piranka/iStock via Getty Images

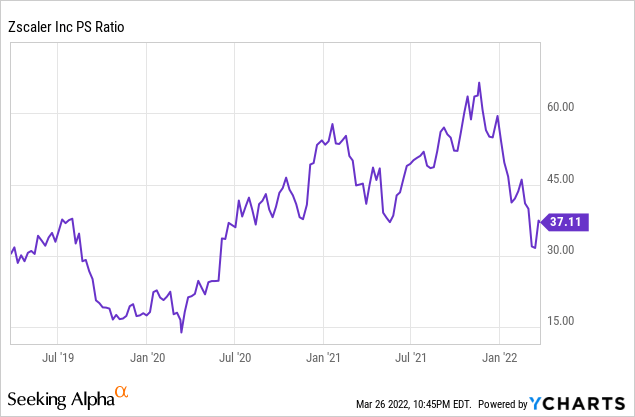

Zscaler (NASDAQ:ZS) is one of the tech stocks that leave me scratching my head. While other stocks in the tech sector are seeing their valuations get squashed, ZS has somehow managed to sustain a premium multiple that is still arguably too rich. The company has guided for decelerating growth rates, but has not been punished like peers for the same crime. While I expect the company to continue growing at rapid rates, the current stock price suggests that investors are counting on growth rates to remain at unsustainable levels. Given where the rest of tech trades, I recommend avoiding the stock at current levels in favor of more attractive alternatives.

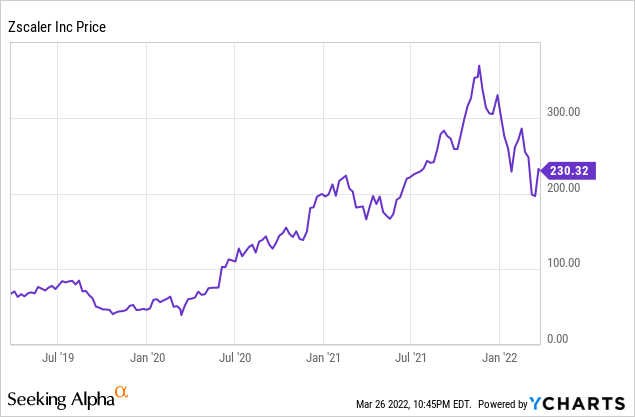

ZS Stock Price

While ZS is down nearly 40% from all-time highs, the stock remains nearly 300% higher than pre-pandemic levels.

YCharts

I previously covered the stock here, stating that the stock was still overvalued in spite of a mild correction. Since then, the stock has fallen another 20%, but after the latest earnings report projected for steady declines in growth, it is my view that this is not a “buy the dip” moment. Unlike many other highly buyable tech stocks, ZS still trades at elevated multiples. In this follow-up report, I show why despite the 40% fall, the stock is still not really buyable.

While some multiple expansion makes sense, I am surprised that the gains have persisted even as other tech names are trading at multiples well below pre-pandemic levels. It is possible that the ongoing war in Ukraine has led investors to expect increased spending on cybersecurity, but even so, current multiples appear quite stretched.

YCharts

What is Zscaler?

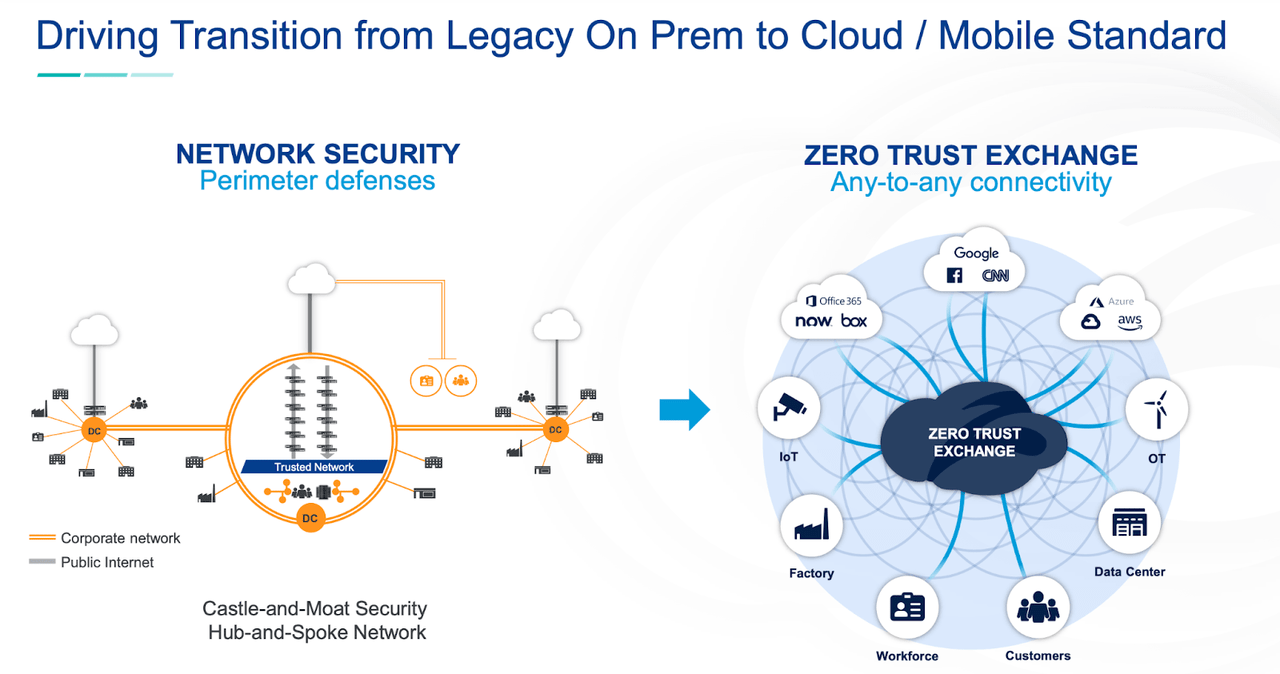

ZS is a cybersecurity company which protects applications using its “zero trust exchange.” In the pre-cloud era, companies typically secured their property using perimeter defenses but that kind of defense does not work in the cloud era where applications can be accessed by any other application.

Zscaler March Investor Presentation

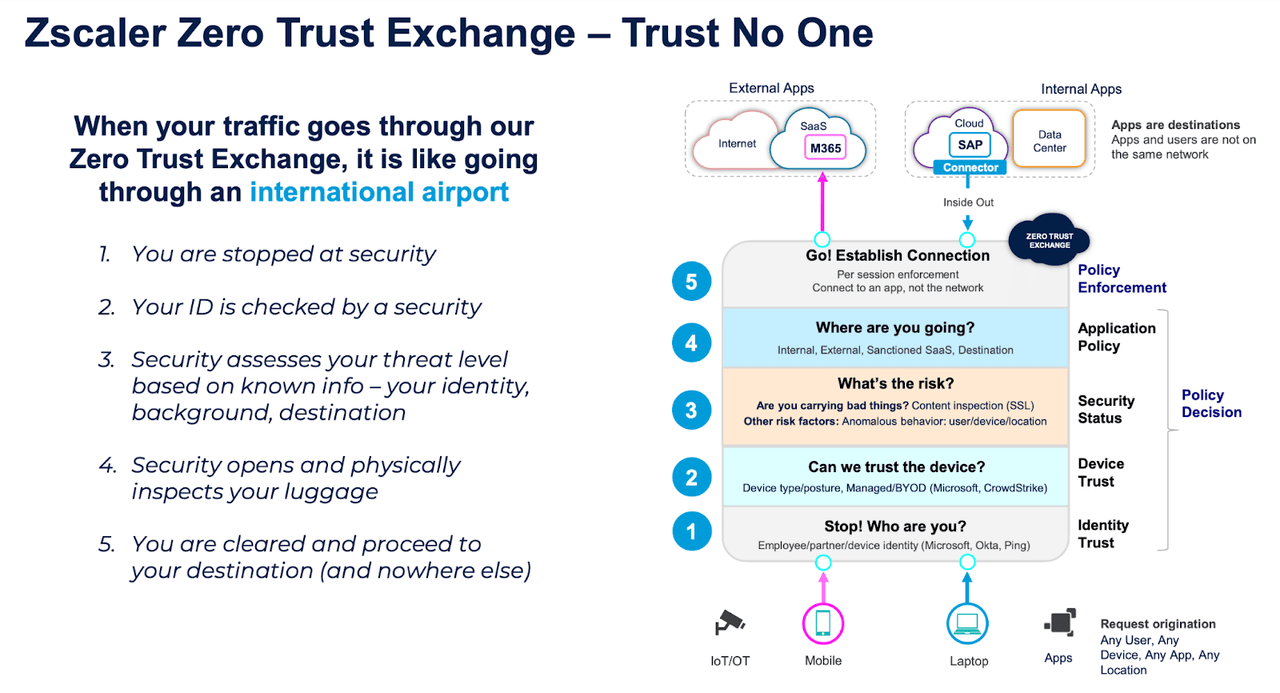

ZS describes its role in cybersecurity below. We can see that whereas peers Okta (OKTA) secures identity, CrowdStrike (CRWD) secures endpoints (devices), ZS takes care of the rest of the process before allowing access to the protected applications.

Zscaler March Investor Presentation

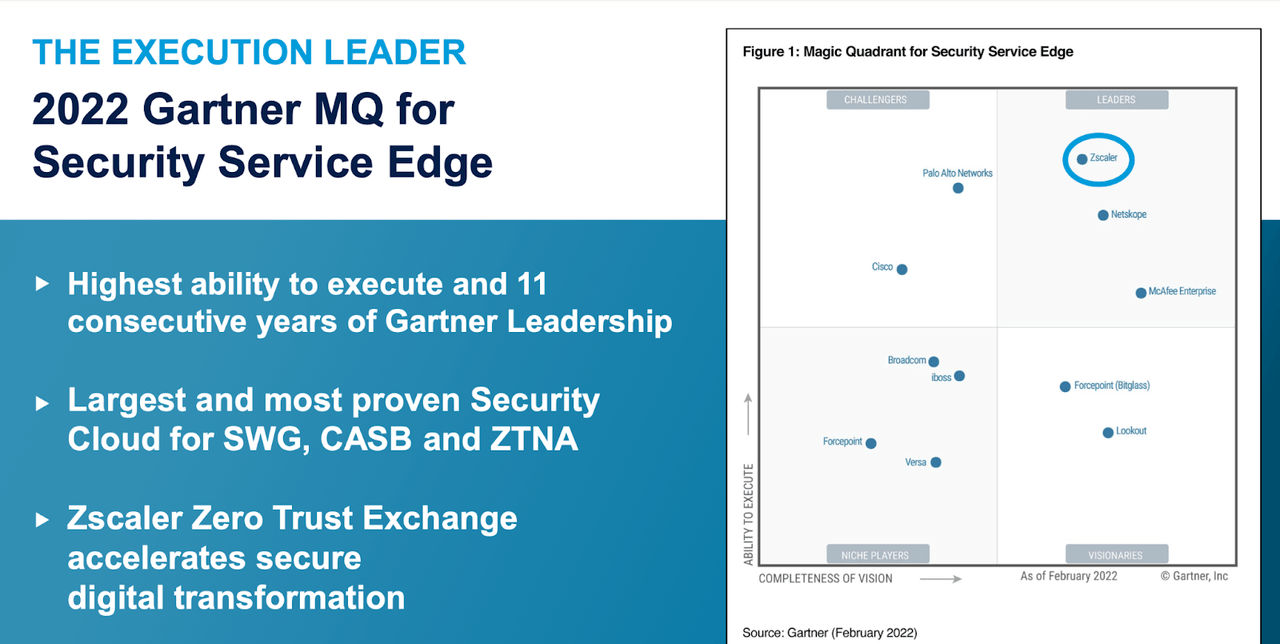

In this space, ZS ranks very highly as the clear leader as measured by Gartner.

Zscaler March Investor Presentation

Zscaler Stock Earnings

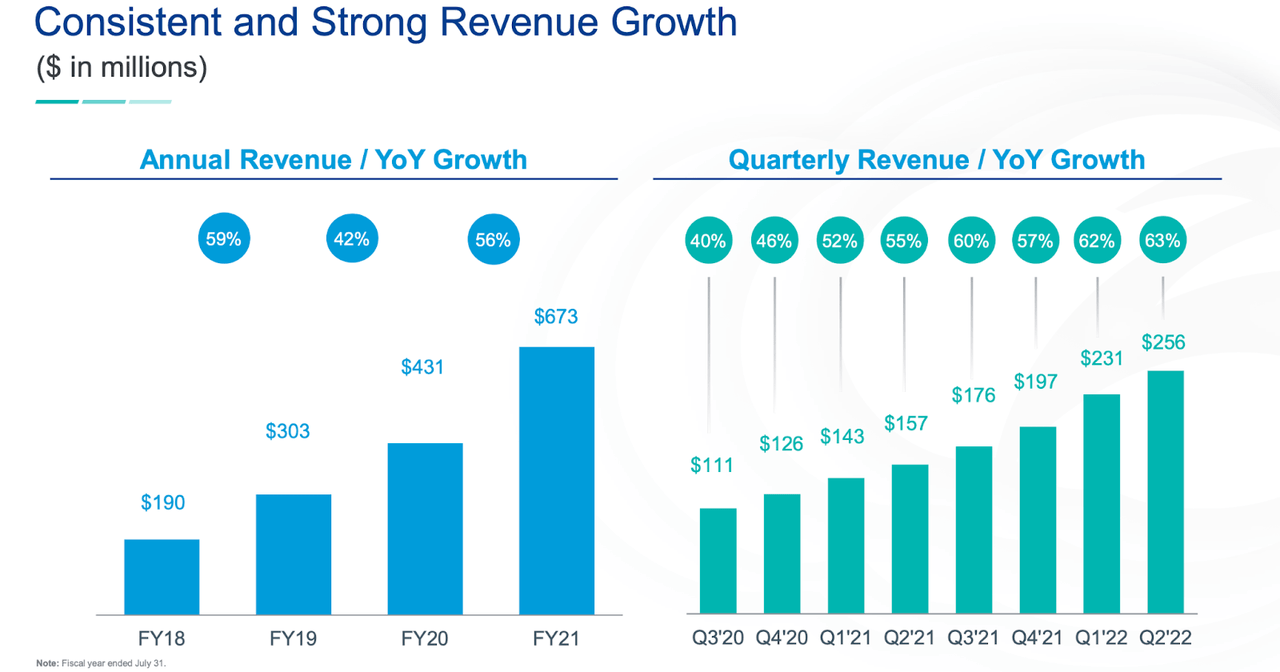

The fact that ZS continues to trade at stretched multiples is understandable. The company has sustained 2 straight quarters of accelerated revenue growth, with a 63% growth rate that is higher than pandemic levels.

Zscaler March Investor Presentation

Most tech companies are seeing rapidly decelerating growth, largely due to the pull forward in demand during the pandemic. ZS is not.

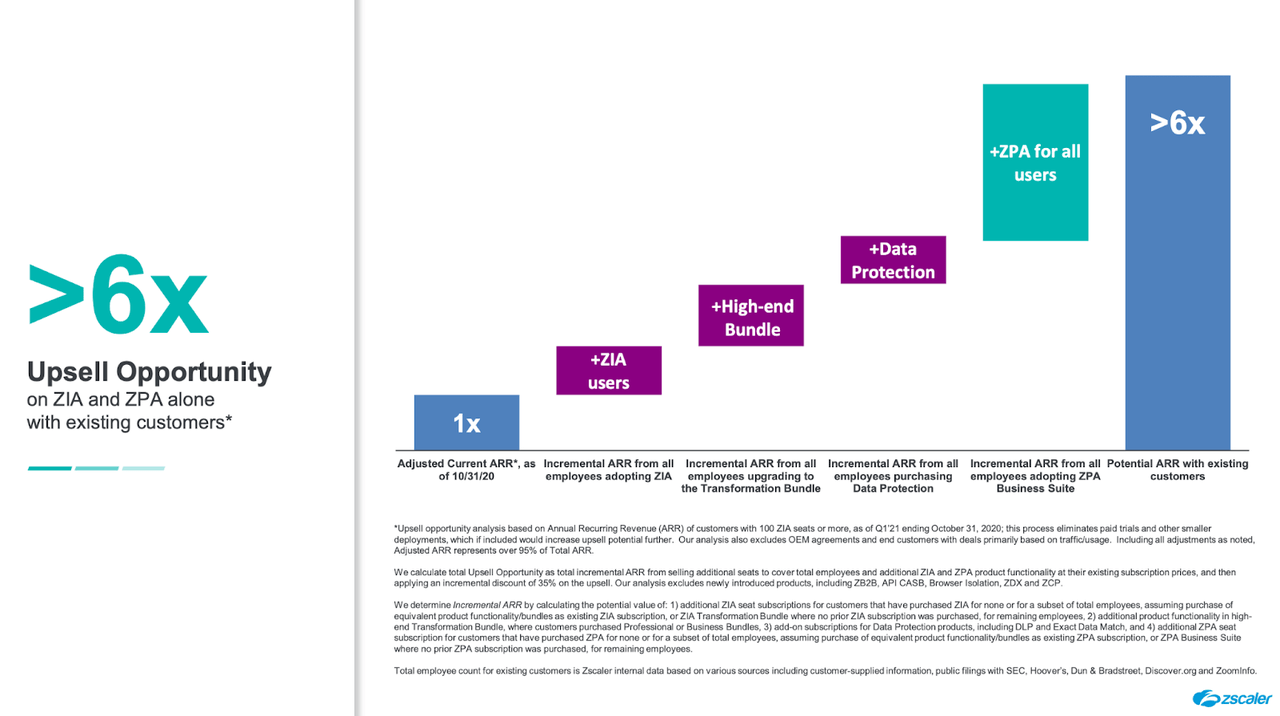

Moving forward, ZS continues to see an opportunity to increase business by 6x with existing customers through cross-selling additional products.

Zscaler March Investor Presentation

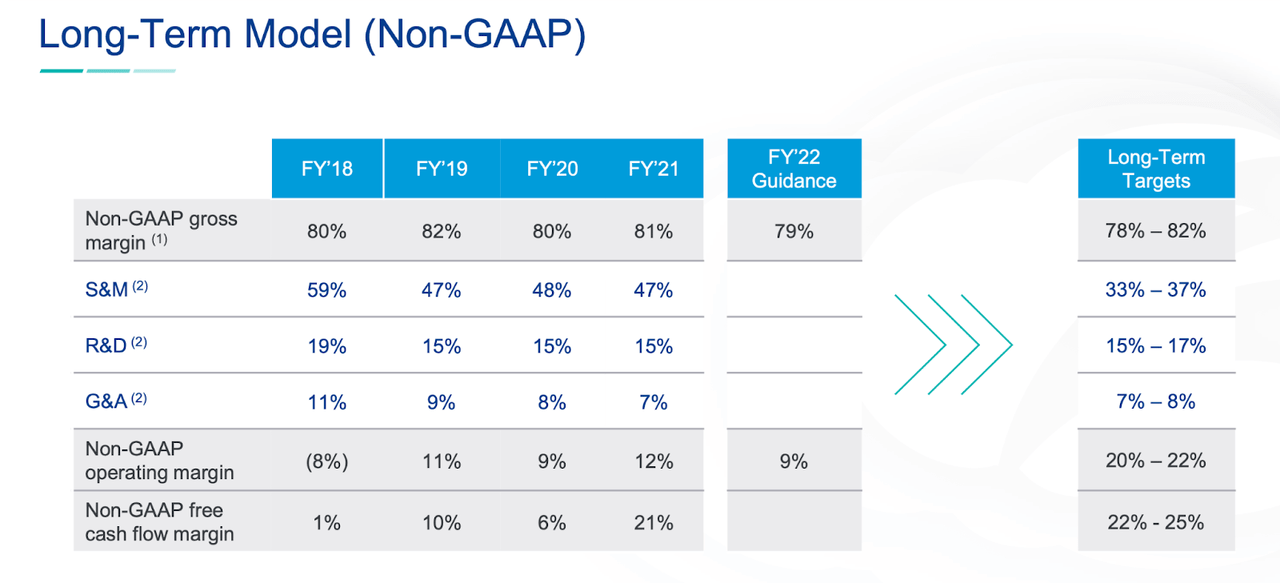

ZS guided for the next quarter to have up to $272 million in revenue and for the year to have up to $1.05 billion in revenue. That represents 54% growth next quarter and 48% growth in the fourth quarter. Judging by the valuation, I suspect that investors expect the company to materially beat on those estimates. ZS has sustained solid non-GAAP margins and has projected for non-GAAP operating margin to hover at 22% long term.

Zscaler March Investor Presentation

Is ZS Stock A Buy, Sell, or Hold?

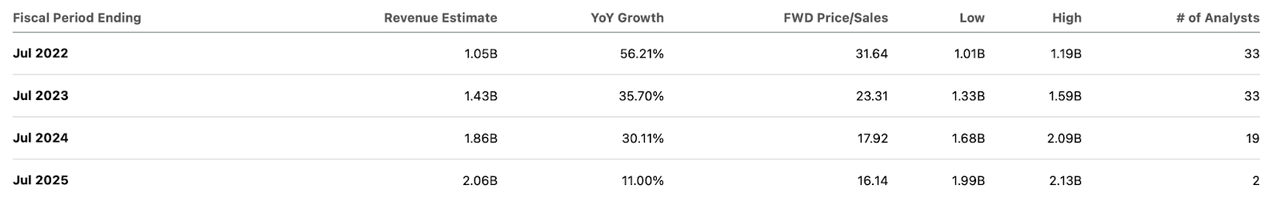

The company’s financials are strong – very strong in fact. Yet every stock can become overvalued at the wrong price. ZS is trading at 32x FY22 sales.

Seeking Alpha

I just mentioned that the company has guided for long-term 22% operating margins. Let’s instead assume 30% long-term net margins. Instead of the above-consensus estimates, let’s assume annual growth of 45%, 40%, 35% over the next 3 years, and 30% on the fourth. At current prices, ZS is trading at 12x 2025e sales. If we assume that ZS trades at a 1.5x price to earnings growth ratio (‘PEG ratio’), then the stock might trade at 13.5x sales by then. That suggests only 12.5% upside over the next 3 years, for an annualized return of only 4%. Sure, ZS might deliver stronger returns than that, but it would need to either outperform my already above-consensus estimates and/or trade at richer multiples. If we instead assume 40% long-term margins and a 2x PEG ratio, then ZS might trade at 24x sales by 2025, suggesting 100% upside over the next 3 years. Yet if ZS trades at those multiples, then that suggests the rest of the tech sector would have fully recovered as well, with far more upside than 100% over 3 years. ZS is richly valued based on estimates 3 years out, yet many other tech stocks are trading cheaply based on this year or even last year’s financial results. While ZS might be the kind of stock that “feels good” to own in a portfolio, the stock is unlikely to keep up with tech peers. I am no stranger to buying tech stocks and tech makes up the vast majority of my portfolio holdings. Yet valuation always matters, and this is the only (but important) problem facing ZS stock today.

Be the first to comment