling positive real GDP growth of 0.8% in the third quarter, also showed that manufacturing slowed more than expected. The data point for the ISM manufacturing report tends to have a very high correlation to changes in earnings growth rates for the S&P 500. The chart below shows that the ISM manufacturing report can be a leading indicator for the earnings outlook of the S&P 500.

If the relationship continues to play out, then this would suggest the earnings growth rate for the S&P 500 should slow further. Still, at this point, analysts estimate roughly 8% earnings growth in 2023 to $241.92 from $223.89 in 2022.

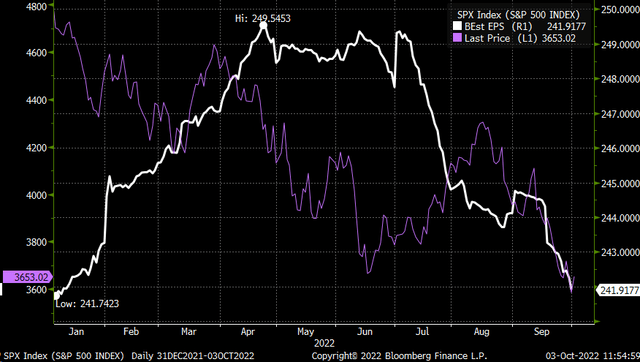

Earnings estimates for 2023 have already dropped 3% to $241.92 from $249.55, which isn’t much at this point. It is, however, potentially an indication estimates have much further to decline, especially if the ISM data is acting as a leading indicator.

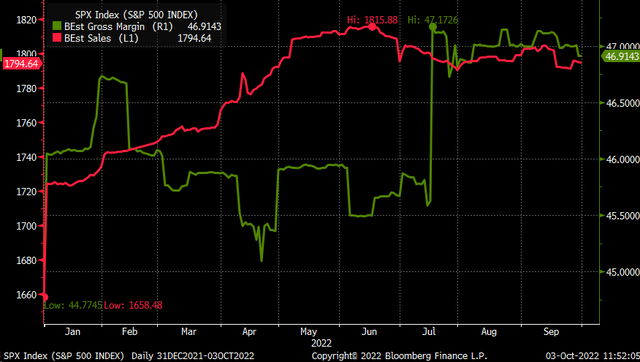

Another reason earnings estimates are likely to fall is that sales and gross margin estimates for the S&P 500 seem too high for 2023. Sales estimates for the S&P 500 have lost around 1.1% to $1.794 trillion from $1.815 trillion, while gross margins have increased from roughly 45.5% to 46.9% since the spring of 2022.

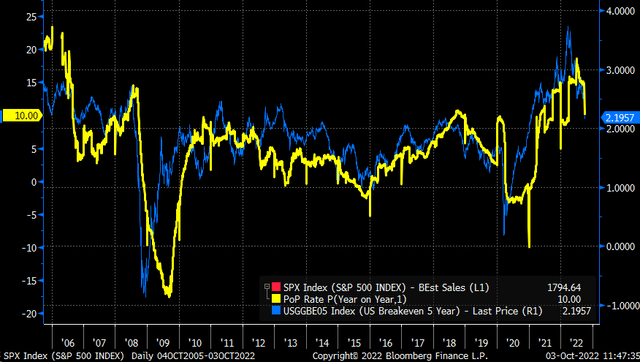

On top of that, inflation expectations are now falling, and falling inflation expectations may be a sign of potentially fewer Fed rate hikes. Falling inflation expectations also probably mean that S&P 500 revenue growth will slow dramatically. There is a strong correlation over time between sales growth and 5-Year inflation expectations. It is not a perfect relationship but it shows that inflation expectations tend to lead to changes in the revenue growth rates.

If revenue estimates follow inflation expectations lower from here, that will pressure earnings estimates down unless gross margins can continue to push higher. But given that gross margins are already at nearly their highest levels since 2009, it may be tough to get margins to squeeze higher. Falling revenue estimates and lower gross margins should lead to lower earnings estimates.

It also seems that the S&P 500 has latched on to falling earnings estimates, with the latest drop in the S&P 500 also reflected in the latest drop in earnings estimates. For most of 2022, the S&P 500 had been ignoring changes in earnings estimates. In fact, until July, earnings estimates rose dramatically, while the S&P 500 was declining. Meanwhile, the S&P 500 rallied sharply in July and August, as earnings estimates fell sharply. But at least more recently, the S&P 500 and earnings estimates are heading lower together for the first time all year.

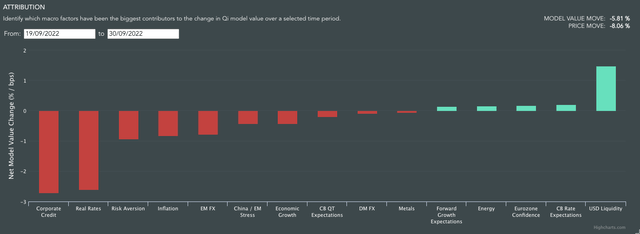

It could be a temporary event, or it could be that stocks are slowly beginning to decouple from movement in interest rates and are now beginning to focus more on the impacts of slowing economic growth. Data from Quant-Insight shows that since the beginning of the year, changes in real rates were, by and large, the most significant macro driver of the S&P 500.

Meanwhile, since September 19, corporate credit, risk aversion, china, and economic growth have increased in factor impacts. While real rates are certainly still significant, other factors are gaining importance, again indicating there may be a decoupling in the equity markets from rates.

Earnings season starts in about 2 to 3 weeks, so earnings adjustments should pick up. That very well could lead to a further decline in earnings estimates, and if the equity market has now latched on to falling earnings estimates, as those earnings estimates make new lows, the S&P 500 is likely to follow.

Be the first to comment