daneger/iStock via Getty Images

Introduction

The war in Eastern Europe sadly shows no signs of ending, nor does the resulting economic issues hitting the rest of Europe as Russian natural gas exports plunge and inflation runs wild, prompting rapidly tighter monetary policy and making a recession a near-foregone conclusion. Despite being headquartered in the United States, Kronos Worldwide (NYSE:KRO) carries a large exposure to Europe that now sees the clock is ticking to a dividend cut.

Coverage Summary & Ratings

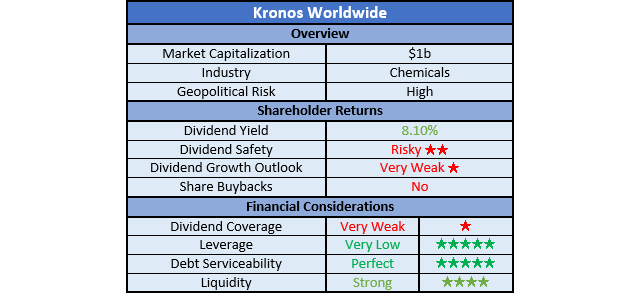

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

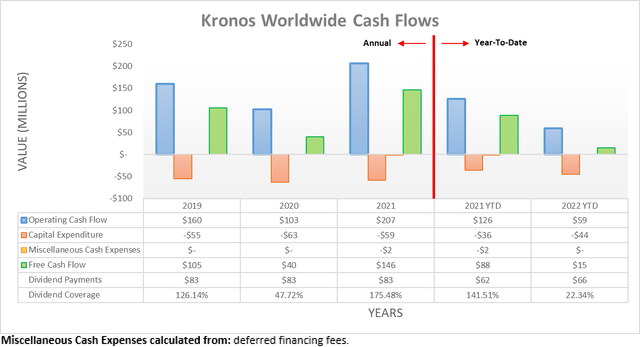

When looking at their cash flow performance, quite unsurprisingly as a chemical company, it varies significantly across time as economic conditions influence demand. As a result, their operating cash flow was hammered during 2020, falling to $103m versus $160m during 2019, before subsequently surging to $207m during 2021 as economic conditions recovered. Unfortunately, this recovery appears to have been short-lived with their operating cash flow during the first nine months of 2022 only reaching a mere $59m, which is down slightly more than half year-on-year versus their previous result of $126m during the first nine months of 2021.

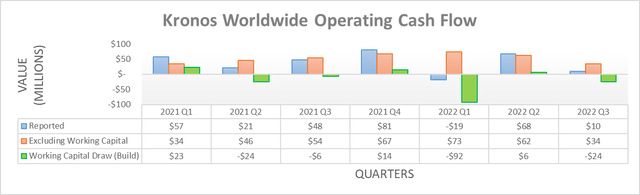

Due to this weak cash flow performance, they were only left with a tiny $15m of free cash flow during the first nine months of 2022, thereby leaving very weak dividend coverage given the significant $51m gap to fund their dividend payments of $66m. Admittedly, this was partly weighed down by their working capital movements that saw a sizeable build, although when digging deeper, investors should remain cautious given the outlook for Europe.

Interestingly, upon removing their working capital movements, their underlying operating cash flow for the first and second quarters of 2022 landed at $73m and $62m respectively, which was actually higher year-on-year versus their previous equivalent results during 2021 of $34m and $46m respectively. If excluding their large working capital build during the first nine months of 2022, it shows their weak financial performance did not strike until the third quarter, when their equivalent result sank to $34m, as pressure facing Europe intensified.

Whilst their cash flow performance during the first nine months of 2022 was not terrible as a whole if excluding their working capital movements, I would caution against relying upon this too greatly because $134.1m of their working capital build resulted from higher inventories. In fact, this one aspect played an outsized role in shaping their operating cash flow, as their working capital build was only $110m and thus every other variable, such as accounts payable, actually provided a boost to their operating cash flow that was more than offset by the hindrance of their higher inventories. Due to the pressure faced by a looming recession, it may prove more difficult than normal to unwind these higher inventories, thereby releasing this pent-up operating cash flow, especially given their exposure to Europe.

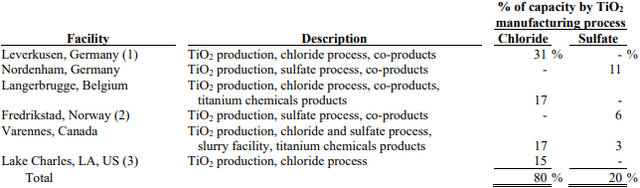

Throughout 2021, they saw 65% of total production was located in Europe, which as every investor would know by now, is facing a natural gas crisis as Russia retaliates at NATO nations following their invasion of Ukraine. Since this is old news, there is little reason to recover the European natural gas crisis in detail but suffice to say, as an industrial company, this places upward cost pressure on their production as electricity price head north. Not to mention, downward pressure on pricing as worsening economic conditions weigh upon their customers and thus demand for their titanium dioxide, which sees end uses ranging across paints, plastics and paper.

Unless operating conditions recover quickly, which does not look likely, it seems reasonable to expect the entirety of their dividend payments will not be covered by free cash flow going forwards, thereby leaving a $66m cash burn per annum. The length of time this can be sustained depends largely upon the will of management but disappointingly, their third quarter of 2022 results announcement made no mention of their dividends. Although given their dividends were sustained throughout the turmoil of 2020, it implies management will likely fight to the end, which is largely determined by the strength of their financial position.

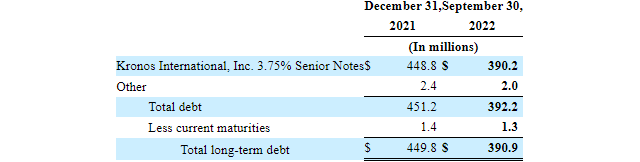

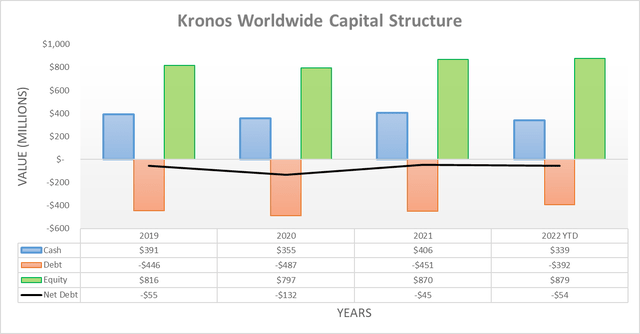

Following the $51m gap between their free cash flow and dividend payments during the first nine months of 2022, it was initially surprising to see their net debt only increased to $54m versus its previous level of $45m at the end of 2021, thereby representing an increase of merely $9m. This was not due to divestitures but rather, it resulted from almost the entirety of their debt being denominated in Euros, €400m to be exact. Due to the strong USD, it suppressed the carrying value on their USD-denominated balance sheet and thus makes their cash balance the more important aspect to watch, as they are drawing it down to fund the gap in their dividend coverage.

When looking ahead, it would take around five years for their dividend payments of $66m to deplete their cash balance of $339m, although this might change. The big uncertainty remains how much worse their operating conditions and thus free cash flow will become there is no road map for this scenario, as never before has Europe faced a recession at the same time as surging inflation, along with a natural gas crisis. This makes the coming quarters very important to watch because if operating conditions deteriorate too significantly, their cash burn may accelerate and thus see their cash balance deplete faster.

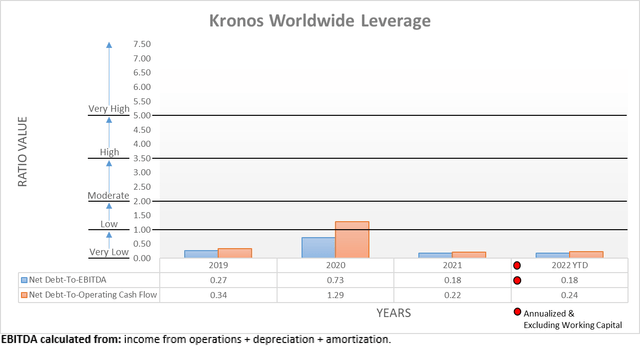

Despite their weakening financial performance, thankfully their leverage is still only very low thanks to their minimal net debt, as primarily evidenced by their respective net debt-to-EBITDA and net debt-to-operating cash flow of 0.18 and 0.24 sitting well beneath the applicable threshold of 1.00. When looking ahead, until they see a recovery, their leverage will begin moving higher as their net debt increases and their weak financial performance persists. Thankfully, they are starting from a very solid base and thus can endure this pain in the short-term, although in the medium to long-term, they still require a recovery to fix their dividend coverage.

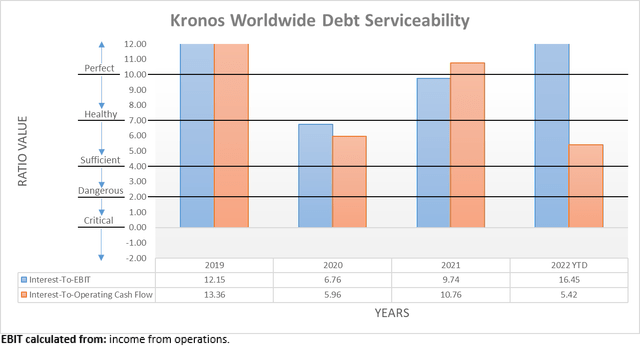

Similar to their leverage, they also entered this downturn with debt serviceability starting from a very solid base, which is becoming increasingly important to consider as interest rates climb rapidly. Even though the first nine months of 2022 were far from amazing, their interest coverage when compared against their EBIT was still perfect with a result of 16.45. Whilst the comparison against their operating cash flow was much lower at 5.42, this was simply due to their large working capital build. Once again as with their leverage, until they see a recovery, their debt serviceability will also suffer as their weak financial performance persists but thankfully, the interest rate of their debt is fixed at only a low 3.75% and thus rapidly rising interest rates do not pose too great of a concern.

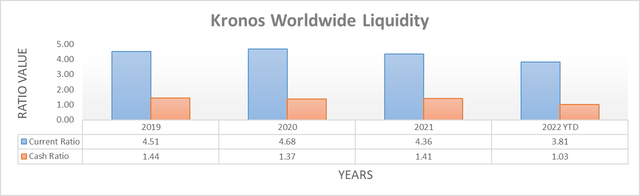

Apart from very low leverage, thankfully their financial position also sports strong liquidity with respective current and cash ratios of 3.81 and 1.03. This helps support their ability to navigate this turmoil and sustain their dividends, although it obviously rests upon their cash balance that is being drawn down to fund gaps in their dividend coverage. As a result, until they see a recovery, their liquidity will deteriorate unless their dividends are cut as their cash balance is progressively depleted each quarter. Whilst they retain $207m available under their credit facility, drawing this down to fund gaps in dividend coverage would be very risky and could potentially jeopardize their ability to remain a going concern. Thankfully, they do not face any debt maturities until September 2025 and thus providing they avoid running out of cash and credit facility availability, they have almost three years to wait for conditions in debt markets to improve before asking for liquidity.

Kronos Worldwide Q3 2022 10-Q

Conclusion

Thankfully they entered this downturn with deep pockets but nevertheless, they are not bottomless and thus unless operating conditions recover, the clock is ticking to a dividend cut as they lean upon their cash balance to fund gaps in coverage. The biggest question remains how severe this downturn will become, as there is no historical precedence but thankfully, their cash balance roughly equals five years of dividend payments and thus metaphorically speaking, this ticking clock still has quite a few hours to go, which means that I believe a hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Kronos Worldwide’s SEC filings, all calculated figures were performed by the author.

Be the first to comment