loongar/iStock via Getty Images

Thesis

I recently published an article on ZIM Integrated Shipping (NYSE:ZIM) to alert readers that the short interest on the stock has surged to 22.7% after it released its Q3 earnings report (“ER”). The main thesis is quoted below:

The short interest in October (about $352M in dollar amount) already ranks at a high level since 2021. With the further surge this month after the Q3 ER, the current short interest is among the highest level in recent years. The signal is quite clear here to me: the market or at least the many short investors, views ZIM’s profitability has already passed its peak in Q3, and its current stock prices cannot be supported by the fundamentals anymore. And I strongly agree with the above view.

Indeed, since the time of that article (published about 1 month ago), ZIM’s stock price has fallen by about 15% from about $25 at that time to the current level of $18.7. As a context, the overall market represented by the S&P 500 index stayed unchanged (fell by -0.08%) during the same period.

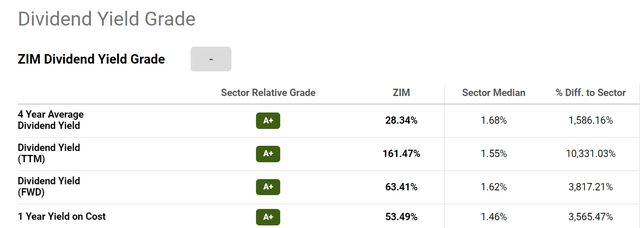

In this article, I want to examine the stock from a different perspective: its dividends. The goal is to caution those investors who are wishing the dividend could make up for the price declines. The stock currently provides a dividend yield of 161% on a TTM basis and 63% on an FWD basis as you can see from the following chart. And at a first glance, such yields are indeed more than sufficient to make up for the price declines.

In the remainder of this article, I will argue that the stock is a textbook example of a dividend trap under its current conditions. That is, I expect the stock to cut its dividends AND also suffer price declines at the same time. As to be elaborated more immediately next:

- For the dividend cuts, no one would expect the current yields to be sustainable. The only question is when the cuts would come and how deep they will be. My view is that the dividends could completely go away in the next 1~2 years.

- And as for the stock prices, I see its valuation as unsustainable even at a share price in the $10 range.

Source: Seeking Alpha data

A historical perspective

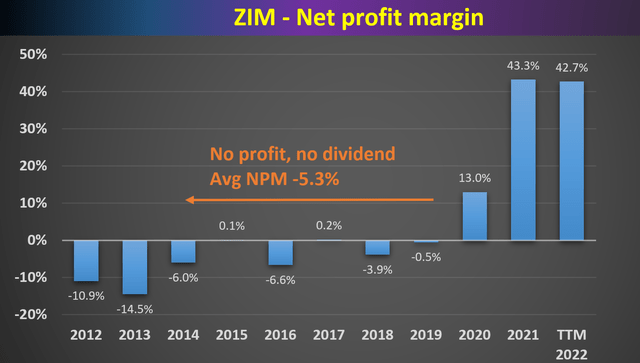

Let’s start with a historical perspective first. The next plot shows ZIM’s net profit margin (“NPM”) in the past decade on an annual basis. As you can see, the business had no net profit on average between 2012 and 2019. As a matter of fact, its average net profit margin is negative – 5.3% during those years. And of course, as a result, it was unable to pay any dividends during those years.

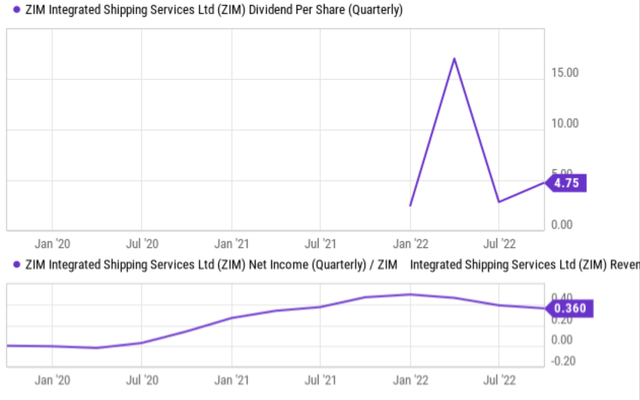

Things took a sudden turn in 2021, as shown in the second chart, plotted on a quarterly basis this time to better illustrates the turn of events. The breakout of the COVID pandemic exacerbated the shipping congestion. Shipping costs surged to a record level (and also an unsustainable level as to be explained later). ZIM’s NPM climbed from a negative level in the first half of 2020 to a spectacular peak level of almost 40% in 2021. Awash with cash, ZIM started playing dividends and the dividends surged to above $15 dollar per share at its peak. And even after cuts, it still pays $4.75 per share.

Next, I will argue why the business is still the same business as it was in 2012 and 2019, and what the business had gone through since 2020 is an abnormality – an abnormality that is ending as we speak.

Source: Author and Seeking Alpha data

Source: Seeking Alpha data

The abnormality is ending as we speak

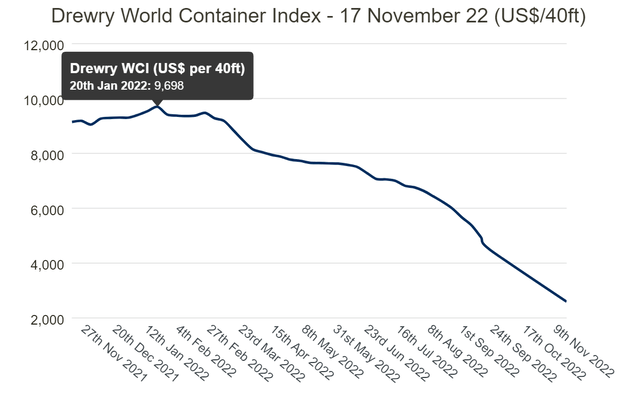

First, the shipping price index has declined dramatically over the past year already as seen from the chart below (taken from Drewry’s report). The spot shipping container prices declined from ~$10k to the current level of $2.6k, actually below the 5-year average of $3.7k already. At the same time, ZIM’s business is still the same as it was before. It competes with other shipping companies with similar facilities and the only differentiator is price. Since it wasn’t able to earn a profit during 2012~2019 at the average shipping price index, I don’t see how it can earn a profit as the shipping price now stands below the average.

Source: Drewry’s report

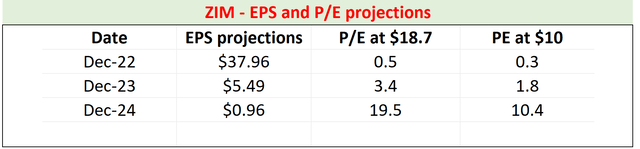

The consensus estimates seem to be in line with my above view as seen below. The consensus estimates project its EPS to contract from $37.96 in 2022 to $5.49 in 2023 (that is why I do not see the current $4.75 per share of dividend sustainable) and then to $0.96 in 2024 (that is why I won’t be surprised if the dividends totally disappear in 1 or 2 years).

At the same time, the implied P/E ratio at its current price of $18.7 is about 19.5x based on 2024 earnings. Even if the price further drops to $10, the implied P/E ratio would still be 10.4x based on 2024 earnings. I don’t see how such a business with no real moat to speak of can sustain any P/E multiple in the double digits.

And next, I will argue that these consensus estimates are still on the optimistic side. Things could deteriorate more quickly.

Source: Author based on Seeking Alpha data

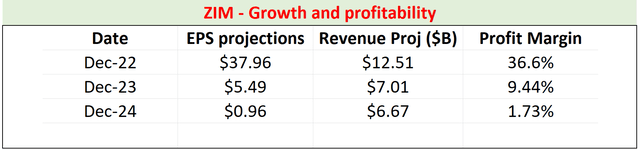

The next table illustrates its implied NPM based on the consensus estimates of its EPS shown above and also of its revenues. The consensus estimates project its revenues to decline by about ½ in the next 2 years, from $12.5B in 2022 to $6.67B in 2024. Assuming its outstanding shares remain fixed at the current count of 120.5 million shares, the implied NPM based on these consensus estimates is shown in the last column. As seen, these estimates are still implying an NPM Of 9.44% for 2023 and 1.73% for 2024.

And my view is that these margins are too optimistic. As aforementioned, the business wasn’t able to earn a profit (actually suffered losses consistently during 2012~2019 with its negative 5.3% NPM) at the average shipping cost. I do not expect it to earn 9.44% or 1.73% of NPM as the shipping price has already renormalized to be below the historical average.

Source: Author based on Seeking Alpha data

Risks and final thoughts

To recap, I see ZIM as a dividend trap under its current conditions. Besides the issues mentioned, a recession in the U.S., or even worse, a global recession, would further accelerate the shipping price decline and also shrink shipping volume simultaneously. If this happens, the trap would close in at a much-quickened pace than I anticipated in this article. Additionally, ZIM’s fleets are mostly chartered, not owned. As a result, having long-term charter contracts can be a double-edged sword – which creates another uncertainty. In the case of increasing charter costs (which is the direction things are going now), ZIM wouldn’t be able to benefit from the decreased cost because their charter costs have been locked in given the long-term contract. This would put ZIM at a disadvantage compared to other shipping companies that have shorter contracts and can benefit from decreasing charter cost immediately. On the other hand, if the charter costs begin to reverse its current direction and began to decrease, then ZIM would benefit from the existing long-term contracts (i.e., compared to other companies that have shorter term contracts).

All told, I see ZIM as a dividend trap under current conditions. My view is that the dividends could completely go away in the next 1~2 years. As for the stock prices, I see its valuation as unsustainable even if it drops to ~$10. Lastly, I also see a good chance for the timeframe to quicken given the possibility of a recession and also the pace of shipping price decline.

Be the first to comment