Roman Tiraspolsky/iStock Editorial via Getty Images

Generally speaking, the footwear industry may not be viewed as all that exciting to many investors. But at the end of the day, shoes are a necessity for pretty much everyone and companies that perform well in this space tend to generate strong growth over an extended period of time. A great example of how a successful player in this market can be treated can be seen by looking at Deckers Outdoor Corporation (NYSE:DECK). In late October of this year, management announced financial results covering the second quarter of the company’s 2023 fiscal year. Sales rose materially, but shrinking margins negatively affected the firm’s bottom line. Even so, current guidance for the company is positive and the long-term outlook for the company looks solid. Admittedly, shares of the firm do look to be more or less fairly valued compared to similar businesses. But considering the company’s track record and current guidance, I do believe that it still warrants a ‘buy’ rating at this time.

Impressive results

The last time I wrote an article about Deckers Outdoor was back in late August of this year. In that article, I lauded the company’s strong top line growth but also simultaneously pointed out its mixed profitability. Even though shares had risen significantly in the months leading up to that, leading me to conclude that the easy money had been made, I felt as though the continued catalyst that was the HOKA brand justified a bit more upside from that point. This led me at the time to rate the business a ‘buy’, reflecting my belief that it should outperform the broader market for the foreseeable future. Since then, the company has performed as I would have anticipated. While the S&P 500 is down by 6.8%, shares of Deckers Outdoor have generated upside for investors of 7.4%.

This is a remarkable return disparity in such a short period of time. This is especially true when you consider broader economic concerns. But this return disparity was not unwarranted. In fact, it was driven largely by strong fundamental performance generated by management. Consider, for instance, the company’s revenue. During the second quarter of its 2023 fiscal year, the only quarter for which data is available that was not available previously, sales came in at $875.6 million. That’s 21.3% higher than the $721.9 million generated the same time last year. The real winner here for the company was the direct-to-consumer portion of the enterprise, with revenue shooting up 35.3%. That compares to the more modest, but still impressive, 16.7% of revenue attributable to the wholesale operations of the firm. In terms of individual brands, the star for the company was, once again, HOKA. Revenue there grew by 58.3% year over year, hitting $331 million compared to the $210.4 million reported only one year earlier. Earlier this year, management touted the brand as having the potential to generate $1 billion a year or more in revenue. Clearly, they were right. In addition to this, the company’s flagship UGG brand saw revenue grow by 6.3%, while the Teva brand grew by 4.3%. The only real weakness for the company came from the Sanuk brand, with sales dropping 25.2% year over year.

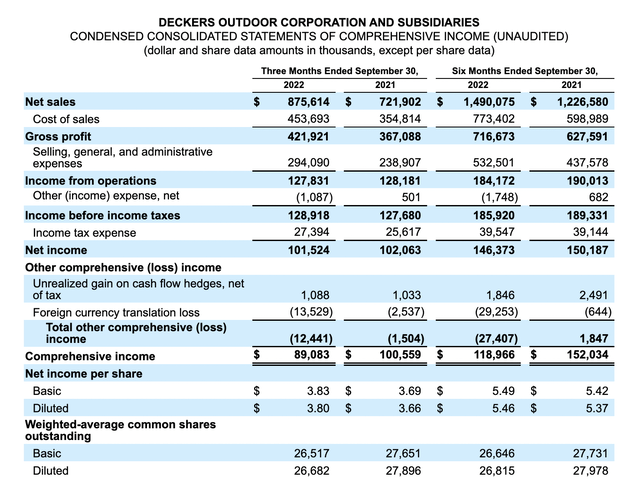

It’s great to see revenue increase. Unfortunately though, not everything for the firm was excellent. Net income in the latest quarter came in at $101.5 million. That was actually down from the $102.1 million reported the same quarter one year earlier. The fact that profits shrank while revenue increased means that the company dealt with some margin compression. During the quarter, the firm’s gross profit margin shrank from 50.9% to 48.2%, while selling, general, and administrative costs rose from 33.1% of sales to 33.6%. Clearly, Inflationary pressures are negatively affecting the company. But it’s also true that growing a brand rapidly like management is doing with the HOKA brand name, does not come cheap. Normally, I would also like to look at operating cash flow and EBITDA. But management has not yet revealed that data either through a press release or through the publication of its 10-Q, so we are at a loss.

When it comes to the 2022 fiscal year as a whole, management anticipates revenue of between $3.45 billion and $3.50 billion. That implies year-over-year growth of between 10% and 11%. Meanwhile, earnings per share should be between $17.50 and $18.35. At the midpoint, and assuming the company doesn’t buy back any additional stock, this should translate to net income this year of $478.3 million. If we apply the year over a year growth anticipated here to the other profitability metrics, we should anticipate operating cash flow of $499 million and EBITDA of $676.4 million.

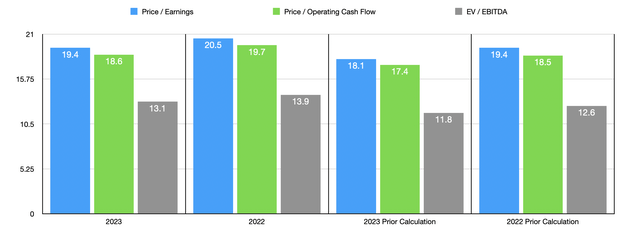

Based on these figures, the company is trading at a forward price-to-earnings multiple of 19.4. The forward price to adjusted operating cash flow multiple is lower at 18.6, while the EV to EBITDA multiple should come in at 13.1. This massive disparity, it’s worth mentioning, between the EV to EBITDA multiple and the other two comes from the fact that the company has no debt and has cash and cash equivalents of $419.26 million. It’s also true that the multiples here are cheaper than if we were to use data from the 2022 fiscal year. At the same time though, the stock is definitely more expensive than when I last wrote about it in August of this year. This much can be seen in the chart above. As part of my analysis though, I decided to compare it to five similar businesses. On a price-to-earnings basis, these companies range from a low of 7.9 to a high of 26.7. Our prospect was more expensive than four of those five companies. Using the price to operating cash flow approach, the range was between 10.8 and 110.4. In this case, two of the five companies were cheaper than Deckers Outdoor. And when it comes to the EV to EBITDA approach, the range was between 6.8 and 20.6. In this scenario, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Deckers Outdoor | 20.5 | 19.7 | 13.9 |

| Skechers U.S.A. (SKX) | 7.9 | 110.4 | 9.5 |

| Crocs (CROX) | 8.2 | 10.8 | 8.5 |

| Steven Madden (SHOO) | 9.4 | 21.9 | 6.8 |

| Wolverine World Wide (WWW) | 12.1 | 12.7 | 16.3 |

| Nike (NKE) | 26.7 | 33.1 | 20.6 |

Takeaway

For some time now, I have found myself bullish on Deckers Outdoor. Since my first article this year on the company, published in February, shares are up 19.2%. This compares to the 13.2% decline experienced by the S&P 500 over the same window of time. Although shares of the company aren’t the cheapest, they do look affordable and growth has been impressive, especially when you consider the HOKA brand name. With no clear evidence that the company will face a material slowdown, I am tentatively rating it a soft ‘buy’ at this time.

Be the first to comment