allanswart

Bristow Group (NYSE:NYSE:VTOL) is the largest international offshore helicopter operator in the world, created when the best managed company in the space, the former Era Group, acquired the largest company (legacy Bristow Group) out of bankruptcy. The acquisition was completed in June 2020, and the combined company elected to keep the name of the much larger Bristow. The company owns roughly 180 aircraft, most of which are used to transport workers to offshore oil and gas (“O&G”) installations worldwide. About 75% of revenue comes from serving O&G customers, while 25% comes from government contracts, including a lucrative long-term Search and Rescue contract (“SAR”) with the U.K. government. Senior management comes from legacy ERA. I first wrote about VTOL here, and you might also want to check out the company’s September 2022 investor presentation.

The industry has suffered from a massive oversupply of O&G configured helicopters, leading to many aircraft sitting idle, and leaving the remainder on low price contracts. However, eight years of headwinds are about to turn into tailwinds. The government contracts segment continues to grow, but more importantly, the offshore O&G segment is about to absolutely boom. The offshore O&G business responds to higher oil prices, but with a significant lag that I think is not well understood in the market. VTOL will see zero benefit from higher oil prices in 2022, and instead this will show up in their earnings beginning in 2023 and continuing for about five years. The company will benefit not only from putting idle aircraft to work, but also because the end of the supply glut will lead to much greater pricing power on new contracts.

VTOL has never issued guidance, but on their CY Q2 2022 earnings call they announced that they would begin issuing guidance for the first time ever. I don’t think the timing is a coincidence. After eight years of nothing but headwinds, the company finally has a good story to tell investors, and they want to tell it.

The company in 2022

VTOL will generate perhaps $135 million of EBITDA in 2022 after adjusting for various one time items. As of CY Q2 2022 they have $277 million of net debt, and are therefore right at their 2x leverage target. The company will deploy meaningful growth CAPEX in 2022, but aside from that the ongoing CAPEX burden is quite low, at perhaps $25 million per year. They are still funding a closed but underfunded pension, to the tune of $10 to $15 million per year, through YE 2024, and interest expense – mostly from $400 million of fixed rate debt at 6.875% due in 2028 – is about $30 million. Fully taxed at 25%, this leaves them with a run rate FCF of just under $50 million, which on the current 30 million share count – they are buying back shares, so this number will change going forward – but at 30 million, FCF per share is ~$1.60 in 2022. At the current ~$25 share price the stock trades at a P/FCF multiple of ~15x.

While the stock is neither particularly cheap nor expensive on 2022 numbers, the current year is almost certainly a trough for EBITDA. In the peak year of 2014, legacy Bristow and legacy ERA combined to earn just over $400 million of EBITDA. If you want a window into how good things can get some day, that’s not a bad number to have in mind. But ever since the oil crash in 2014, many aircraft have been idled, and the rest have been put on contracts at low rates. I estimate that all FCF in 2022 is being generated by VTOL’s very stable government services contracts, and that the offshore O&G segment is likely at roughly break even. I think this is about to change dramatically.

VTOL management, CEO Chris Bradshaw

Before I get into describing the future, I want to talk about the guy running the company. VTOL is run by legacy ERA management, including CEO Chris Bradshaw. Most offshore management is extremely weak in my opinion, far below the standards set in other industries. VTOL is the exception. I consider Bradshaw to be the best CEO in the offshore services space, not because he has made money for shareholders who paid too much – no one could have done that – but because he executed well after inheriting one of the toughest hands any CEO has ever had to play.

Bradshaw took over legacy ERA in late 2014 just as everything was about to go desperately wrong across the industry. All of ERA’s larger competitors were forced into bankruptcy, and by rights that probably should have been ERA’s fate as well. Perhaps a third of offshore helicopters were about to be idled, and the rest were put on low rate contracts. Despite heroic efforts at cost control, Bradshaw would oversee an EBITDA decline of almost 70%, to only $30 million.

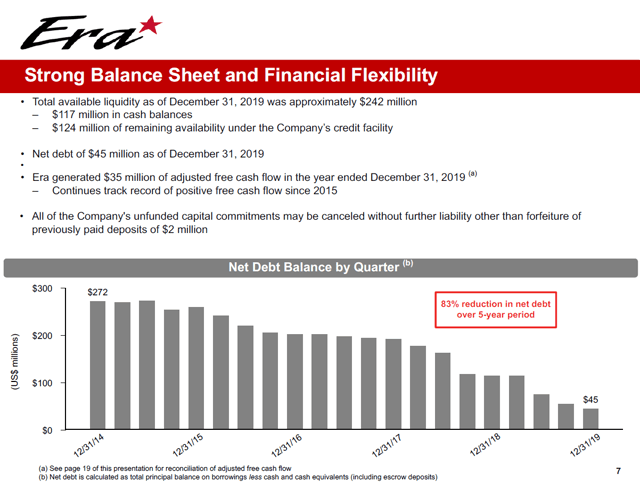

And the leverage! ERA had $272 million of net debt, and another $100 million of debt equivalents – so often overlooked! – in contractually owed payments to OEMs. Those were for new aircraft that were simply not needed given the massive supply glut that was about to unfold. That’s $372 million of net debt and equivalents, $30 million of EBITDA, and leverage at 12x.

Doomed, right? Wrong. Here’s a slide from legacy ERA:

Bristow

Note that they only consider net debt in the slide, and don’t even mention the more than $100 million of debt equivalents they also paid down during this period. For those who follow the company, this is a classic Bradshaw move, not taking full credit for this. The guy is almost too humble.

How did he and his team do it? First, cost controls kept FCF coming in the whole time. Bradshaw completed huge cost cuts before most competitors even began, and achieved efficiencies they were never able to reach. Even as EBITDA shrank, cash still came in every year. And they sold assets, deftly unloading older helicopters in markets outside of offshore O&G, again getting well ahead of the curve, and selling before competitors even thought to try. Most of these aircraft were sold for more than book value. And leverage dropped from 12x to 1.5x by YE 2019.

Shareholders who overpaid for the stock in 2014 don’t necessarily get it, but what they probably deserved was a total wipeout. Bradshaw was uniquely able to preserve value, rescuing the company from a starting point which, to be clear, he did not create. Remember, he took over in late 2014.

In 2019, with leverage down to 1.5x, and all competitors bankrupt, it seemed like the perfect time to switch from defense to offense, and take advantage of the distress across the industry. In a bold move, just as a recovery in offshore appeared on the horizon, ERA bought the largest operator in the space, Bristow, out of bankruptcy. The new combined company would keep the name Bristow for competitive reasons, change the ticker to VTOL, and was expected to hit $240 million EBITDA in 2020.

By rights, Bradshaw should have been able to take a well deserved victory lap. Not only had he, uniquely in the space, managed to avoid a total loss for shareholders, he had turned the tables and created a juggernaut, buying out his much larger, much more poorly run competitor. The plan from there was simple. Harvest the FCF, sell off the useless assets legacy Bristow was too inept to act on, and run the new company as efficiently as legacy ERA already was.

And then the pandemic hit, and the price of oil briefly went negative, and, well, you get it. Some bad luck for them. The price went to $14, but I had been watching them for a while, and had enough confidence in them that I wrote this article.

In short, VTOL management has never faced anything but strong headwinds, and in that environment, their performance has been exemplary. I see no reason to think that management will be anything less than excellent from here. And they will finally, after eight years, have the wind at their back.

A 5-year tailwind

VTOL’s offshore O&G segment is about to boom. This will play out over five years, as idle aircraft are put on contract, and contract rates increase. Anyone familiar with the way investors think about offshore rigs will find this familiar. For offshore rigs, each rig deployed generates incremental EBITDA and FCF compared to an idle rig, and as the supply glut ends, day rates increase.

It’s much the same for helicopters. The higher price of oil has triggered substantial offshore activity, with new projects set to ramp up in 2023 and beyond. Roughly speaking, each new rig or production facility requires one and a half helicopters to service it, depending on the details, and projects that are sanctioned today begin to generate EBITDA for VTOL once the aircraft are actually flying. Currently idle aircraft will begin to return to work in large numbers in early 2023, and ramp up through the middle of 2024, at which point there will be no more excess capacity.

While VTOL doesn’t provide information on how many idle helicopters they have, they have been clear that the number is substantial. I estimate something like $45 million of incremental EBITDA from this once they reach full utilization of their fleet. There are a number of non-O&G tailwinds coming in 2023 that I go through in the next section, adding up to another $35 million or so. That’s $135 + $45 + $35, or $215 million of EBITDA by mid 2024, assuming no change in operating rates.

But that’s just not how it works. Operating rates are highly suppressed today because of the huge supply glut of aircraft over the past eight years, and now that supply glut is finally coming to an end. This is well understood inside the tiny offshore O&G helicopter community, for example Air & Sea Analytics reports:

It’s only a matter of time before scarcity of available aircraft and parts drives up pricing significantly

And Bradshaw delivered a similar message on VTOL’s CY Q1 2022 earnings call:

The industry fundamentals and trends continue to strengthen. The supply and demand balance… is in the process of tightening materially. With the tighter equipment market… rates in our sector must increase significantly

This is a huge wildcard. It’s all upside from here, but how much? At full utilization, offshore O&G revenue at current rates would be about $1 billion. Each 10% increase in rates adds $100 million EBITDA, so a fully phased in 10% rate increase would put VTOL EBITDA at $315 million, well over double the current $135 million. Recall that in 2014 the two legacy companies that make up VTOL today combined for over $400 million of EBITDA. This gives us some sense of the upside that could be coming from higher rates!

It’s worth noting that helicopters are a relatively small part of the overall budget for any offshore oil project, well under 10% of the total cost. So a 10% increase in rates represents well under a 1% increase in project cost. Oil companies will pay what they have to.

Finally, this really is a 5-year tailwind, even though the supply glut is effectively ending much sooner than that. The reason is that VTOL typically signs 5-year contracts, so that only 20% of contracts will reset to higher rates each year. Contracts being signed today, and which are set to begin in 2023, are already at much higher rates. So the benefits of higher rates will begin in early 2023 and ramp each year through 2027.

$35 million of non-O&G tailwinds

VTOL will benefit from about $35 million of incremental EBITDA in 2023 aside from any recovery in offshore O&G. The company has won three new SAR contracts (with the Netherlands, the UK, and Equinor), signed a favorable new long term maintenance support contract, and is absorbing substantial one time costs in their Australian fixed wing business in 2022 that will go away in 2023.

We expect that fleet transition to be substantially complete a year from now… the financial performance of this business will be much stronger in 2023 compared to 2022

VTOL doesn’t break out any of this numerically for us, with the exception of the maintenance contract, which they guide to deliver $11 million of incremental annual EBITDA. The rest is just educated guesswork. I estimate ~$15 million for the new SAR contracts, based on the aircraft being deployed. And I estimate the fixed wing business going from negative EBITDA today, as Bradshaw has said, to a small positive number equal to a high single digit percentage of revenue in 2023.

Investing in the business through 2025

VTOL currently has $277 million of net debt, but they have committed to another ~$240 million of investment spending through YE 2025. Roughly $80 million of this is coming due in 2H 2022, with the balance paid mostly in 2024 and 2025. The biggest piece of this, $160 million, will secure a 10-year extension to their SAR contract with the UK, which runs through 2036. Another $55 million is an investment in securing long-term reduced maintenance costs, which they have said will result in cash on cash returns of 20%. And the final $25 million is needed for new SAR contracts with the Netherlands and the UK in the Falkland Islands.

Note that these government contracts are extremely easy to borrow against. Financing will not be a problem.

The share count is coming down

VTOL is buying back shares and driving down the share count. The company targets 2x leverage, and is pretty conservative. They don’t buy back shares when they are above this target. The actual number of shares repurchased will depend meaningfully on the level of EBITDA the company achieves, and on FCF, less the $240 million organic investments the company is making through 2025.

As an example of how this might work, if VTOL reaches $250 million of EBITDA in 2025, then to hit their 2x leverage target they would need $500 million of net debt. FCF over the next three years would be roughly $300 million, less $240 million for the investments I referenced in the previous section. With net debt today at $277 million, in this example VTOL would be able to buy back $283 million of shares through 2025 (500 +300 – 240 – 277). The number of shares bought will of course depend on the share price. At the current ~$25 price, that would be 11.3 million shares, or 38% of the ~30 million shares outstanding today, while at an average repurchase price of $50, they would only be able to buy 5.7 million shares, or 19% of the total outstanding today.

The company in 2025

I don’t include it here, but there’s an excellent chance VTOL will make an acquisition in the next few years, or move into a new business line serving offshore wind farms. Either of these would add EBITDA and FCF, but of course also require capital. However, I will ignore these possibilities here, and just compute an FCF estimate for the existing business segments instead.

I have already made the case that VTOL, with all aircraft fully utilized, will earn $215 million EBITDA at current rates, but also noted that these rates will rise meaningfully over the next five years. While a case can be made for EBITDA as high as $400 million in 2027, I will assume here that rates will only increase 10%, resulting in a $100 million boost to EBITDA by 2027. In 2025 this effect will only be halfway achieved, and EBITDA will therefore be $265 million that year. For the share count, I will assume an average repurchase price of $50, and the resulting share count will be 24 million, down from 30 million today.

Of the $530 million of net debt needed to hit their 2x leverage target, the company has $400 million funded at 6.875% through 2028, and any new debt can be borrowed on extremely creditworthy government contracts. I will assume $630 million of total debt at this same interest rate in 2025, resulting in $43 million of annual interest expense, maintenance CAPEX of $25 million, and no further need to fund their closed pension plan. Fully taxed at 25%, the FCF run rate in 2025 will be $148 million, or $6.15 a share.

Offshore wind farms

In addition to the current SAR and offshore O&G business, VTOL is likely to pursue helicopter support contracts for offshore wind farms. A report by Air & Sea analytics predicts demand for ~125 helicopters to service the offshore wind market by 2030, up from about 25 today, and then continuing to grow dramatically for another two decades. If VTOL gets their fair share of this work it could easily add another $25 or $50 million of EBITDA outside of their traditional O&G and SAR segments. Bradshaw agrees, saying in the CY Q1 2021 earnings call that:

On offshore wind, which we do think will be a long-term secular growth market opportunity for us… We have all the experience that we need operating in difficult offshore environments. We also have thousands and thousands of hours of hoist experience from our search and rescue business around the world that’ll be relevant in the offshore maintenance phase of those offshore wind farms.

My guess is that the company is considering buying one or more of the smaller European wind operators, or indeed maybe rolling up the sector, and then expanding aggressively from there. Notably, VTOL already owns many of the helicopters needed for this, and many of them are currently idle.

Advanced Air Mobility [AAM]

An even more intriguing prospect comes from electric vertical takeoff and landing [eVTOL] and electric short take-off and landing [eSTOL] aircraft. Morgan Stanley has estimated an incredible $1 trillion addressable market by 2040, and significant investments have occurred, including a handful of multibillion dollar SPAC transactions. VTOL has issued numerous press releases announcing ventures in the space, including a recent one with BETA technologies on August 9 2022.

Despite the opportunity being both speculative and some years into the future, the very conservative and understated Bradshaw – the man is not exactly prone to hype, unlike so many in the offshore space – seems very excited and focused on this opportunity, and said this:

Electric vertical takeoff and landing (eVTOL) and short take-off and landing (eSTOL) aircraft… [have] the potential to revolutionize air transportation. Bristow will lend its 70+ years of transport expertise in regulatory processes, operations and design… early AAM adoption opportunities for Bristow within cargo and/or Regional Air Mobility missions… build upon existing markets and regulatory framework.

There’s a lot of money being thrown into AAM, and the opportunity over the long term is as clear today as the electric car was 15 years ago. VTOL is in a nice position here. They don’t have to invent anything or build anything to benefit. They have customers, regulatory approval, an operating history, and an exemplary safety track record. They are a perfect partner for any of the emerging deep pocketed companies in the space, and even a tiny fraction of a $1 trillion market represents a ton of upside for a $750 million market cap company like VTOL.

Valuation

BY 2025, and with years of highly visible EBITDA growth both behind them and still to come, I think VTOL could price at 12x my $6.15 FCF/share estimate, or about $75, as a base case. That’s up 3x from the current ~$25 share price, and assigns no value to speculative ideas like eVTOL. I am also assuming only $265 million of EBITDA, well below the combined $400 million peak EBITDA number the two legacy companies hit in 2014. If they were to hit that number, the share price would presumably be well into triple digits.

Risks to the thesis

By far the biggest risk to the thesis is that the anticipated offshore recovery fizzles. That has happened once before, when the pandemic struck and cratered what seemed like a fairly visible recovery brewing. While I don’t see this as particularly likely, it’s certainly possible that oil prices could decline meaningfully below the implied prices in the futures curve, and the offshore recovery simply does not happen. If that occurs, EBITDA is unlikely to rise too much above $170 million, and FCF through 2025 will be needed to fund investments, and will not be available for share repurchase. FCF/share would be ~$2, and a 10 multiple might seem appropriate for a business that’s not growing, resulting in a $20 share price in 2025. Discounting back to the present would result in a $15 NPV for the shares in 2022, well below the $25 price as I write this.

Conclusion

Bristow is superbly managed and moderately levered. The company has weathered eight years of devastation in offshore O&G that bankrupted all of their competitors, and is currently operating at all time low EBITDA. Despite this, the company is still only 2x levered, and generates substantial FCF. The offshore sector is finally rebounding, and the supply glut of helicopters is about to come to an end. Idle aircraft are being put back to work, and at much higher prices. The combined legacy companies used to generate three times the EBITDA that VTOL does today, but even hitting a number somewhere in the middle will unlock massive value, perhaps 3x the current share price in 2025. The current stock price of ~$25 is absurd, and the stock should be bought.

Be the first to comment