ClarkandCompany/E+ via Getty Images

Co-produced with Treading Softly

I’ve never been an avid angler. I’ve known them. They can have masterful skills at casting a line, hooking a fish, and reeling them in. They will look at a body of water and identify where the largest fish are likely to be.

Of course, most of these master anglers are completely unknown. If you want attention, get a TV show. Better yet, get a reality TV show, and it doesn’t matter whether you are skilled or not. The magic of editing can make anyone look like a master angler!

When the market falls, it’s easy to whip out a 5-year chart and make almost any investment look bad. So in times of negativity, I find positive articles on tickers to be more beneficial personally. Likewise, I am more prone to examples of a bearish case for tickers when the rest of the market is bullish. This counter-intuitive nature often puts me at odds with the new waves of gurus and analysts who appear whenever the market makes a course change.

It also can lead to me sticking to my guns and buying more shares when others are following the crowd and exiting.

In investing, when you are buying against the moves of a selling crowd and believe an investment is oversold or undervalued based on a set of metrics, it is called bottom-fishing.

Today, I want to touch on two such high-yield bottom-fishing picks. They combined have 4 Sell ratings, 4 hold ratings, and 1 buy rating from other SA authors since September 1st.

Let’s see why we’re still buying.

Pick #1: NLY – Yield 20.9%

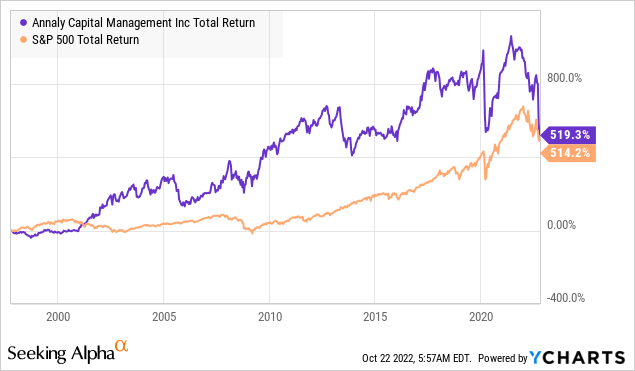

There is no doubt about it, Annaly Capital Management, Inc. (NLY) has been a controversial pick. Let’s get this out of the way: the share price is down a lot. The charts look “bad” when a company’s stock price falls over 50%, and you are measuring to that low price; past performance isn’t going to be pretty.

NLY’s price has fallen so far that since IPO, it has almost matched the abysmal performance of the S&P 500.

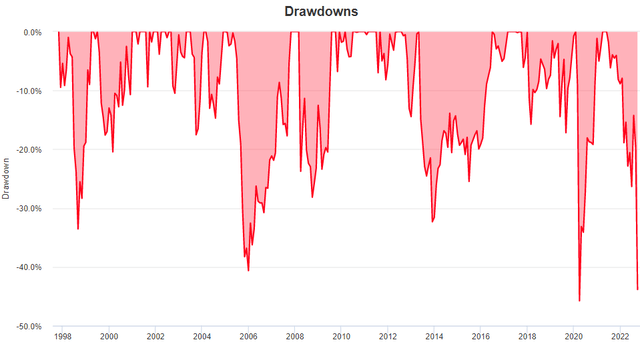

So let’s just get that out of the way – NLY has seen its share price take a beating that is very similar to the beating it took in March 2020. In fact, this is the second sharpest drawdown in NLY’s history, second only to 2020. Source

So let’s stipulate that the price action on NLY has been unpleasant. The idea that it will “never recover” because “capital has been destroyed” flies in the face of NLY’s past experience. The two times in history where NLY did fall this far, March 2020 and late 2005/2006, NLY went on to recover both times. Both were extraordinary buying opportunities.

What hasn’t been beaten up? NLY’s dividend. The share price has fallen dramatically, but the dividend remains unchanged. This is for the same reason that we see with many debt-related investments. Prices fall because interest rates are rising. As interest rates rise, the value of older lower-yielding debt declines.

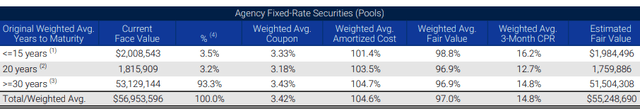

Today, 5.5% coupon MBS are trading slightly below $100 par. NLY’s portfolio has an average coupon of approximately 3.42%. Source

So if you can buy a new MBS with a coupon of 5.5%, what happens to the market value of a 3.5% coupon? It falls. Source

Note that NLY is still receiving the same 3.5% coupon. Cash flow hasn’t changed at all. NLY will still get $100 when the borrower repays their mortgages or if they default. What has changed is the carrying value on its balance sheet. In June, the average fair value was $97. Now it is much lower. That is why the book value has declined, and the share price has followed.

Today, we want to talk about NLY’s strategy. For the past two years, NLY has not been a major buyer of MBS. Instead, NLY has allowed its portfolio to “run-off” over the past year. As mortgages prepaid, NLY allowed the balance to decline instead of reinvesting.

Note that at the end of Q2 2022, NLY’s face value was just under $57 billion. Here is a comparison from two years ago – Q2 2020: Source

NLY allowed the face value of its portfolio to decline by nearly 20%. This is the par value owed by the borrowers and guaranteed by the agencies, so market prices do not impact it. This was a conscious decision by NLY, who decided that MBS prices were too high and reinvested less than 100% of the principal it was receiving. Instead, NLY chose to deleverage and wait for a better buying opportunity.

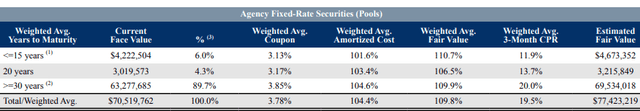

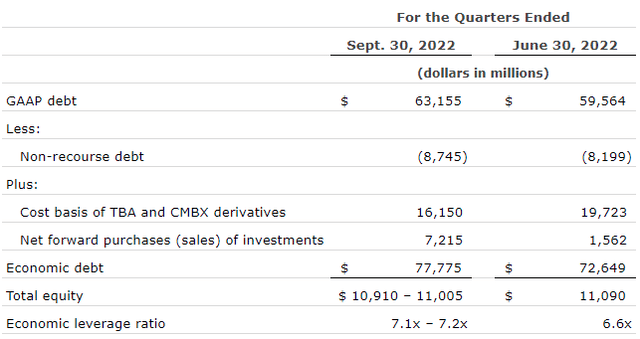

The wait is over. Last week, NLY updated the market on its portfolio. Source

Note that total equity is relatively unchanged, likely due to NLY issuing equity above book value during the quarter. The leverage ratio and economic debt are up. This is the first material step-up in debt that we’ve seen from NLY in two years and indicates that NLY has finally decided it is time to buy MBS. Judging by the $7.2 billion in forward purchases that have not settled yet, a good portion of their buying activity was late in the quarter when MBS prices were very low. This means that if MBS prices start going up, NLY will own more MBS on the upswing than it owned on the downswing. NLY let its portfolio dwindle when prices were high, and is now buying when prices are low. That is a great investment strategy if it can be executed.

The unknown is whether MBS prices are actually at the bottom, but they are certainly much closer to the bottom than they were last year. NLY has decided to pull the trigger and start buying. This will be beneficial to their cash flow in Q4 and beyond. If MBS prices rebound off of 20+ year lows, it could also be very positive for the recovery of their book value for those who are concerned about it.

Annaly will report Q3 earnings after the market close Wednesday, Oct. 26th.

Pick #2: ECC – Yield 16.4%

Eagle Point Credit Company Inc. (ECC) CEO Tom Majewski did an interview last week that is worth checking out. He repeated many of the points we’ve been making regarding CLOs and CLO equity. We’ve previously compared a CLO to a BDC, he compares them to “mini banks.”

Ultimately, what many investors fail to realize is that CLOs are not static, and they are not “derivatives”. Each CLO is a dynamic fund that the manager actively manages. ECC owns a well-diversified portfolio of these funds and could be considered a “fund of funds.”

At its core, a CLO borrows money at a low rate and lends at a higher rate, profiting from the difference. This is what banks do every day.

CLOs borrow money through “securitization,” which is slightly different from your typical bank. A CLO will sell “tranches” that vary in price depending on priority.

Investors in the senior A tranches pay a hefty premium and collect very low-interest rates for the security of being very first in line. CLOs typically offer a variety of protections and guarantee that the senior tranches get repaid first. Only after the senior tranches get what they are promised, then the junior debt tranches are paid.

The managers of the CLO hold the “equity” position. In other words, they collect the gains after the debt is serviced or repaid as agreed. These are the positions that ECC buys into. The managers are clearly interested in maximizing returns for the equity and actively manage the portfolio to achieve that. A typical CLO has a life of 12 years. For the first five years, the CLO can reinvest the principal as it is repaid. For the following seven years, principal payments are used to pay down the debt tranches, starting with the AAA tranche.

Majewski explained what happened during the Great Financial Crisis and why CLO equity positions issued before the crisis had a median return of 15% IRR.

The reality is, if you had the staying power and saw the investments through to their full cycle, you had a return in many cases better than the kind of the contemplated base case pre-crisis and why that is, every loan that doesn’t default pays off at par. It’s a binary. Every credit has a binary outcome. One of two things…. you get your money back or you don’t. In 2009, between 2008 and 2009, the 12-month default rate peaked at about 11%. But what that means is all the other loans paid off on par and at the same time, loan prices fell significantly during that time, 60, 70, $0.80 on the dollar and loans, those that don’t default, keep paying. They make prepayments. They make amortization of payments, payments when they’re due.

And that money, that par money coming back can be reinvested, typically, for the first five years of a CLO’s life, into either new loans or in choppier markets, you invest them in loans in the secondary market.

In other words, this is a theme I’ve spoken of many times: if you are a net buyer, lower prices are always a positive for you. I am a net buyer of stocks. Every single year, I own more shares than I did the year before, whether the market is up, down, sideways, or imitating a superball. This is because I use a portion of my dividends to reinvest every single year. My plan is to continue reinvesting a portion forever. So I am always a net buyer of stocks, and therefore lower stock prices are favorable for me.

Well, CLOs are always net buyers of loans. For their first 5 years, for every loan that is repaid at par, the principal is reinvested at the going rates. If loan prices are low, that means returns will be higher! After the first 5 years, CLOs don’t sell loans. They allow them to mature and then repay their debt as it comes down.

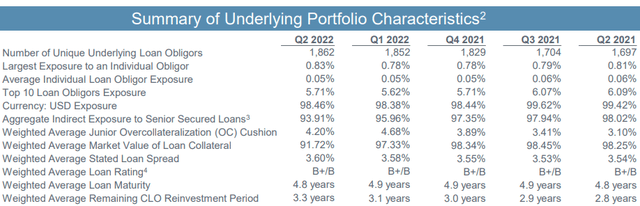

ECC is always a net buyer of CLO equity positions. ECC’s plan is not to buy a bunch of positions today and flip them for a higher price next year. ECC collects the dividend payments and holds the CLO positions to maturity. We can see over the past year that ECC has increased the size of its portfolio to 1,862 underlying loans, even though the market value of those positions has declined. Source

Before COVID, this was 1,541. As prices have fallen, ECC has been buying. When an investment is bought at a low price, the loss is on the part of the seller, not the buyer!

Today, the fundamentals are very strong for ECC. Prices are low, but default rates are also low. During periods like the GFC, prices were low because defaults were high, so there was the risk of a significant loss with each purchase.

Today, prices are falling, but that is being driven primarily by a reaction to the Federal Reserve changing interest rates. As well as dynamics like UK pension funds being forced to dump assets to meet margin calls. Assets including CLO debt tranches and leveraged loans have been going for fire-sale prices as desperate sellers seek cash at any price.

When prices are low, it is the buyers who win. If you are following the Income Method and earmarking 25% or more of your dividend income for reinvestment, then you are positioned to be a buyer. ECC is positioned to be a buyer. I for one am happy to be fully aligned with “Team Buy Income.”

ECC is expected to report Q3 earnings around the second week of November.

Dreamstime

Conclusion

Why are we “bottom-fishing” for these two picks? Simple. The income is steady and continuous. Unlike others who try to dance a jig with their secret sauce that lets them tell the future, We take a different approach. We understand that price moves occur and cannot be avoided unless you park your cash in a bank account and don’t want to sit at the adults’ table – called the stock market.

Some people do love to cash out from time to time when they get exhausted by the swings and climbs. I don’t blame them. If my retirement depended on those climbs and swoons, I would want to get off the rollercoaster as fast as possible.

You see, my retirement is paid for by the market but does not rely on share price movements to achieve my financial stability. This way, I can walk away for a month, a year, or even a decade, and my retirement income will keep on pouring into my coffers. Cash dividends don’t vanish overnight into thin air as unrealized gains do. They are the lifeblood of my retirement budget.

This way, my valuable time is best spent doing what I love. Spending time with my amazing wife and enjoying new experiences together.

What would you be doing with your time and energy if you didn’t feel the compulsive need to watch every market swing? I’d love to hear about it in the comment section below. While you’re telling me about it, perhaps take a few minutes as well to ask yourself why you aren’t letting the market help you achieve that instead of what you have been doing.

Be the first to comment