metamorworks

Thesis

Zoom (NASDAQ:ZM) reported earnings for the June quarter on August 22, and the stock plunged by more than 8% following the announcement (after hours reference). The market’s first reaction is perfectly justified, I argue. Growing revenues at a rate of less than 10% year over year, which is below the performance of most tech stocks, Based on the recent results, it seems that Zoom may not be able to maintain its status of the growth company. Accordingly, the company’s earnings multiple should contract. Currently trading at one-year forward P/E of about x27, I see a downward correction to x20 as fair—which would imply about 27% downside. This is in line with my personal valuation. In this article I take a close look at Zooms financials, and I structure a Residual Earnings framework to value the company’s shares. My findings conclude that Zoom—despite the sell-off—is still about 35% overvalued. My target price is $55.04/share.

About Zoom

Zoom is a software company and one of the leaders in video communication solutions. Zoom’s cloud-based communication platform is designed for multiple devices and connects people through video, voice, chat, and content sharing. The company was founded in 2011 by CEO Eric Yuan and has seen truly astonishing growth in the past year, which accelerated during the Covid-19 lockdowns. In the early days of Covid (April 2020), Zoom announced having achieved a milestone of 300 million daily meeting participants. Now, as of early 2022, Zoom software has been installed more than 500 million times. Zoom serves about 204.100 enterprise customers; and the number of customers contributing +$100 thousand in TTM are 3.116. The company is headquartered in San Jose, CA and serves customers worldwide.

The Boom …

Zoom has enjoyed remarkable growth in the past few years: Revenues in 2021 were 4.1 billion, almost x10 the 330 million revenues in 2018. Moreover, while Zoom was barely profitable in 2019 (net income margin of 3.5%), the company achieved a 25.5% net profitability in 2021, generating net-income of 1.033 million or $3.37 on a per share basis. But now growth is slowing and the company’s market opportunity is arguably quite limited. According to Gardner research, Zoom’s addressable market for 2024 is estimated at ‘only’ $14 billion.

… and the Reality

Analyst consensus expects that Zoom’s revenues would grow at a CAGR of about 10% until 2025 (Source: Bloomberg EEO, as of August 22). But in my opinion, there is considerable downside to these estimates. Investors should consider that competition with RingCentral, Microsoft and Google continues to intensify and that the Covid-19 tailwind has arguably completely faded away. My bearish thesis is supported by Zoom’s disappointing June quarter results. From April to end of June, Zoom generated total revenues of $1.099 billion dollars, which was below consensus of $1.12 billion and most notably below the lower end of the company’s own guidance. As the company increased spending on sales and marketing, Zoom’s net income fell to $45.7 million in Q2 versus $316.9 million for the same quarter one year prior. And perhaps most notably, Zoom lowered guidance for 2023, indicating that Q2 is not a one-quarter miss. The company commented:

As the majority of our revenue has shifted back to the enterprise and we have moved beyond the pandemic buying patterns, we are returning to more normalized enterprise sales cycles with linearity weighted towards the backend of the quarter…

… This contributed to higher than expected deferred revenue in Q2, and as we believe this customer behavior will persist, we have factored it into our outlook.

Residual Earnings Valuation

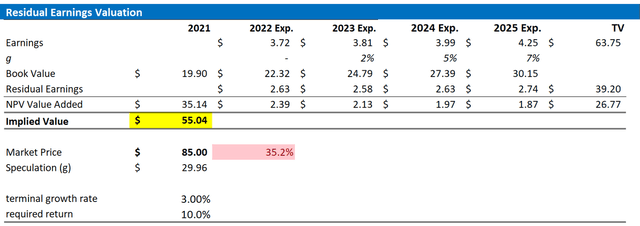

Let us now look at the valuation. What could be a fair per-share value for Zoom’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Zoom’s cost of equity at 10%.

- To derive Zoom’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate after 2025, I apply 3%. This is more/less in line with the expected nominal GDP growth.

Based on the above assumptions, my calculation returns a base-case target price for Zoom of $55.04/share, implying material downside of almost 35%.

Analyst Consensus EPS; Author’s Calculations

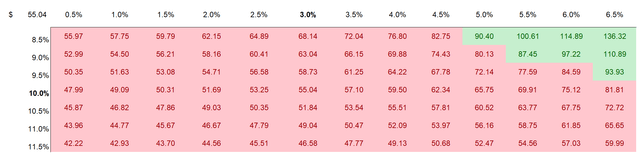

I understand that investors might have different assumptions with regards to Zoom’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculations

Upside Risk

Zoom’s stock valuation has arguably been closely correlated with the inflating and deflating of the Covid-induced bubble in tech companies. Accordingly, I have identified ‘speculative’ behavior as the biggest upside risk to my thesis. Investors should consider, that Zoom stock is still loved by some highly followed investor, including Cathy Wood whose third largest single stock holding is Zoom. That said, if speculative risk sentiment returns, Zoom stock might see a disproportional large share of investor interest.

Conclusion

In a post-Covid world, the market for video communication is arguably saturated. Consequently, competition among players remains the primary way for Zoom to claim additional revenue expansion. And I believe that Zoom is too small to claim the market through M&A. But can Zoom successfully compete against the FAANG’s including Microsoft and Google? Personally, I doubt it.

Moreover, without the growth premium, Zoom’s x27 earnings multiple seems stretched. To justify the risk/reward for investors, I argue ZM stock should trade about 35% lower–at $55.04/share.

Be the first to comment