damircudic/E+ via Getty Images

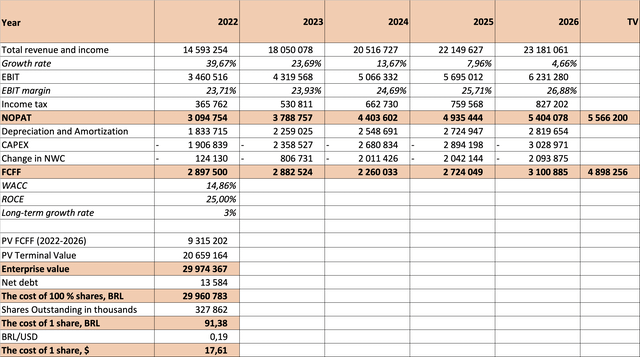

PagSeguro (NYSE:PAGS) shares are falling and have already lost half of their value since the beginning of the year. After performing a DCF analysis, we believe that the stock has upside potential. Based on our analysis, the fair value of the company is $17.61 per share. Because of this, our investment call on PAGS is that it’s a buy.

About the company

PagSeguro is a financial services and digital payments company situated in Sao Paulo, Brazil. Founded in 2006, the company mainly provides payment processing software for e-commerce websites and mobile applications, as well as merchant terminals. PagSeguro is a part of Universo Online, the largest internet portal in Brazil. Since January 2018, the issuer has been trading as a public company on the New York Stock Exchange.

- Total revenue and income for 2021 – BRL 10.45 million (+53.33% Y/Y).

- Total revenue and income for the first half of 2022 – BRL 7.34 million (+65.38% Y/Y).

Macroeconomics

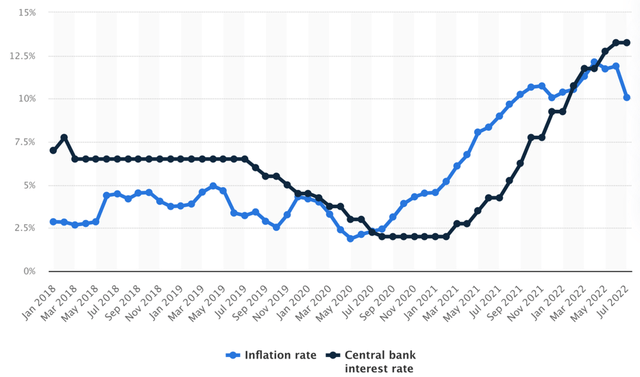

The issuer’s activities are closely related to the situation in the economy as a whole. The cost base is strongly affected by inflation developing and the growth of the key rate in Brazil, which leads to decline in margins. Possibly, a high key rate would have a lesser negative effect on the issuer in the event of a more active provision of lending services by the company, but so far this has not been observed. The central bank’s key rate, or short-term deposit rate, has risen from a low of 2% during the pandemic to a whopping 13.25% today. There is a graph of inflation and the key rate growth according to Statista below.

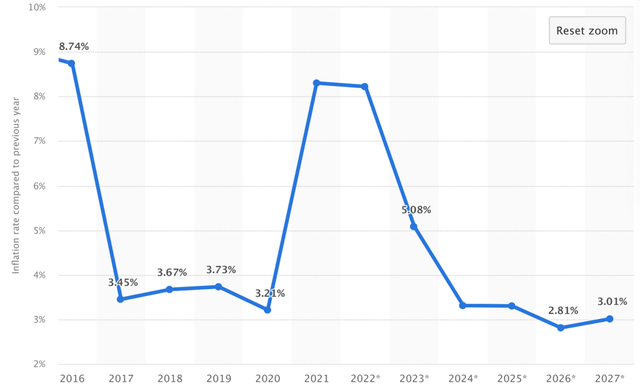

Brazil is not only one of the largest countries in the world, but also one of the largest economies and a member of the so-called BRICS countries, one of the five promising emerging economies. Nevertheless, Brazil continues to have difficulties due to the ongoing recession, what prevents the reduction of the key rate. However, Statista’s further forecast for the key rate size looks optimistic, as by 2027 its size is expected to have been at the level of 3%. This forecast is shown in the chart below.

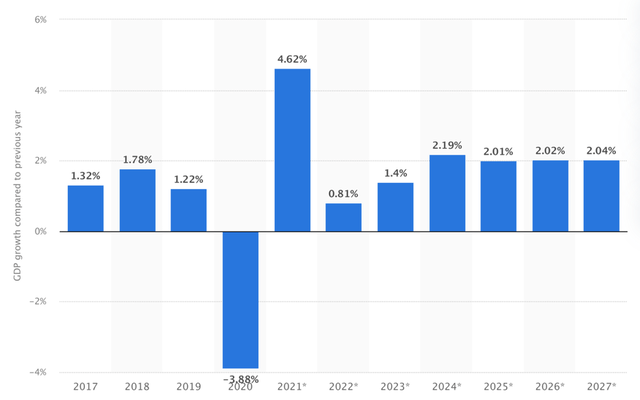

In case of a recession being forecast, attention should be paid to the dynamics of GDP and the unemployment rate in Brazil. The improvement of the macroeconomic environment and the growth of the population’s solvency will have a positive impact on PagSeguro’s activity. Brazil’s GDP is growing, a decrease was observed only in 2020 over the past few years. The GDP growth forecast according to Statista is presented in the graph below.

Unemployment, on the contrary, is declining, according to Statista, as of July 2022, its level reached a record low of 9.1%. For comparison, at the beginning of 2022, the unemployment rate was over 11%.

As mentioned earlier, GDP growth and unemployment reduction, along with decreasing of the key rate in the long term, is an undoubted positive moment for the issuer. However, it is important to avoid a sharp reduction in the key rate, since an increase in the solvency of the population, along with an increase in the number of economically active citizens, will again lead to upturn in inflation and new tightening by the Central Bank.

The growth of e-commerce in Brazil

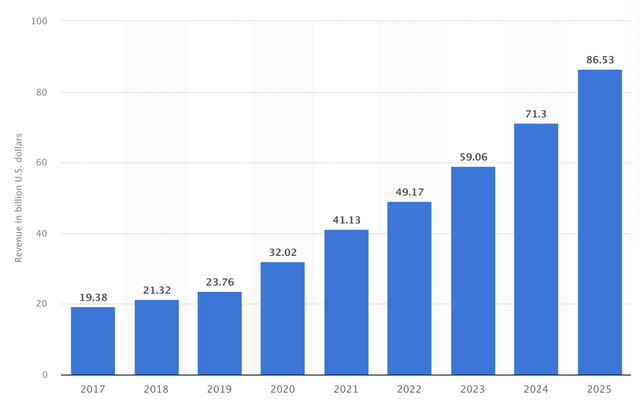

The e-commerce market in Brazil is growing, so at the end of 2022 its size is expected to be $49.17 billion, which will correspond to an increase of 19.5% compared to 2021, and the average annual growth rate for the last 5 years will be 20.47%. Note that the growing popularity of e-commerce is a positive for PagSeguro and is a trigger for its further growth. There is a forecast for the e-commerce market according to Statista until 2025 below.

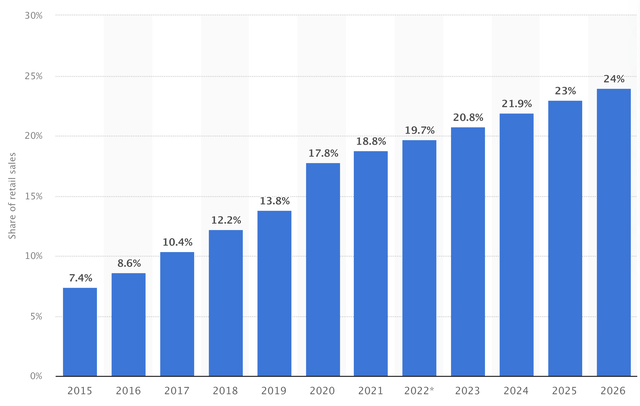

Globally, e-commerce is growing in popularity, measured as a percentage of total retail sales. This fact also indicates the potential growth of PagSeguro. In 2021, this value was 18.8%, and by 2026 it is expected to have increased to 24%. Below is the dynamics of this value.

Finance

The company is growing rapidly. The number of active users of PagBank in 2021 amounted to 13.1 million people, a year ago this value was 7.9 million (a 66.2% increase over the year). PagSeguro has a high gross margin of 44.7% in 2021. At the end of 2022, due to the growth in production costs, we expect this value to decrease to 40-40.5%, and in the long term we expect a gradual return to the median value over the past 6 years at around 46%.

The profitability of the company is also at a high level. In 2021, the EBIT margin was 21.8%, which is the lowest in the last 5 years. At the end of 2022, we expect to see this value at the level of 23-24%, followed by a systematic increase in the long term to 26-27%.

The company’s debt load is not high, net debt is only 13.6 million BRL. Nevertheless, the debt burden is growing; previously, net debt was negative. The issuer’s current liquidity is at a good level of 1.37, and the amount of cash on the balance sheet is sufficient, therefore there will be no problems with debt servicing.

The company’s cash flow leaves much to be desired. The P/OCF is currently 23.2, with the industry median looking better at 17.2. PagSeguro’s 2021 free cash flow was negative at negative BRL 853.82 million. Over the past 12 months, including the first half of 2022, the situation has not changed, FCF has worsened even more and now is negative BRL 1.19 billion.

Despite the negative free cash flow, the company looks strong on the balance sheet, and operating results are growing. For this reason, PagSeguro can be considered a financially strong company.

Risks and Competition

The main risk for the issuer is the persistence of high inflation and, consequently, a high key rate. As the Brazilian economy is in decline, the volume of payments passing through PagSeguro is also declining, what is hurting the company’s income. The current diversification of the company’s products does not allow to fully hedge these risks.

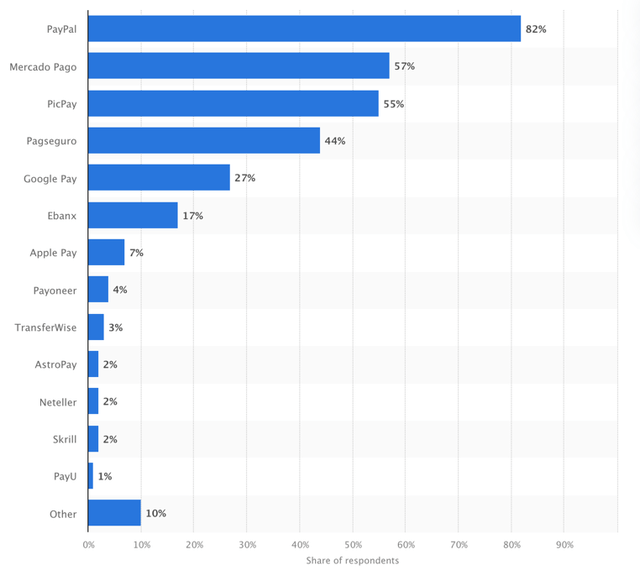

The competition in the market is very high. The issuer’s main competitors include StoneCo (STNE), Mercado Pago (MELI), PicPay (PICS), and even partly Apple (AAPL) and PayPal (PYPL). In this case, such strong competition can put pressure on the profitability of the company, forcing them to allocate more marketing costs. Below is the result of respondents’ survey in Brazil aged 18 to 64 on the use of various companies for making online payments services. Data collected by Statista.

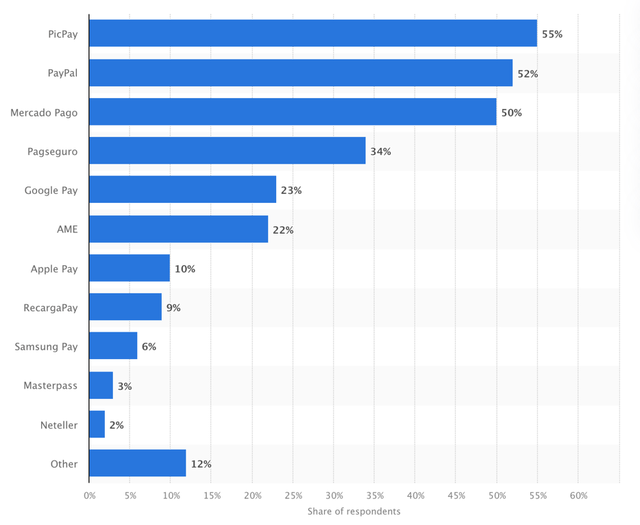

The survey results show that less than a half of the respondents use the PagSeguro service. However, given that the company is growing rapidly, expanding its client base, awareness of the issuer will improve. The situation with mobile payments is somewhat worse; in this area only 34% of respondents use the company’s service, as shown in the graph below.

Valuation

According to the multipliers, the company’s valuation does not look too high in comparison with historical values. The issuer’s P/S is currently at 1.8. While maintaining the current level of capitalization and given the growth in revenue in 2022, by the end of the year, according to our forecasts, this value would have been up to 1.7, which is well below the PagSeguro’s median value of 10. For comparison, StoneCo’s P/S is now 1.7.

PagSeguro’s P/E of 17.6 is below the industry average of 22. It is also below the company’s median value of 44.

In terms of book value, the issuer cannot be called cheap, P/B is 2.1, but the median value is even higher and equals 7. At StoneCo, this value is better and equals 1.2.

DCF analysis

The company is growing at a rapid pace, however, in fiscal 2022, the growth rate is expected to be lower than in 2021. Our forecast reflects the company’s gradual slowdown in growth and an increase in EBIT margins, which expected to have reached 26,88 % by 2026. This EBIT margin is close to the 2016-2021 median of around 28%. Also we predict a narrowing of the large gap between depreciation and CAPEX costs. Long-term growth is roughly in line with forecasted inflation. We believe that the forecast value of the issuer’s shares by most investment houses is too positive. In our forecast, we proceeded from the principle of conservatism and have come up with a fair price of $17.61 per share. All data are presented in thousands, except for the value of one share and the BRL/USD ratio. Currency in BRL.

DCF analysis of PAGS by FinDay Stocks

Conclusion

PagSeguro is a financially stable company with a strong balance sheet, high growth rates and a low leverage. The company is currently valued below its fair value based on DCF analysis and relative to historical multiples. As to its negative factors, the recession in Brazil is still ongoing, inflation is at a high level, and, consequently, the key rate remains high. It is also necessary to remember that the company has a negative free cash flow. Despite this, we believe that the company looks interesting as a long-term investment. Given all of this, our recommendation is to buy shares.

Be the first to comment