Rocky89/E+ via Getty Images

There’s plenty of debate over whether internally or externally managed BDCs are better. In some ways, I believe it’s a moot point, as it all comes down to management quality. High quality management will do what’s right to drive shareholder value, and it really comes down to that.

This brings me to Fidus Investment (NASDAQ:FDUS), which I view as being a well-managed BDC that currently yields over 8%. This article highlights why Fidus is an attractive stock at present for a diversified income portfolio.

Why FDUS?

Fidus Investment is an externally-managed BDC that invests primarily in lower middle-market, as defined by U.S. companies with annual revenues between $10 to $150 million, and annual EBITDA from $5 to $30 million. It was founded in 2007 as a Small Business Investment Company and went IPO as a BDC in 2011.

Fidus targets companies in niche markets with defensible market positionings, diversified customer and supplier bases, and strong free cash flows with significant equity cushions. Like a few of its bigger peers such as Main Street Capital (MAIN), FDUS invests primarily in the lower middle market space, which is highly fragmented with more than 100,000 companies and offers attractive risk-adjusted returns.

FDUS employs a rigorous investment vetting process that’s centered around direct sourcing across multiple channels, followed by initial screening with the investment committee, further research, site visits, and 3rd party diligence reviews. It reviews on average 630 opportunities a year, with just 6.6% of deals being funneled for rigorous review, and closing on just 2% of opportunities sourced.

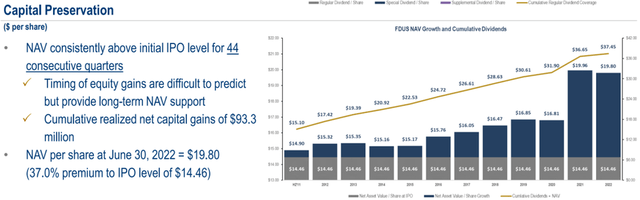

This has resulted in perhaps what is most important for BDC investors, and that is capital preservation and income. FDUS has done well on that front. As shown below, FDUS has given initial investors at IPO more than a 100% return through a combination of both NAV per share growth and cumulative dividends.

FDUS Shareholder Returns (Investor Presentation)

At present, FDUS carries a well-diversified investment portfolio of 73 investments with an $811 million fair value and an attractive 11.9% weighted average yield on debt. FDUS is able to achieve a higher yield on debt through exposure to second lien debt, which comprise 24.6% of the portfolio, and subordinated debt, which comprise 9.2% of portfolio value. The remainder is comprised of first lien debt (58%) and equity investments (8%), the latter of which give more potential for NAV appreciation.

Second lien debt is traditionally thought of as being more risky, but it really boils down to risk management. For example, first lien debt can be just as risky if not more if management is incompetent and picks the wrong companies to invest in. Importantly, FDUS’s management has demonstrated their ability to effectively manage risk. This is reflected by investments on non-accrual representing just 1% of portfolio fair value.

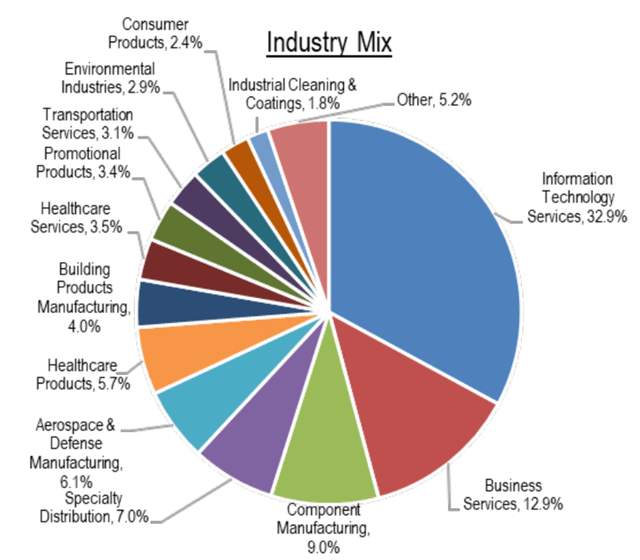

Also encouraging, the portfolio is worth more than what FDUS paid for it, with a fair value to cost ratio of 109.6%. As shown below, the portfolio is generally comprised of a combination of growth and defensive segments such as IT & Business Services, Component Manufacturing, and Specialty Distribution, comprising 62% of the portfolio fair value.

FDUS Portfolio Mix (Investor Presentation)

Looking forward, FDUS has plenty of capacity to grow its investment portfolio with the support of its strong balance sheet, with a 0.6x statutory leverage, sitting well below the 2.0x regulatory limit, and weighted average interest rate on outstanding debt is at a low 3.8%. Plus, unlike some externally managed BDCs that have tight dividend coverage ratios, FDUS’s 8% dividend yield is very well-protected by an 80% payout ratio based on NII per share of $0.45 during the second quarter.

Meanwhile, I find FDUS to be inexpensive at the current price of $17.90, equating to a price to book value of 0.9x. As shown below, this sits towards the low end of FDUS’s valuation range over the past 5 years outside of the 2020 timeframe. This means that a simple reversion to mean valuation could result in strong double-digit returns, especially when the dividend is included. Analysts have a consensus Buy rating and S&P Capital IQ has an average price target of $20.

FDUS Price to Book (Seeking Alpha)

Investor Takeaway

FDUS is a well-run BDC that has demonstrated a strong track record of capital preservation and income generation. It’s well-positioned to continue this in the future with plenty of capacity to invest, a strong balance sheet, and experienced management. Meanwhile, it trades at an attractive valuation that could result in strong double-digit returns for investors. As such, I find FDUS to be an attractive buy at present for high income.

Be the first to comment