MagioreStock/iStock Editorial via Getty Images

Recently, Seeking Alpha’s The Weekend Bite interviewed Wall Street Legend George Ball, Chairman of Sanders Morris Harris, a multibillion-dollar broker-dealer and investment firm. Ball’s investment prowess and success has been sought after by many, so we asked him to provide key insights for investing in the current volatile environment. Given geopolitical issues abroad and inflationary concerns, his key insights on FAANG stocks may surprise you, but they are worth considering.

Consider Tech Alternatives to FAANG Stocks

Ball recommends cybersecurity holdings like the ETFMG Prime Cyber Security ETF (HACK) and said, “Cybersecurity is going to be a growth area and theme for a long time to come.” Cybersecurity threats are putting individuals and companies around the world on the defensive. The buildup of Russia’s invasion of Ukraine has the world on edge, with cybersecurity defense in action and fears of cyberwarfare mounting. While there is no clear solution on how to thwart hackers, one thing is sure: governments, corporations, and individuals are equipping themselves with cybersecurity solutions and software, which is why cybersecurity ETFs and stocks are timely.

Ball also believes, instead of investing in a market-cap weighted tech ETF, investors should consider an equal-weighted ETF such as Invesco S&P 500 Equal Weight Technology ETF (RYT). Ball states, “This is a technology ETF, but it’s equal-weighted. It removes the risk of dramatically overweighting a few (vulnerable) monopolies like FANG+s.” As the Head of Seeking Alpha Quantitative Strategy, I also share some of the same concerns on FAANG stocks. The stocks are significantly overvalued and vulnerable to government attack. Along the same lines of Ball’s concerns, in a September 2020 article, I highlighted The Truth: Your S&P 500 ETF Is Riskier Than You Realize. This article emphasized the extreme concentration within the S&P 500 index and the five mega-tech stocks that have driven the index’s forbidding valuation. The same strategy would apply to broadening out ownership of a Technology ETF to remove concentration risk. On a granular stock level, let us first dive into why two of the most popular FAANG stocks, Apple and Amazon, are overvalued and lack growth rates compared to other tech companies.

Top FAANG Stocks

Industry tech leaders Apple (AAPL) and Amazon (AMZN) are two of the most popular and historically best-performing American companies of all time. I wrote an article to start 2022 called 6 Questions And Answers About Apple: Why The Stock Has Not Been A Buy. Some of the key points in this article discuss why our quant system has rated Apple a Hold versus Buy or Strong Buy rating. Although Big Tech stocks dominate performance in the Nasdaq and IT indexes with Apple responsible for 11.6% of the Nasdaq 100 weighting, Apple has a poor valuation and weak growth.

Amazon’s market capitalization of $1.68 Trillion and Apple’s $2.76 Trillion market cap and stellar growth over the years have turned these companies into near-monopolies, prompting requests from politicians like Elizabeth Warren to crack down on Big Tech monopolies. In addition to requests for government intervention, these companies are severely overvalued and according to George Ball, he believes FAANGs may be “tapped out” and it’s time to consider alternative tech options for investment.

1. Apple (AAPL)

In line with the market, and rebounding from its lows, Apple is down 4.14% YTD. Going forward, weakness in demand, global regulatory problems, fears over the App store revenue growth slowing, supply chain shortages (particularly the chips used in Apple phones and products) all point to issues that are likely to hinder their revenue generation. According to SA contributor, Bluesea Research, Apple Faces A Perfect Storm. Bluesea highlights, the “App Store is facing massive challenges from regulators and legislators within the U.S. and international regions. A Dutch regulator has already asked Apple to allow other payment options for dating apps within the Netherlands. South Korea has passed a similar law for all apps on the App Store. It is likely that we will rapidly see similar actions across the globe by regulators who want to lower the commissions for small app developers within their region.” The latter issues, along with recent geopolitical factors make it evident that Apple is facing major problems above and beyond its overvaluation.

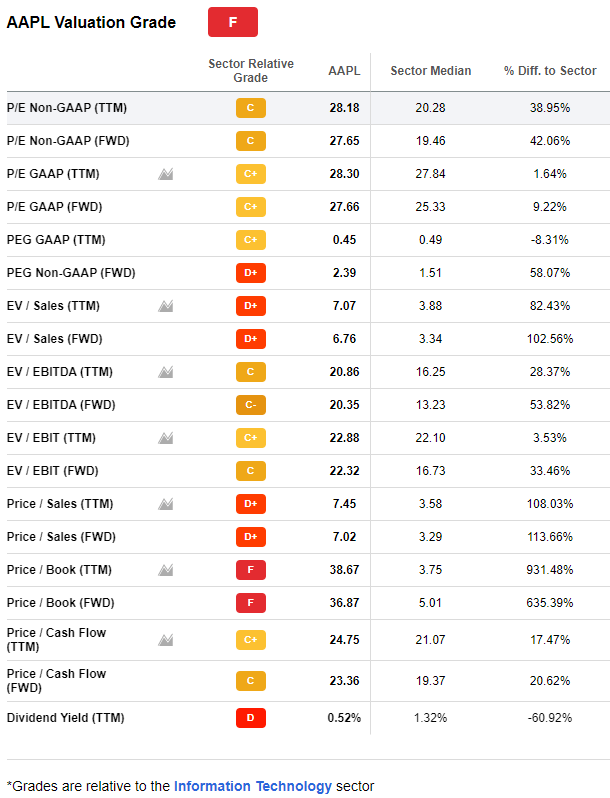

AAPL Valuation

Apple Inc. is trading at $172/share and as you can see from our valuation grade of F, the stock is extremely overvalued. Trading above its sector and having a forward PEG ratio of 2.39x which is more than 58% above the median, investors are not getting the best bang for their buck.

When you factor in the Price/Sales ratios that are also underwhelming and what is projected for the company’s sales per share going forward, Apple is facing some headwinds in the growth category. Despite strong profitability, given some of their headwinds including solutions to projects like the electric vehicle development along with reporting plans to make their own chips in-house, these types of investments can make a big dent in profits.

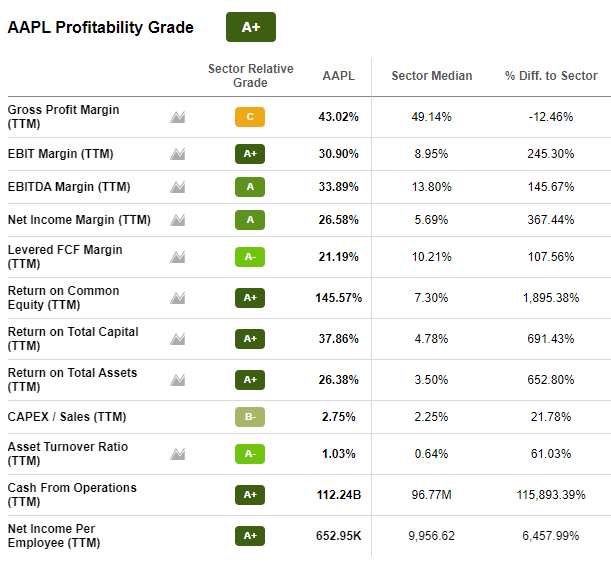

AAPL Profitability

Although Apple has had tremendous success, demonstrating its prowess as a tech pioneer and innovator that’s proven profitable over the years, it maintains an A+ Profitability Grade with excellent EBITDA margins and they’re cash-flush with more than $112.24B Cash from Operations.

However, gross profit margins have been shrinking due to supply shortages, increasing component costs, and wearable products – when defective – decrease margins which increase the cost of goods sold (COGS). In addition to Russia’s alliance with China, if there’s a forced reunification with Taiwan, “A $100 share price for AAPL could be conservative, and shares could go lower,” writes Seeking Alpha author Steven Fiorillo. These threats to Apple’s business along with other factors could be devastating to their growth. Plans to make their own chips are part of their long-term plan, but also a significant investment and capital expenditure. Chip facilities cannot be built overnight, but long-term could help them.

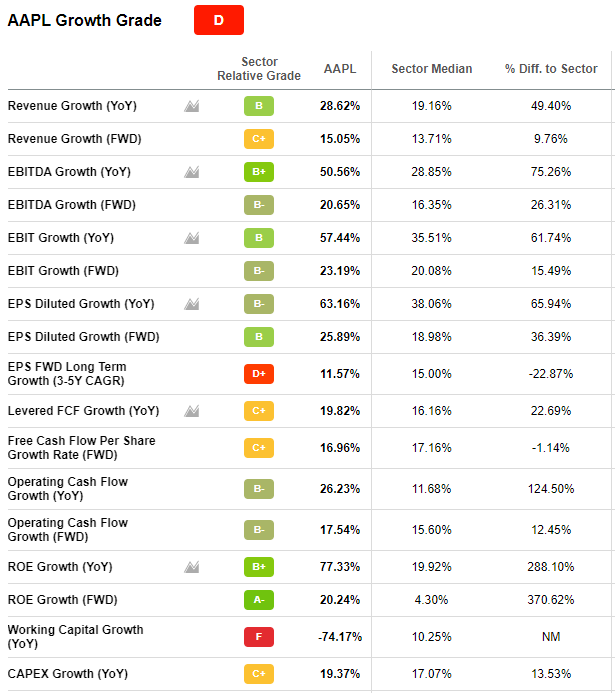

Apple Growth

Despite Apple’s growth grade being a D, the company had solid Q1 Earnings. With an EPS of $2.10 beating by $0.21 and a revenue increase of 11.22% YoY, Apple “set all-time records for both developed and emerging markets and saw revenue growth across all of our product categories, except for iPad, which we said would be supply-constrained,” said Tim Cook, Apple CEO.

Because the underlying metrics are not weighted equally, you can see that EPS FWD Long Term Growth(3-5yr CAGR) of 11.57%, which measures the next period’s earnings is a D+. And YoY Working Capital which is -74.17% is assigned an F grade, we have serious reservations about the growth of the company and outstanding payment obligations as it relates to Apple’s future plans that involve electric vehicles that have so far been unprofitable, and creation of their own semiconductor facilities.

Source: Seeking Alpha Premium

Issues with their electric vehicle plans also aren’t looking so well, especially as they continue losing all of their executive talents to competitors. We’ve yet to see Apple produce an electric vehicle as I wrote in The Next Top EV Stock, costing Apple a ton of time and money. As we consider Apple’s future growth coupled with overvaluation, there is another mega-tech stock that comes to mind.

2. Amazon (AMZN)

Amazon announced a 20 to 1 stock split this month in an effort to entice smaller retail investors to buy the stock. Stock splits typically don’t affect earnings but lowers the price of a stock so more people have access. Outside of corporate actions, there are investors concerned with the stock’s future. SA Contributor Paul Franke, recently wrote in Amazon: Bearish Growth Trends And Expanding Antitrust Investigations that there are serious antitrust issues. “It is entirely possible billions in fines will eventually be levied against Amazon the next 12-24 months, and/or the company will be broken up into three companies by U.S. regulators to promote greater competition: the leading online retail giant, AWS cloud computing, and a subscription/streaming division with its movie, music and online security businesses bundled together.”

Along with the later issues, there are also concerns about inflation and what impacts it will have on consumer spending. At the same time, AMZN stands to benefit due to increased gas prices as more people spend on AMZ when they’re stuck at home rather than spending when going out.

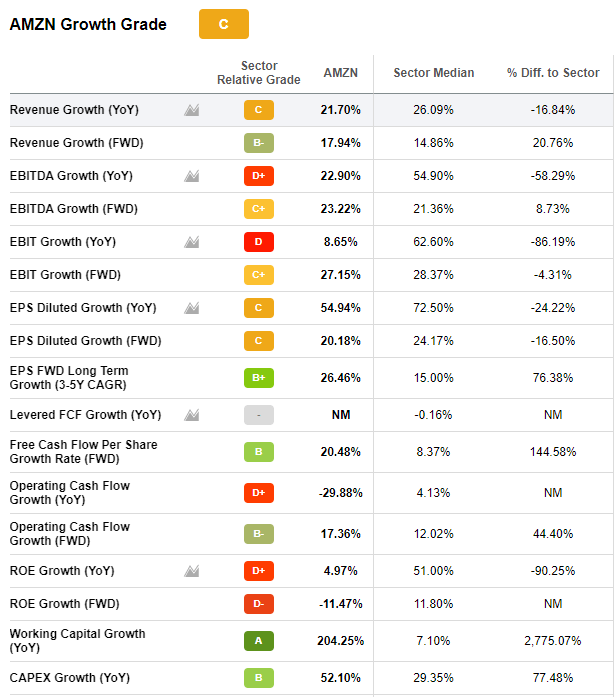

Amazon Growth & Profitability

The increasing price of goods that we’re already seeing will dampen consumer demand aside from the price of gas. Net-net, Amazon could be looking at a slowdown in revenue although it may be offset by their recent increase in subscription prices, up by nearly $20/year. As evidenced by the C growth grade below and when compared to one year ago, Amazon is seeing a decline.

Amazon’s Q4 total revenue in North America was $75.4B compared to the year prior of $82.4B. International revenue also experienced losses, and like Apple, supply chain disruptions and high inflation are taking their toll on key segments of Amazon’s business, impacting margins while increasing costs. In addition to our concerns for the company’s future growth and profitability, Amazon is highly overvalued.

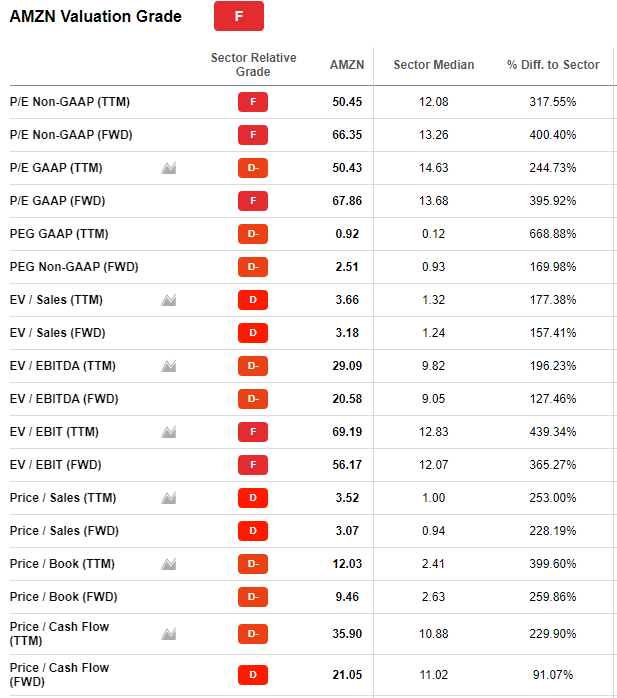

Amazon Valuation

Like Apple, Amazon’s valuation is dismal. As you can see in red and the giant F as an overall valuation grade, from forward earnings ratios to PEG ratio, this stock, and its underlying valuation metrics are all severely above its competitors in the sector.

Consider using our screener to search for alternate Top Technology Stocks with solid valuations. As George Ball indicates, lighten up on FAANG stocks and emphasize buying broader tech companies. While FAANG stocks are good companies, they are overrated and overvalued. Seeking Alpha’s technology screen displays higher quality stocks with strong earnings, reasonable valuations, and cash flow to weather storms better. Right now, one of the best-ranking tech industries is semiconductors, and chips are popular products used everyday, which puts them in high demand. They present a buying opportunity for long-term investors because they come at reasonable valuations and showcase strong earnings and the long-term cycle looks very favorable. Semi stocks have been all the news due to chip shortages. Here are some of my favorite semiconductor stock picks.

3 Top Semiconductor Stocks

The start of 2022 has taken mega technology stocks from boom to bust. The economic effects and fears of geopolitical concerns, inflation, and Fed tightening have prompted many investors to consider alternative investments. With record demand for electronic devices, vehicles, emphasis on renewable energy, amid supply chain disruptions, the semiconductor industry is having a heyday, and we have the stock picks that are set to reap the rewards.

1. Alpha and Omega Semiconductor (NASDAQ:AOSL)

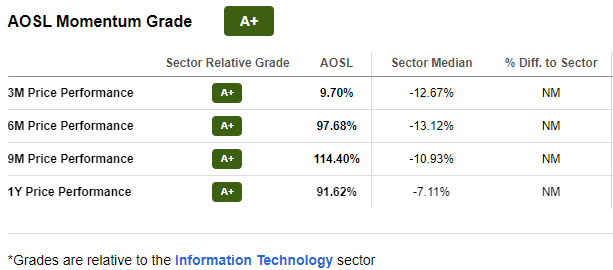

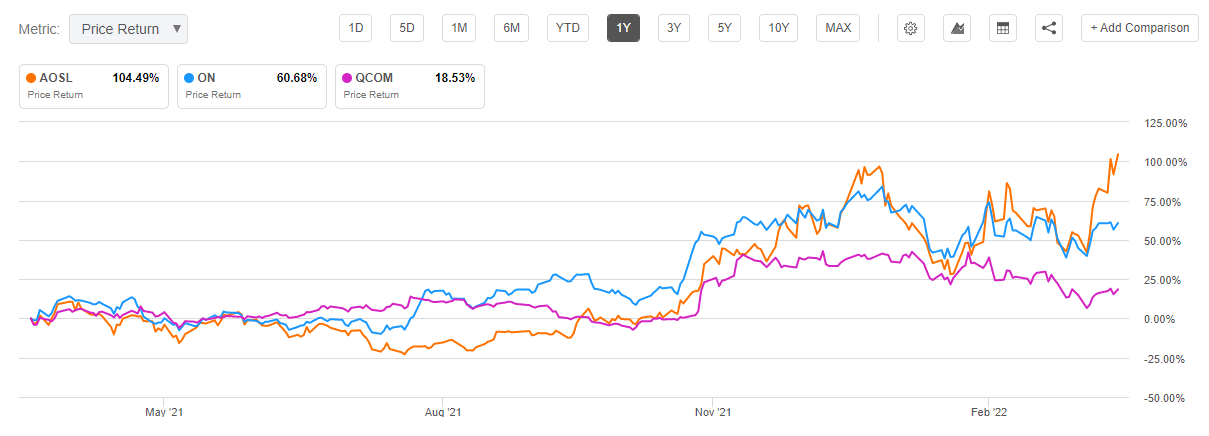

International designer and developer of power semiconductor products Alpha and Omega Semiconductor (AOSL) is crushing its sector, and industry, ranking #1 in both, providing a range of digital power products focused on high-volume applications like computers, televisions, smartphones, and more. The company has been on the rise over the last few years, and with an A+ Momentum Grade, consistently outperforms its sector peers quarterly over the previous year.

Source: Seeking Alpha Premium

Despite the stock experiencing a 33.1% decline earlier this year along with much of the tech sector that was getting crushed during the same time period, AOSL has since rebounded and is up nearly 5% YTD, and trading at an excellent valuation.

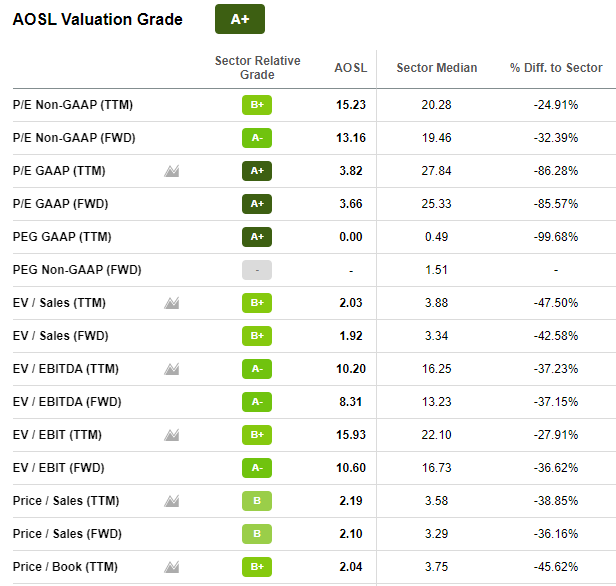

Alpha and Omega Valuation

Alpha and Omega has an overall A+ valuation grade, with stellar underlying valuation metrics. Forward P/E ratio of A- is -32.39%, current PEG ratio of A+ is -99.68%, and the stock showcases strong EV/Sales and EV/EBITDA figures. In addition to rebounding from its 2022 price decline, the stock is currently trading below $70/share and has seen a one-year price increase +106%, and a five-year increase of 279.57%.

AOSL Growth & Profitability

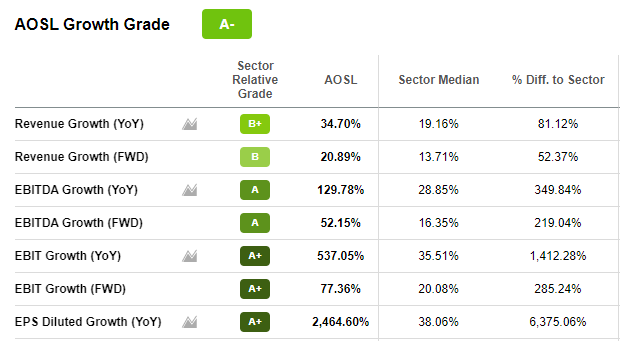

After reporting second-quarter FY2022 earnings, AOSL stock jumped +12% having beat top and bottom-line figures. EPS of $1.20 beat by $0.16 and revenue jumped 21.71% or $5.32 YoY from $193.32. “Calendar year 2021 was an exceptional year for AOS, both in terms of our business execution as well as our financial results…with the December quarter coming in at 36.7% on a non-GAAP basis, which is a record (gross margin)…As we look to the future, we now have our sights set on actively planning and marching towards $1 billion annual revenue, with much stronger and a more sophisticated R&D capability and the supply chain operations,” said Dr. Mike Chang, AOLS Chief Executive Officer during the 22Q2 Earnings Call.

Source: Seeking Alpha Premium

AOSL’s financials have continued to improve over the past few years and is growing fast, relative to its competitors like ON and QCOM.

Source: Seeking Alpha Premium

As the tech sector outperformed the broader market throughout the majority of 2021 with mega-tech stocks overshadowing the performance of smaller tech companies, we see a number of tailwinds for the semiconductor industry, given the race to digitization and explosion of data, needing chips for digital transforming products.

2. ON Semiconductor (NASDAQ:ON)

One of my favorite chip companies which continues to shine is Fortune 1000 company, ON Semiconductor Corporation. American supplier of intelligent power technology that is propelling sustainable energy, longer-range electric vehicles (EVs), and overall leading provider of power management, ON continues to thrive as a result of their innovative technologies.

High-value trends have continued to make this stock a Strong Buy. Semiconductors are in high demand and in short supply.

Source: Seeking Alpha Premium

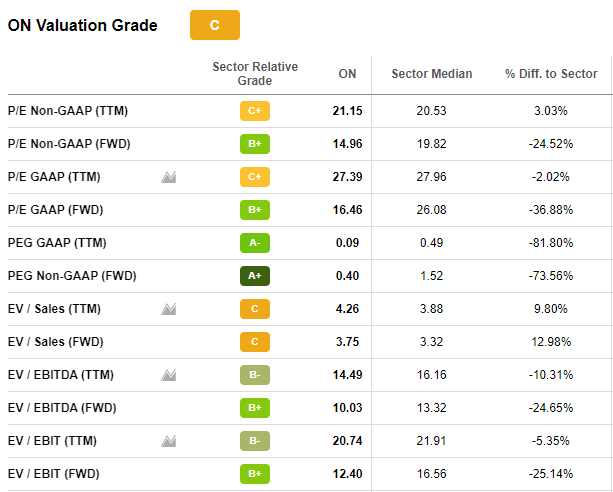

ON Valuation Grade

ON Semiconductor comes at a fair Valuation Grade, remaining attractive relative to its sector by 24.52%, at a forward P/E of 14.96x. Its A+ PEG ratio of 0.40x also indicates a great value. While supply constraints pose some issues for the industry, ON continues to capitalize, as exhibited by a one-year share price increase of +56.53% and excellent growth and profitability.

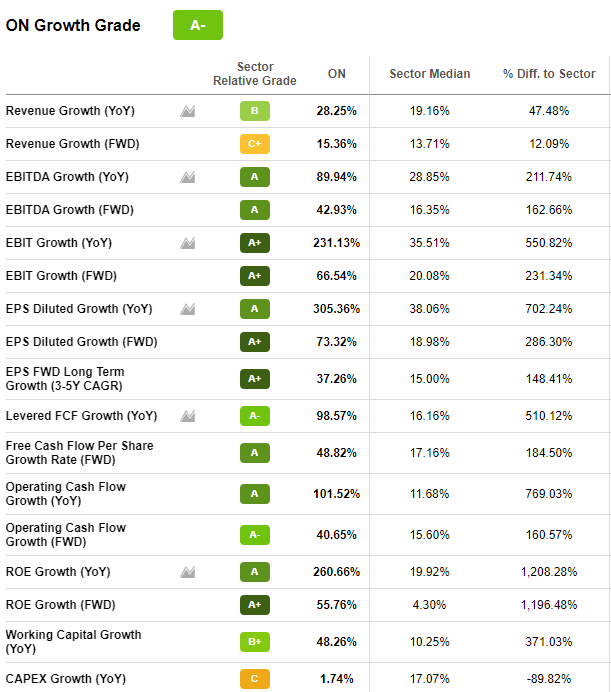

ON Semiconductor Growth and Profitability

According to our quant rankings, On Semi is ranked #4 in its industry out of 62 and #8 out of 578 for its sector. Standing out with high growth and plans to lead market share, ON closed out 2021 with another stellar earnings report. Revenue increased 28%, as its operating income and free cash flow rose six times in lieu of supply chain disruptions. “We continue to see strong demand for our products. And in 2021, our design win funnel grew over 60% year-over-year, and our new product revenue grew 28% from 2020. This design win performance, along with long-term supply agreements, have positioned the company for sustained long-term growth,” said Hassane El-Khoury, On Semi President and CEO, during the Q4 Earnings Call.

Source: Seeking Alpha Premium

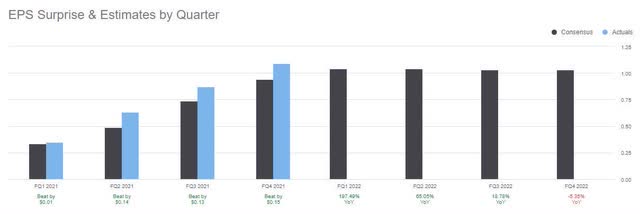

Q4 earnings resulted in both top-and bottom-line beats, with EPS of $1.09 increasing $0.15 and revenue of $1.85B rising to $55.17M or 27.645% YoY, resulting in an A+ revisions grade and 29 FY1 Up revisions within the last 90 days. ON has exceeded estimates for seven quarters, and analysts continue to increase their earnings estimates.

ON Semiconductor Earnings

Source: Seeking Alpha Premium

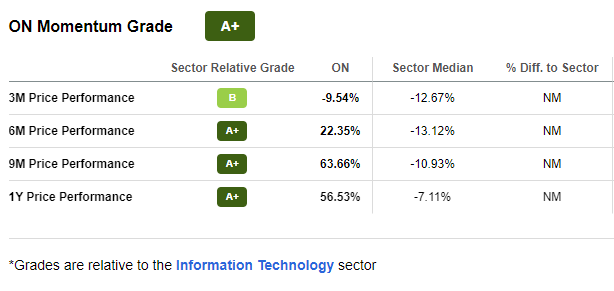

ON Semiconductor Momentum

Momentum is very positive for ON as they have an A+ Momentum Grade and continue with a price-performance return over ten years exceeding 300%. Digging further into their growth grades showcases strong year-over-year EBITDA Growth +211% above the sector, and EPS FWD Long Term grade of A+, 148% above the sector. As we continue to observe the growth and profitability trends within the semiconductor sector, there’s another popular name, and one of my favorites in the industry.

3. QUALCOMM Incorporated (NASDAQ:QCOM)

High-demand semiconductor stock with a market capitalization of $177.63B, continues to rise. With solid Factor Grades and one of the few tech stocks with an excellent dividend scorecard and 1.96% Dividend Yield, not only is this stock a great tech and semiconductor option, QCOM is also a quality dividend stock.

Semiconductors are utilized in a countless number of devices and products, including smartphones, electronics, electric vehicles, and renewable energy sources. I wrote in The Next Top Electric Vehicle Stock: Look Out Tesla and Apple that semiconductor stocks continue to benefit from supply chain issues, helping prime this sector to become one of the best-performing over the next few years. Investors want stocks with solid fundamentals and long-term strength. Although the world continues to experience supply shortage and when you factor in the ongoing geopolitical issues, companies like QCOM that can provide a steady stream of dividend income, especially following a dividend increase by 10% from $0.68 to $0.75/share quarterly dividend, make this stock even more attractive.

QCOM Dividend Scorecard

QCOM Dividend Scorecard (Seeking Alpha Premium)

“Given our long-term earnings growth expectations we provided at Investor Day, we remain committed to returning capital to stockholders through a balanced capital return policy, including a baseline of anti-dilutive stock repurchases, and strong dividend growth with an annualized target of high-single-digit to low-double-digit growth,” announced Cristiano Amon, QCOM President & CEO. Not only does QCOM possess strong dividend scores, but the stock is trading at a relative discount within its sector.

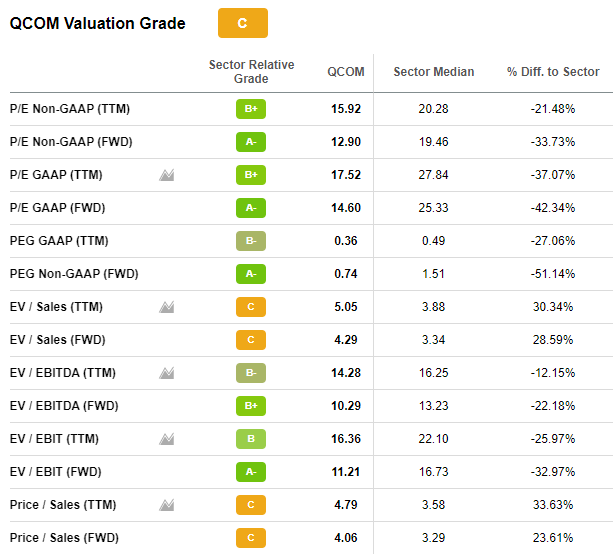

QCOM Valuation

QCOM is trading at a discount, and while its valuation grade is a C, its forward P/E of 12.90x, trading 33% below its sector makes for an attractive metric. Forward PEG is more than 50% below the sector, and given QCOM’s dominance in the cellular technology space with history as a top patent holder, namely Internet of Things (IOT), “We think that at the current entry valuation there can be years of stock price growth ahead.

QCOM Valuation (Seeking Alpha Premium)

Every company has competition, but QCOM’s is not as extreme thanks to the patents protecting their early intellectual property development.” Although the valuation grade isn’t an A, QCOM has seen a share price increase of nearly +16% over one year and continues to possess excellent growth and profitability.

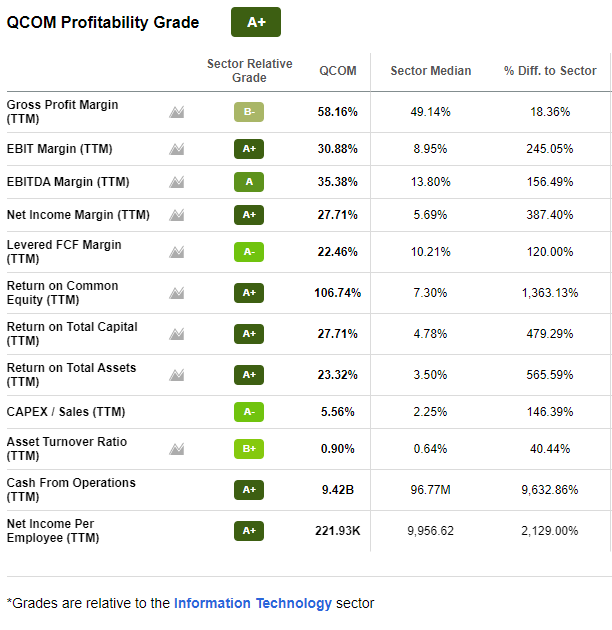

QCOM Profitability and Growth

Source: Seeking Alpha Premium

QCOM possesses excellent profit margins, which are a result of the company’s technology roadmap, high-tier devices, and advancements in technology for a 35% operating margin. Cash from Operations is readily available as showcased above in its $9.42B stash and A+ grade.

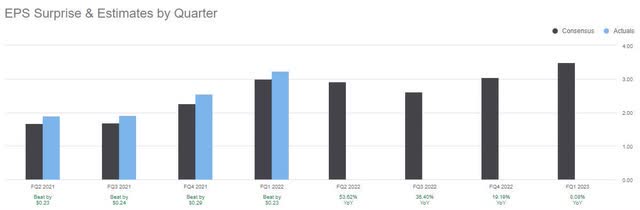

QCOM EPS

QCOM EPS (Seeking Alpha Premium)

QCOM is growing as evidenced by its record 22Q1 revenues of $8.8B including an increase of IoT revenue of 41% YoY to $1.5B and automotive revenue increase of 21% YoY to $256M. Twenty-four analysts increased their earnings estimates up over the last 90 days resulting in an A- Revisions Grade. EPS of $3.23 beat by $0.23 and Revenue of $10.70B beat by $262.71M, +30% YoY. Semiconductors are hot tech stocks used in everyday life, and as investors look to the future for long-term investments, consider adding some of our three top picks to your portfolio.

Conclusion: The Broader Tech Sector Makes Money Too

Tech stocks are excellent buys, as proven by their stellar performance over the last five years. But since last November, they’re taking a hit. Why not identify tech stocks with fair valuations, solid fundamentals that can capitalize on the growth drivers in the tech industry? George Ball offers excellent insights into why investors should lighten up on FAANG holdings. In a nutshell, George Ball tells investors to keep some powder dry and be ready to put money to work in the broader tech market. Our semiconductor stock picks provide a good balance of profitability, growth, and solid value, especially compared to the FAANGs – and they’re a great way to ride the semiconductor wave.

If you’re not sold on semiconductor stocks, we have dozens more stocks to choose from. Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions. Check out our Top Technology Stocks and Top Growth Stocks.

Be the first to comment