HJBC/iStock Editorial via Getty Images

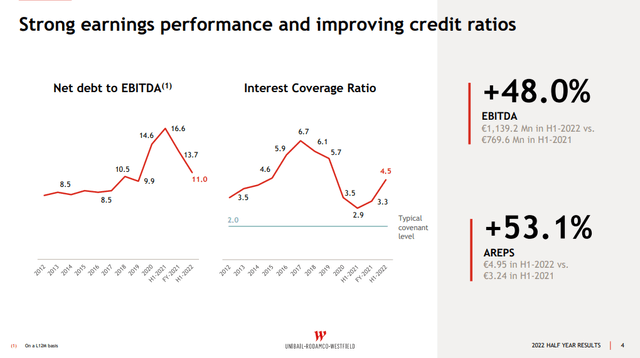

Unibail-Rodamco-Westfield (OTCPK:UNBLF) just reported a very strong first half of 2022, with sales exceeding 2019 levels, earlier than expected for Continental Europe. There was also a marked recovery of the Convention & Exhibition division, which achieved €94.5 million of Net Operating Income. Overall, the company delivered strong earnings performance and credit ratio improvements. It also showed that it still has access to credit markets by refinancing €1 billion of mortgage debt, raised with a 7-year maturity.

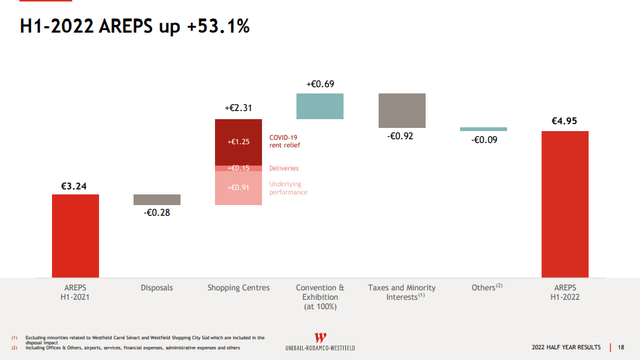

In our view, however, the most impressive data point was the massive recovery in Adjusted Recurring EPS, which grew +53.1% from H1 2021. This earnings level is getting close to pre-COVID levels, and shows that full recovery is withing reach for the company.

Unibail-Rodamco-Westfield Investor Presentation

Financials

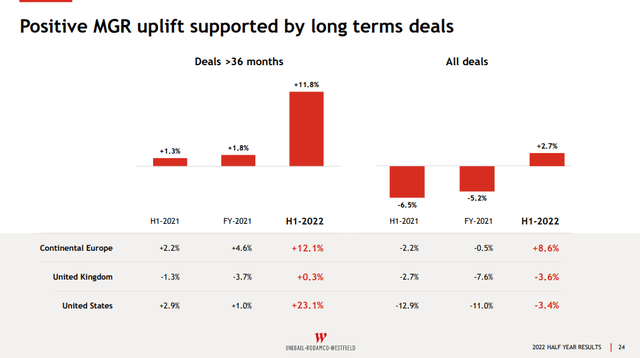

Another strong positive that the company shared is that lease renewals are seeing a positive uplift. Minimum guaranteed rent for all deals signed was +2.7%, but critically, for longer duration deals (>36 months), the uplift was very significant at +11.8%. The way we interpret this data is that the company is willing to offer attractive deals for short duration leases, since it wants to quickly restore occupancy levels. For longer duration leases, however, it is taking a tougher negotiating position as it expects conditions to move in its favor in the next few years as the economy recovers, and as its own occupancy goes up closer to historical levels.

Unibail-Rodamco-Westfield Investor Presentation

Balance Sheet

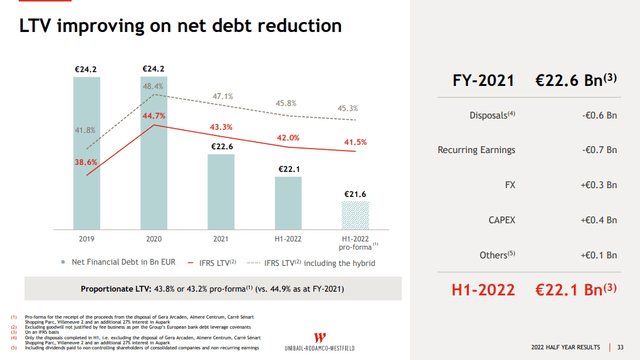

The balance sheet remains the number one concern for us, as the company over leveraged to acquire Westfield. There has been good progress, however, in the deleveraging, with significant debt reduction in the past year. Loan to value has been decreasing since it reached a peak of more than 44% in 2020, and a sub 40% value is within reach in the next couple of years.

Unibail-Rodamco-Westfield Investor Presentation

Other credit metrics have also improved, such as the net debt to EBITDA which is now at ~11x, a lot better than the scary 16.6x that it reached during the worse of the COVID crisis. Similarly, the interest coverage ratio has improved to 4.5x, after it had gotten dangerously close to the typical covenant level of 2x. All of this paints the picture of a company that is now much healthier compared to where it was during the worse of the COVID crisis.

Unibail-Rodamco-Westfield Investor Presentation

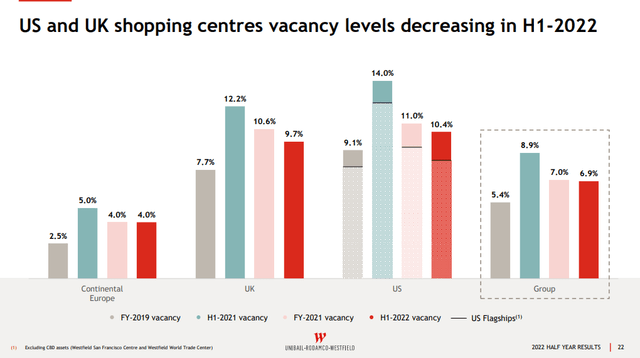

Occupancy

Occupancy continues to improve for the company, particularly in the US and UK markets where vacancy levels reached very high numbers. All markets still have significant room for improvement, and thanks to the healthy leasing activity we expect occupancy to continue improving for the company the next few years.

Unibail-Rodamco-Westfield Investor Presentation

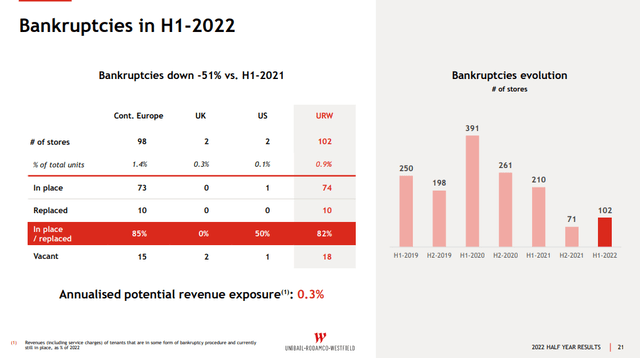

One thing working on the company’s favor is that retailer bankruptcies are well below average, even compared to pre-COVID periods. There was a small uptick compared to the first half of 2021, but they remain significantly below average, and far from the number of bankruptcies that took place during the worse of the COVID crisis.

Unibail-Rodamco-Westfield Investor Presentation

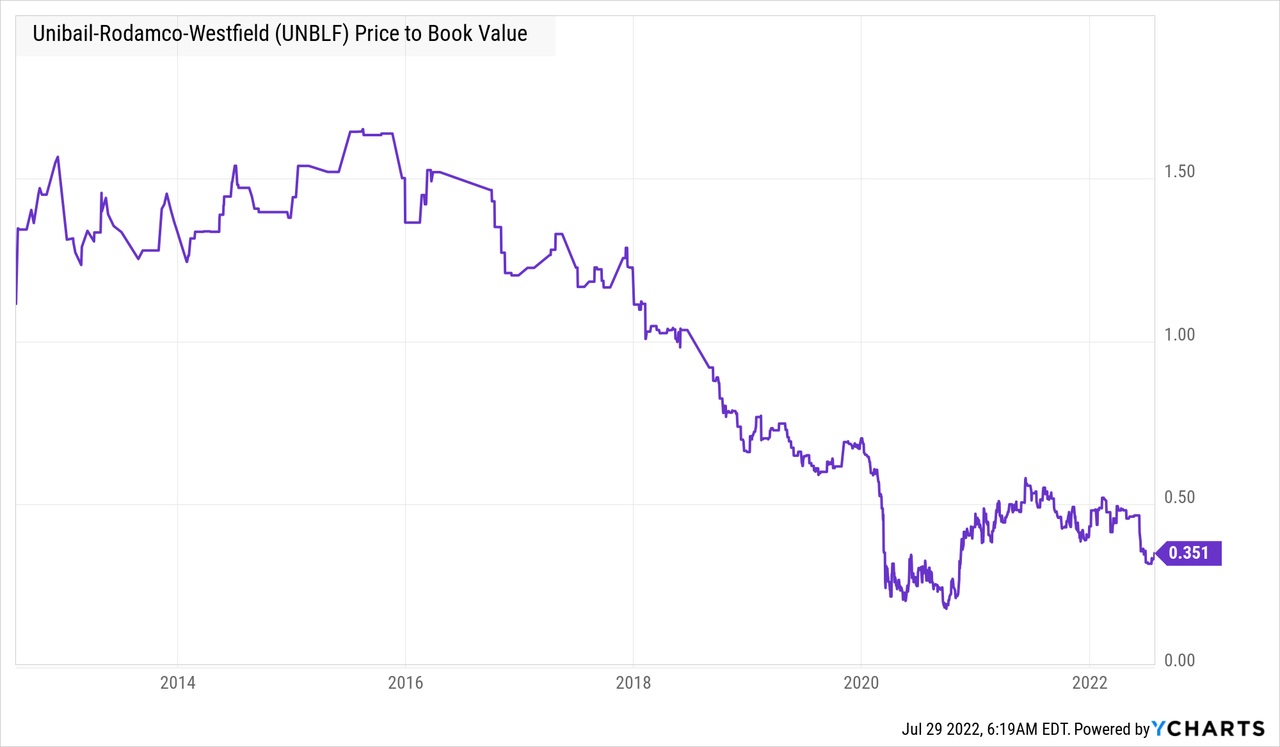

Valuation

Despite the improving results, shares remain surprisingly cheap, currently trading at only ~0.35x of book value. Historically shares used to command a premium over book value, but even if a significant premium to book value might be difficult to justify, we do think that trading at close to book value in the next two years is a realistic possibility, and that would mean a ~200% return from these levels. What makes us think that trading close to book value is justified is that the company has been able to dispose of several assets at a premium to book value, showing that appraisals are realistic.

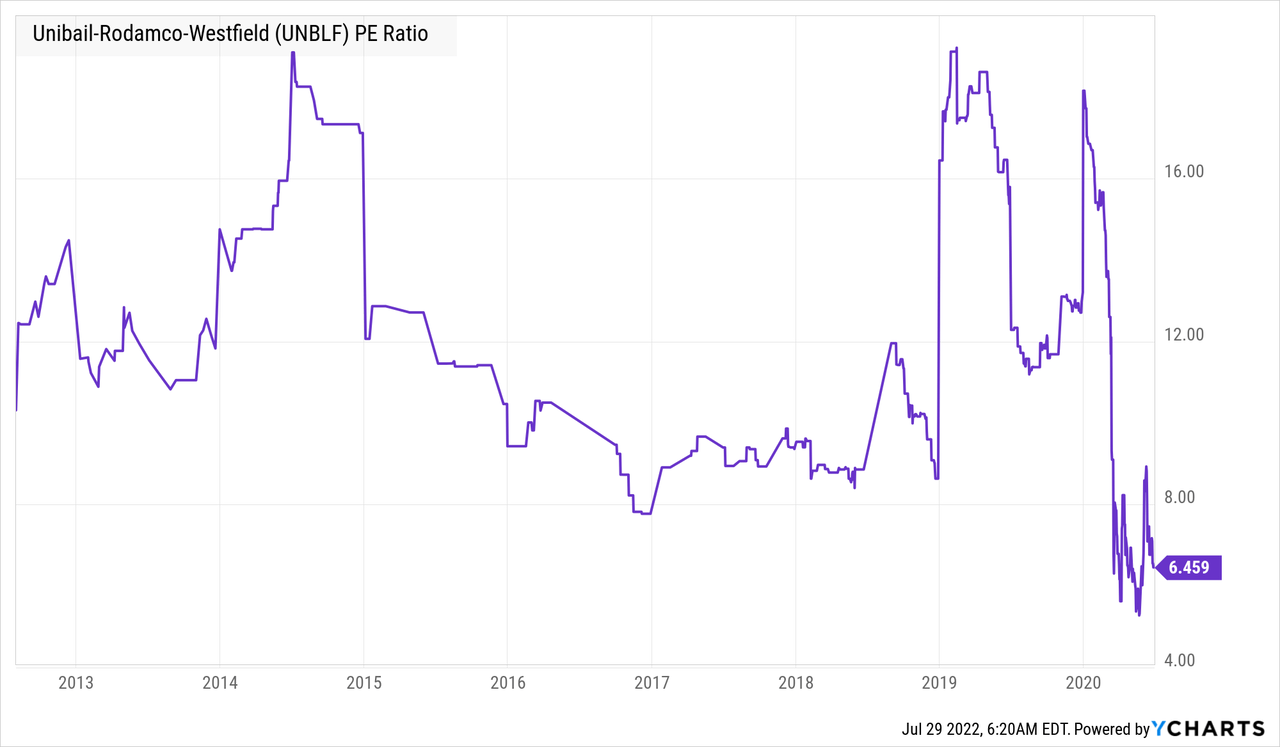

Similarly showing just how cheap shares currently are, the price/earnings ratio is at ~6.4x. We find this too a sign of severe undervaluation, especially as the company’s earnings are in the process of improving.

Risks

There are certainly risks to consider with Unibail-Rodamco-Westfield. From the risk of new lock-down measures by the government, to the risk of a severe recession causing significant retailer bankruptcies, to rising interest rates. That said, we still believe the risk/reward is very attractive at current prices.

Conclusion

Unibail-Rodamco-Westfield delivered strong H1 2022 results despite a still challenging macro-economic environment. The company increased its guidance for adjusted recurring EPS to at least €8.90. Shares are incredibly undervalued when compared to book value and to earnings per share. While there are risks to take into consideration, we still believe the risk reward is very attractive at these price levels.

Be the first to comment