Mordolff/E+ via Getty Images

The additive manufacturing space these days has a number of players, some large and others small, that attract investors for various reasons. Though this investment niche is no longer as popular as it used to be, there’s no denying that the opportunity in this market is significant. One company that is dedicated to a very particular segment of this market is Israeli company Nano Dimension (NASDAQ:NNDM). Recently, management posted some positive news when it comes to revenue. And that could have a nice impact once the company reports financial results for the final quarter of its 2021 fiscal year later this month. However, the bigger picture is just how fundamentally strong the company is compared to the firm’s current value. All things considered, investors who don’t mind a very long-term play that is certain to burn through some cash, should view this as an appealing prospect at this time.

Nano Dimension – A niche 3-D printing firm

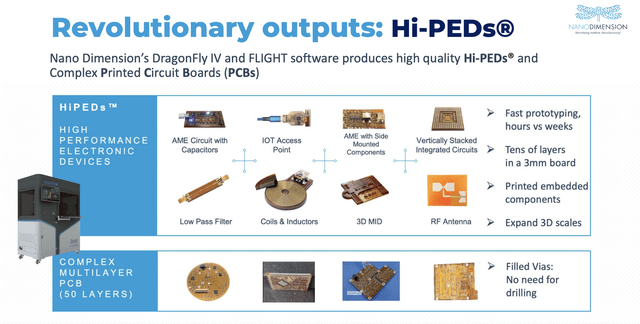

Nano Dimension

Today, Nano Dimension operates as a provider of additive manufacturing, or what is more commonly known as 3-D printing, technologies. The only difference between this firm and many of the other players in the market is that this one has a particular focus. Its emphasis is on providing machines and materials that can print electronic devices. The circuit board is one such example of an electronic device the company enables its customers to produce. This happens to be a rather niche category on its own. According to one source, the global 3-D printing market was worth about $13.8 billion in 2020. Current forecasts have it expanding at a 21% rate per annum through at least 2028. However, Nano Dimension’s emphasis is on the production of printed electronics. In 2017, this market was worth just $176 million. It should have expanded to $592 million by 2021. And by 2025, it’s estimated to be worth $2.4 billion.

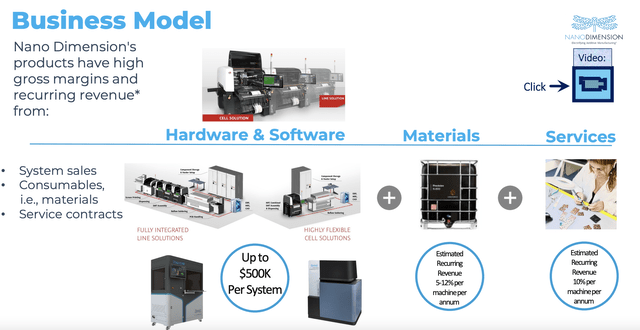

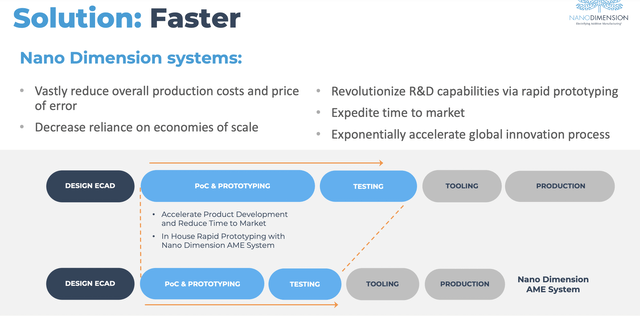

Nano Dimension

To get where it is today, the business has engaged in a number of acquisitions. It also has 106 patent applications out, with 18 patents granted in the US and another 6 that came from its Fabrica acquisition. In order to generate revenue, the company plans to sell its printers for between $350,000 and $500,000 apiece. They estimate that materials costs will bring in annual recurring revenue of between $50,000 and $100,000 per machine. Other revenue opportunities exist as well, such as services that management believes will amount to 10% of the price tag of the machine each year. The reason why companies might be willing to spend so much on a piece of machinery is because, according to management, the ability to print custom electronics on site can have significant impacts in terms of speeding up both the prototyping and testing of the product development lifecycle for technology-oriented firms. This will ultimately reduce costs for their customers to get to market. And it will reduce time.

Nano Dimension

Keep an eye on new developments

On March 31st of this year, before the market opens, the management team at Nano Dimension is due to report financial performance covering the final quarter of the company’s 2021 fiscal year. As we near that time, there are a couple of items that we should keep an eye out on. And for one of these, we already have some guidance from management. You see, in late January of this year, the company announced preliminary results covering the final quarter of the firm’s 2021 fiscal year. They estimated then that revenue would be $7 million. That represents a 255% increase over what the company generated one year earlier. It’s also up 420% compared to the third quarter last year. And as a result of this, it pushed overall sales up to $10 million for the year, an increase relative to 2020 of 194%.

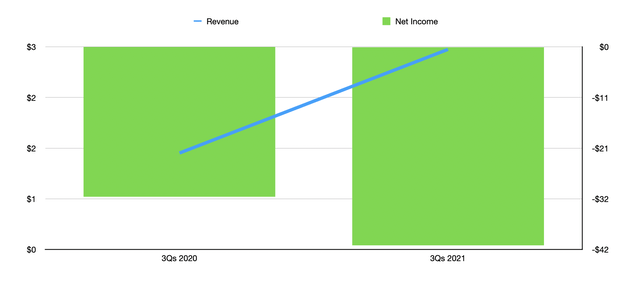

Author – SEC EDGAR Data

Currently, analysts expect the business to have only generated $5.5 million in revenue. Naturally, since the news is already out, it would be painful for investors if management’s preliminary forecast ends up coming in short. On the other hand, given what analysts currently anticipate, any outperformance might prove bullish for the company. The other item relates to earnings. For the quarter, management has not provided any guidance. But analysts are anticipating a loss per share of $0.07. That’s actually larger than the $0.02 per share loss the company incurred one year earlier. Given that the company is trying to ramp up its operations, it wouldn’t be surprising to see continued losses mount moving forward.

NNDM stock – Where the value lies

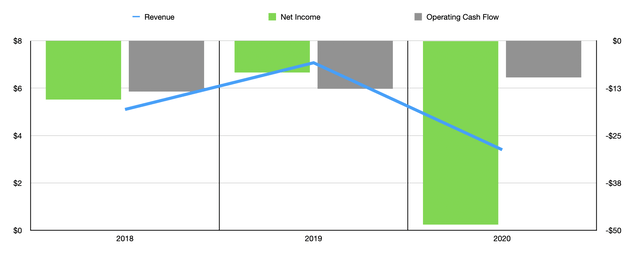

At present, Nano Dimension is valued at $961.83 million. If you look at the revenue and profitability of the company, the fundamentals in no way support this kind of valuation. Over the past three years, sales have ranged from a low of $3.40 million to a high of $7.07 million. Net losses have ranged from $8.4 million to $48.5 million. And operating cash flow for the company has improved only marginally, moving from a negative $13.4 million to a negative $9.6 million. Sure, investors are focused more on the growth prospects of the company. Ultimately, the firm will have to establish itself as a meaningful and valuable player if it wants to justify its current valuation. But there is another component to the picture as well.

Author – SEC EDGAR Data

That component has to do with the company’s balance sheet. At present, there is no debt on hand. At the same time, the company has cash and cash equivalents of nearly $1.39 billion. In short, the company is worth more dead than alive right now. This tremendous amount of cash should be useful in protecting the company. Ultimately, management will use much of this cash to expand the business. So in any given year, investors will have to balance out the protection the cash remaining offers against the firm’s progress in getting a sizable hold on its market.

Takeaway

At this point in time, Nano Dimension strikes me as a fascinating prospect. Just from a revenue and cash flow perspective, I would not normally touch the business. However, management has a tremendous amount of cash on hand to fund current operations. This makes the business very low risk at the present moment. Of course, this picture could change from quarter to quarter. And investors should pay attention to what management reports in a few days to see whether or not the picture has changed for the better or worse. Because at the end of the day, these frequent updates can be valuable in establishing the extent to which management is creating value or draining it.

Be the first to comment